DeFi protocols are generating $1M+ in fees every day in a bear market.

Here’s how you get your share of passive income as the #RealYield narrative takes hold.

Here’s how you get your share of passive income as the #RealYield narrative takes hold.

Previous cycles were dependent upon inflationary emissions of various governance tokens.

The #RealYield era is focused on sharing of protocol fees.

There's a few choices, let's talk about how to find them.

The #RealYield era is focused on sharing of protocol fees.

There's a few choices, let's talk about how to find them.

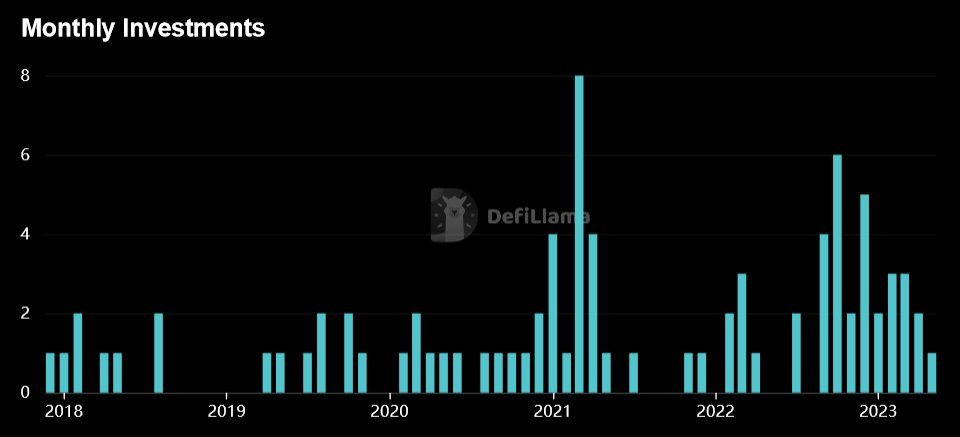

First, you need to find the protocols that are generating the most fees.

This is where you get that info: cryptofees.info

Only certain protocols share fees with holders.

This is where you get that info: cryptofees.info

Only certain protocols share fees with holders.

@GMX_IO

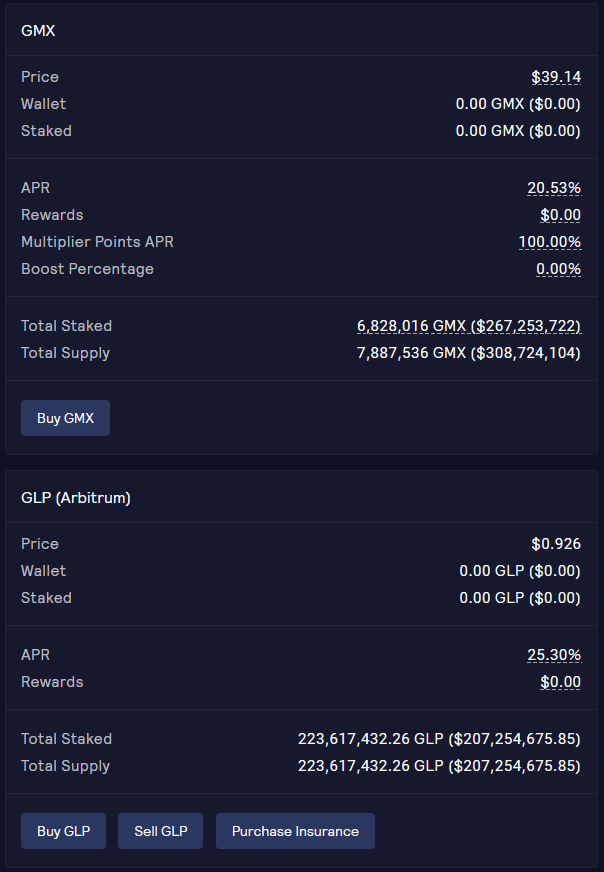

GMX is a decentralized perp exchange on @arbitrum and @avalancheavax. You can buy and stake either $GMX or $GLP.

· $GMX - governance token, pays out $ETH, $esGMX, and multiplier points

· $GLP - composed of an index of assets, pays out $ETH and $esGMX.

GMX is a decentralized perp exchange on @arbitrum and @avalancheavax. You can buy and stake either $GMX or $GLP.

· $GMX - governance token, pays out $ETH, $esGMX, and multiplier points

· $GLP - composed of an index of assets, pays out $ETH and $esGMX.

@synthetix_io

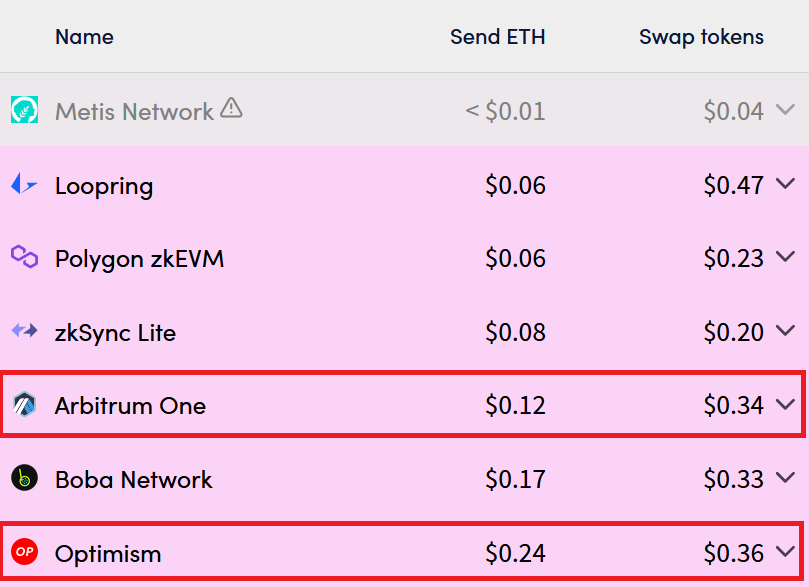

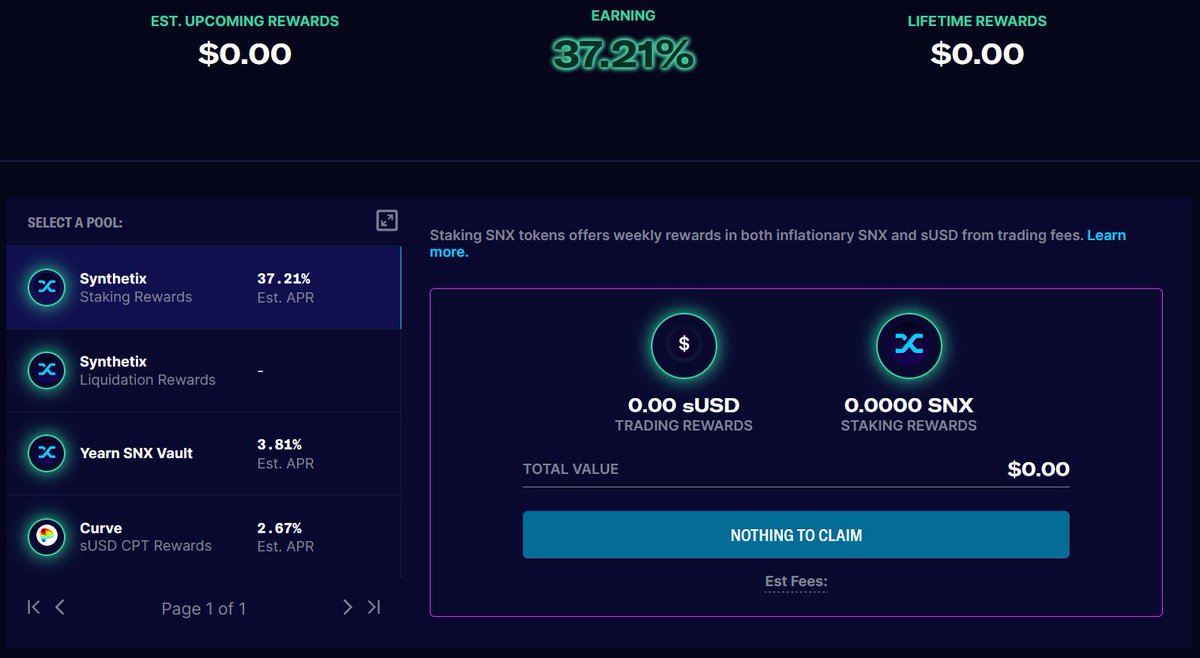

Synthetix, found on mainnet and @optimismFND, offers the trading of synthetic assets including RWAs (real world assets).

By staking $SNX, yield is paid out in both $sUSD (their native stable) and $SNX.

Synthetix, found on mainnet and @optimismFND, offers the trading of synthetic assets including RWAs (real world assets).

By staking $SNX, yield is paid out in both $sUSD (their native stable) and $SNX.

@ConvexFinance

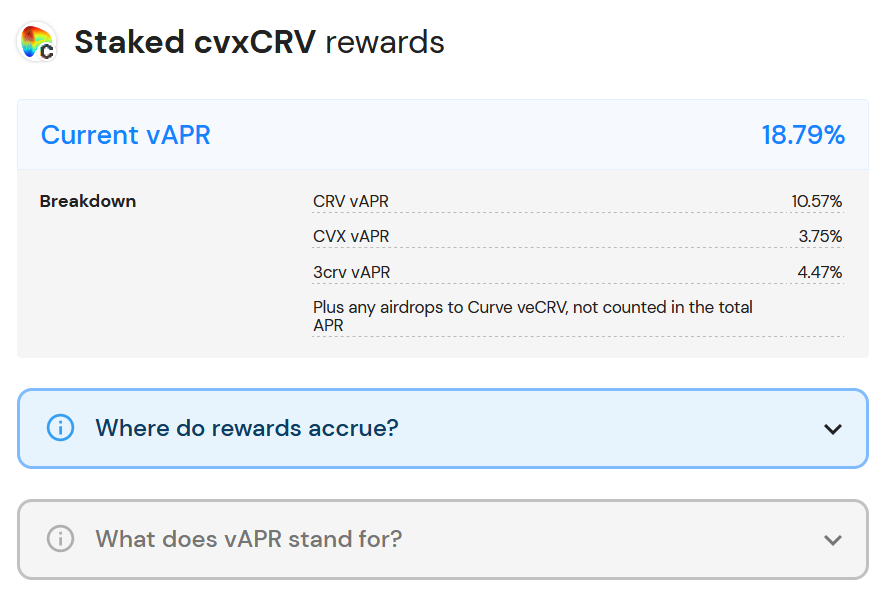

Built on top of @CurveFinance, Convex offers boosted rewards.

By staking $CRV on Convex, it becomes $cvxCRV. Yield is paid out in $CRV, $CVX, and $3crv (LP token composed of $DAI, $USDC, and $USDT).

Built on top of @CurveFinance, Convex offers boosted rewards.

By staking $CRV on Convex, it becomes $cvxCRV. Yield is paid out in $CRV, $CVX, and $3crv (LP token composed of $DAI, $USDC, and $USDT).

This new era of DeFi places a focus on sharing of protocol fees instead of just governance tokens.

Token inflation helps bootstrap networks but fee distribution is more sustainable in the long run.

This is the future of DeFi.

Token inflation helps bootstrap networks but fee distribution is more sustainable in the long run.

This is the future of DeFi.

Did you find this helpful?

1. Follow me: @dLuxGMI

2. Favorite/RT the first tweet!

1. Follow me: @dLuxGMI

2. Favorite/RT the first tweet!

https://twitter.com/dLuxGMI/status/1554442344581283843

• • •

Missing some Tweet in this thread? You can try to

force a refresh