1) Some thoughts on Coinbase's 2022Q2 earnings!

s27.q4cdn.com/397450999/file…

previous:

s27.q4cdn.com/397450999/file…

previous:

https://twitter.com/SBF_FTX/status/1497336018852327429

2) A lot of the same mistaken takes on it.

First, crypto's down. So are Coinbase's earnings. Nothing surprising there, and nothing Coinbase specific.

First, crypto's down. So are Coinbase's earnings. Nothing surprising there, and nothing Coinbase specific.

3) Second: the quarterly "look at that diversified income!" take.

Coinbase knows what they're good at: consumer crypto investing/trading.

That's where all their profit comes from.

"But how about that Services revenue?" Nah.

Coinbase knows what they're good at: consumer crypto investing/trading.

That's where all their profit comes from.

"But how about that Services revenue?" Nah.

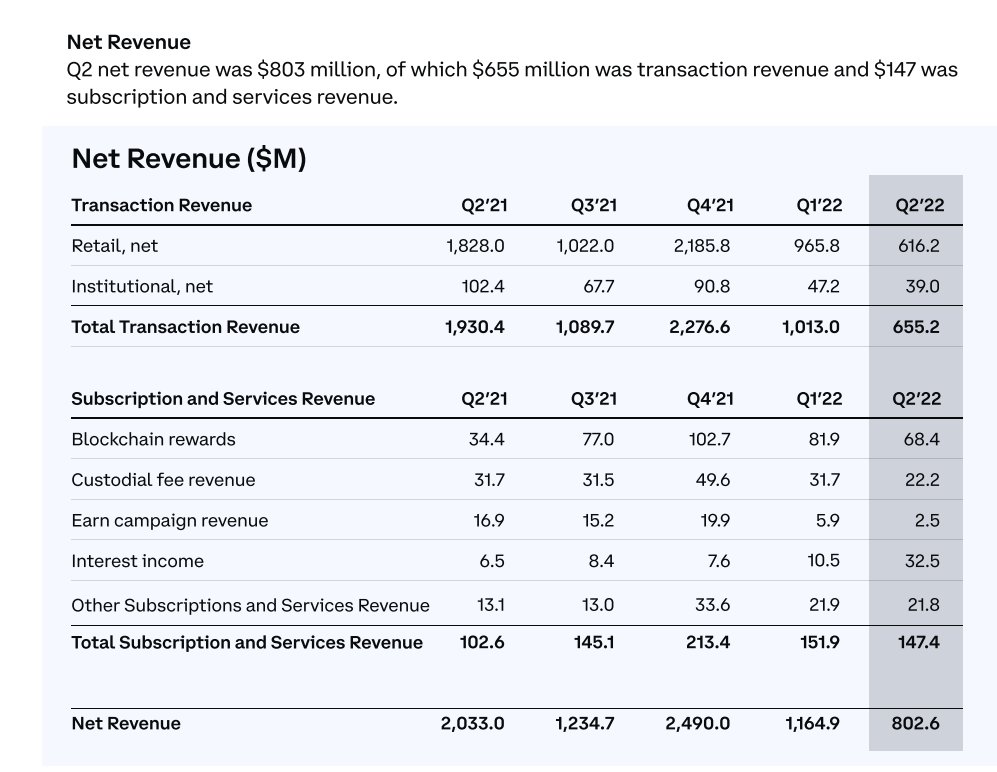

4) See, while they recorded ~$150m/$800m of their revenue as "services"...

...check out their opex.

See that "Transaction expense" of $167m? I'm pretty sure that includes items offsetting much of the services revenue; it's passthrough to customers from e.g. ETH staking.

...check out their opex.

See that "Transaction expense" of $167m? I'm pretty sure that includes items offsetting much of the services revenue; it's passthrough to customers from e.g. ETH staking.

5) So their real revenue was probably closer to the $650m Transaction revenue.

Once again, over 90% of that comes from retail, because of the pricing differences between the (retail) mobile app and the (mixed) website/exchange.

So, netting out the ~$150m...

Once again, over 90% of that comes from retail, because of the pricing differences between the (retail) mobile app and the (mixed) website/exchange.

So, netting out the ~$150m...

6) You get a revenue of ~$650m, and expenses of...

...well:

a) $150m of marketing

b) $600m of dev payroll

c) $500m of other payroll

d) $100m of 'other'

e) $400m of balance sheet asset price decline

for a total of ~$650m rev, ~$1.4b core expenses, plus $400m impairment.

...well:

a) $150m of marketing

b) $600m of dev payroll

c) $500m of other payroll

d) $100m of 'other'

e) $400m of balance sheet asset price decline

for a total of ~$650m rev, ~$1.4b core expenses, plus $400m impairment.

7) That leads to a loss of roughly $700m, plus another $400m from impairment.

My guess is the vast majority of the expenses are coming from payroll/bonuses/etc. here.

Coinbase has ~5k FT employees, paying roughly $4b/year for them. (Makes sense, for devs.) Revenue now ~$2.5b.

My guess is the vast majority of the expenses are coming from payroll/bonuses/etc. here.

Coinbase has ~5k FT employees, paying roughly $4b/year for them. (Makes sense, for devs.) Revenue now ~$2.5b.

7) I *think* this include stock-based-comp.

So, roughly speaking, *annualized*, Q2 would imply:

a) $2.5b of real net revenue (~90% mobile app trading fees)

b) $4.4b of employee comp

c) $1b of other expenses

--> on net, losing roughly $3b/year, including stock based comp

So, roughly speaking, *annualized*, Q2 would imply:

a) $2.5b of real net revenue (~90% mobile app trading fees)

b) $4.4b of employee comp

c) $1b of other expenses

--> on net, losing roughly $3b/year, including stock based comp

8) It'll be interesting to see the impact of their recent headcount changes on upcoming earnings!

FWIW I highly recommend Brian's well-written post on it: blog.coinbase.com/a-message-from…

And macro. Remember: Coinbase is more sentiment-dependent than FTX! Large upside in a recovery.

FWIW I highly recommend Brian's well-written post on it: blog.coinbase.com/a-message-from…

And macro. Remember: Coinbase is more sentiment-dependent than FTX! Large upside in a recovery.

9) (Not investment advice! There might be errors in the above, I haven't double checked it all!)

• • •

Missing some Tweet in this thread? You can try to

force a refresh