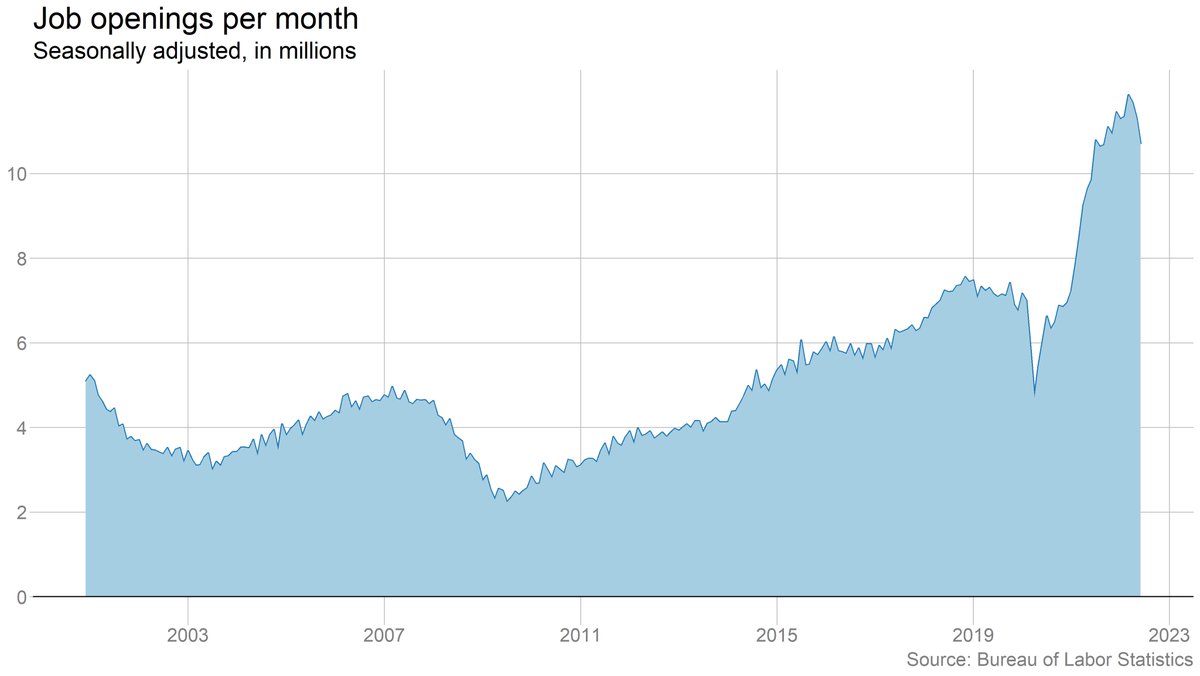

Job openings fell by more than 600,000 in June, the largest one-month decline on record, outside of the two months at the start of the pandemic. #JOLTS

nytimes.com/2022/08/02/bus…

nytimes.com/2022/08/02/bus…

Still, the job market remains strong by most standards. 10.7 million would have been far and away a record before the pandemic. And there are still 1.8 job openings for every unemployed worker (down from 2 back in March).

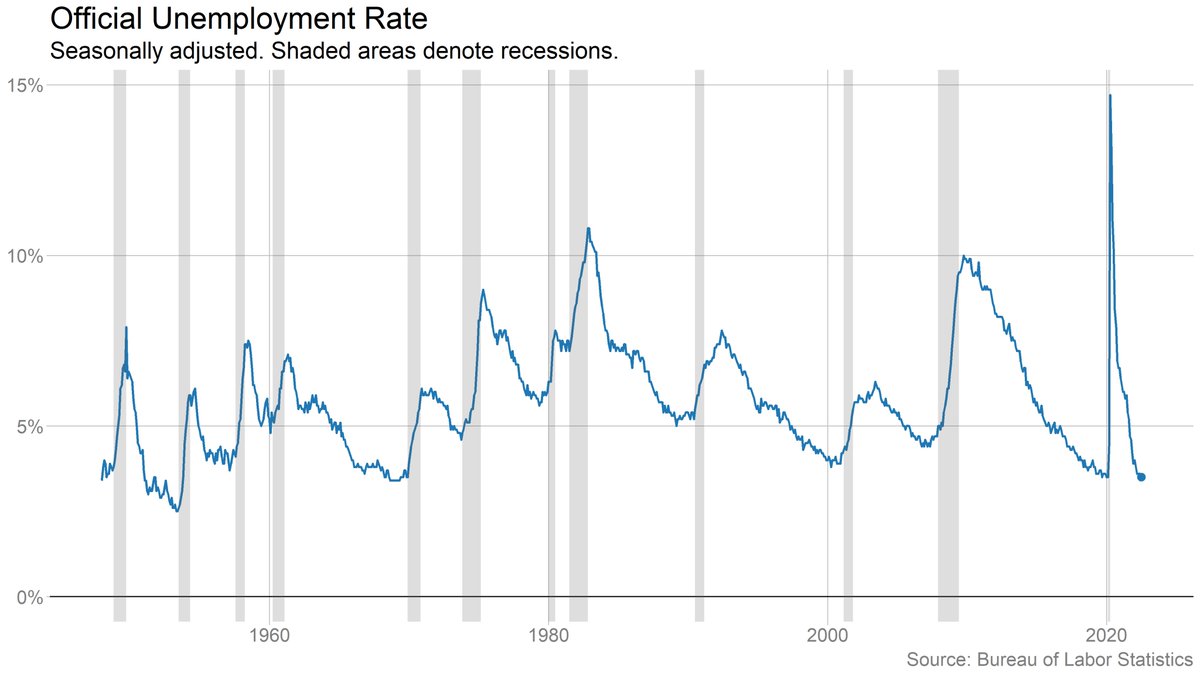

Layoffs remain near record lows (though data only goes back about 20 years). No sign of the uptick that we've seen in the weekly unemployment claims data.

The "great resignation" (not a term I like) has ebbed a bit, but it hasn't stopped. There were 4.2 million voluntary quits in June, down from a peak of 4.5 million last fall.

Remember that most people quitting their jobs are going to OTHER jobs, not stopping work altogether.

Remember that most people quitting their jobs are going to OTHER jobs, not stopping work altogether.

• • •

Missing some Tweet in this thread? You can try to

force a refresh