A very special 'Independence' edition of 𝗡𝗲𝘁𝗿𝗮 (August 2022) is out now!

#DSPNetra helps you keep track of the latest economic trends & gives you the insights that matter.

Download #DSPNetra: dspim.co/NetAug22

#DSPNetra helps you keep track of the latest economic trends & gives you the insights that matter.

Download #DSPNetra: dspim.co/NetAug22

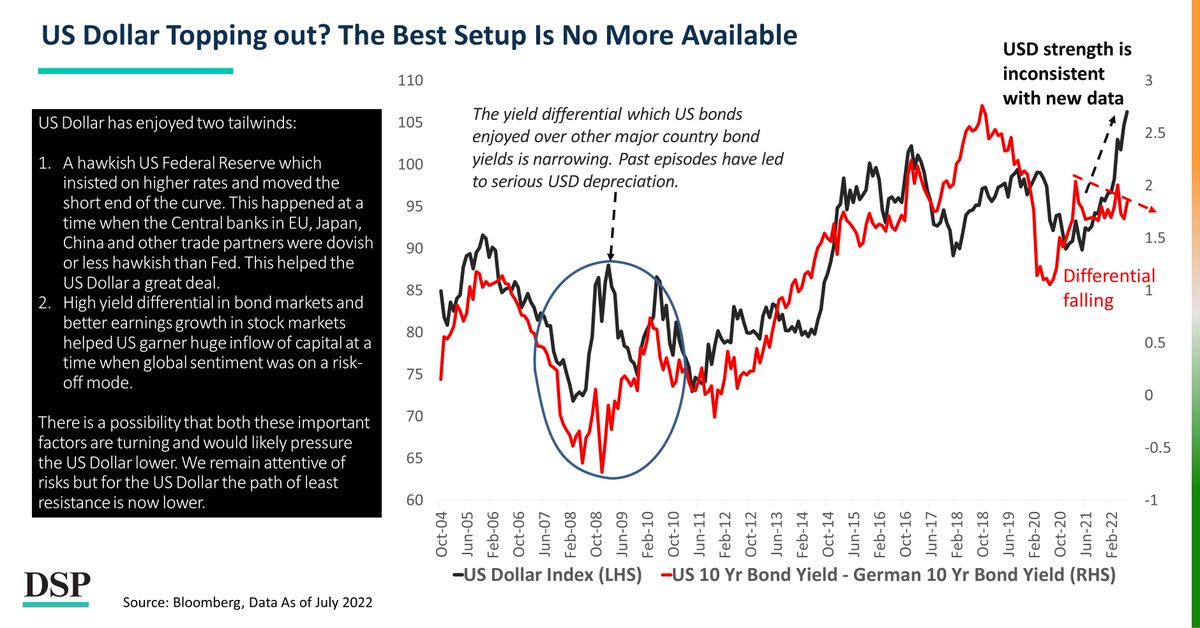

US Dollar’s dream run may be over… that’s what the data suggests.

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

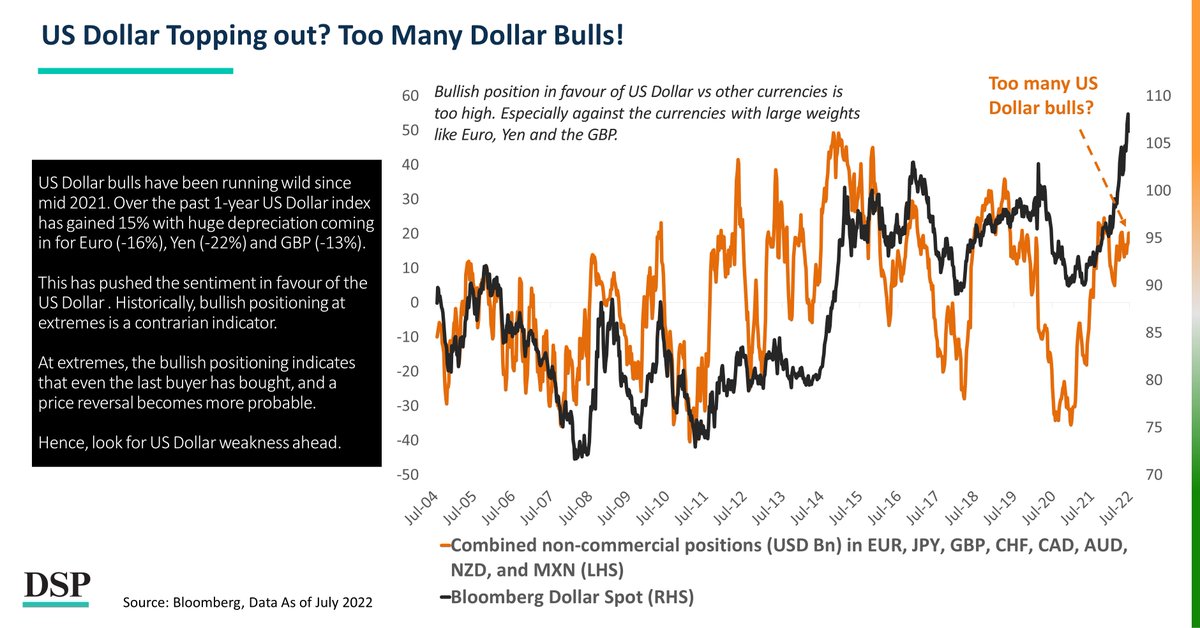

Too many Dollar bulls aren’t a great set-up for US Dollar strength. Caution ahead.

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

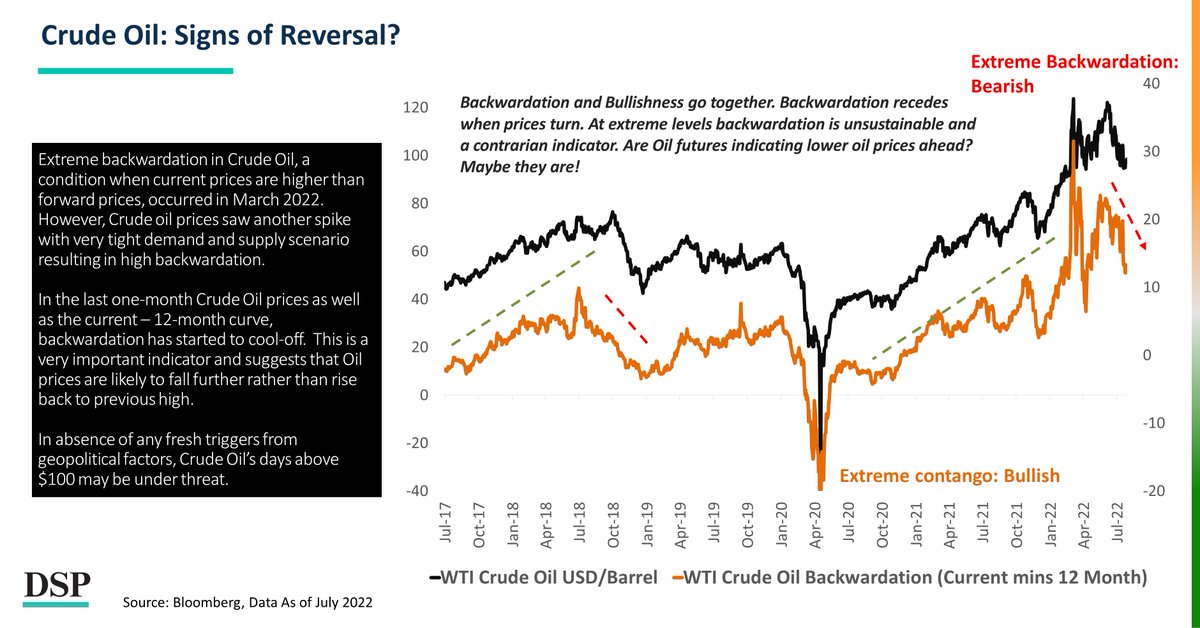

Crude Oil shows signs of an imminent breakdown, as demand cools and supply improves.

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

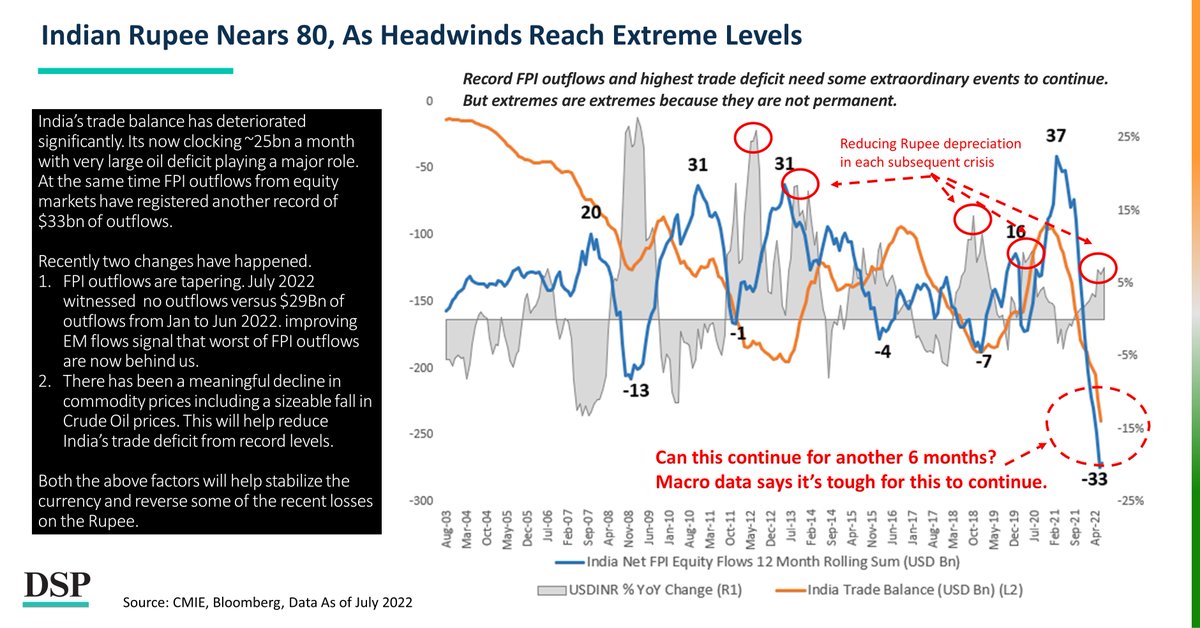

Indian Rupee’s weakness might reverse. The worst of times are probably over.

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

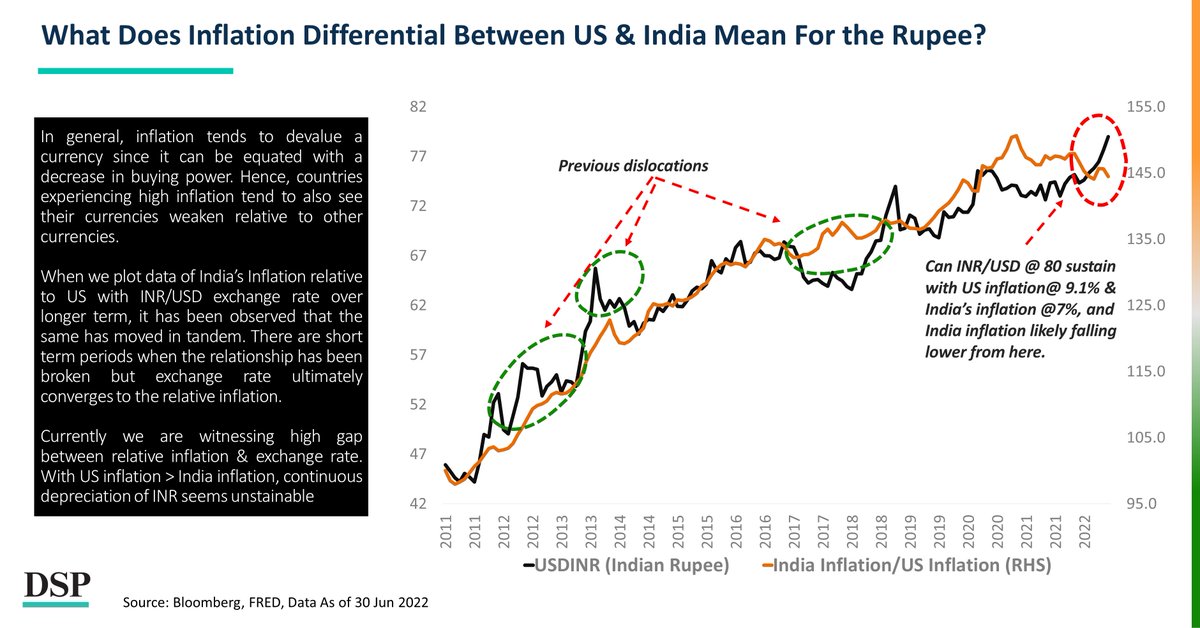

Inflation differential between India and US begins to favour the Rupee. That’s rare.

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

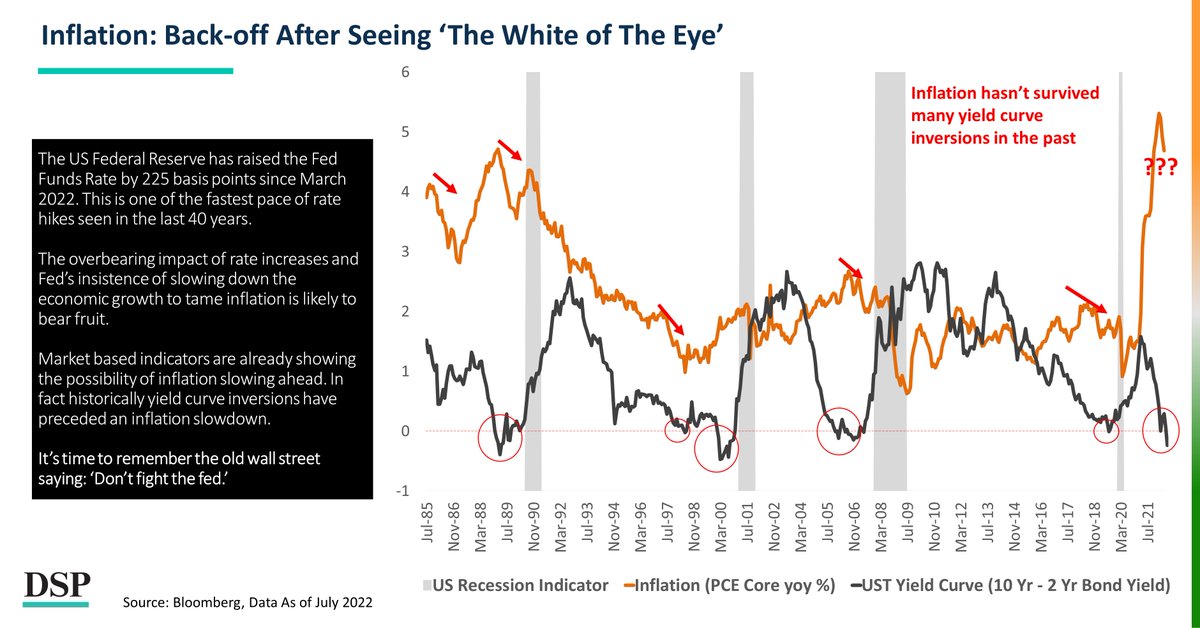

The coming collapse of inflation – that’s the message from the bond market.

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

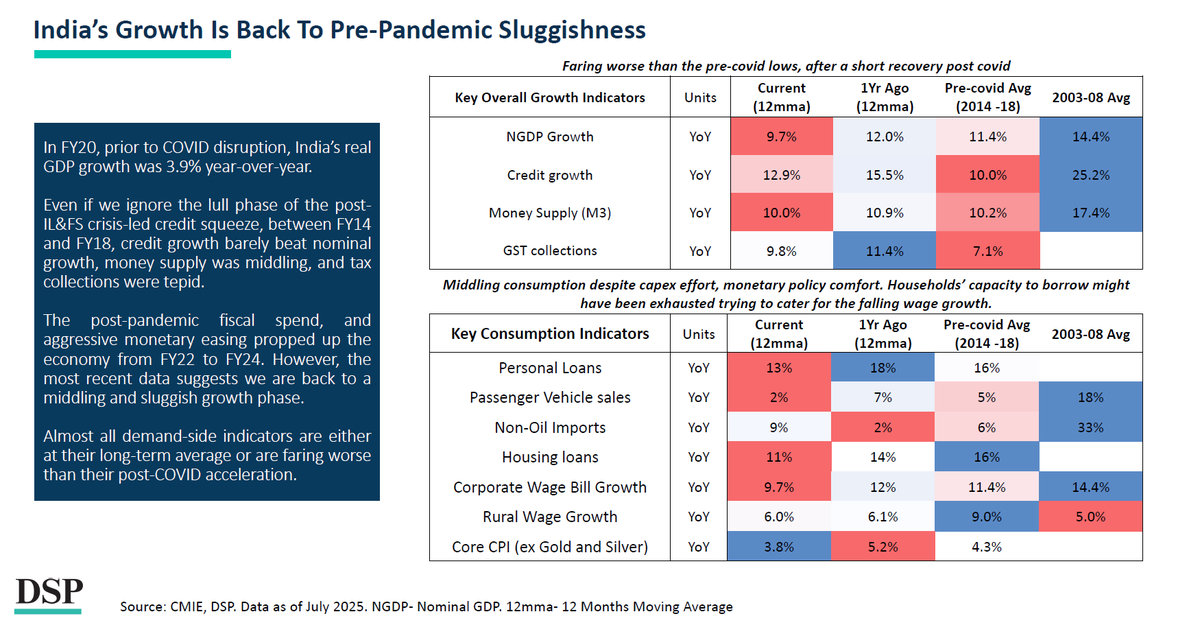

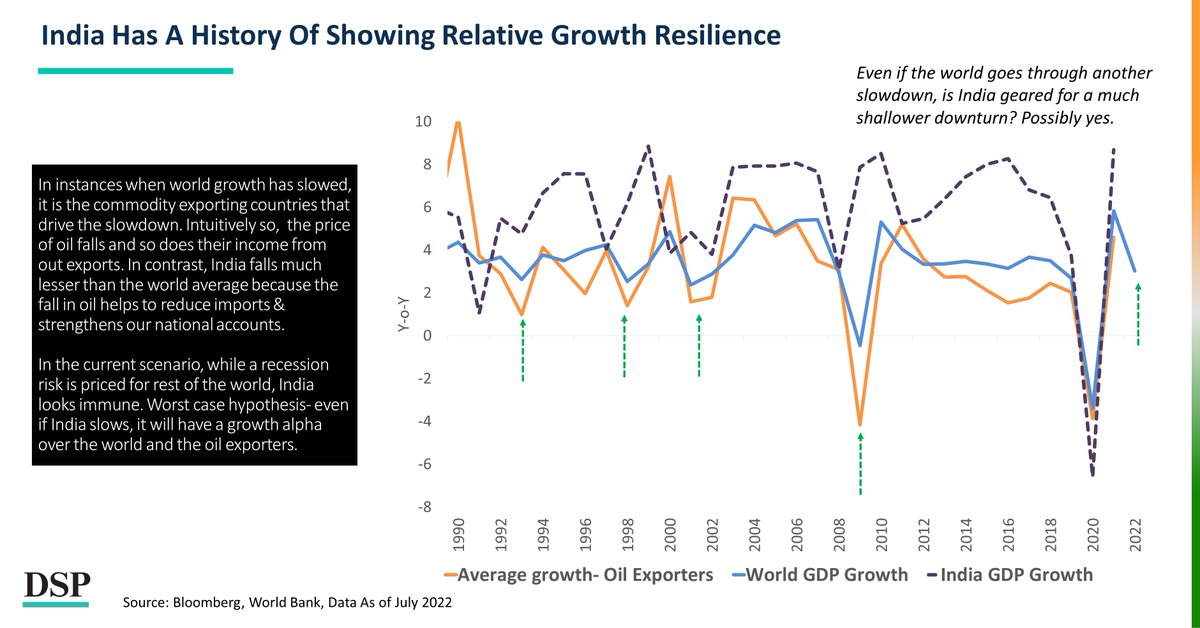

India’s growth is stronger than others and is likely to be more resilient.

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

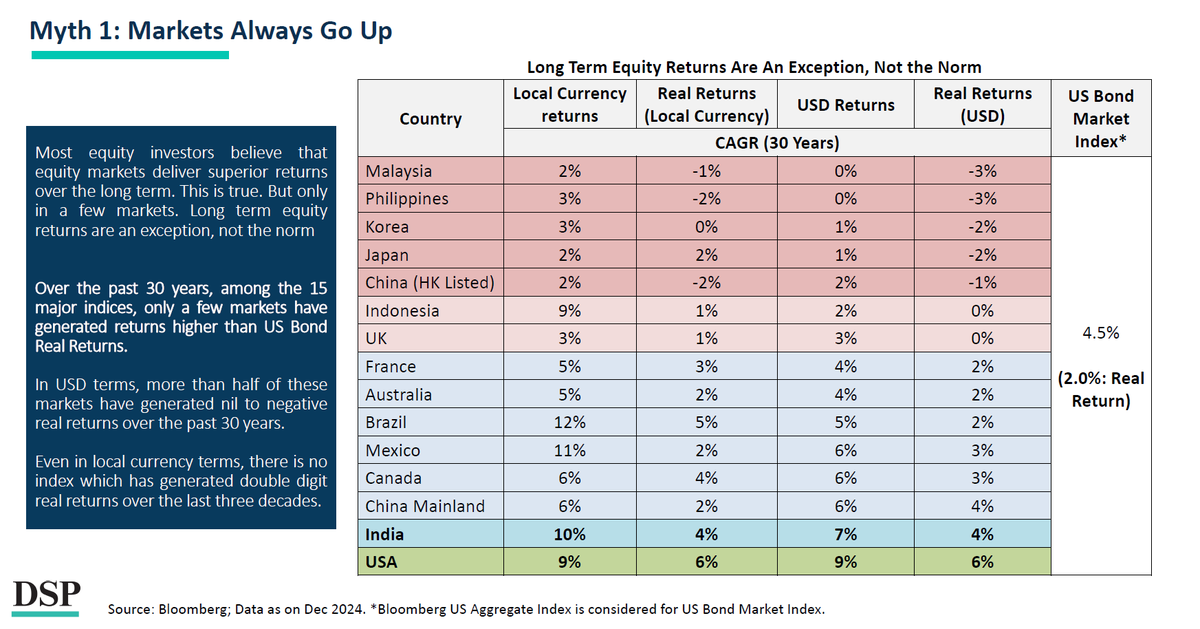

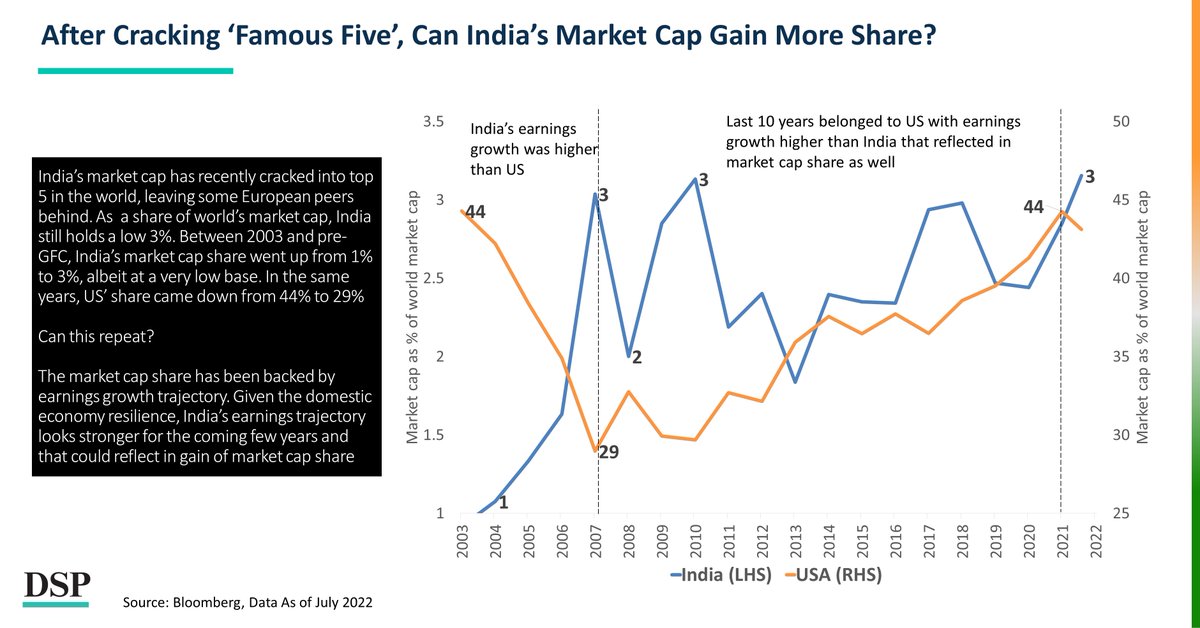

Can India gain a stronger foothold in global market cap share? Probably yes.

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

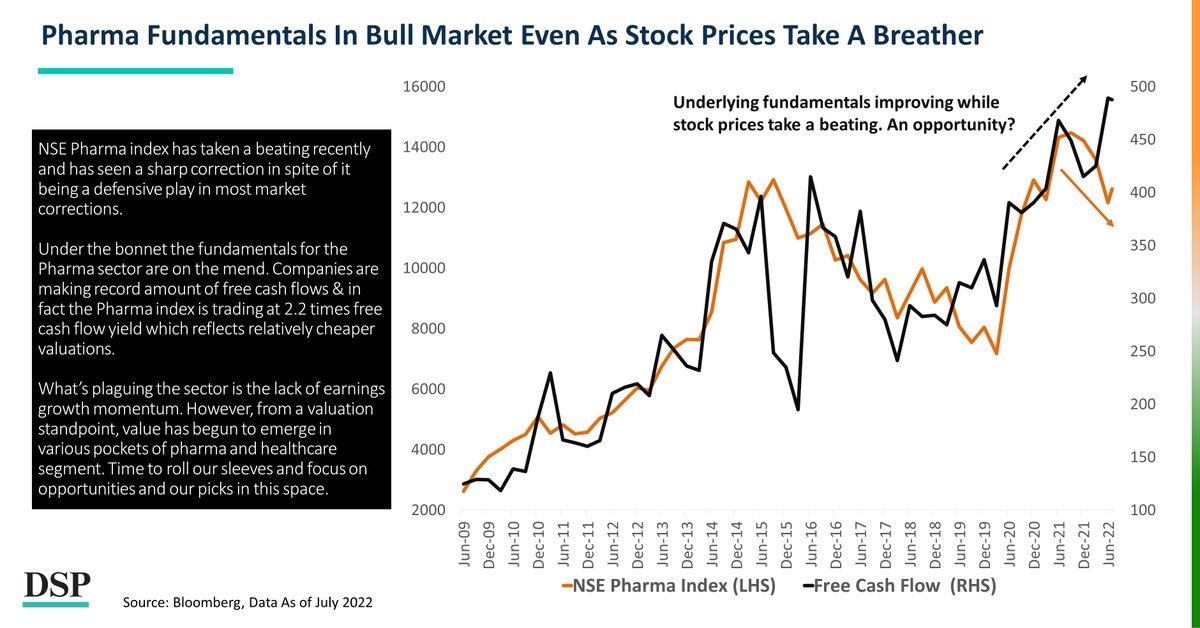

The boring long term underlying trend for Pharma sector keep improving while prices fluctuate. A typical ‘Buy’ set-up.

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

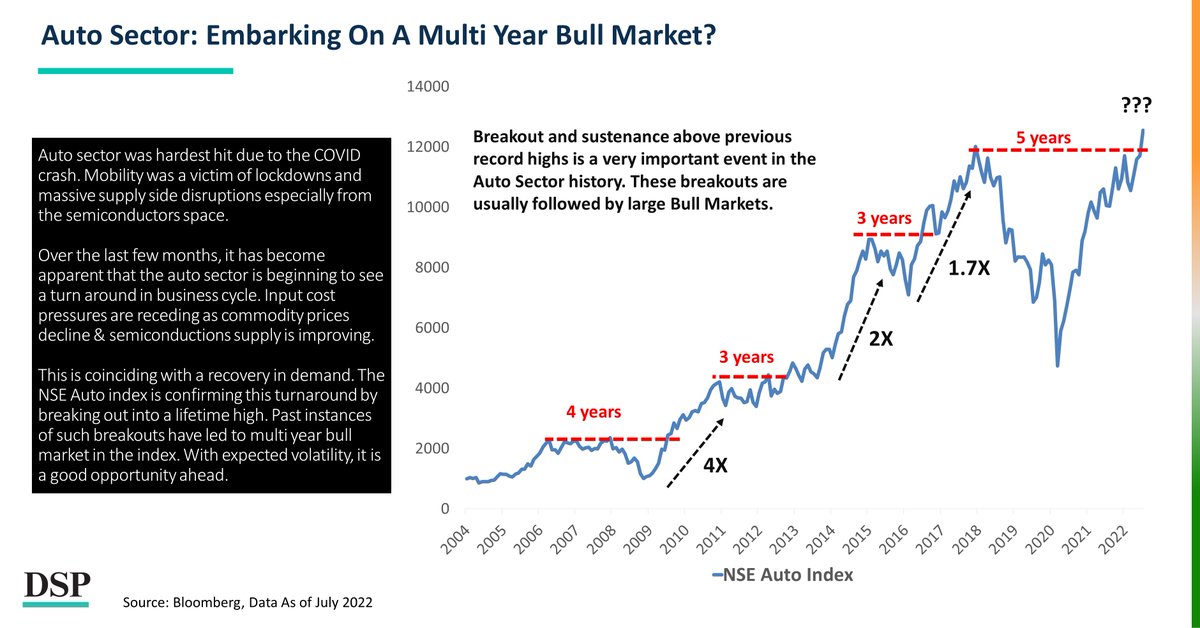

Auto sector is now in a well-defined bull market. Can it sustain? History says…

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

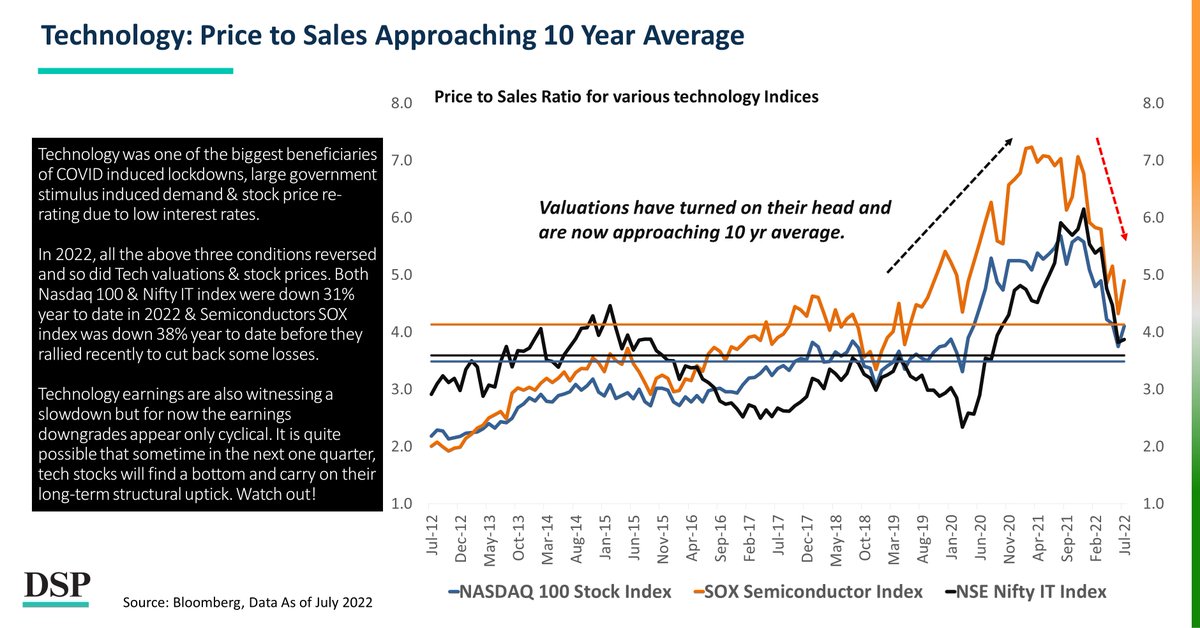

Technology may exert its long-term bullish trend as valuation means revert.

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

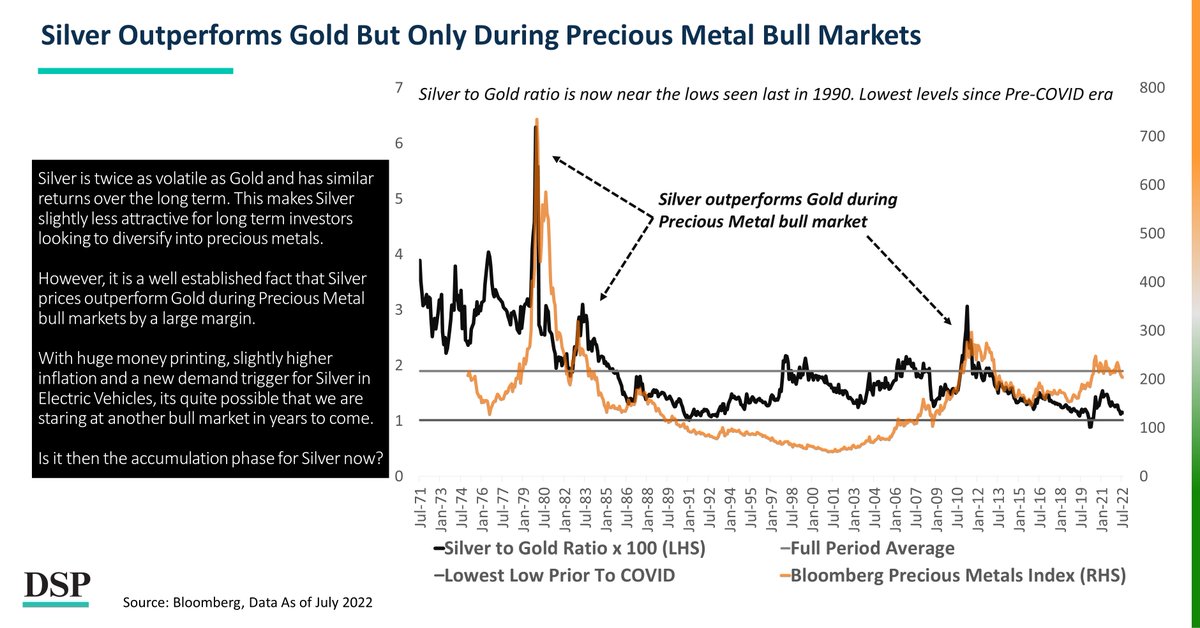

Silver is relatively cheaper and is in a phase of consolidation. Good time to accumulate?

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

Choose only those actions that take you closer to your goal. Shun the rest.

Download #DSPNetra: dspim.co/NetAug22

Download #DSPNetra: dspim.co/NetAug22

• • •

Missing some Tweet in this thread? You can try to

force a refresh