There's a hot new narrative brewing in DeFi.

It's called "Real Yield", where protocols pay out yield to users based on revenue generation.

🧵: My TOP 10 picks to capitalise on this growing sector, and how they could become the pillars of the next cycle. 👇

It's called "Real Yield", where protocols pay out yield to users based on revenue generation.

🧵: My TOP 10 picks to capitalise on this growing sector, and how they could become the pillars of the next cycle. 👇

1/ Real Yield is classified as yield derived from the generation of "real" revenue, as opposed to revenue derived from token emissions.

Real Yield operates reflexively: More revenue = more yield paid to users and vice versa.

Real Yield operates reflexively: More revenue = more yield paid to users and vice versa.

2/ Thus, a bet on a "real yield" project becomes a bet on its ability to a) accrue new users, and b) increase revenue generation overtime to reward token holders.

3/ But before I get into any "picks", it's important to understand where this narrative stems from.

Let's rewind to 2021, where the most common form of user acquisition was the offering of juiced up APRs in order to attract more TVL (at any cost).

Let's rewind to 2021, where the most common form of user acquisition was the offering of juiced up APRs in order to attract more TVL (at any cost).

4/ Some examples of DeFi protocols which incentivised heavily via emissions/dilution.

$TIME

$SUNNY

$AXS

$ANC

$TIME

$SUNNY

$AXS

$ANC

5/ The truth is, almost all DeFi protocols in 2021 utilised aggressive emissions models in order to attract liquidity FAST.

Why? Because the race was on. Retail interest and greed was at an all time high. Just like investors, projects felt the FOMO and didn't want to miss out.

Why? Because the race was on. Retail interest and greed was at an all time high. Just like investors, projects felt the FOMO and didn't want to miss out.

6/ The problem is, this model isn't sustainable. Projects can only offer artificial yield for so long until they're forced to pivot to sustainable models.

Without that artificial incentive for users to deposit and stake, many DeFi protocols suffered an inventible collapse.

Without that artificial incentive for users to deposit and stake, many DeFi protocols suffered an inventible collapse.

7/ This resulted in many investors getting badly burnt, none more so than $LUNA and $UST.

A combination of PTSD and the flush out of retail following DeFi's subsequent collapse highlighted key flaws in the current DeFi landscape.

A combination of PTSD and the flush out of retail following DeFi's subsequent collapse highlighted key flaws in the current DeFi landscape.

8/ a) Emissions were "padding" TVL by incentivising liquidity. Once removed, the "true" value of many chains were exposed.

b) Many protocols didn't have well-designed underlying value accrual mechanisms.

b) Many protocols didn't have well-designed underlying value accrual mechanisms.

9/ The result? A drastic pivot from "fake" to "real" yield protocols as the market shifted to a more risk-off environment.

This shift is exemplified by the recent growth in perp DEXs, alongside the $ETH ecosystem rally in anticipation of The Merge.

This shift is exemplified by the recent growth in perp DEXs, alongside the $ETH ecosystem rally in anticipation of The Merge.

10/ Here are my favourite real yield projects that generate yield via actual revenue generation.

I'll give you the TLDR on what they do, how they generate revenue, and what I think their potential is.

I'll give you the TLDR on what they do, how they generate revenue, and what I think their potential is.

11/ The first category of tokens fall under the "Decentralised Perpetual Exchange" sector.

They offer leverage trading with deep liquidity and low fees, whilst possessing all the positive qualities of a DEX vs CEXs:

• No KYC

• No Counter-party risk

• Security

• Sovereignty

They offer leverage trading with deep liquidity and low fees, whilst possessing all the positive qualities of a DEX vs CEXs:

• No KYC

• No Counter-party risk

• Security

• Sovereignty

12/ First on the list is $DYDX.

It's the largest and most actively used perp DEX, generating over $321m of annualised protocol revenue according to @tokenterminal.

This puts it in the top 3 of any dAPP by protocol revenue.

It's the largest and most actively used perp DEX, generating over $321m of annualised protocol revenue according to @tokenterminal.

This puts it in the top 3 of any dAPP by protocol revenue.

13/ $DYDX currently centralises this revenue (it isn't paid directly to token holders), but they have plans to change this model in V4, which is launching in late 2022.

https://twitter.com/dYdX/status/1480950587025887234?s=20&t=ld6VqMJdZiijEk7novitSA

14/ There is still significant dilution to come.

Thus as it stands, DYDX doesn't have the best tokenomics out of all its competitors, but...

Thus as it stands, DYDX doesn't have the best tokenomics out of all its competitors, but...

15/ I think the most upside from @dydxfoundation comes from the launch of their own chain on Cosmos.

This flexibility offers them a unique advantage vs other DEXs, and is one of the reasons why I'm bullish long-term.

This flexibility offers them a unique advantage vs other DEXs, and is one of the reasons why I'm bullish long-term.

https://twitter.com/dYdX/status/1539607062291877889?s=20&t=KcMw3g1bo2sOTYMxfOOBAQ

16/ $GMX

The largest project on Arbitrum ($250m TVL), and 7th largest on $AVAX ($90m).

GMX is underpinned by a unique multi-asset pool that earns liquidity providers fees, facilitating 30x leveraged trading of spot assets with low slippage.

The largest project on Arbitrum ($250m TVL), and 7th largest on $AVAX ($90m).

GMX is underpinned by a unique multi-asset pool that earns liquidity providers fees, facilitating 30x leveraged trading of spot assets with low slippage.

17/ $GMX arguably has the best tokenomics out of any perp DEX.

Staking GMX tokens exposes you to 30% of all platform fees, paid in $ETH. There is also a esGMX model to incentivise "sticky" liquidity.

Staking GMX tokens exposes you to 30% of all platform fees, paid in $ETH. There is also a esGMX model to incentivise "sticky" liquidity.

https://twitter.com/ThorHartvigsen/status/1533127027506630656?s=20&t=UpHoSSbOI62ApBU0YKPV1A

18/ $GNS

@GainsNetwork_io operates on $MATIC, with its premiere offering "gTrade" recently crossing $15b in trading volume.

It has a sleek UI, great tokenomics, and comes in at a "modest" $60m market cap compared to its peers.

@GainsNetwork_io operates on $MATIC, with its premiere offering "gTrade" recently crossing $15b in trading volume.

It has a sleek UI, great tokenomics, and comes in at a "modest" $60m market cap compared to its peers.

https://twitter.com/ViktorDefi/status/1556284607909269504?s=20&t=UwtR6bw0M-zI7xJ3a8oFyw

19/ @CertiK gives $GNS a strong rating for security, with an 87/100 Trust Score and 84 community score.

Given the recent exploits in DeFi, it's always nice to know that a project is trustworthy prior to investing.

Given the recent exploits in DeFi, it's always nice to know that a project is trustworthy prior to investing.

20/ @gnsGoblin breaks down the math with a $GNS price forecast based on revenue models.

With a trading volume of $1b/per day, $GNS would theoretically be worth ~$100 (it's currently ~$2.50).

With a trading volume of $1b/per day, $GNS would theoretically be worth ~$100 (it's currently ~$2.50).

https://twitter.com/gnsGoblin/status/1554252958203666432?s=20&t=UpHoSSbOI62ApBU0YKPV1A

21/ All three aforementioned DEXs are good long-term bets imo.

This comparison will help you navigate the differences between them, to help you determine where to efficiently allocate capital.

This comparison will help you navigate the differences between them, to help you determine where to efficiently allocate capital.

https://twitter.com/gnsGoblin/status/1554876578978377728?s=20&t=UpHoSSbOI62ApBU0YKPV1A

22/ If you want a comprehensive go-to resource to further your understanding, this substack by @alpha_pls is a must-read:

alphapls.substack.com/p/defi-gns-gmx…

alphapls.substack.com/p/defi-gns-gmx…

23/ $SNX

@synthetix_io is a decentralised synthetics protocol built on $ETH and $OP.

Meaning, you can trade between real world assets like gold, silver, cryptos, EUR, oil & stocks.

@synthetix_io is a decentralised synthetics protocol built on $ETH and $OP.

Meaning, you can trade between real world assets like gold, silver, cryptos, EUR, oil & stocks.

24/ You can stake $SNX to earn $sUSD and $SNX.

They generate this yield via protocol fees (generated from the minting/burning of synths).

Read more about this mechanism below:

They generate this yield via protocol fees (generated from the minting/burning of synths).

Read more about this mechanism below:

https://twitter.com/Subli_Defi/status/1553868917927452674?s=20&t=ld6VqMJdZiijEk7novitSA

25/ $SNX is currently generating $100m of annualised protocol revenue, ranking it as dAPP #9 by revenue on @tokenterminal.

Talk about "real" yield.

Talk about "real" yield.

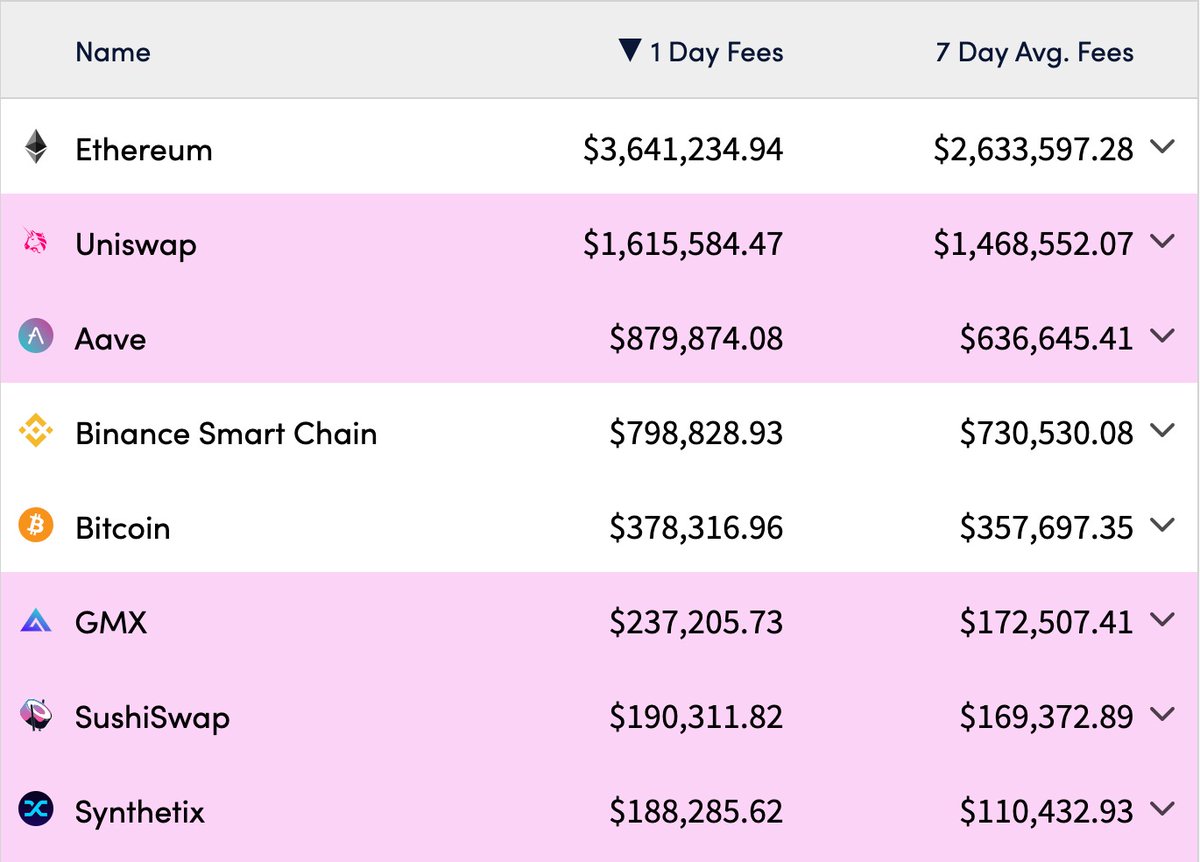

26/ We can also observe that both $SNX and $GMX rank in the top 10 for fees generated, exceeding 7 Day Avg. Fees of $100m across the entirety of the crypto space.

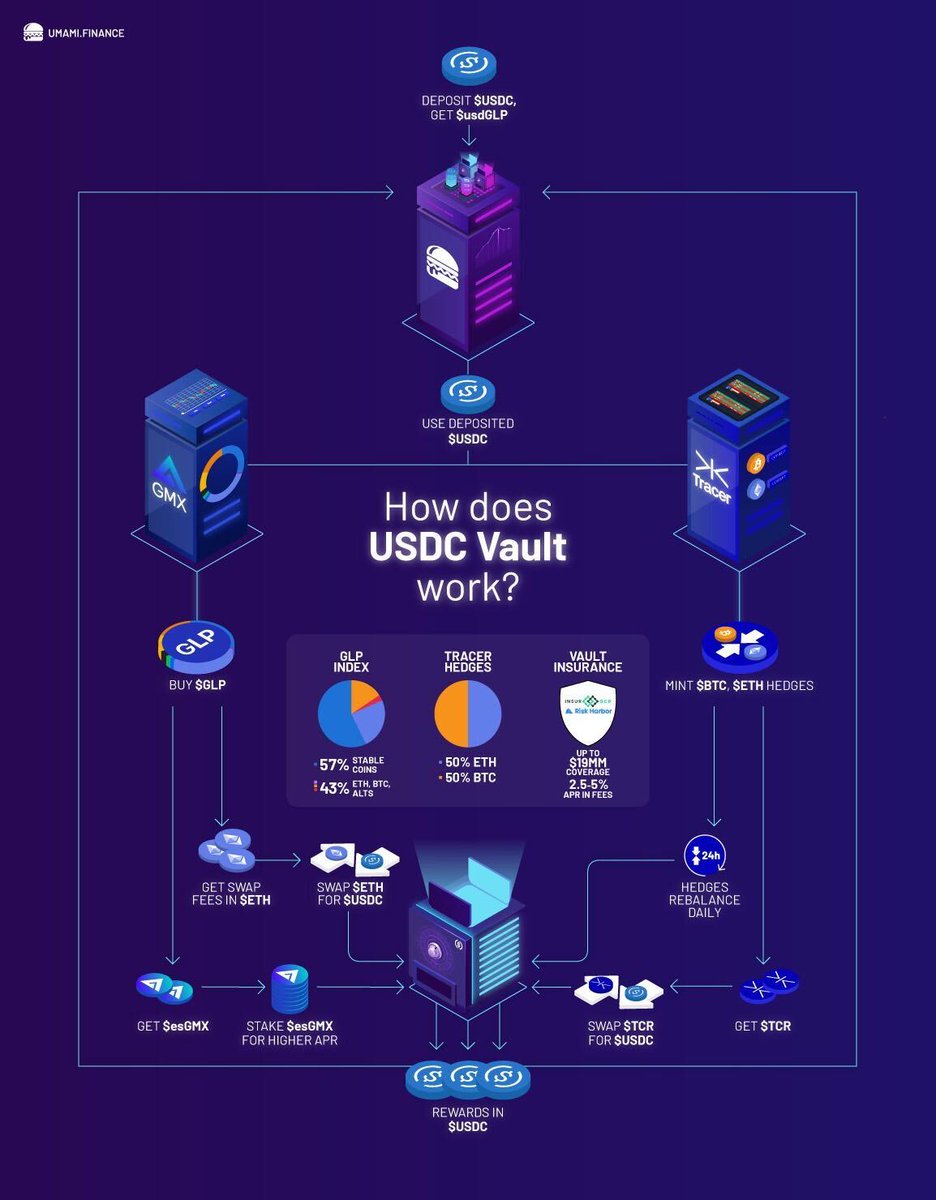

27/ $UMAMI

The big innovation here is its USDC Vault, which unlike Anchor, pays 20% in *sustainable* yield, generated from minting GLP and collecting trading fees.

The big innovation here is its USDC Vault, which unlike Anchor, pays 20% in *sustainable* yield, generated from minting GLP and collecting trading fees.

28/ They're also launching an $ETH and $BTC vault in the near future.

Here are all the details:

Here are all the details:

https://twitter.com/TheDeFinvestor/status/1553376396080074752?s=20&t=ld6VqMJdZiijEk7novitSA

29/ Additional UMAMI resources can be found in @iamllanero's Google Doc.

docs.google.com/spreadsheets/d…

docs.google.com/spreadsheets/d…

30/ There are many other projects which fall under this narrative, some of which include:

• $RBN

• $BTRFLY

• $DPX

• $LOOKS

• $FXS, $CVX, $CRV

I'll be covering these in a future newsletter.

• $RBN

• $BTRFLY

• $DPX

• $LOOKS

• $FXS, $CVX, $CRV

I'll be covering these in a future newsletter.

31/ A few caveats:

• I think there is one misconception that "real yield" is objectively better.

Emissions serve their purpose. Many protocols have successfully acquired many new users and built great communities via emitting tokens to boost APRs.

• I think there is one misconception that "real yield" is objectively better.

Emissions serve their purpose. Many protocols have successfully acquired many new users and built great communities via emitting tokens to boost APRs.

32/ • Many tokens which originally started with aggressive emissions schedules are gradually pivoting to a fee generation model.

Ultimately, only the protocols generating real revenue will succeed. Hype and inflation is only good for temporary price performance.

Ultimately, only the protocols generating real revenue will succeed. Hype and inflation is only good for temporary price performance.

33/ So although this list may be what is considered as "real yield" right now, there will be many DeFi protocols which pivot to this model.

Some will fail, as weak underlying tokenomics are exposed.

Some will succeed, as they adapt to their new architecture.

Some will fail, as weak underlying tokenomics are exposed.

Some will succeed, as they adapt to their new architecture.

34/ Nonetheless, "real yield" is looking increasingly like the future of DeFi.

Projects which successfully implement features that drive both adoption and revenue generation should thrive over the coming years.

Projects which successfully implement features that drive both adoption and revenue generation should thrive over the coming years.

35/ As the space matures, investors will gravitate towards the protocols generating real and sustainable revenue, especially amidst volatile market conditions.

For institutional DeFi to eventuate, longevity and risk-adjusted growth also becomes a key consideration.

For institutional DeFi to eventuate, longevity and risk-adjusted growth also becomes a key consideration.

36/ I'll be covering more "Real Yield" tokens in the next issue of my newsletter.

Subscribe if you haven't already.

getrevue.co/profile/milesd…

Subscribe if you haven't already.

getrevue.co/profile/milesd…

37/ I hope you've found this thread helpful.

Follow me @milesdeutscher for more.

Like/Retweet the first tweet below if you can. 💙

Follow me @milesdeutscher for more.

Like/Retweet the first tweet below if you can. 💙

https://twitter.com/milesdeutscher/status/1557059384143781890

I just released part 2 to this thread, which covers 5 new Real Yield projects, including some hidden gems.

Check it out. 👇

Check it out. 👇

https://twitter.com/milesdeutscher/status/1559900472487837696

• • •

Missing some Tweet in this thread? You can try to

force a refresh