We are obsessed with helping you invest better, so you can #InvestForGood | Official DSP Mutual Fund handle | RTs/ Likes/ Follows are not endorsements.

3 subscribers

How to get URL link on X (Twitter) App

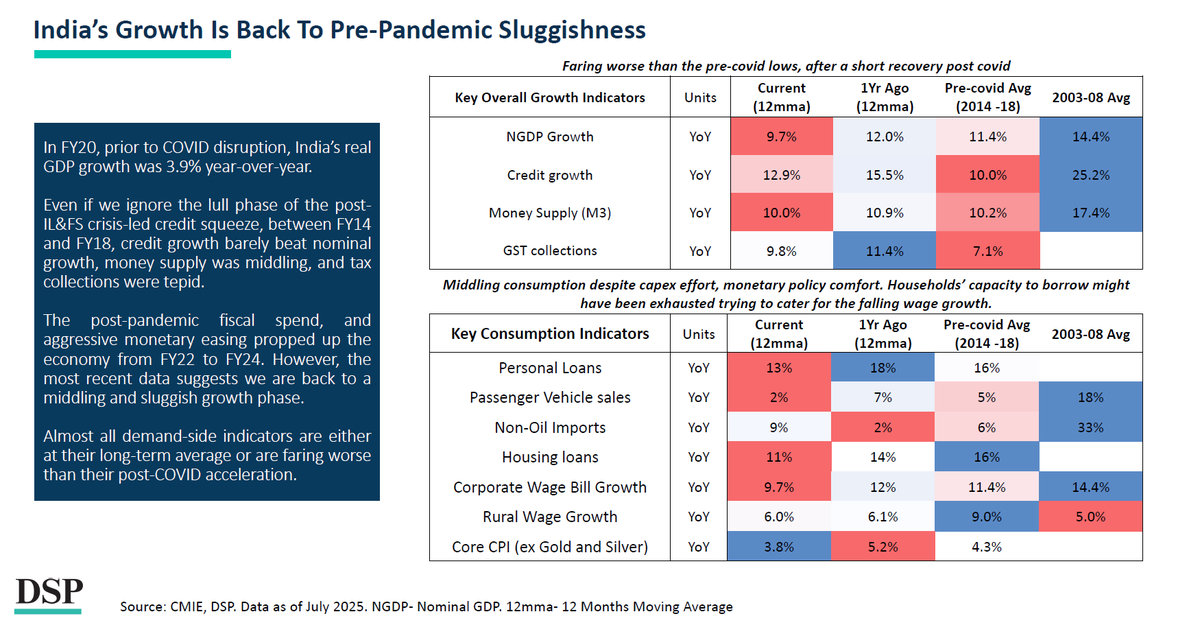

India’s growth has reverted to pre-pandemic sluggishness.

India’s growth has reverted to pre-pandemic sluggishness.

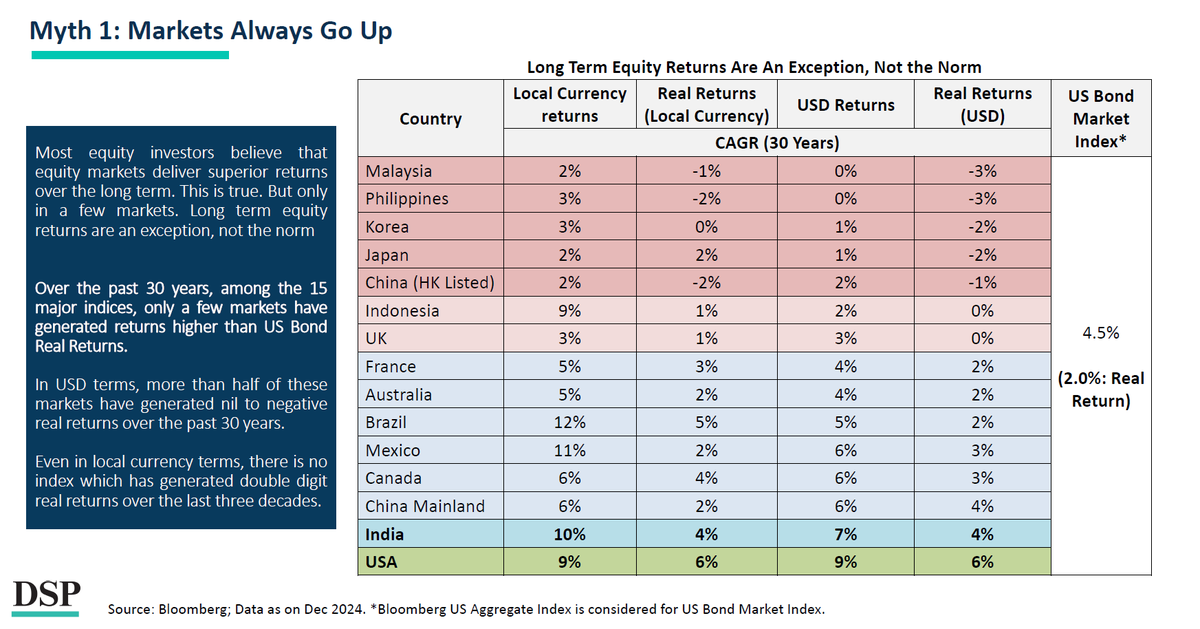

Myth 1: Markets always go up.

Myth 1: Markets always go up.

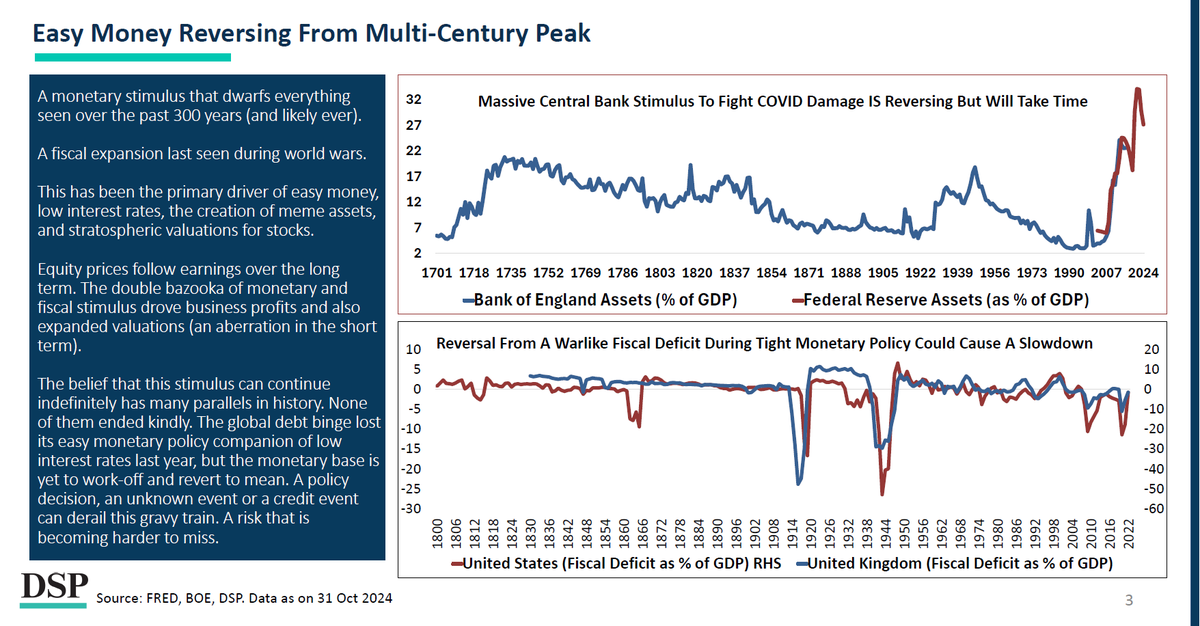

When talk is cheap, liquidity is cheaper, stocks are expensive.

When talk is cheap, liquidity is cheaper, stocks are expensive.

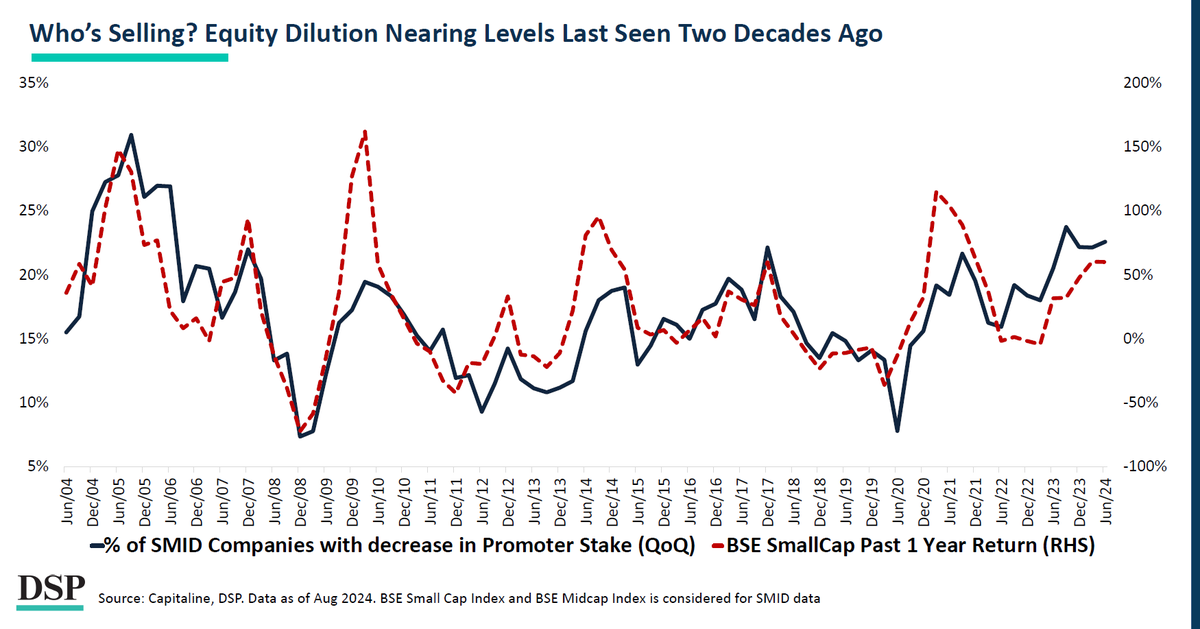

The street is focused on buyers – the FII’s, MF’s, SIPers.

The street is focused on buyers – the FII’s, MF’s, SIPers.

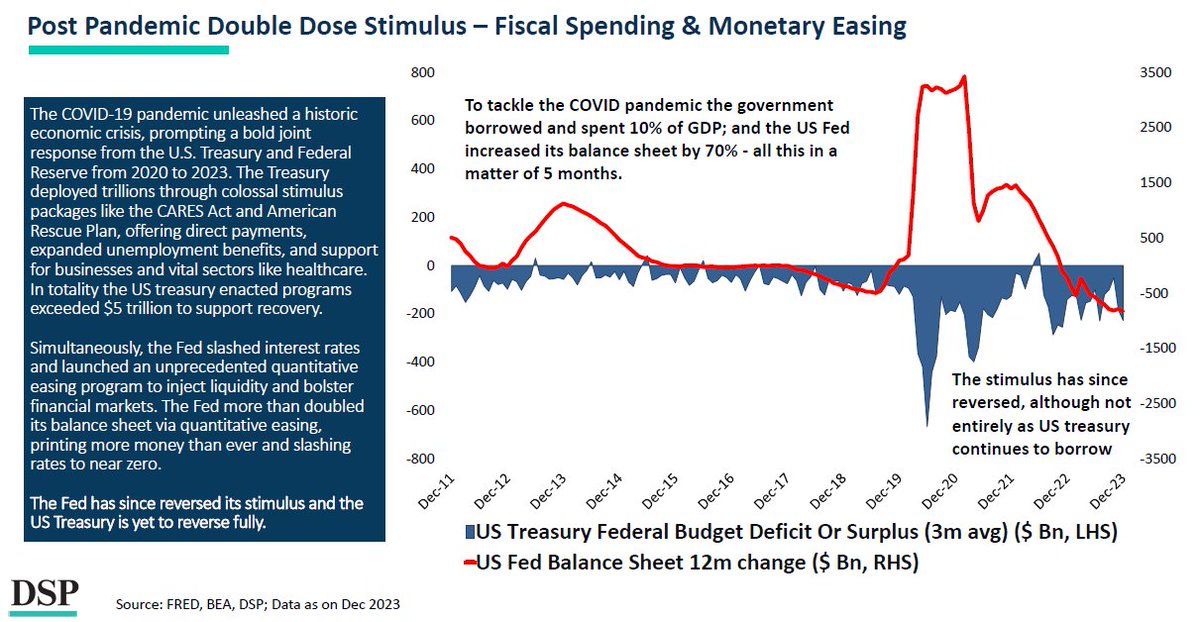

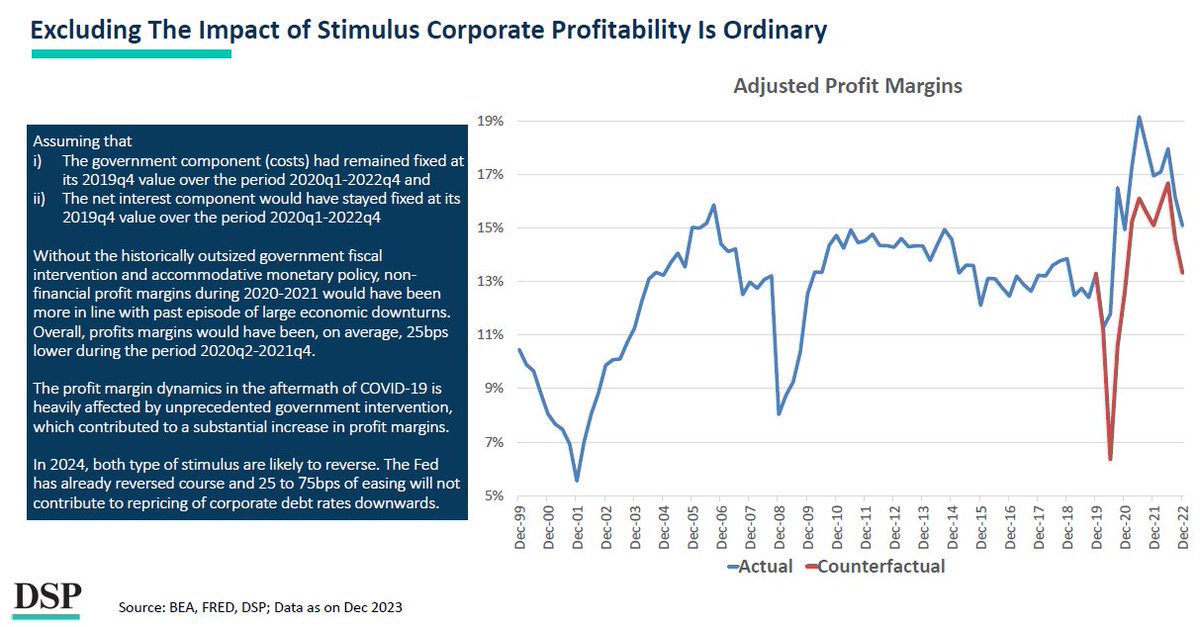

US Corporate profit growth has got a big boost from:

US Corporate profit growth has got a big boost from:

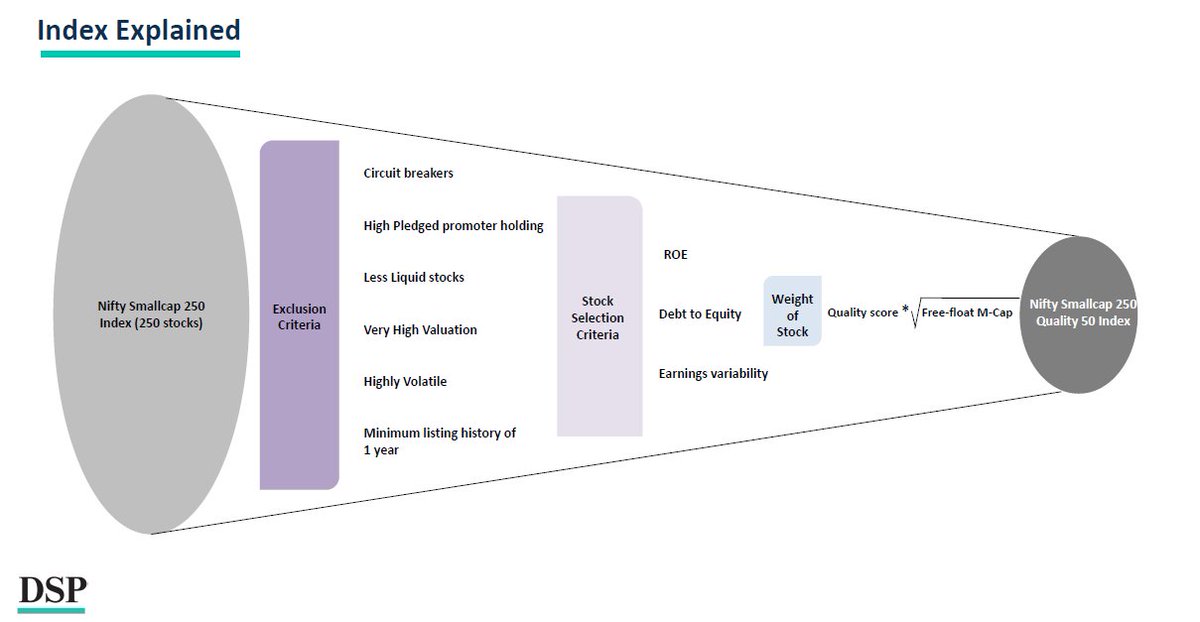

What is Nifty Small Cap 250 Quality 50 Index

What is Nifty Small Cap 250 Quality 50 Index

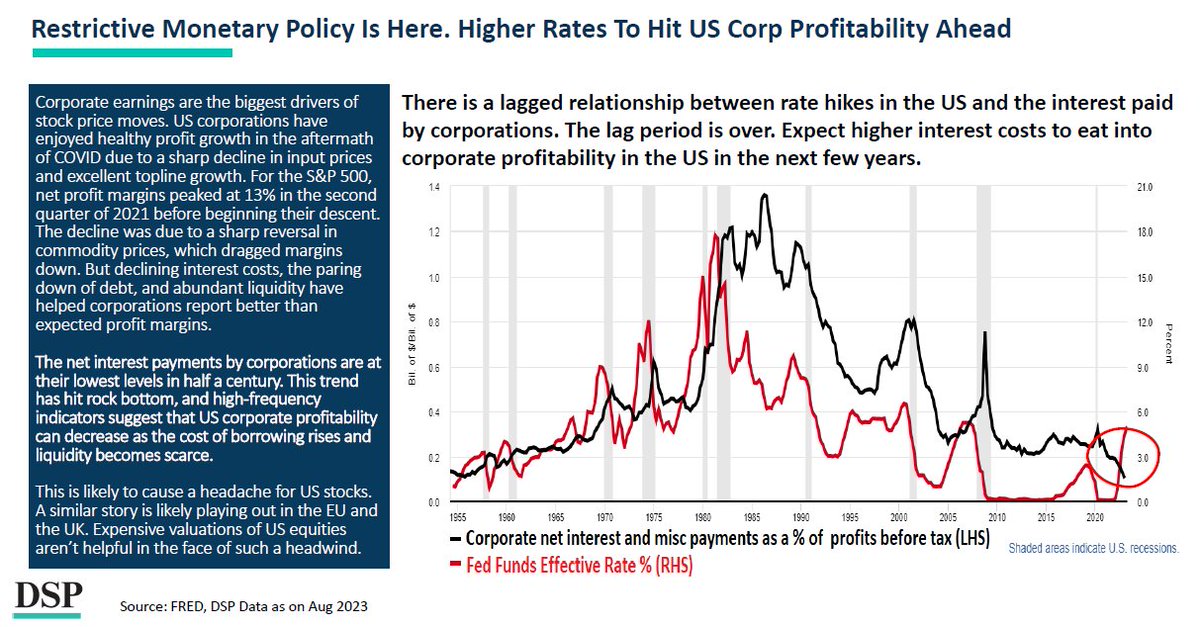

US Corporate profitability has enjoyed a dream run. The dream is about to run out. 2/16

US Corporate profitability has enjoyed a dream run. The dream is about to run out. 2/16

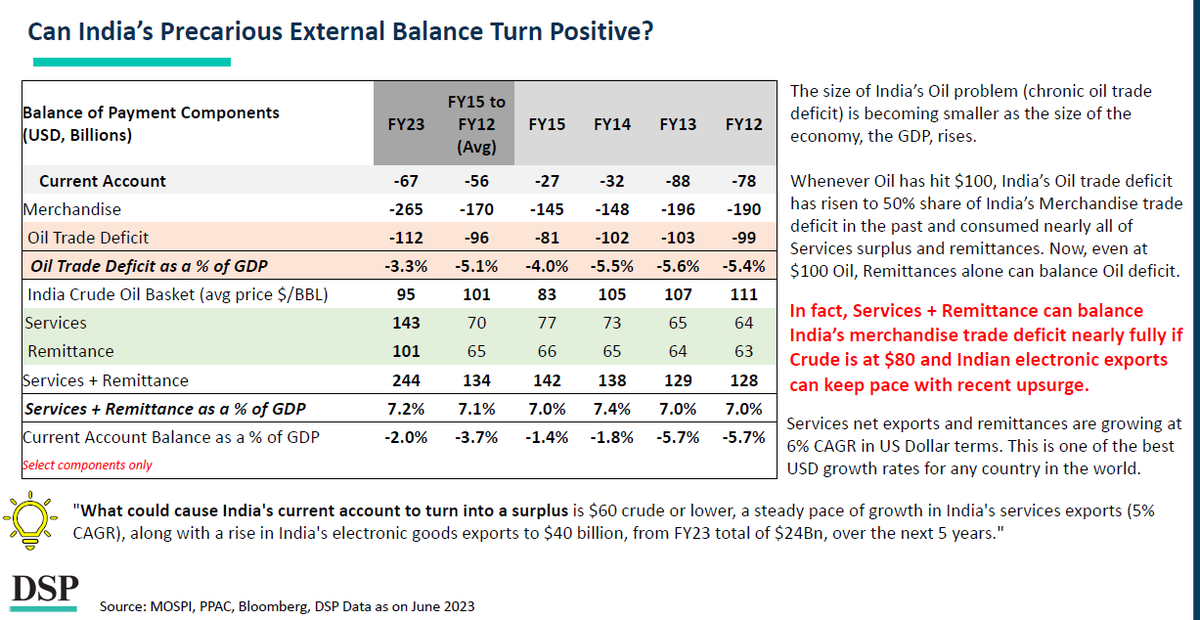

India’s trade deficit & foreign flows have been a continued source of problems.

India’s trade deficit & foreign flows have been a continued source of problems.

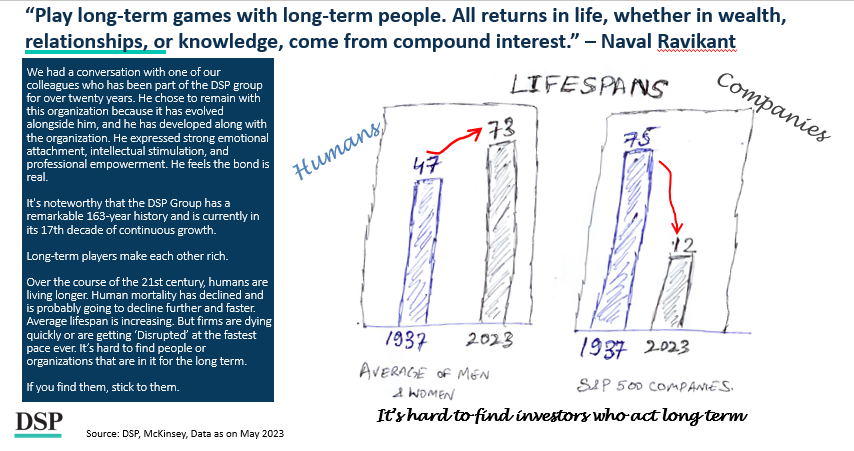

The relentless speed of modern life impedes our ability to act with a long-term perspective. However, those who can consciously prioritize long-term thinking and identify enduring people, organizations, and investments gain a distinct advantage.

The relentless speed of modern life impedes our ability to act with a long-term perspective. However, those who can consciously prioritize long-term thinking and identify enduring people, organizations, and investments gain a distinct advantage.

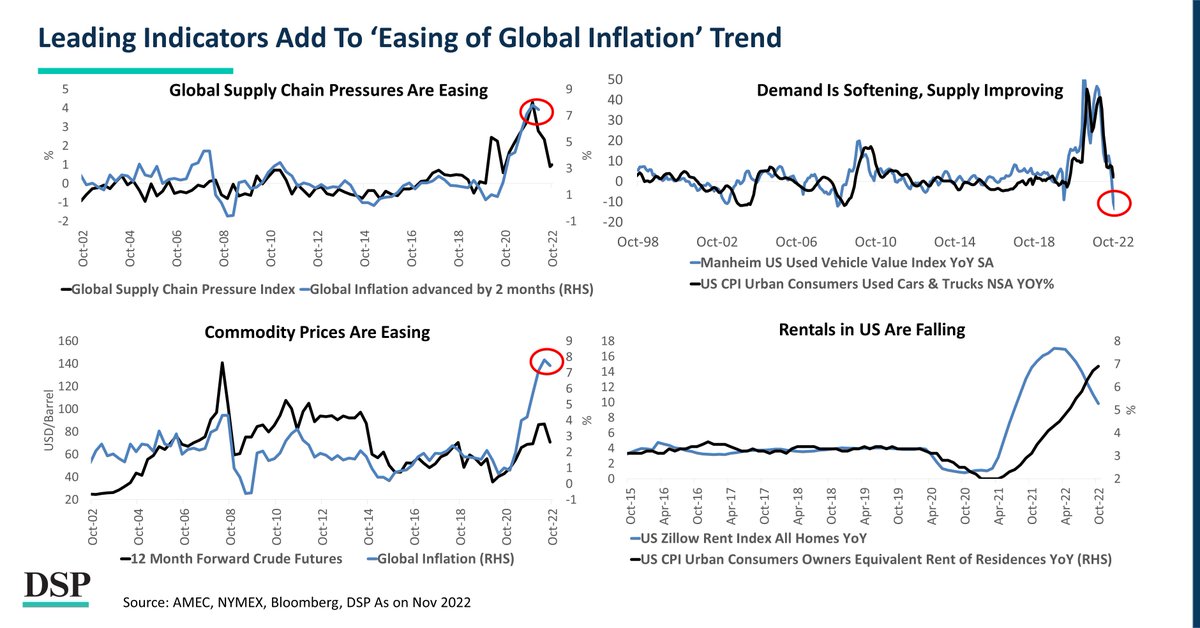

Inflation is easing. The indicators which make up the inflation basket have softened. This lowers one of the hurdles for policy makers.

Inflation is easing. The indicators which make up the inflation basket have softened. This lowers one of the hurdles for policy makers.

A ‘Risk-off’ signal from bonds & stocks sell-off. Is it a time to buy? Maybe!

A ‘Risk-off’ signal from bonds & stocks sell-off. Is it a time to buy? Maybe!

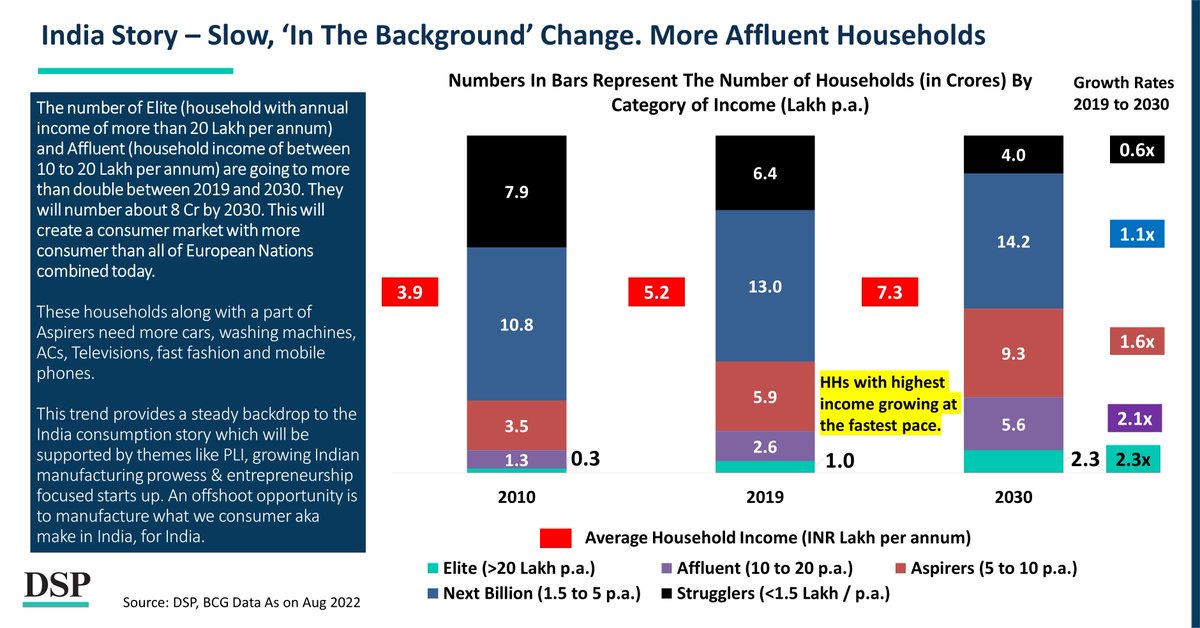

Consumption: The India story is alive and kicking. The changes which happen slowly and aren’t visible on a daily basis are powerful. Indian households are becoming more affluent.

Consumption: The India story is alive and kicking. The changes which happen slowly and aren’t visible on a daily basis are powerful. Indian households are becoming more affluent.

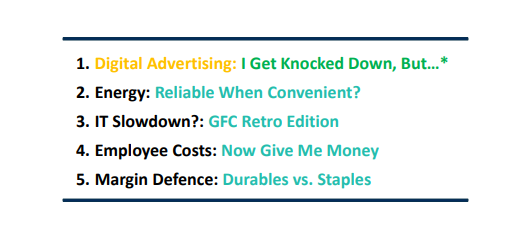

Segments covered in this edition of #DSPTranscript 👇

Segments covered in this edition of #DSPTranscript 👇

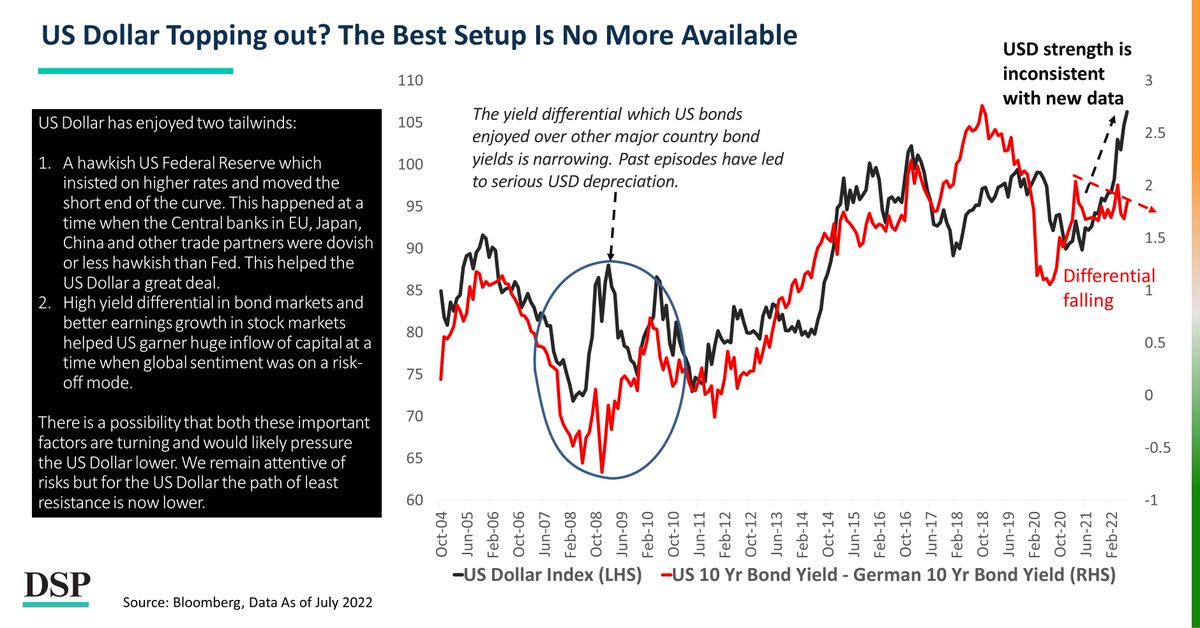

US Dollar’s dream run may be over… that’s what the data suggests.

US Dollar’s dream run may be over… that’s what the data suggests.

What are the key drivers that make Silver a potent investment option?

What are the key drivers that make Silver a potent investment option?

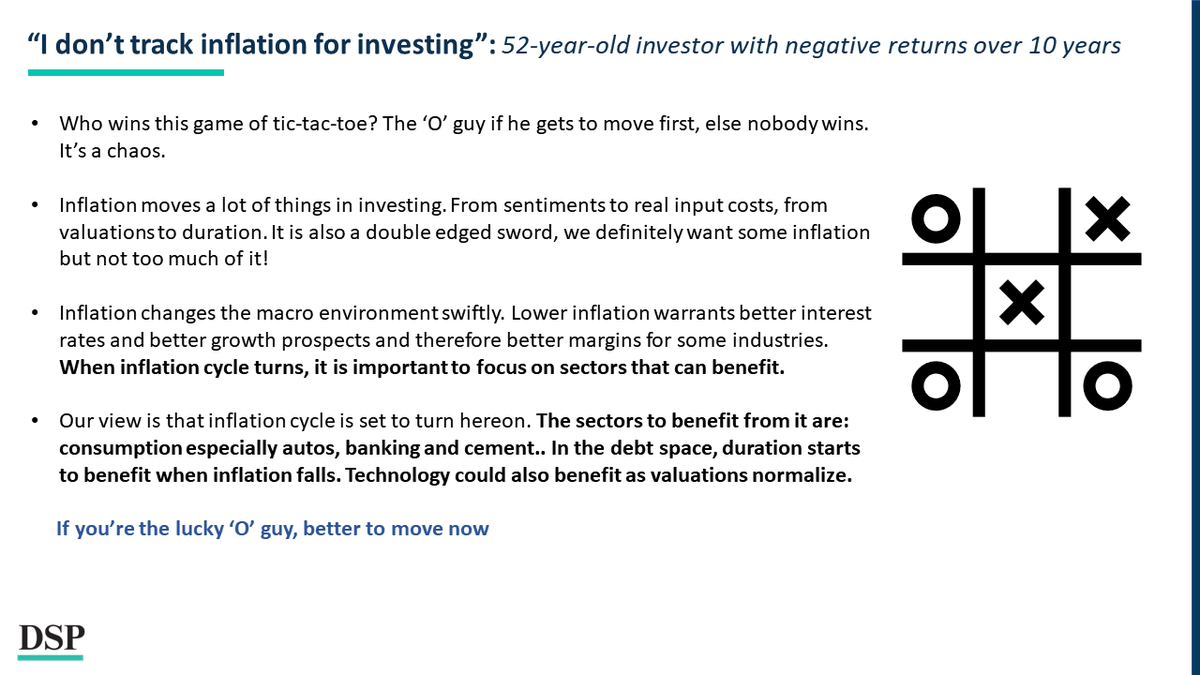

“I don’t track inflation for investing”: 52-𝘺𝘦𝘢𝘳-𝘰𝘭𝘥 𝘪𝘯𝘷𝘦𝘴𝘵𝘰𝘳 𝘸𝘪𝘵𝘩 𝘯𝘦𝘨𝘢𝘵𝘪𝘷𝘦 𝘳𝘦𝘵𝘶𝘳𝘯𝘴 𝘰𝘷𝘦𝘳 10 𝘺𝘦𝘢𝘳𝘴!

“I don’t track inflation for investing”: 52-𝘺𝘦𝘢𝘳-𝘰𝘭𝘥 𝘪𝘯𝘷𝘦𝘴𝘵𝘰𝘳 𝘸𝘪𝘵𝘩 𝘯𝘦𝘨𝘢𝘵𝘪𝘷𝘦 𝘳𝘦𝘵𝘶𝘳𝘯𝘴 𝘰𝘷𝘦𝘳 10 𝘺𝘦𝘢𝘳𝘴!

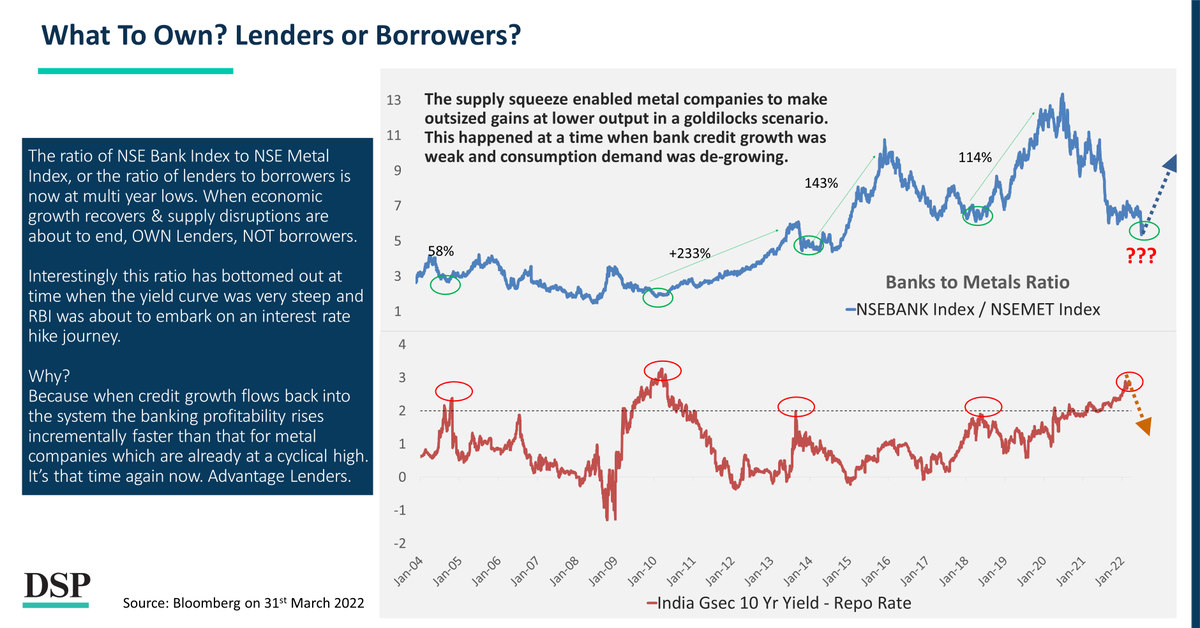

Lenders have been lazy while metals were hyper active. Are they likely to wake up from their slumber & have a good time?

Lenders have been lazy while metals were hyper active. Are they likely to wake up from their slumber & have a good time?

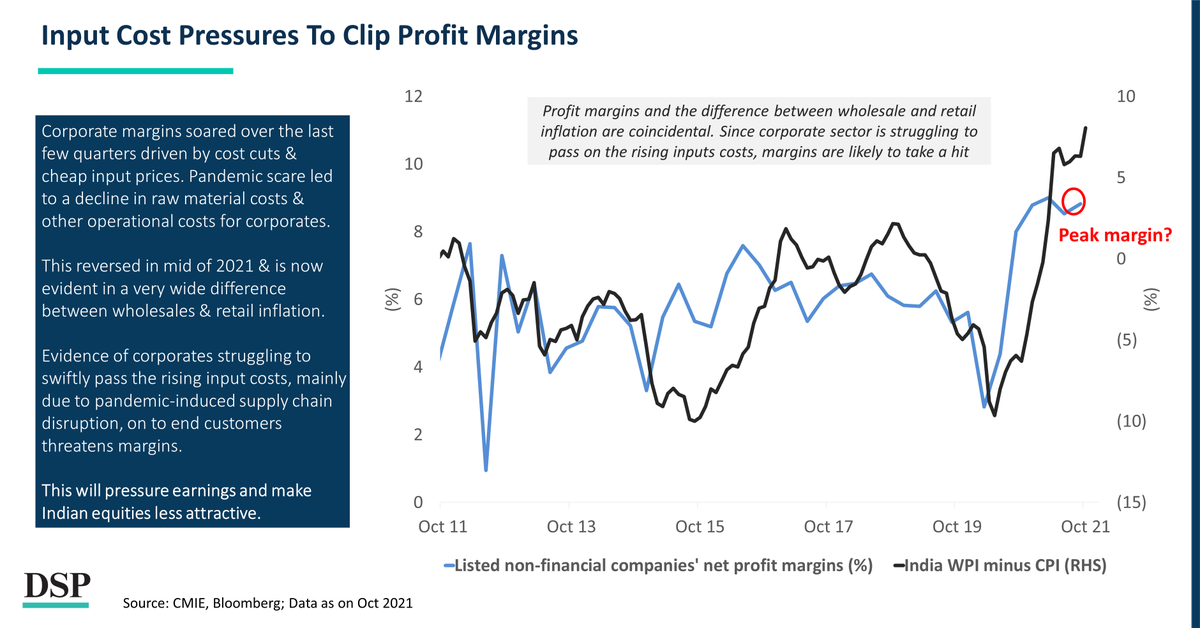

Corporate India’s margin expansion is under threat. Costs have escalated. A margins squeeze ahead?

Corporate India’s margin expansion is under threat. Costs have escalated. A margins squeeze ahead?

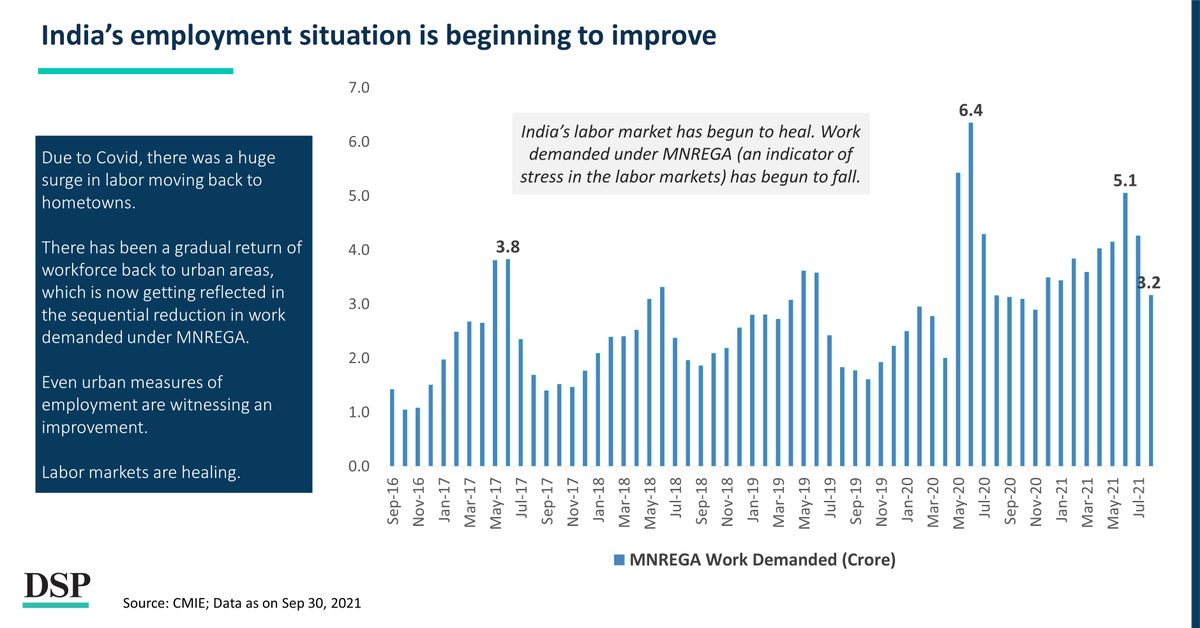

India suffered a bleak employment situation due to the pandemic. This is now beginning to reverse.

India suffered a bleak employment situation due to the pandemic. This is now beginning to reverse.

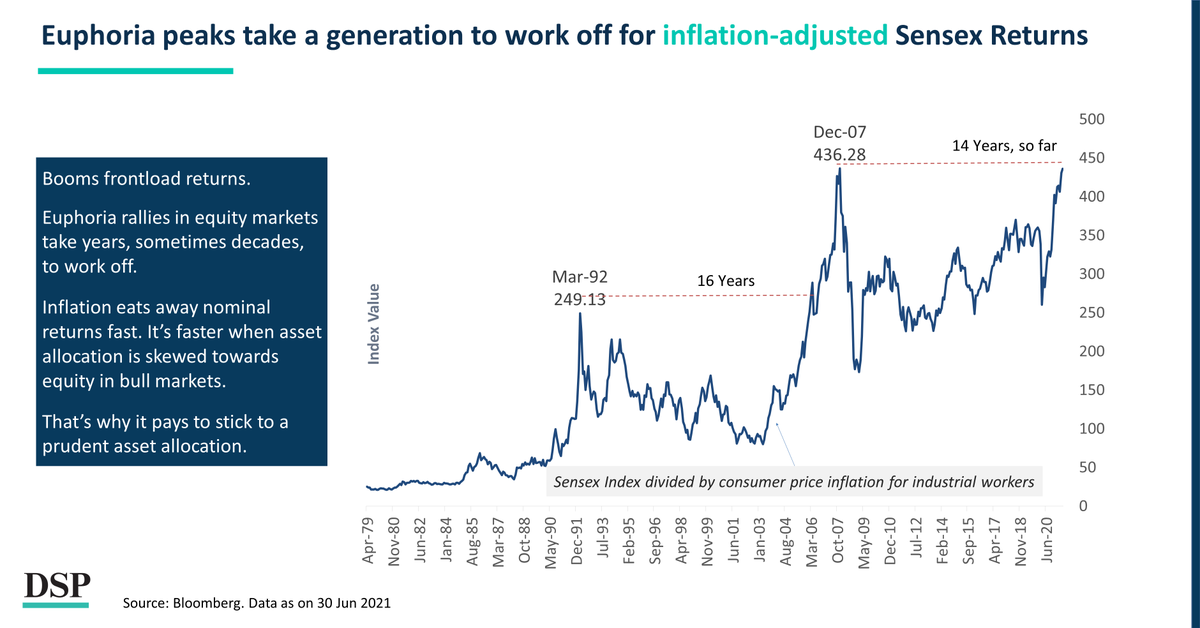

When equity prices rise exponentially, they reflect euphoric investor sentiment. This causes future real returns adjusted for inflation to be subpar for a long time.

When equity prices rise exponentially, they reflect euphoric investor sentiment. This causes future real returns adjusted for inflation to be subpar for a long time.