📊TATA POWER COMPANY LIMITED (#TATAPOWER)

💥CMP: 231 Rs, Market Cap: 74,148 Cr

💥EV Charging Solutions + Renewable Energy

💥Business Analysis. A Thread 🧵

💥CMP: 231 Rs, Market Cap: 74,148 Cr

💥EV Charging Solutions + Renewable Energy

💥Business Analysis. A Thread 🧵

🌁BUSINESS

Established in 1915.

India’s largest integrated power company has a presence across the power value chain.

Involved in the business of generation (Thermal, Hydro, Solar and Wind), transmission and distribution of electricity.

Established in 1915.

India’s largest integrated power company has a presence across the power value chain.

Involved in the business of generation (Thermal, Hydro, Solar and Wind), transmission and distribution of electricity.

One of the largest renewable energy players in India and has developed country’s first 4000 MW Ultra Mega Power Project at Mundra (Gujarat) based on Supercritical technology.

In February 2017, Tata power has become the first Indian company to ship over 1 GW Solar Modules.

In February 2017, Tata power has become the first Indian company to ship over 1 GW Solar Modules.

🌁MANAGEMENT

Dr. Praveer Sinha (MD & CEO) : Total 37 Years of Experience.

Joined in Tata power on 5 September 2007.

CEO from 1 May 2018 (4.2 Years).

CEO and leadership team salary has been consistent with company performance.

Average Tenure of Leadership Team is ~13 Years.

Dr. Praveer Sinha (MD & CEO) : Total 37 Years of Experience.

Joined in Tata power on 5 September 2007.

CEO from 1 May 2018 (4.2 Years).

CEO and leadership team salary has been consistent with company performance.

Average Tenure of Leadership Team is ~13 Years.

🌁SHAREHOLDING PATTERN

Promoters increased the shareholding from 36.21% in Sep 2019 to 46.86% in June 2022

On the other side DII and FIIs are reduced the stake.

Promoters increased the shareholding from 36.21% in Sep 2019 to 46.86% in June 2022

On the other side DII and FIIs are reduced the stake.

🌁INSTALLED CAPACITY

Renewable Energy: 3,400 MW

Conventional Energy : 10,115 MW

Renewable energy is currently contributing 34% and is expected to increase by 80% in 2030 and 100% by 2040-50.

Renewable Energy: 3,400 MW

Conventional Energy : 10,115 MW

Renewable energy is currently contributing 34% and is expected to increase by 80% in 2030 and 100% by 2040-50.

🌁CLEAN & GREEN ENERGY

Tata power is steering the transformation of traditional utilities to providers of integrated solutions by initiating new business models in

EV Charging Solutions

Solar Pumps

Rooftops

Micro Grids

Home Automation

Smart Meters

Tata power is steering the transformation of traditional utilities to providers of integrated solutions by initiating new business models in

EV Charging Solutions

Solar Pumps

Rooftops

Micro Grids

Home Automation

Smart Meters

🌁DISTRIBUTION NETWORK

Total Sates and UTs Served : 19

Total Customers Served : 12.3 Million

🌁EV CHARGING SOLUTIONS

E-Bus charging points: 242

Home Chargers installed: 18,513

public EV Chargers installed: 2,373

Total Sates and UTs Served : 19

Total Customers Served : 12.3 Million

🌁EV CHARGING SOLUTIONS

E-Bus charging points: 242

Home Chargers installed: 18,513

public EV Chargers installed: 2,373

🌁INTERNATIONAL PRESENCE

It has operations in India, Georgia, Singapore, Indonesia, South Africa, Bhutan, Zambia and Mauritius

As on 31 March 2022, Tata power had

59 Subsidiaries (44 are Wholly Owned)

32 Joint Ventures (JVs)

5 Associates

It has operations in India, Georgia, Singapore, Indonesia, South Africa, Bhutan, Zambia and Mauritius

As on 31 March 2022, Tata power had

59 Subsidiaries (44 are Wholly Owned)

32 Joint Ventures (JVs)

5 Associates

🌁REVENUE BREAKUP (Product wise)

Transmission & Distribution: 65%

Generation: 17%

Renewables: 17%

Others: 1%

Transmission & Distribution: 65%

Generation: 17%

Renewables: 17%

Others: 1%

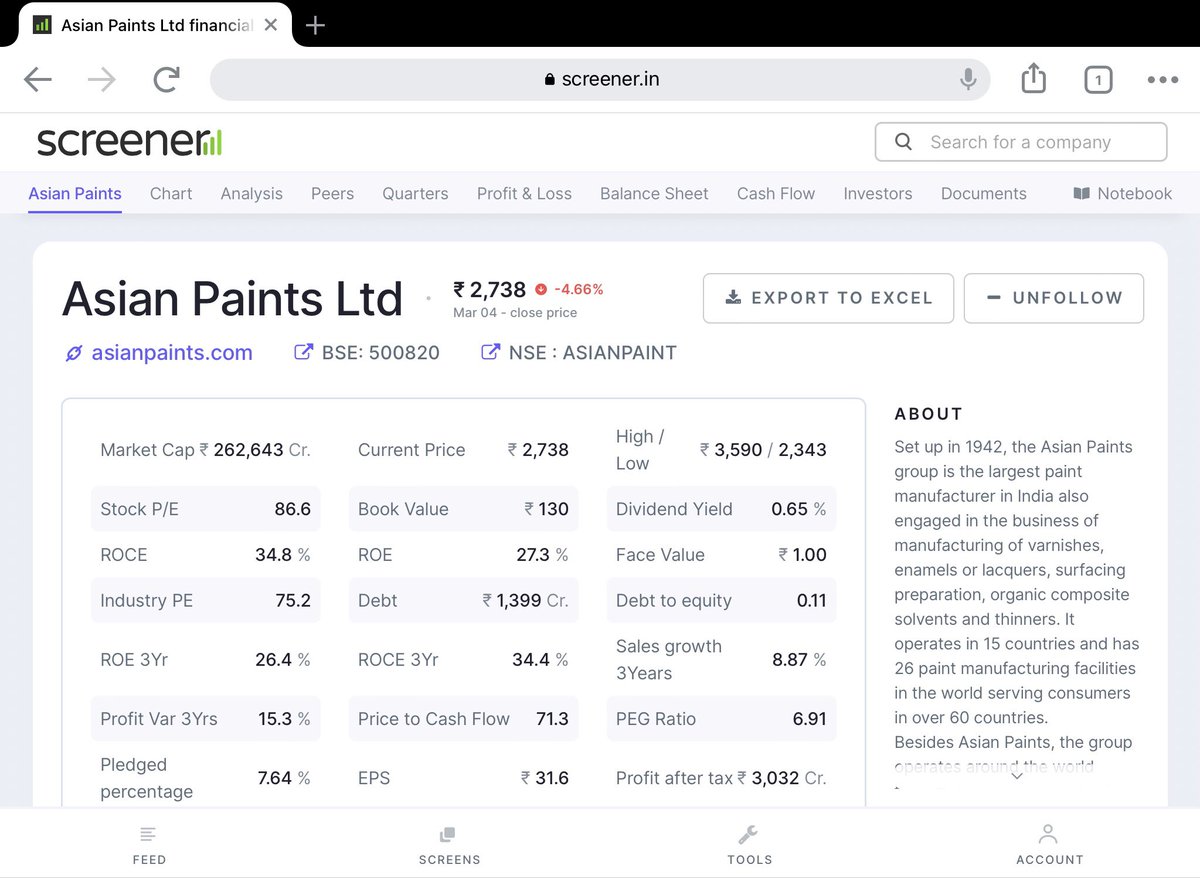

🌁FINANCIALS (5 Year CAGR)

Sales Growth : 9.2%

EBITDA Growth : 5.3%

PAT Growth : 9%

ROCE: 9.3%

ROE: 8.42%

Net Cash Flow as on March 2022 : - 741 Cr

Overall financials are very poor but improving

Sales Growth : 9.2%

EBITDA Growth : 5.3%

PAT Growth : 9%

ROCE: 9.3%

ROE: 8.42%

Net Cash Flow as on March 2022 : - 741 Cr

Overall financials are very poor but improving

🌁DEBT

Debt is reducing continuously from 2017, good sign.

Still debt is on the higher side and company is paying lot of interest.

Debt is reducing continuously from 2017, good sign.

Still debt is on the higher side and company is paying lot of interest.

🌁VALUATION

Price to Earning (PE) : 34.6 (Above it’s 5 Yr median PE 18.8)

Price to book value : 3.30

PEG Ratio : 3.94

EV to EBITDA : 17.62

By considering the future of EV and Renewables energy, stock price rallied heavily and is trading at premium valuation.

Price to Earning (PE) : 34.6 (Above it’s 5 Yr median PE 18.8)

Price to book value : 3.30

PEG Ratio : 3.94

EV to EBITDA : 17.62

By considering the future of EV and Renewables energy, stock price rallied heavily and is trading at premium valuation.

🌁QUARTERLY RESULTS (Q1 FY23)

Net Sales: 14,495.48 Cr (45% Up YoY, 21% Up QoQ)

Consolidated Net Profit: 794 Cr (103% Up YoY, 57% Up QoQ)

Operating Profit declined in QoQ and YoY

Net Sales: 14,495.48 Cr (45% Up YoY, 21% Up QoQ)

Consolidated Net Profit: 794 Cr (103% Up YoY, 57% Up QoQ)

Operating Profit declined in QoQ and YoY

🌁STRENGTHS

Power portfolio, international presence, strong distribution network

Improving scale of new business, Capex to support growth

Contribution from renewable business improving

Collaboration with OEMs to roll out EV infrastructure

Improving financials

Power portfolio, international presence, strong distribution network

Improving scale of new business, Capex to support growth

Contribution from renewable business improving

Collaboration with OEMs to roll out EV infrastructure

Improving financials

🌁WEAKNESS

Poor sales growth

Low ROE and ROCE

Debt reduced but still on the higher side

High interest payment

Good competition in Renewable sector

Premium Valuation

Poor sales growth

Low ROE and ROCE

Debt reduced but still on the higher side

High interest payment

Good competition in Renewable sector

Premium Valuation

• • •

Missing some Tweet in this thread? You can try to

force a refresh