Telling my 8 years of experience in 5 min. A thread on how to trade with Gann Swings.

There are three trends applicable to any time frame that you are analyzing: Minor, intermediate, and major.

1⃣Gann Minor Swings

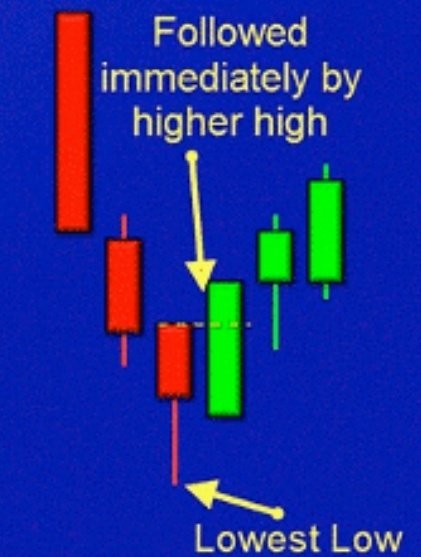

(a) A minor bottom is a price lower than the previous low that is immediately followed by a higher low and higher high on the next bar or candle.

(a) A minor bottom is a price lower than the previous low that is immediately followed by a higher low and higher high on the next bar or candle.

(b) The minor top is a higher high than the previous high in the price, immediately followed by a lower high and a lower low.

2⃣Gann Intermediate Swings

(a) The intermediate bottom is also a lower low compared to the previous lows. However, it differs in that the immediate high that follows must be higher than the previous two bars or candles.

(a) The intermediate bottom is also a lower low compared to the previous lows. However, it differs in that the immediate high that follows must be higher than the previous two bars or candles.

(b) The intermediate top is a higher high than previous highs that is immediately followed by a low that is lower than the previous two lows.

3⃣Gann Major Swings

(a) A major bottom will hold much significance to a trader using Gann .A major bottom would be a low price on a bar or candle that is lower than previous lows but is immediately followed by a high that is higher than the previous three bars or candle highs.

(a) A major bottom will hold much significance to a trader using Gann .A major bottom would be a low price on a bar or candle that is lower than previous lows but is immediately followed by a high that is higher than the previous three bars or candle highs.

(b) The major top is a high that is higher than previous price action followed immediately by a low that is lower than the previous three bars or candles.

If you see price breaking the previous swing top, then you are in an uptrend on the time frame and level (minor, intermediate, or major) that you are trading in. You would continue to trade only in the long direction until you break a previous swing bottom of the same degree.

After the minor swing bottom is broken, a trader should wait for a new intermediate or major swing bottom to form before entering any additional long positions.

In Gann trend analysis,a downtrend occurs when price breaks a swing bottom.If price moves down in a defined uptrend but does not break a swing bottom,it is deemed a correction and the trader has no need to exit their long.A break of a swing bottom would constitute an exit signal.

The rules for a downtrend will also be the same: Once a major downtrend has been established for the time frame you are trading in, you could look to short intermediate or minor swing tops until they are broken.

Therefore , in this thread, we have tried to understand how gann swings work.

I hope you all learn something new today. I post such threads every week.

Follow me for regular stock market learning.

#Gann #StockMarket #trading

I hope you all learn something new today. I post such threads every week.

Follow me for regular stock market learning.

#Gann #StockMarket #trading

• • •

Missing some Tweet in this thread? You can try to

force a refresh