Just a few charts to recap #EUETS price activity in the last couple of months. EUAs have traded between €75-€92 for the last five months. The price floor has been pretty solid at €75-79, while the ceiling has mostly been around €90. #OCTT 1/10

To be clear though, EUA prices are nowhere where they need to be (under normal conditions). Chart shows price of EUAs needed to force switching coal -> gas for yr-ahead power generation in Germany. #EUETS price is €88 today, needs to be minimum €405 for switching. #OCTT 2/10

Why? Well, looky here: German cal-23 power is on its way to quadrupling in price this year. TTF cal-23 gas is already 4x where it started 2022. And cal-23 API2 coal is around 3x. Meanwhile, #EUETS price is up 4.6% YTD. #OCTT 3/10

Coal generation is making pots of money: more than €250/MWh operating profit or cal-23 generation, and even gas is profitable. Same applies in cal-24. So there’s nothing really holding #EUETS prices down – or is there? #OCTT 4/10

There's still a proposal to bring €20 billion worth of EUAs out of the market stability reserve to auction for funds to help transition off Russian fossil fuels. Whether this is approved, and rate at which c.227m EUAs are sold would have big impact on #EUETS prices. #OCTT 5/10

There’s also plenty of political pressure building up against the #EUETS: ft.com/content/eefea7… #OCTT 6/10

Some critics continue to claim “speculators” have driven up the price of #EUETS carbon, but (see above) the price isn’t high enough to be having an impact at the moment. And anyway…..: #OCTT 7/10

In fact, speculators have been exiting the market in recent months. Exchange data shows that net long positions in #EUETS held by investment funds were recently at their lowest in nearly 2 years. #OCTT 8/10

While this doesn’t mean that algorithmic traders aren’t still active in the #EUETS – and traders say they are – active funds have other fish to fry right now… in gas, for example. #OCTT 9/10

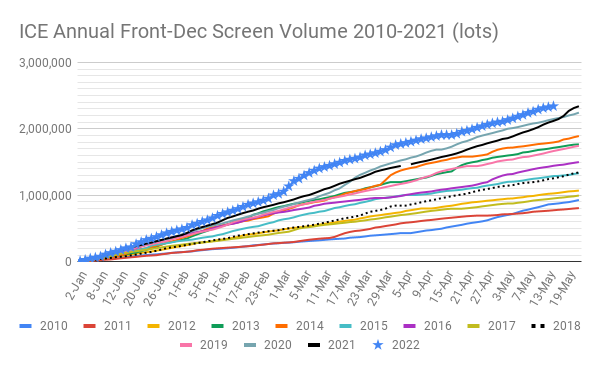

Right now, #EUETS prices are on an upswing as auction volumes have been cut in half for the Aug holiday season. Liquidity is at a low ebb as well. From Sept, we will have a slight decrease in normal fortnightly auction volumes to 21.9m EUAs from 23.7m Jan-Jun. #OCTT 10/10

• • •

Missing some Tweet in this thread? You can try to

force a refresh