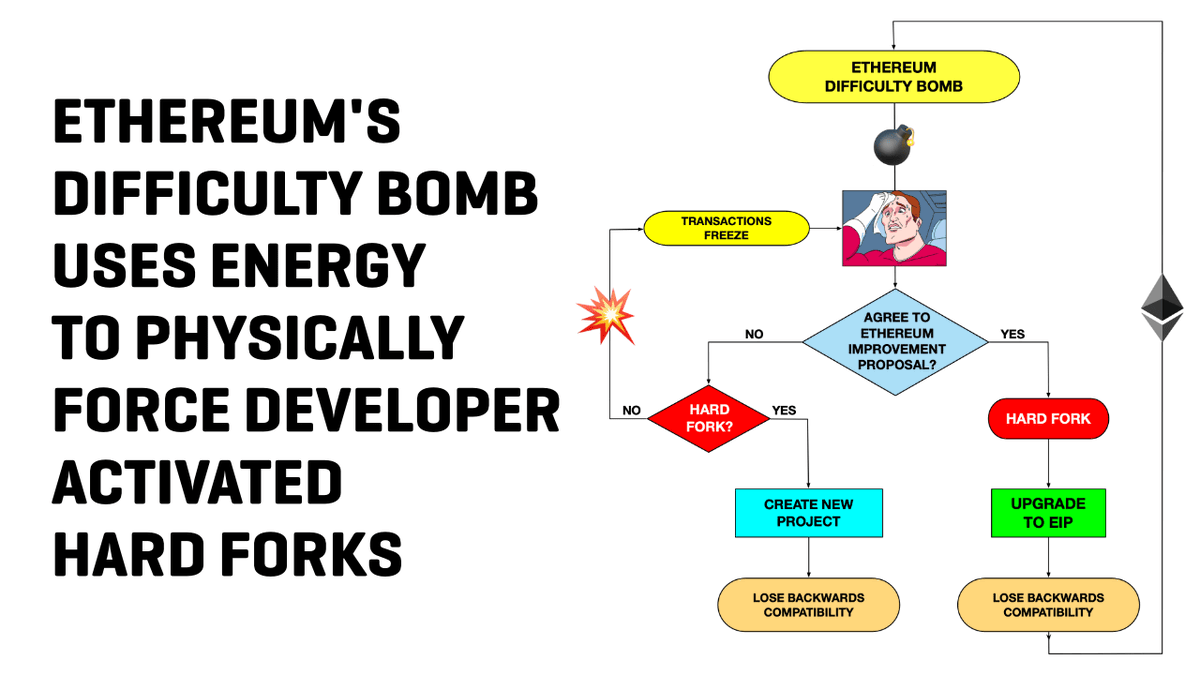

[THREAD] Ever wonder how the Ethereum Foundation can run Ethereum like a software company and centrally navigate its decade-long roadmap? Its secret sauce is the Difficulty Bomb💣, which coerces both miners and users into "official" upgrades. Let’s take a look at how it works. /1

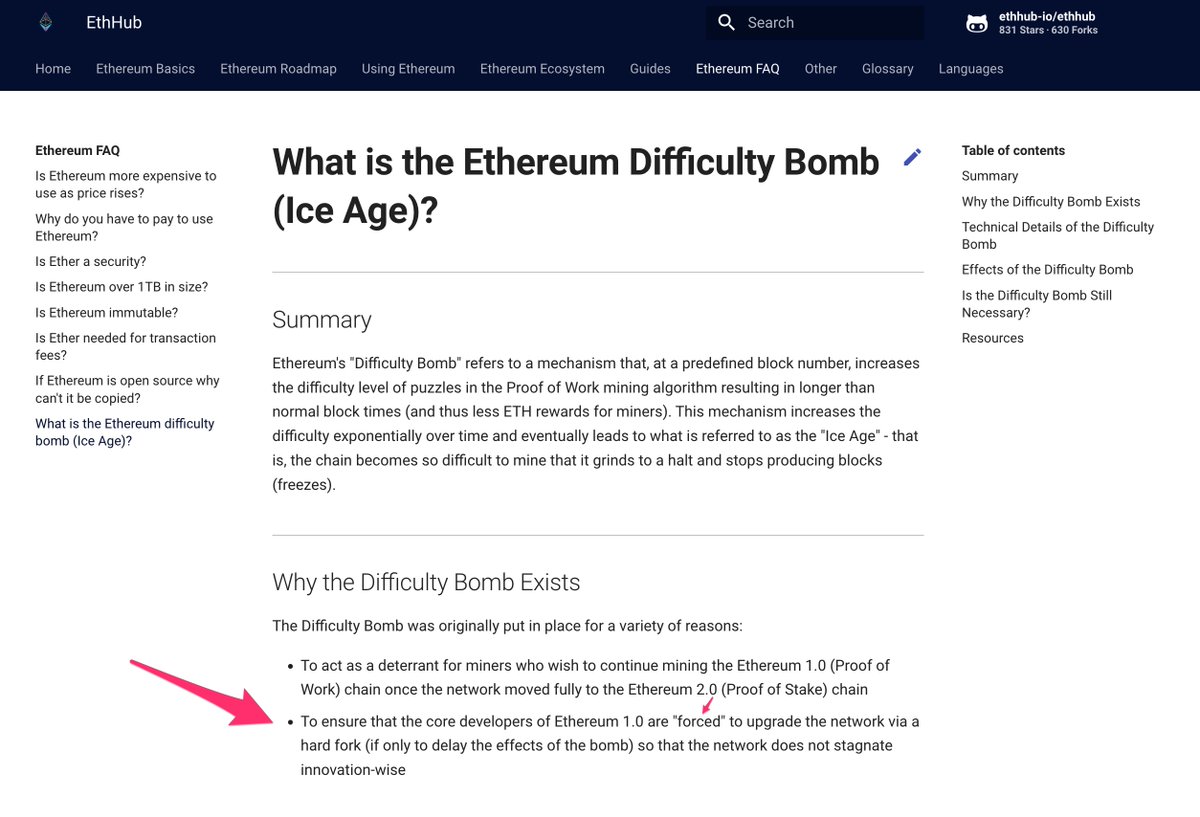

The difficulty bomb is code that incrementally increases the difficulty level of ETH's proof-of-work mining in order to slow block times, until the chain becomes unusable. According to EthHub, this is to literally "force" Ethereum’s switch from proof-of-work to proof-of-stake. /2

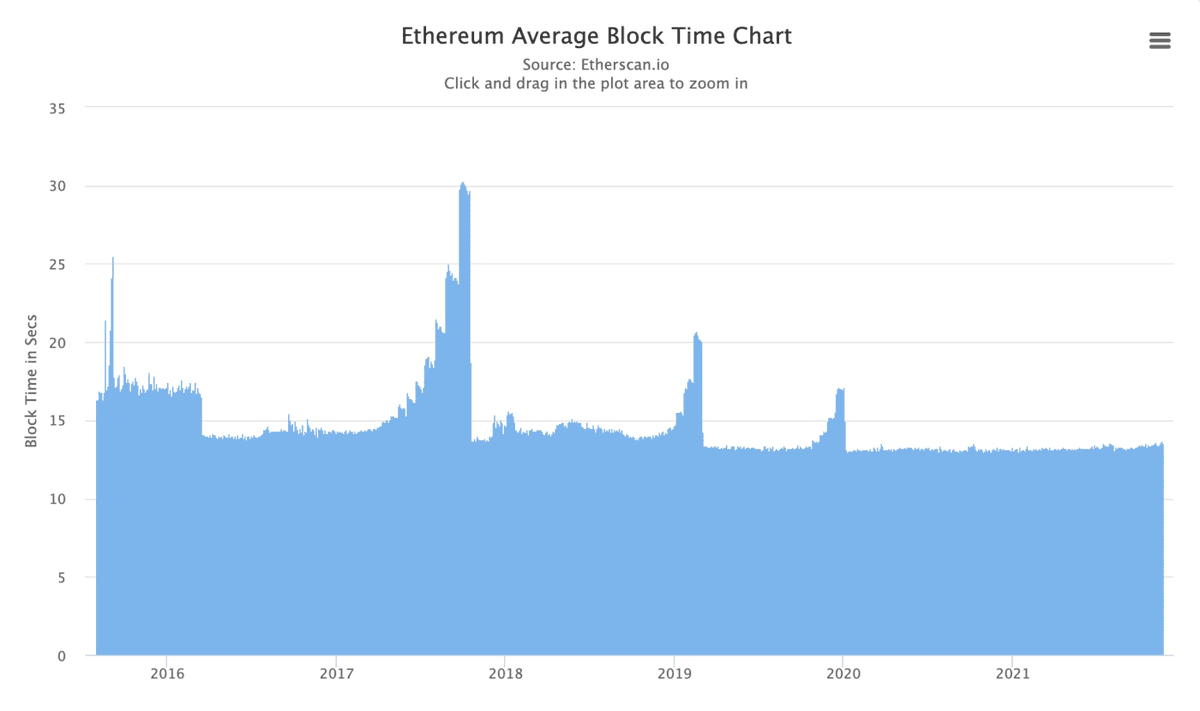

The Ethereum Foundation perpetually resets the Difficulty Bomb💣 after each hard fork. This acts as a looming threat of physical energy, in order to force the next official upgrade. One can even see accidental detonations (and mandatory upgrades) in historical block data. /3

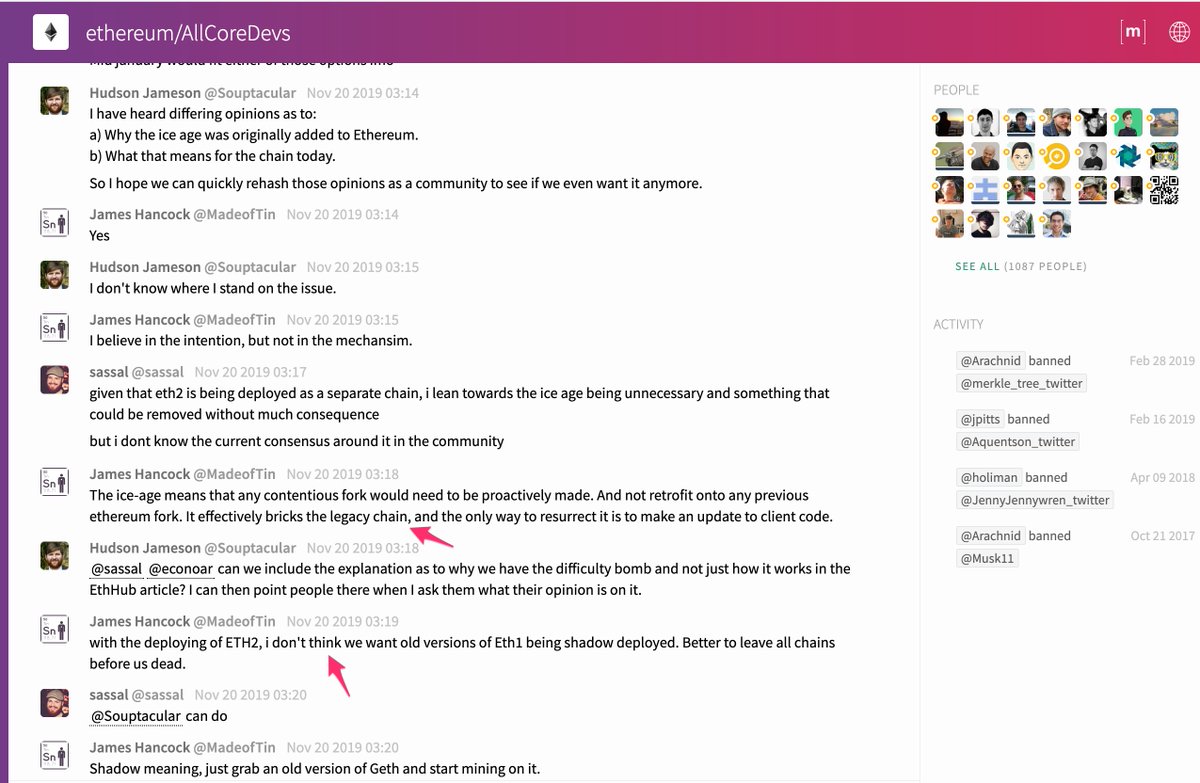

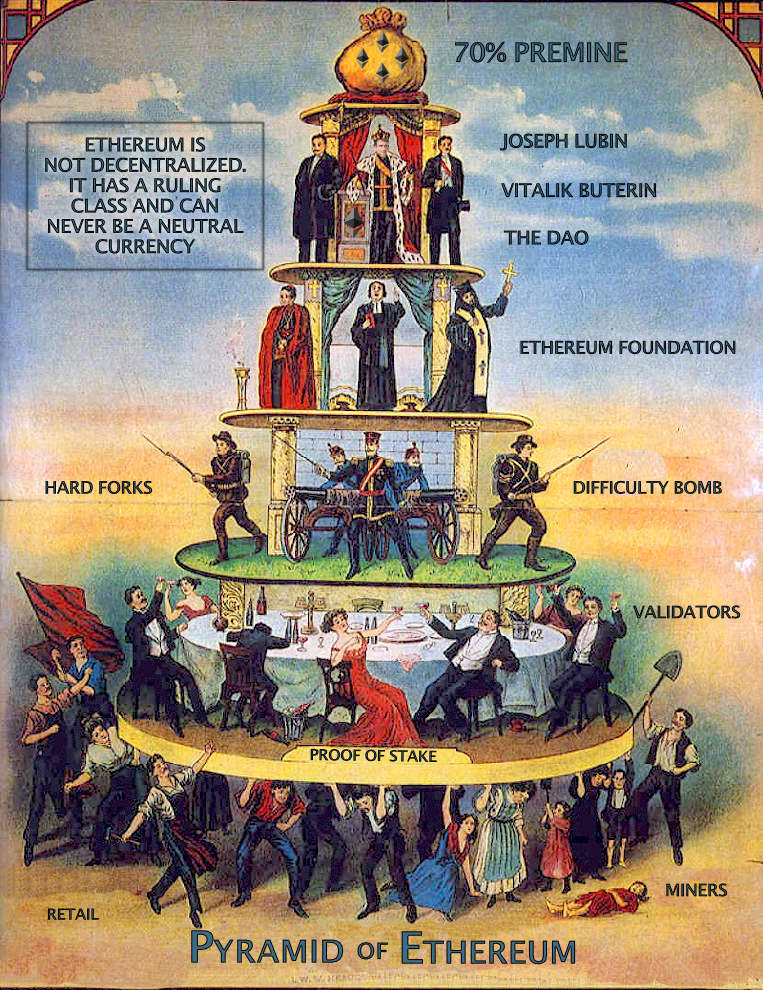

Ethereum devs have publicly said they don't want users or miners to be able to use legacy chains. The Difficulty Bomb💣 ensures they can't. This kind of coercion effectively turns the Ethereum Foundation into a software company, masquerading as a decentralized project. /4

This is in stark contrast to #Bitcoin, which allows users with easy-to-run full nodes to continue using the rules they signed up for. Listen to @pete_rizzo_ explain why #Bitcoin protects minority user rights like no other protocol can. /5 bitcoinmagazine.com/culture/bitcoi…

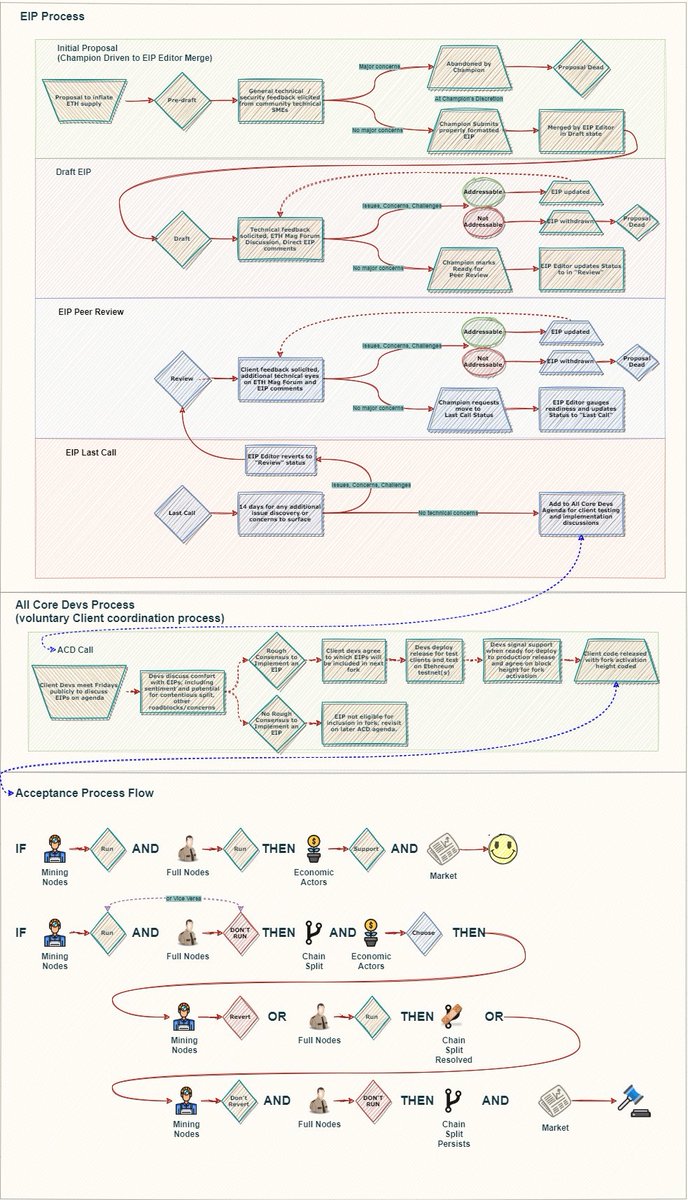

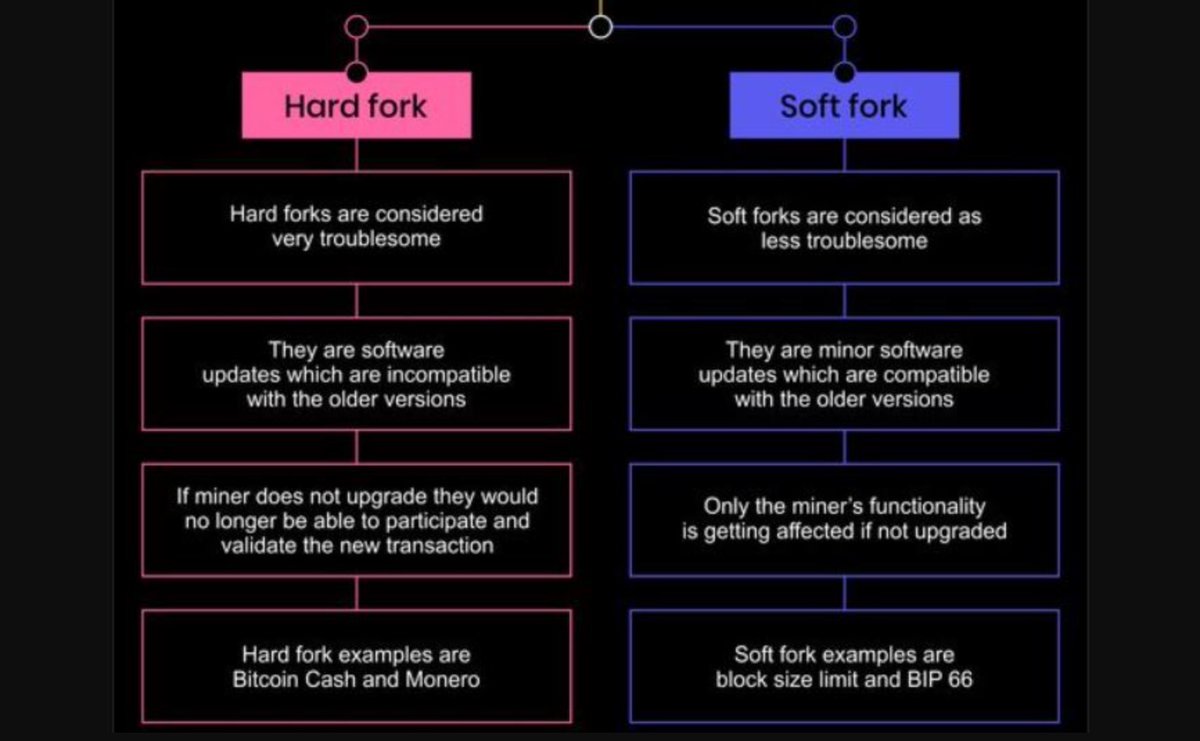

The Difficulty Bomb💣 forces miners and users to choose between a proposed hard fork, known as an Ethereum Improvement Proposal (EIP), or a dying chain. Users and miners have the "freedom" to make a choice between a dying chain or the official Ethereum upgrade. /6

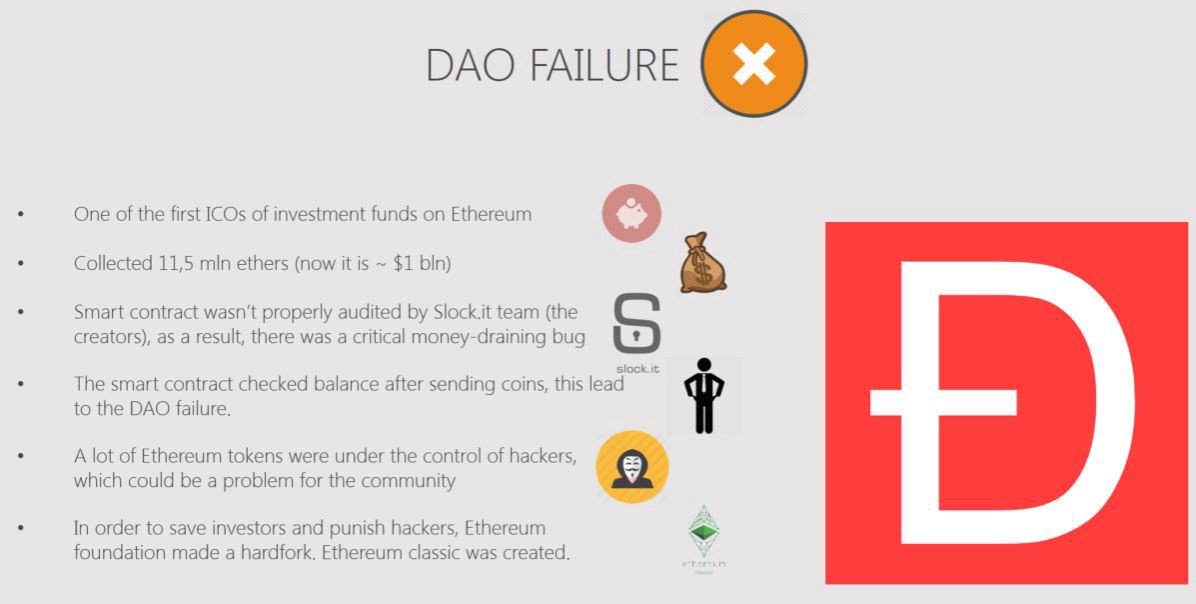

Fans of the Ethereum Foundation say people that don't like an EIP can keep using the legacy chain, with the same rules—as happened with Ethereum Classic (ETC). However, this is only evidence that people who object to EIPs have to defect and create a new "classic" project. /7

Since the Ethereum Foundation controls the official marketing channels for what "Ethereum" is defined as, it can decide what is officially "Ethereum" and what isn't. This recipe effectively turns the Ethereum Foundation into a software company—allowing it to innovate like one. /8

After the 2016 DAO hack, members of the Ethereum community who opposed The DAO hard fork were left stranded on a dying legacy chain that was destined to freeze, due to the Difficulty Bomb💣. It was like leaving objectors in a car that had no oil—it would soon stop running. /9

In Jan 2017, the newly-formed "Ethereum Classic" community implemented the “Die Hard” hard fork in order to defuse the Difficulty Bomb💣 for the remaining users and willing miners. Ethereum Classic developers also added in new changes that couldn't be rejected by those users. /10

In other words, it was impossible to continue using the actual legacy chain, since the "Classic" developers implemented some fixes as part of defusing the Difficulty Bomb💣. Defectors from Difficulty Bombs must adhere to the whims of developers who defuse them. /11

As @Truthcoin Paul Sztorc has pointed out, “A hard fork elevates those who are Technical, Persuasive, or Endorsed, to ‘non-peer’ status.” However, the Difficulty Bomb💣takes this to another level. /12 truthcoin.info/blog/measuring…

The Difficulty Bomb💣 coerces miners into upgrading to "official" releases from the Ethereum Foundation. This is why @saylor and others have pointed out that Ethereum is very likely an unregistered security. /13

This is further complicated by how Ethereum's founders sold its coin to the public—as an investment contract dependent on the efforts of its own founders. /14

@GaryGensler has commented on this—saying he believes Ethereum was a security when it launched. If governments understand how the Difficulty Bomb💣 is weaponized against users and miners, they might see how it still operates like a software company. /15

Forcing official upgrades through hard forks, mandated by the Difficulty Bomb💣, is done by imposing endless threats of increased physical energy for those who don't comply. Disagree and you have to start a new project. This is real world, physical, coercion. /16

Ethereum’s coercion may be seen as a necessary evil to push the project forward given its developers know that Ethereum is unfinished and unworkable in its current form. /17

https://twitter.com/coin_casher/status/1441756649773928449

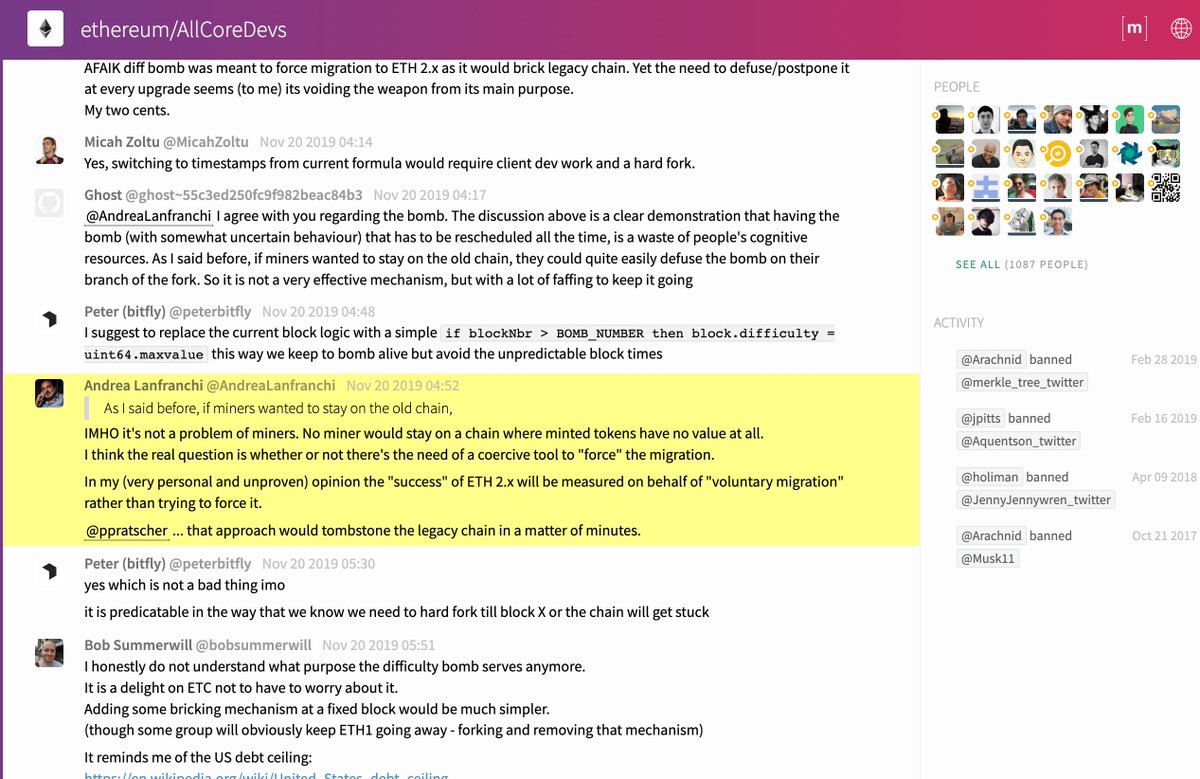

Ethereum developers are well aware that they are coercing upgrades through the Difficulty Bomb💣. Some devs, however, wish these upgrades were voluntary and not forced on users and miners. /18

What happens if/when Ethereum merges to Proof-of-Stake? The Difficulty Bomb💣 will no longer be needed to maintain control over the roadmap, since the project will be controlled by the largest stakeholder who will unimpeachably control Ethereum, like equity in a company. /19

Some lawyers have noticed this as well. But, few seem to grasp that the Difficulty Bomb💣 has been allowing Ethereum to operate like a software company for many years. /20

https://twitter.com/AdamLevitin/status/1550990967670554624

Proof-of-work, in contrast, has no unimpeachable controllers. The largest miners in #Bitcoin can be overthrown and are governed by user nodes. With a culture of backwards-compatible soft forks, Bitcoin users can continue to run the rules they signed up for, if they need to. /21

Of course, Bitcoin's backwards compatible voluntary soft forks reduce its ability to rapidly innovate. But, this is what a decentralized commodity looks like. There is no Gold 2.0 or Oil 2.0. Real commodities tend to be elemental and can't rapidly change like securities do. /22

The reality is that upgrades on Ethereum are not voluntary. If you don't agree with the Ethereum Foundation's hard fork and EIP, you are either stranded on a dying chain or have to form a new unofficial project. You are free to defect, but defectors won't be using "Ethereum." /23

In fairness, Vitalik has attempted to claim that soft forks are more coercive than hard forks. However, he conveniently ignores the coercion of the Difficulty Bomb💣, which makes it extremely difficult for users to keep using a legacy chain. /24 vitalik.ca/general/2017/0…

In an interview with @lexfridman, Vitalik also argued that soft forks are more coercive than hard forks. However, once again he fails to acknowledge the coercive effects of the Difficulty Bomb💣which effectively bans users from the legacy chain. /25

To be clear, this is not a call for regulators to crack down on Ethereum. Open Payment Rails are essential for human progress. However, a project using perpetual Difficulty Bombs💣 to "force" users into upgrades is not decentralized. That misleads the users of those rails. /26

Ethereum's long roadmap needs to be "forced" in order for it to meet its full potential. Therein lies the paradox of decentralization. You simply can't "force" a roadmap and call something decentralized—it's dishonest and possibly fraudulent. /27

https://twitter.com/schin_tomar/status/1550136805848223744

For more on this subject, read “The Coercion of Ethereum’s Difficulty Bomb”—also available in audio in the link, below, read by @TheGuySwann. /28 bitcoinmagazine.com/technical/ethe…

• • •

Missing some Tweet in this thread? You can try to

force a refresh