The Monetary Policy Committee voted by a majority of 8-1 to increase #BankRate to 1.75%. Find out more in our #MonetaryPolicyReport: b-o-e.uk/MPR-Aug-2022

Inflation is over 9%. We expect it to rise further this year to around 13%, due to higher energy bills. b-o-e.uk/MPR-Aug-2022 #MonetaryPolicyReport #Inflation

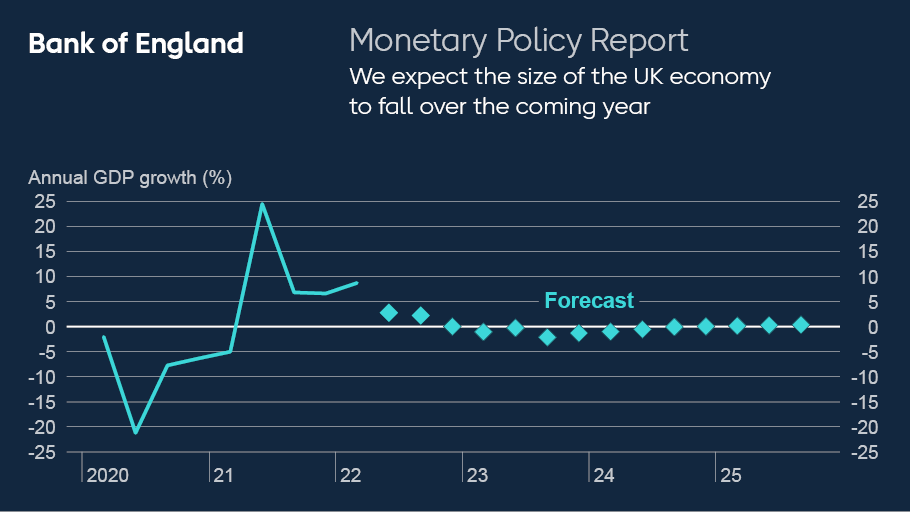

We know the cost of living squeeze is difficult for many people. The squeeze on households’ incomes due to the rise in energy prices has led to slower growth in the UK economy. We expect the size of the UK economy to fall over the coming year. b-o-e.uk/MPR-Aug-2022

We’ve put up interest rates to help return inflation to our 2% target. What happens to interest rates in the coming months will depend on what happens in the economy. b-o-e.uk/MPR-Aug-2022 #MonetaryPolicyReport

We expect inflation will be close to our 2% target in around two years. It’s our job to make sure that inflation returns to our 2% target, and that is what we will do. b-o-e.uk/MPR-Aug-2022 #MonetaryPolicyReport #Inflation

• • •

Missing some Tweet in this thread? You can try to

force a refresh