Telling my 8 years of experience in 5 min. A thread on how to trade with gann square of 9. The best discovery of W D Gann.

Gann square of nine:-

Gann square of nine is the Spiral of numbers starting from 1 in a square of nine rows and nine columns. The spiral moves in a clockwise direction from 1 to onward.

Gann square of nine is the Spiral of numbers starting from 1 in a square of nine rows and nine columns. The spiral moves in a clockwise direction from 1 to onward.

Create a table of nine columns and nine rows. It will form a shape of square.Add the number 1 to the middle cell of the square

Now start writing the numbers in a clockwise spiral from 2 onwards.

Now start writing the numbers in a clockwise spiral from 2 onwards.

The total number in the Gann square chart of nine would be 81 as it is a square of nine.

Now we have to use a simple formula for predicting the next support or resistance level.

In Gann square of 9, the number next to 28 is 53. If a stock price is at 28 and it is a resistance level then, you can forecast the next resistance level to be 53.

In Gann square of 9, the number next to 28 is 53. If a stock price is at 28 and it is a resistance level then, you can forecast the next resistance level to be 53.

Follow the procedure to predict number 53 from 28 in Gann square of nine.

Take the square root of 28 which is 5.29.

Add 2 to 5.29 which is 7.29.

The square of 7.29 is 53 (round off).

Take the square root of 28 which is 5.29.

Add 2 to 5.29 which is 7.29.

The square of 7.29 is 53 (round off).

How to apply Gann square of nine?Gann square of nine gives important numbers that can act as support or resistance price levels in trading.

The degree or angle also shows that how much time the market will take to come to a specific price.

The degree or angle also shows that how much time the market will take to come to a specific price.

The most valuable numbers are at 45 degrees and 225 degrees. For example, if 9 is a support level of stock, then 17 will be the upcoming resistance level. This is how it works.

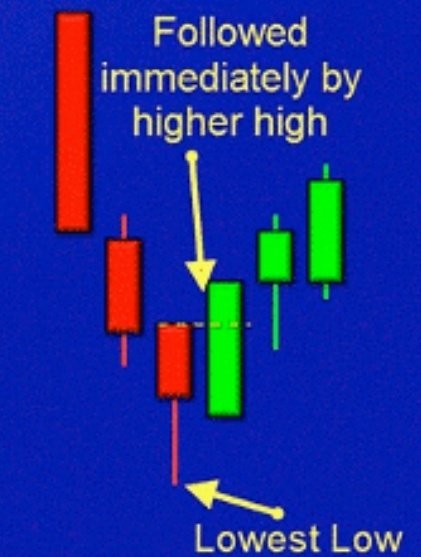

Gann box is used to find out repetitive cycles of price with equal intervals of time. Draw Gann box from swing high to low or swing low to the high point. Modify the Gann box easily without square restriction.

Therefore , in this thread, we have tried to understand Gann Square of 9 in easiest way. We will go deeper in the next thread.

I hope you all learn something new today. I post such threads every week.

Follow me for regular stock market learning.

#Gann #StockMarket #trading

I hope you all learn something new today. I post such threads every week.

Follow me for regular stock market learning.

#Gann #StockMarket #trading

• • •

Missing some Tweet in this thread? You can try to

force a refresh