How to get URL link on X (Twitter) App

The $ is weakening alongside foreigners selling US tech stocks and bringing money home. This is good for $BTC and gold over medium term.

The $ is weakening alongside foreigners selling US tech stocks and bringing money home. This is good for $BTC and gold over medium term.

Thx NDR's Joe Kalish for helping me find out where the FDIC is hiding the money lent to the likes of JPM to gobble up bankrupt regional banks like First Republic.

Thx NDR's Joe Kalish for helping me find out where the FDIC is hiding the money lent to the likes of JPM to gobble up bankrupt regional banks like First Republic.

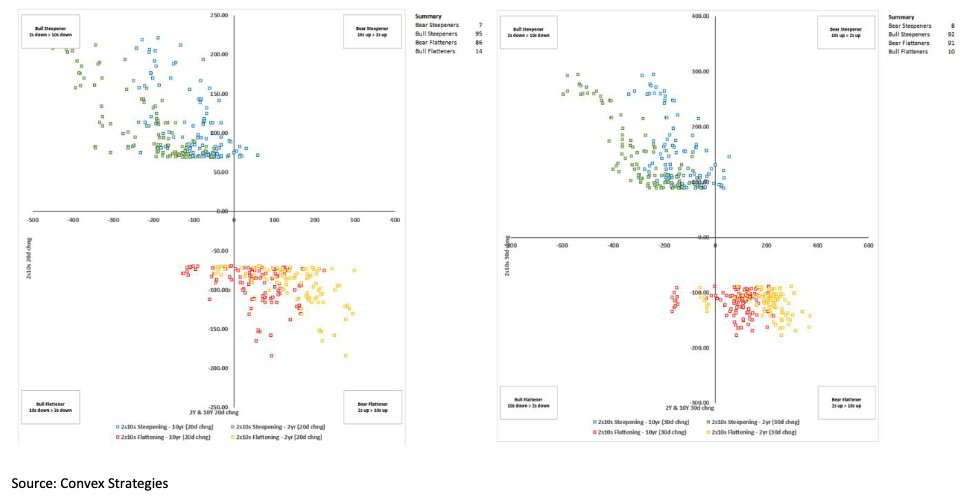

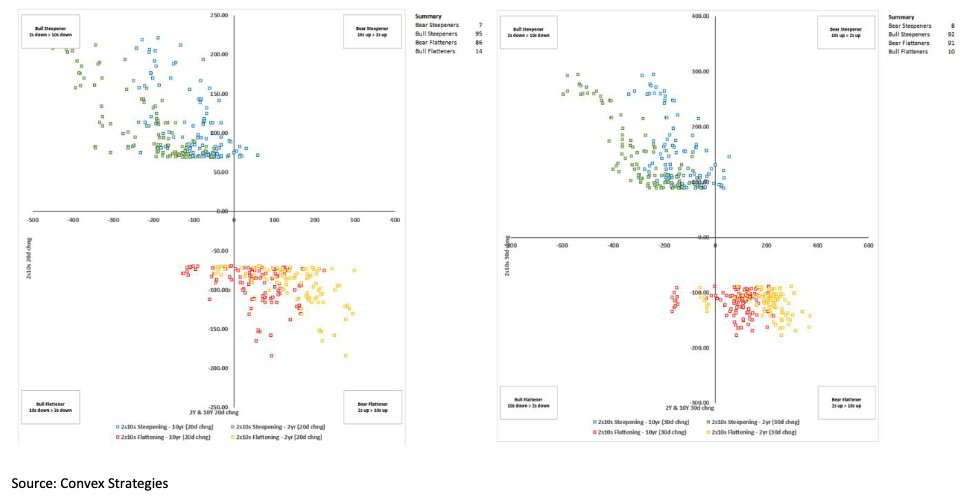

If the banks' models don't have it, then it is considered not a possible outcome and traders don't hedge.

If the banks' models don't have it, then it is considered not a possible outcome and traders don't hedge.

I asked Andrew Collier a china researcher what the best metric would be to quantify possible capital flight. He said to look at the difference between China intl net export earnings and the official foreign reserves.

I asked Andrew Collier a china researcher what the best metric would be to quantify possible capital flight. He said to look at the difference between China intl net export earnings and the official foreign reserves.

2/

2/

2/

2/

2/ The issue with $FRC is that their balance sheet has few treasuries and a lot of other dog shit like commercial real estate loans which are not eligible collateral for the #banktermfundingprogram

2/ The issue with $FRC is that their balance sheet has few treasuries and a lot of other dog shit like commercial real estate loans which are not eligible collateral for the #banktermfundingprogram

2/

2/

https://twitter.com/HAOHONG_CFA/status/15884991037048463362/

https://twitter.com/DeItaone/status/15646917267024650312/

2/

2/