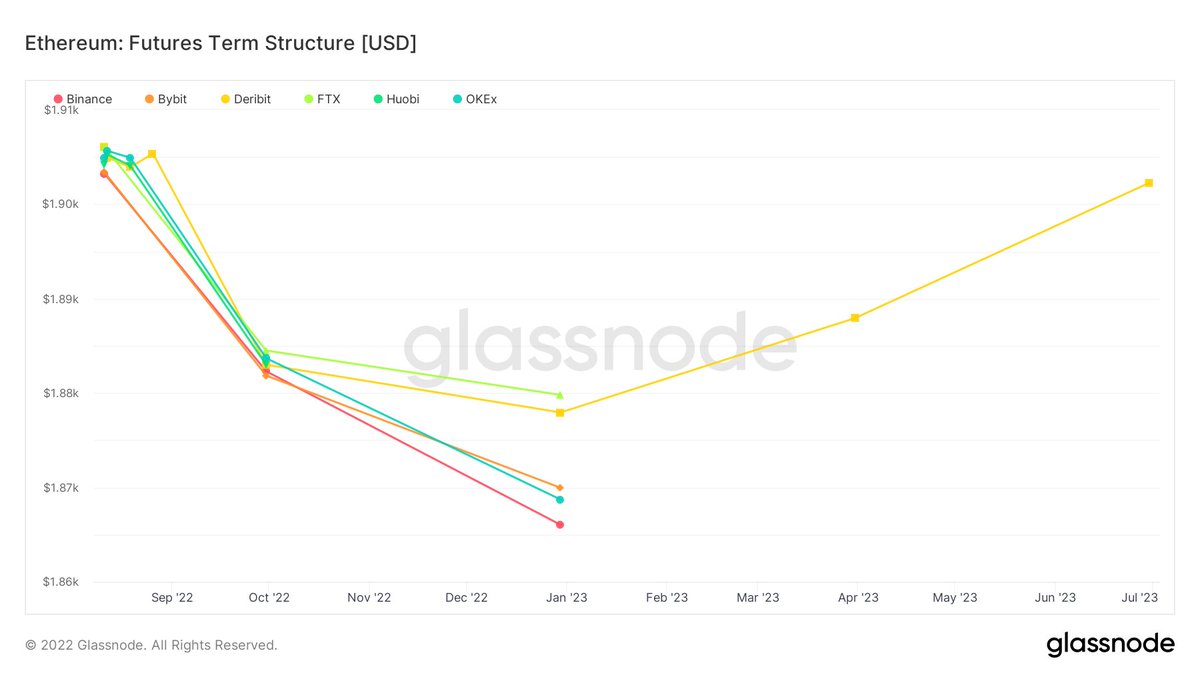

1/ An interesting observation about the current $ETH futures term structure.

2/ The curve is in backwardation, that is futures < spot, out until Jan '23. My guess is because traders are hedging out $ETH exposure pre-merge just in case ... tech is hard.

3/ If the marginal pressure is on the sell side, then the market makers are long futures, and must short sell spot to hedge themselves. This adds downward price pressure to the cash or spot market.

4/ But what happens if the merge is successful, and hedgers cover their shorts so they are net long $ETH again? And what if speculators who believe in a "triple-halving" yolo into leveraged long positions?

5/ Now the pressure is on the buy side, and market makers are short futures and must go long spot. A reversal of their positioning pre-merge.

6/ This is a positive feedback loop that leads to higher spot prices should the merge go smoothly on Sept 15th.

If you believe the merge is going to succeed, then this is yet another positive structural reason why $ETH could gap higher into the end of the year.

• • •

Missing some Tweet in this thread? You can try to

force a refresh