Let’s look at the structural change in the #copper market that will be relevant once the cyclical economic situation has played out in the coming months and IF the energy transition is going to happen in a meaningful way.

Thread below.

1/n

Thread below.

1/n

@SPGCIMetals recently released a study that I recommend people to read.

link: ihsmarkit.com/Info/0722/futu…

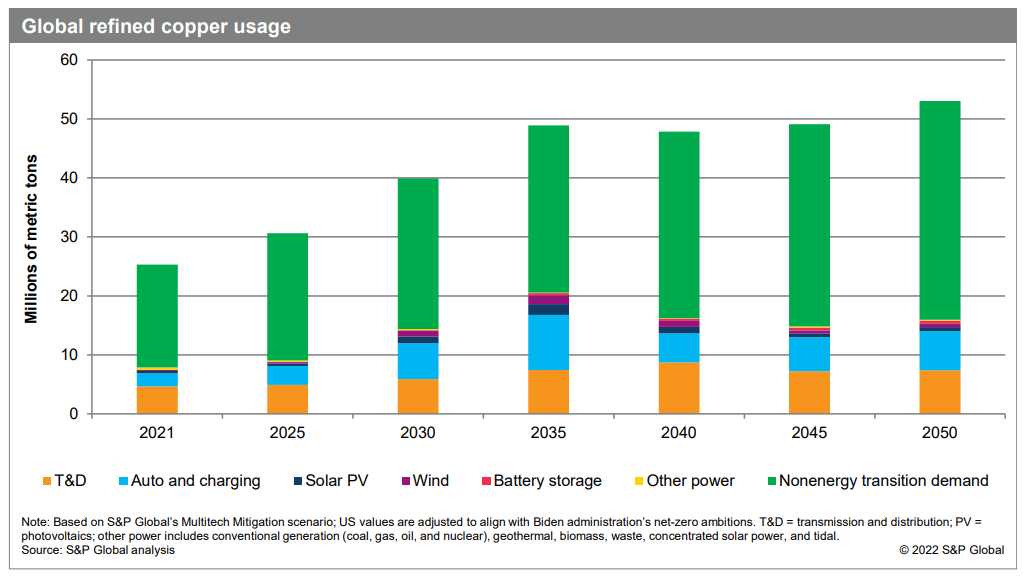

What is important to understand is that the demand for #copper is going to increase greatly within the coming decades,

2/n

link: ihsmarkit.com/Info/0722/futu…

What is important to understand is that the demand for #copper is going to increase greatly within the coming decades,

2/n

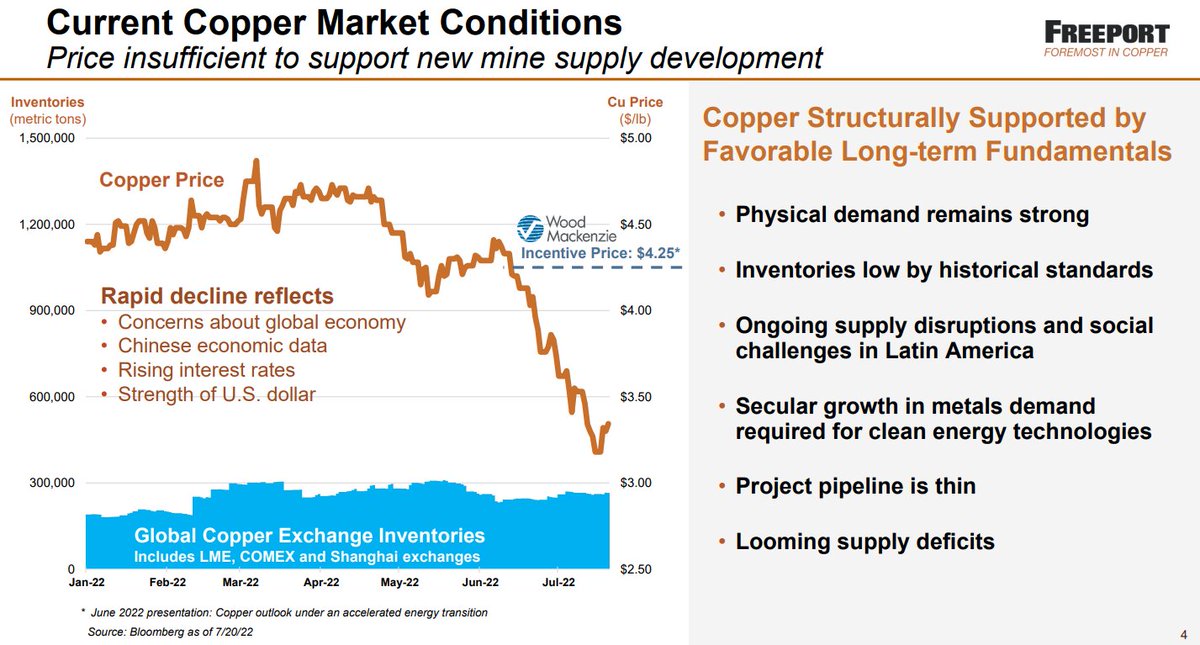

which represents a huge mismatch to the supply that is likely going to be available. A mismatch that requires a much higher copper price to solve (solve = make sure new production comes online but also ensure demand destruction to some degree).

Why will supply be lagging?

3/n

Why will supply be lagging?

3/n

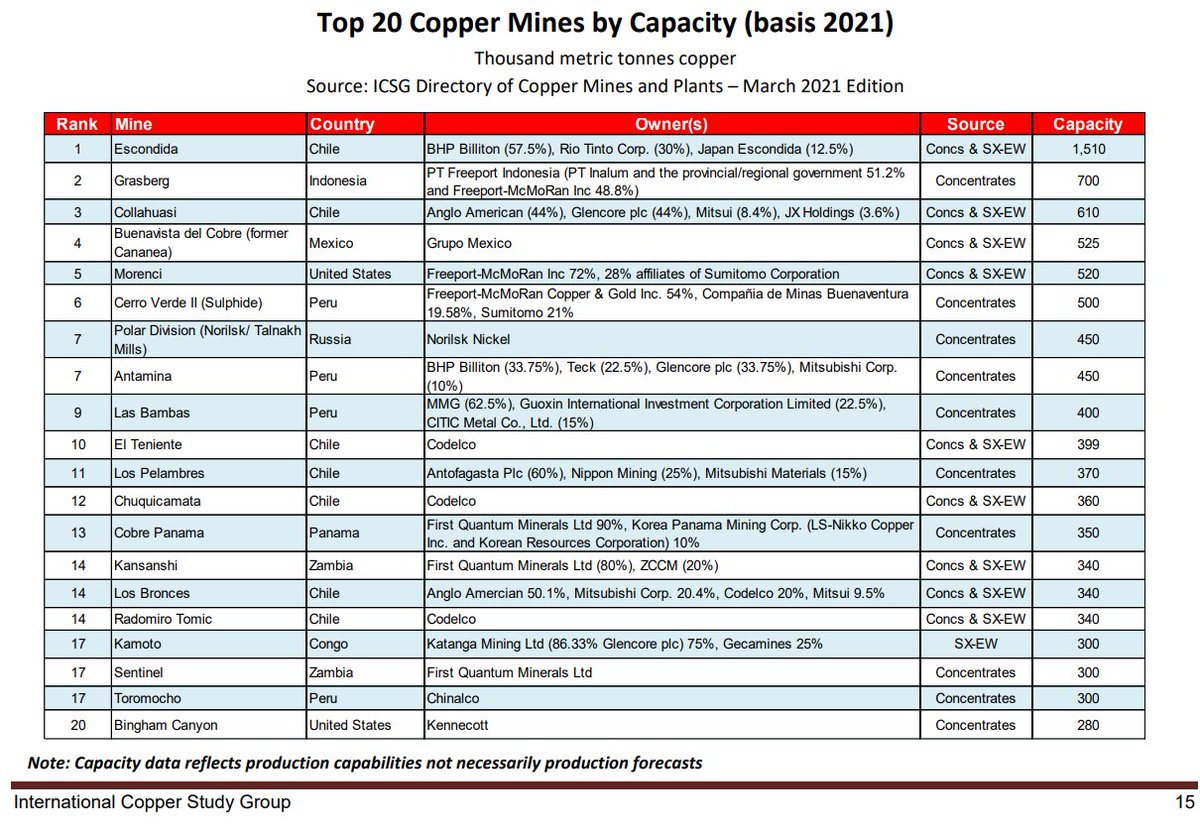

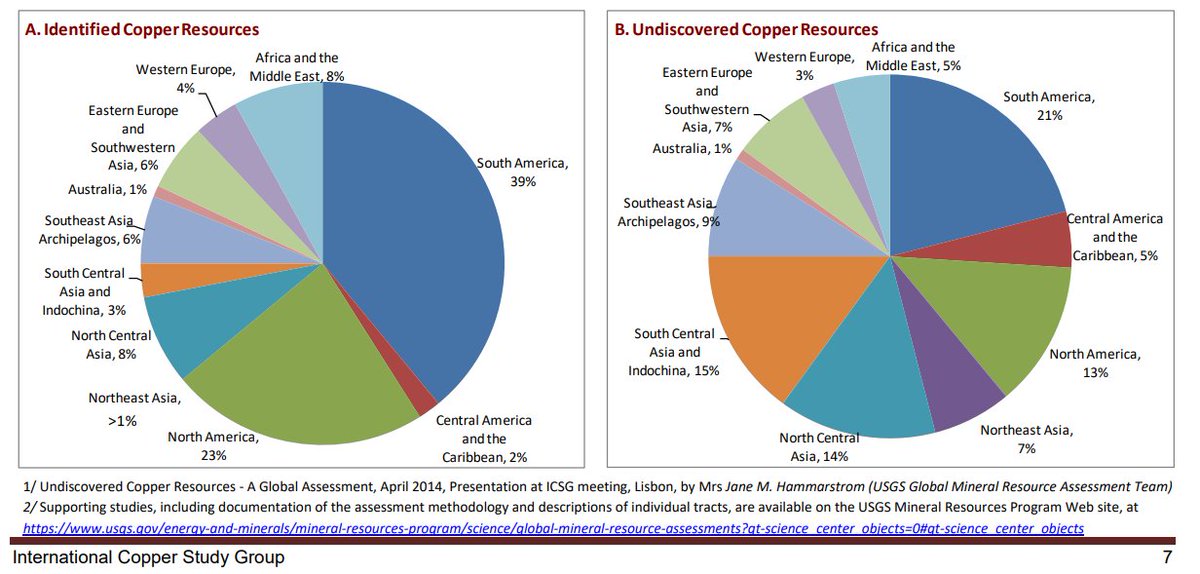

Firstly, the copper industry is extremely capex heavy and has historically been dominated by a few very large and low-cost mines primarily located in Chile and Peru (10 largest mines produces close to 30% of the worlds copper and 6 of the mines are located in Chile/Peru).

4/n

4/n

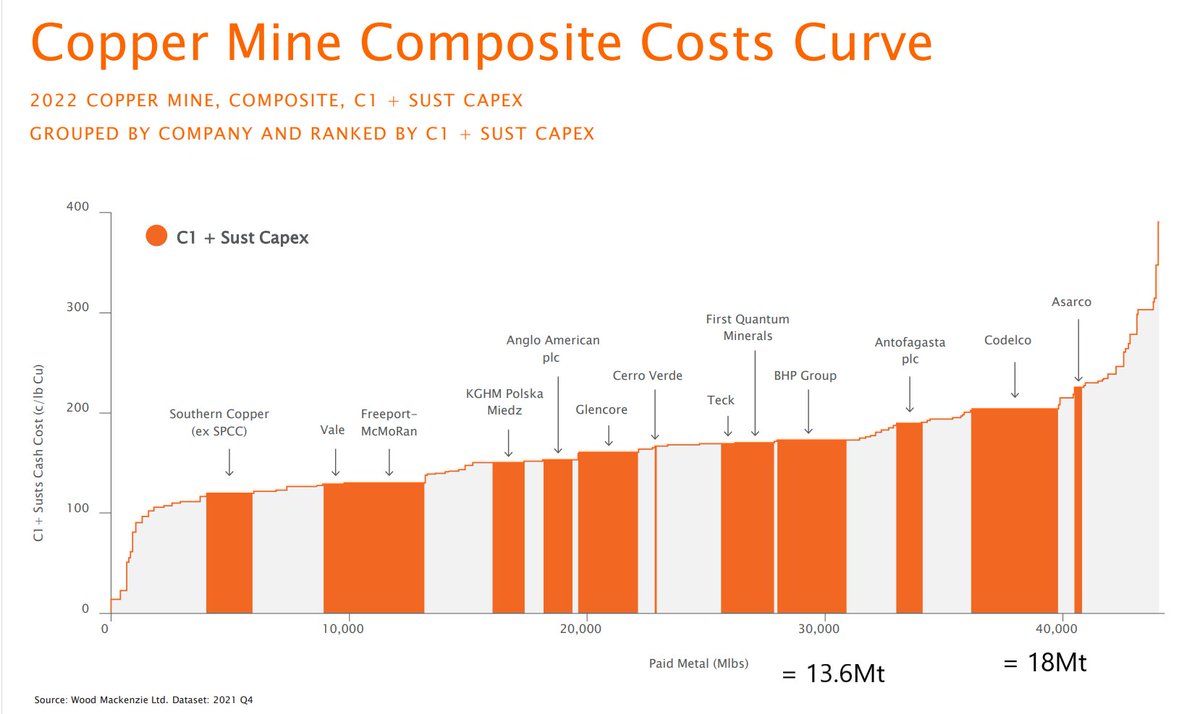

In other words: these large/low-cost mines have ensured cheap supply of copper while decreasing the appetite for exploration and for new production to come online. When looking at the cost curve for copper, it’s clear that the big companies with mega mines have lower cost.

5/n

5/n

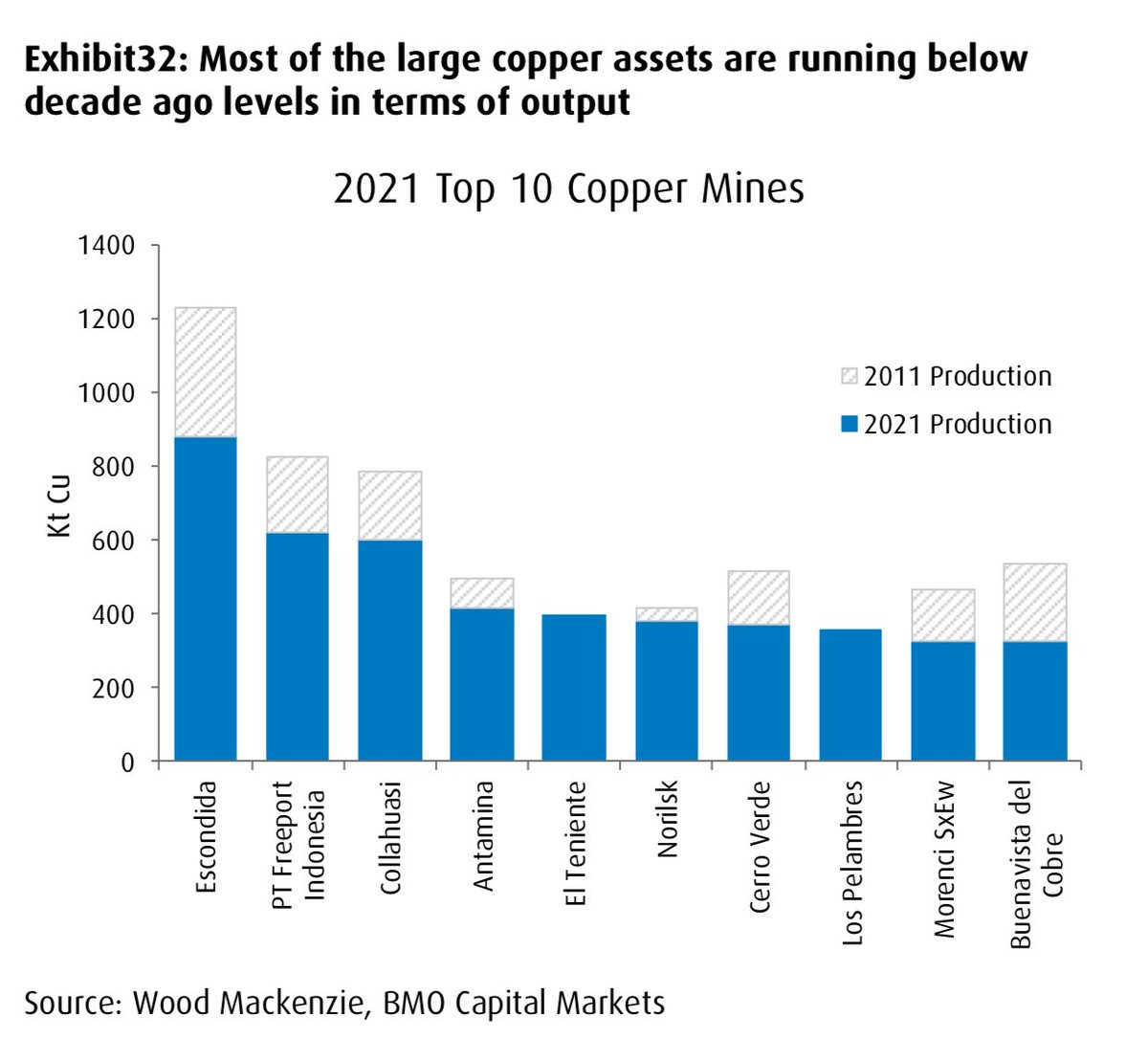

It’s also clear that the current mega mines can only produce approximately 20Mt a year cheaply, which is far less than what is needed a few years from now. In addition, these mega mines are falling in output compared to the past (covid is obviously a factor here too).

6/n

6/n

But as @MABernal7 points out, the big mines are experiencing declines in both grades and resources/reserves, hence they can’t respond to the increase in demand going forward. A few good projects like Kamoa-Kakula ( $IVN.to @IvanhoeMines_ ),

7/n

https://twitter.com/MABernal7/status/1511302698842398724?s=20&t=kZjr9qbhEE43pXHoYdprDg

7/n

QB2 (@TeckResources) and Quellaveco (@AngloAmerican) will help but not sufficiently. The current price of #copper is too low to support the majors investing in new mine supply and mid-tiers are broadly not making money in this current environment. Therefore, existing

8/n

8/n

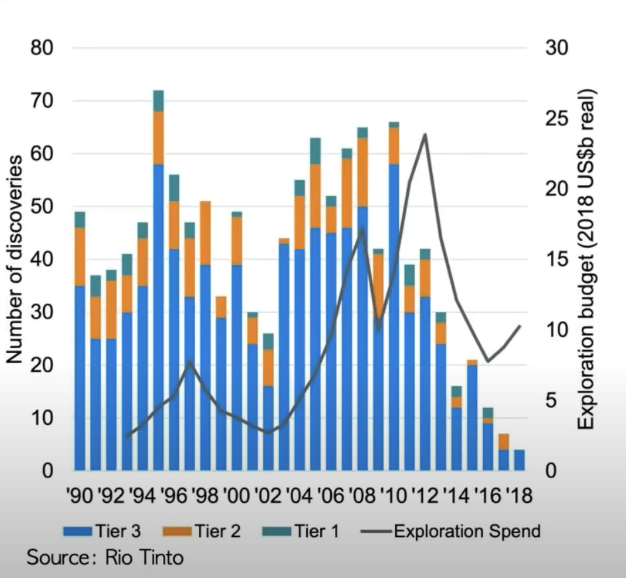

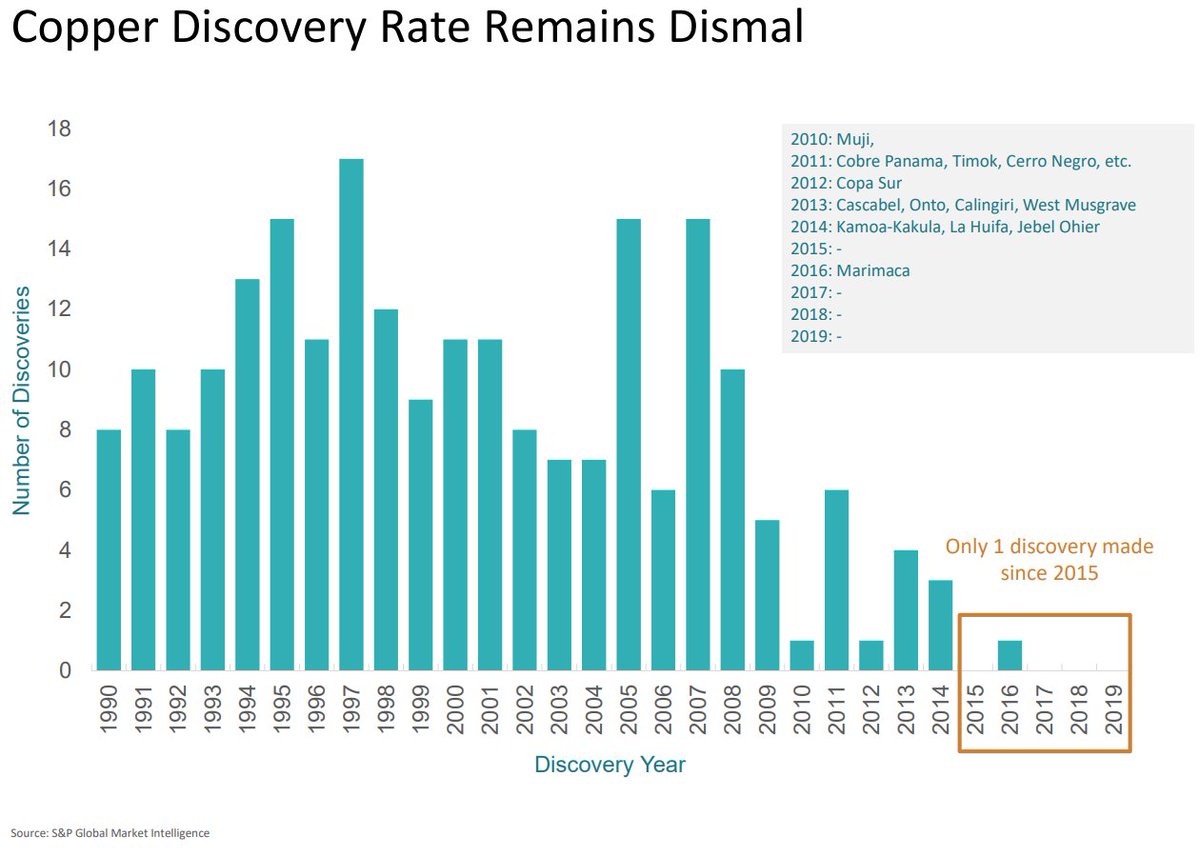

growth plans will most likely be pushed a few years down the line. So, what happens once the incentive price is high enough and majors want to put new projects into production? Well, firstly there aren’t many good projects to choose from due to the lack of discoveries.

9/n

9/n

In addition, it usually takes a very long time to get a project permitted and built no matter what country it is located in (10-20 years from discovery to production is not uncommon). Increased focus on ESG and social/political challenges in Latin America + Africa,

10/n

10/n

where the majority of good projects are located, won’t make this easier going forward. To get to a point where the mismatch between future demand/supply can start to be dealt with, the #copper price has to increase substantially. In other words: before a limited amount of

11/n

11/n

companies like $BHP @bhp, $RIO @RioTinto, $GLEN.L @Glencore, $VALE @valeglobal, $NGLOY @AngloAmerican, $FCX @FM_FCX, $SCCO, $TECK @TeckResources and $FM.to can increase production substantially, the copper price needs to be at a level where they can please stakeholders

12/n

12/n

(host countries, local communities, investors etc.) and therefore optimize the chances of success before investing billions of dollars in capex. This is assuming host countries are willing to provide political stability if treated fairly of course. In addition to

13/n

13/n

capex expenditures, the majors will need to buy all the few good copper projects out there held by juniors, which most likely will increase greatly in price once #copper sees new ATH’s and M&A activity picks up. @paola_rojas has made a list of 10 deposits that could boost

14/n

14/n

supply if put into production ( $MUX, $FIL.to, $LUN.to, $ALDE.v, $SOLG.L, $NDM.to etc.). Many of these projects have been around for a long time already and provide examples on the challenges I have mentioned above.

15/n

https://twitter.com/paola_rojas/status/1542982398895394816?s=20&t=kZjr9qbhEE43pXHoYdprDg

15/n

Other juniors with deposits of a certain size include $LA.v @LosAndesCopper, $NGEX.v @ngex_minerals $REG.v @IncRegulus, $WRN.to, $SLS.to @SolarisResource, $DNT.to @CandenteCopper, $HCH.v, $CUU.v, $ATX.v, $OCO.v @OrocoCorp, $SURG.v @SurgeCopper etc.

A few of these are good

16/n

A few of these are good

16/n

projects and should be put into production within the next 10-20 years.

To round off: the structural change in the copper market seems irrelevant at this moment in time and the lack of investment in new supply continues. This will only amplify the coming mismatch between

17/n

To round off: the structural change in the copper market seems irrelevant at this moment in time and the lack of investment in new supply continues. This will only amplify the coming mismatch between

17/n

demand/supply. A LOT of money must flow into this sector within the next few years, and for the coming few decades, if the green transition is going to happen to some extent at all.

18/END

18/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh