If you’ve ever minted $GLP on @GMX_IO, you may be leaving money on the table.

Let’s talk about how to get the most out of your dollar to get that sweet #RealYield.

Let’s talk about how to get the most out of your dollar to get that sweet #RealYield.

Intro

$GLP represents an index of assets that is used for trading on their platform.

Users are able to mint $GLP with any index asset and may also burn $GLP to redeem any of the index assets.

gmxio.gitbook.io/gmx/glp

$GLP represents an index of assets that is used for trading on their platform.

Users are able to mint $GLP with any index asset and may also burn $GLP to redeem any of the index assets.

gmxio.gitbook.io/gmx/glp

While $GMX is the governance token of @GMX_IO, $GLP is an option for those that would prefer their primary yield be in $ETH like @0xSifu.

Since $GLP is composed ~50% of stablecoins, it will be more stable than other tokens while retaining some upside of $ETH and $WBTC.

Since $GLP is composed ~50% of stablecoins, it will be more stable than other tokens while retaining some upside of $ETH and $WBTC.

Token Weights

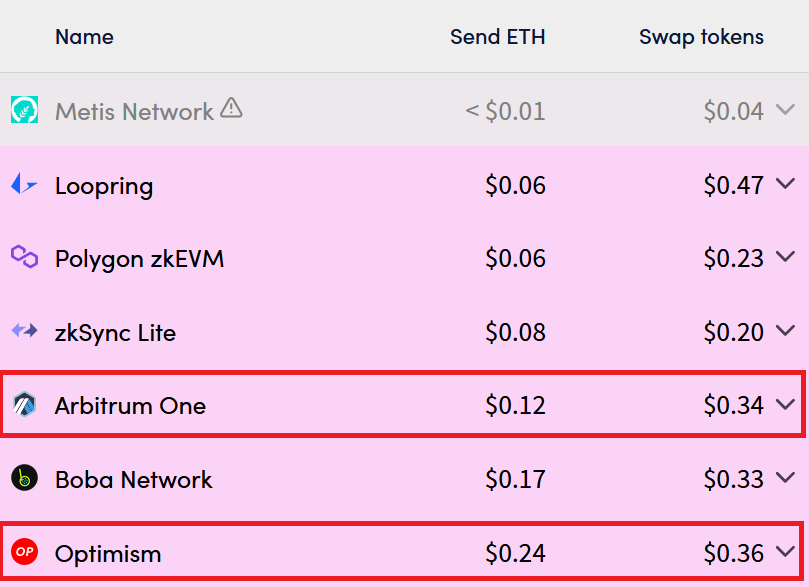

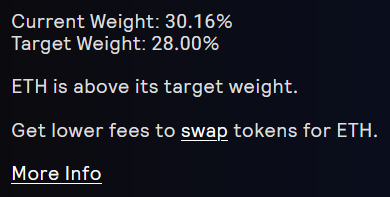

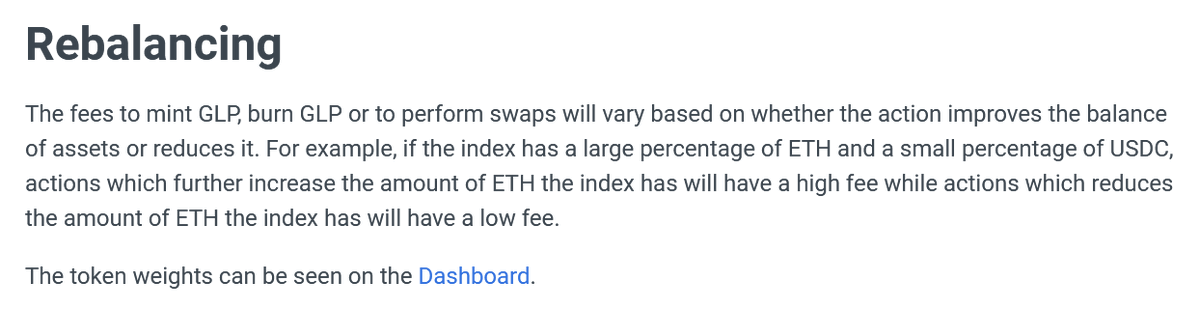

Each index asset has a target weight and its current weight.

It is the protocol's desire to achieve the target weight of each asset.

Each index asset has a target weight and its current weight.

It is the protocol's desire to achieve the target weight of each asset.

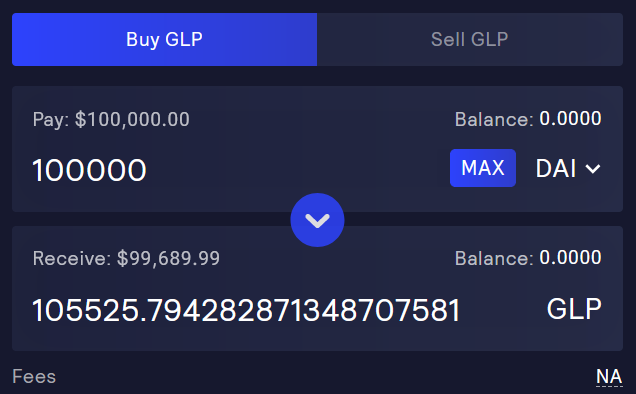

Fees are defined by an asset's weight relative to its target weight.

If above weight, fees will be elevated. If below weight, fees will be reduced or nonexistent.

If above weight, fees will be elevated. If below weight, fees will be reduced or nonexistent.

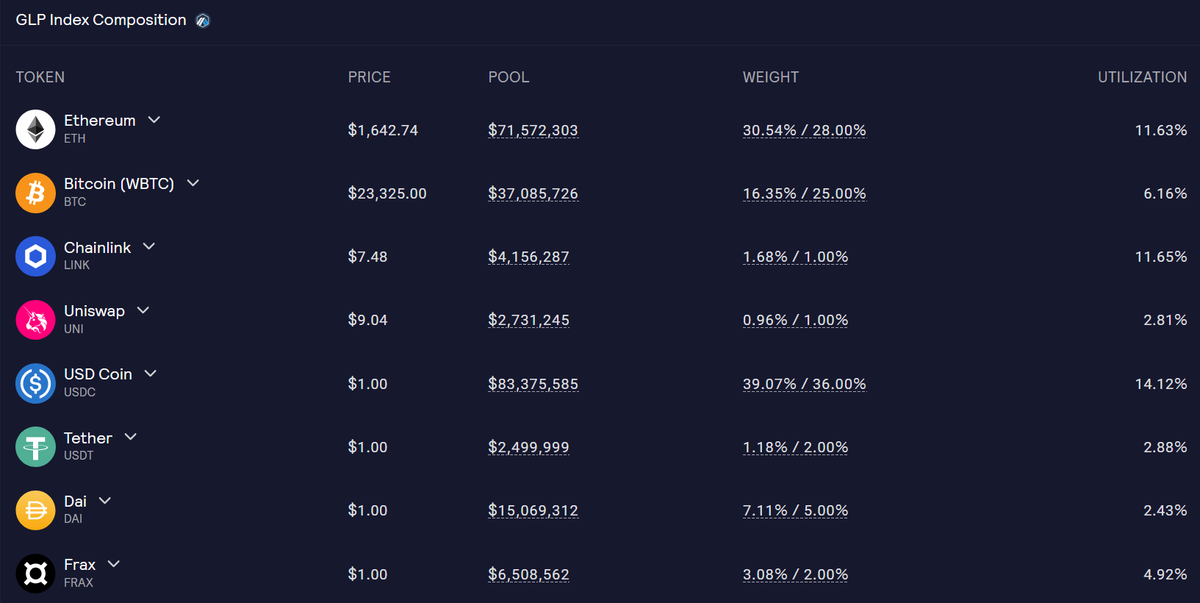

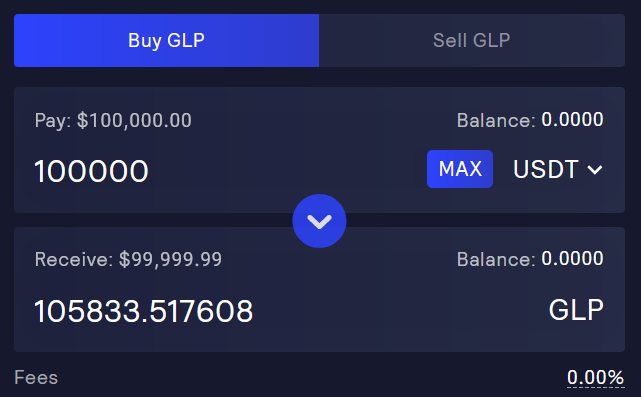

Scenario: $USDT is under its target weight and $DAI is above its target weight.

The protocol would like to return each asset to its target weight.

The protocol would like to return each asset to its target weight.

You can see that you’ll get less $GLP if you were to mint with $DAI as opposed to $USDT.

In this particular example, the minter would be losing $310. Not ideal.

While not an issue for smaller participants, there's no reason to leave money on the table.

In this particular example, the minter would be losing $310. Not ideal.

While not an issue for smaller participants, there's no reason to leave money on the table.

Summary

Minting $GLP with any asset doesn't always get you the same amount of $GLP.

Take a moment to look at fees and get the most out of your capital by minting with an index asset that is under its target weight.

Minting $GLP with any asset doesn't always get you the same amount of $GLP.

Take a moment to look at fees and get the most out of your capital by minting with an index asset that is under its target weight.

Did you find this helpful?

1. Follow me: @dLuxGMI

2. Favorite/RT the first tweet!

1. Follow me: @dLuxGMI

2. Favorite/RT the first tweet!

https://twitter.com/dLuxGMI/status/1555169721862979589

• • •

Missing some Tweet in this thread? You can try to

force a refresh