Crypto Analyst. Sharing DeFi updates and crypto strategies. Subscribe to my blog to stay on top of trends: https://t.co/qrKYXe3Uxo

32 subscribers

How to get URL link on X (Twitter) App

@LayerZero_Labs

@LayerZero_Labs

What's restaking all about?

What's restaking all about?

In this thread I'll cover:

In this thread I'll cover:

First of all, to understand how L3s work, let's start with a quick explanation of L2s:

First of all, to understand how L3s work, let's start with a quick explanation of L2s:

@OffchainLabs released tooling to enable building Arbitrum Orbit chains much easier

@OffchainLabs released tooling to enable building Arbitrum Orbit chains much easierhttps://twitter.com/dabit3/status/1671879980425560066

https://twitter.com/sandeepnailwal/status/1656262074950094850

Polygon zkEVM mainnet beta went live in March 2023.

Polygon zkEVM mainnet beta went live in March 2023.

@arbitrum announced the distribution of its revenue to the DAO

@arbitrum announced the distribution of its revenue to the DAOhttps://twitter.com/arbitrum/status/1656090360119017472

Fastest-growing Protocols📈

Fastest-growing Protocols📈

@SeiNetwork

@SeiNetworkhttps://twitter.com/0xFinish/status/1657023752784211972

1. @Blockpour

1. @Blockpour

First of all, what are pumpamentals?

First of all, what are pumpamentals?

@LidoFinance

@LidoFinance

2023 has been tough so far.

2023 has been tough so far.

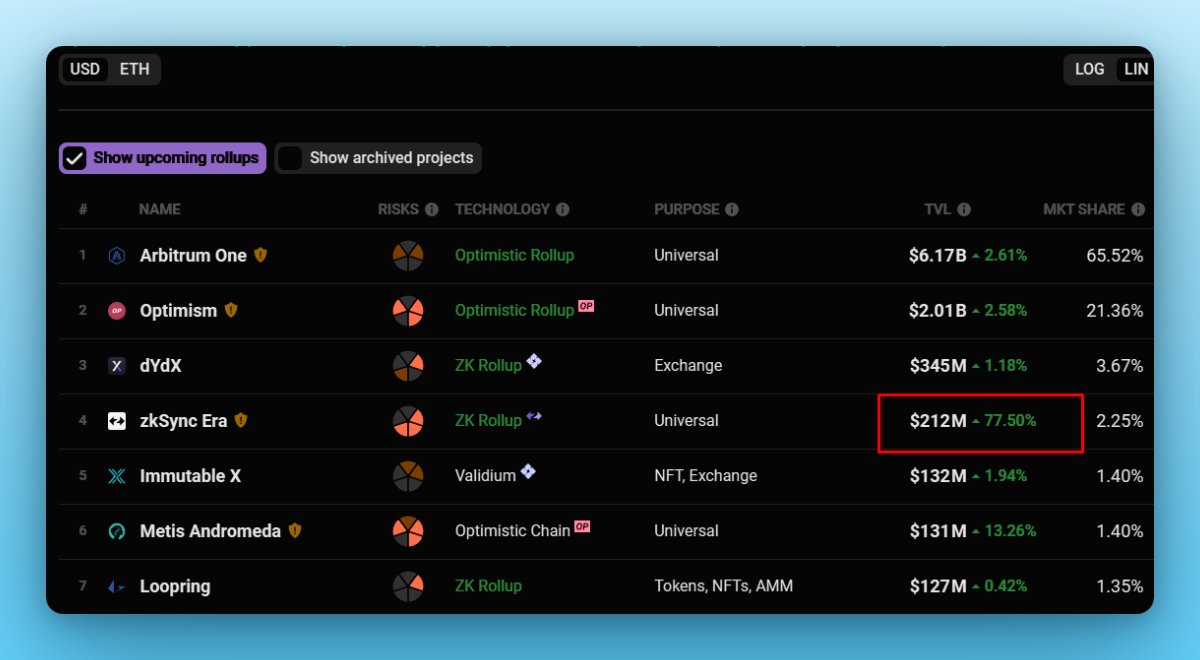

In <30 days after launch, zkSync Era TVL reached $200M TVL.

In <30 days after launch, zkSync Era TVL reached $200M TVL.

With Arbitrum DAO starting grants programs soon, the whole ecosystem is poised for growth.

With Arbitrum DAO starting grants programs soon, the whole ecosystem is poised for growth.

1. @eigenlayer

1. @eigenlayer