Now that it's #RealYield season, let's compare revenues and valuations of a few prominent decentralized perpetuals exchanges.

I will be comparing $DYDX, $GMX, $GNS, and $IDEX in this thread.

🧵

I will be comparing $DYDX, $GMX, $GNS, and $IDEX in this thread.

🧵

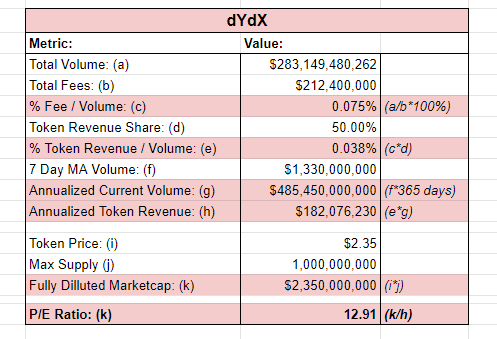

Firstly, we look at $dYdX / @dYdX , the largest and most used perpetuals DEX currently on the market.

We can see that at current volumes and fees, the $dYdX token is being traded at a 12.91 P/E ratio.

We can see that at current volumes and fees, the $dYdX token is being traded at a 12.91 P/E ratio.

While they do currently revenue share, with the planned transition to V4, @dYdX has plans to decentralize.

The tokenomics of this is still TBD, but for this comparison I have assumed a realistic scenario in which token holders get 50% of revenue.

See:

dydx.exchange/blog/v4-full-d…

The tokenomics of this is still TBD, but for this comparison I have assumed a realistic scenario in which token holders get 50% of revenue.

See:

dydx.exchange/blog/v4-full-d…

Being the largest perpetuals exchange, I believe their fee model of ~0.075% of total volume is a good benchmark to compare other protocols to.

The P/E ratio at 12.91 is actually lower than I expected, from this perspective I believe $dYdX could be undervalued, however, without knowing the future tokenomics this is still speculative.

Data source I used for this analysis for $dYdX is @tokenterminal page.

Would love for someone to confirm the accuracy of this data.

tokenterminal.com/terminal/proje…

Would love for someone to confirm the accuracy of this data.

tokenterminal.com/terminal/proje…

Before we move on other projects, I'll say that I don't see $dYdX as a true competitor to either $GMX or $GNS, because they are more like a CEX with self custody.

While they are decentralizing, with a public team they will still struggle with region locks and stock pairs, etc.

While they are decentralizing, with a public team they will still struggle with region locks and stock pairs, etc.

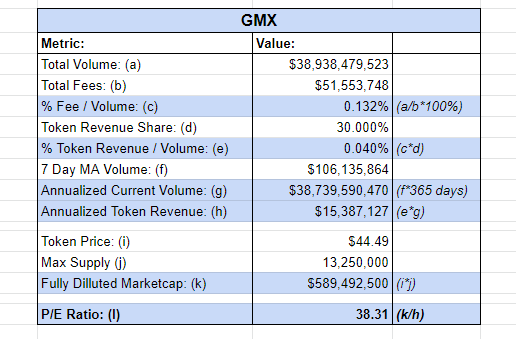

Next we will look at $GMX / @GMX_IO the prominent decentralized perpetuals exchange on @arbitrum.

From my calculations they currently sit at a P/E ratio of 38.31.

From my calculations they currently sit at a P/E ratio of 38.31.

I am sure I will receive some comments about max vs. circulating supply and esGMX.

It's important that we take the max supply into account for this comparison because even though esGMX may not be liquid, revenues are still split to these tokens.

It's important that we take the max supply into account for this comparison because even though esGMX may not be liquid, revenues are still split to these tokens.

We can observe that the % fees are considerably higher than both $dYdX and $GNS. I suspect this is because the % fee on swaps is greater than perpetuals.

Maybe a blueberry can confirm this for us?

Maybe a blueberry can confirm this for us?

Overall I think a P/E ratio around 40, while higher than the other projects is actually reasonable for $GMX with the upcoming update PvP AMM and X4 (see link)

IMO there is still room for growth here and I would not be surprised to see this in the 100s.

medium.com/@gmx.io/x4-pro…

IMO there is still room for growth here and I would not be surprised to see this in the 100s.

medium.com/@gmx.io/x4-pro…

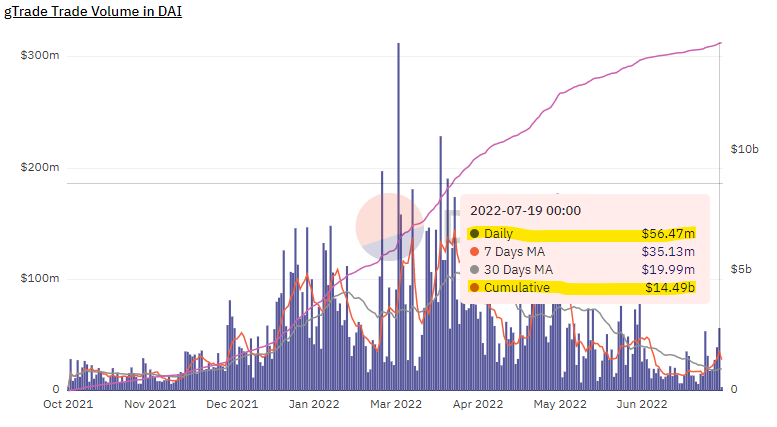

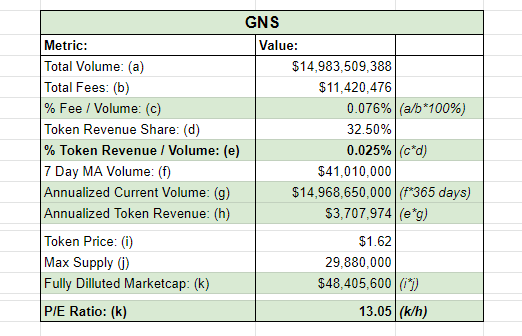

Next we look at $GNS / @GainsNetwork_io

With current volumes and price, we can derive a P/E ratio of 13.05 for this project.

With current volumes and price, we can derive a P/E ratio of 13.05 for this project.

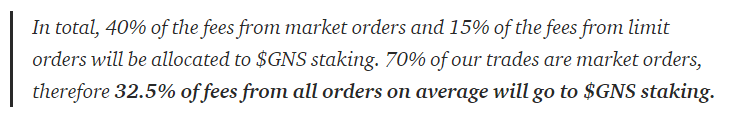

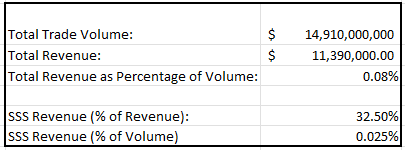

With the recent release of SSS details, it is now possible to do some modeling on $GNS.

I did a deep dive at my last thread here:

I did a deep dive at my last thread here:

https://twitter.com/gnsGoblin/status/1554252958203666432

We can see that the % fee / volume is roughly in-line with $dYdX, which was fairly surprising. I think $GNS is on the right track with this fee structuring.

At this P/E ratio of 13.05 I would consider $GNS to be undervalued, particularly if compared with $GMX and $IDEX.

I believe there is lots of further upside here.

I believe there is lots of further upside here.

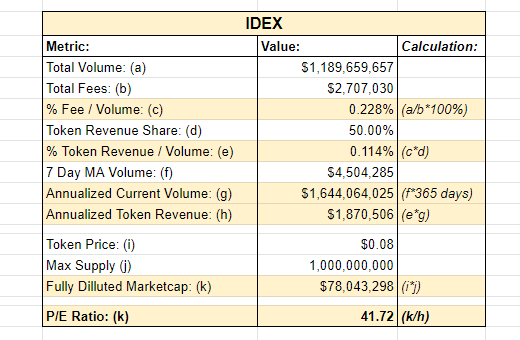

Lastly we look at @idexio / $IDEX.

This one is not mentioned too often on CT but because it has similar tokenomics to $GMX and $GNS and I figured it's worth having a look at.

This one is not mentioned too often on CT but because it has similar tokenomics to $GMX and $GNS and I figured it's worth having a look at.

What surprised me most about this one was the very high % fee in relation to volume and P/E ratio, especially as compared to the other protocols in this thread.

Admittedly I don't know too much about $IDEX, maybe there is something going on behind the scenes.

If you have any alpha on $IDEX my DM's are open.

If you have any alpha on $IDEX my DM's are open.

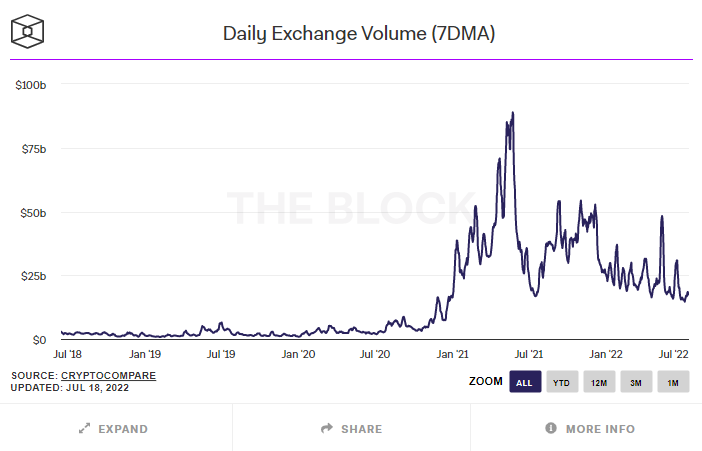

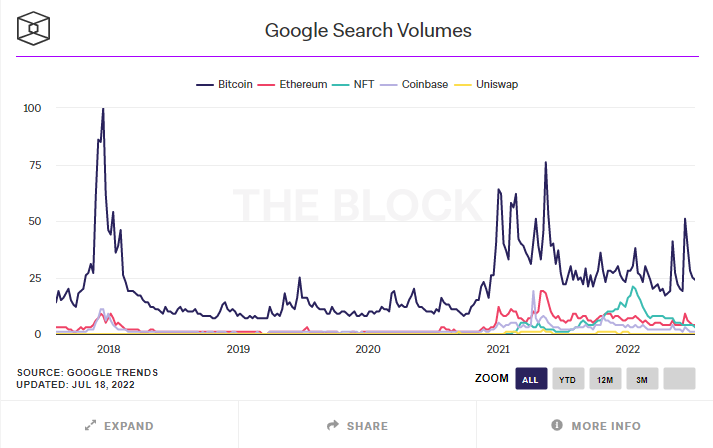

CONCLUSION:

The perpetuals DEX space has lots of room to grow and I hope you found this analysis useful.

I also think that each project can succeed and grow in competition with one another and that it's not a winner takes all play.

The perpetuals DEX space has lots of room to grow and I hope you found this analysis useful.

I also think that each project can succeed and grow in competition with one another and that it's not a winner takes all play.

Is there anything I missed?

Any project that should be added to this comparison?

Please let me know! 💚

Any project that should be added to this comparison?

Please let me know! 💚

Shoutouts for my fellow threadooors who keep me up to date:

@BillyBobBaghold

@derpaderpederp

@CompleteDegen

@0x_d24

@TheDeFinvestor

@crypto_condom

@crypto_age

@AvaxGems

@BillyBobBaghold

@derpaderpederp

@CompleteDegen

@0x_d24

@TheDeFinvestor

@crypto_condom

@crypto_age

@AvaxGems

• • •

Missing some Tweet in this thread? You can try to

force a refresh