Here's why Charter cities are not alarmist remoaner rants

Shanker Singham's World Operating System looks at laws as services companies demand

Titus Gebel wants to 'remove politics' he has invited billionaires to invest in CCs

British Govt sold your sovereignty

UK out of EU laws

Shanker Singham's World Operating System looks at laws as services companies demand

Titus Gebel wants to 'remove politics' he has invited billionaires to invest in CCs

British Govt sold your sovereignty

UK out of EU laws

Private companies can operate jurisdictions under their corporate needs beyond the host countrys laws, a city within a city. A Network of Liberty=Billionaire investors, politicians, economists, think tanks and global business interests.

UK has clean slate

Brexit=Libertarian Exit

UK has clean slate

Brexit=Libertarian Exit

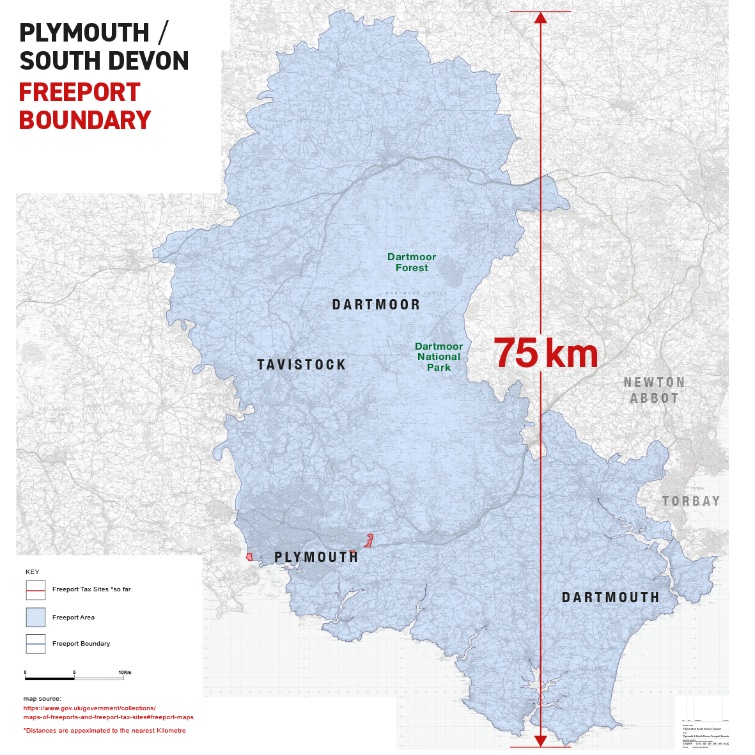

Freeports, free zones, free schools, free laws, free cities.

'Free' is for the investor classes (foreign and domestic) to transform the UK into a corporate governed rogue state

These are the stepping stones Sunak is laying while the UK MSM is asleep at the wheel. #Brexit

'Free' is for the investor classes (foreign and domestic) to transform the UK into a corporate governed rogue state

These are the stepping stones Sunak is laying while the UK MSM is asleep at the wheel. #Brexit

Uk is a Totalitarian democracy where voting exists but with zero participation in decisions made in Parliament. The Charter Cities Institute has a 286 page (Private) Governance Handbook primed for the UK's libertarian 'exit' from democracy and the ECHR.

https://x.com/EuropeanPowell/status/1570091141856468992?s=20

A link to all my Twitter threads on Freeports, Special Economic Zones, Charter Cities, Corporate governance, Brexit, right-wing thinktanks, the network of liberty, Neoliberalism, and names of libertarian economists and anarcho-capitalists alike.

threadreaderapp.com/user/EuropeanP…

threadreaderapp.com/user/EuropeanP…

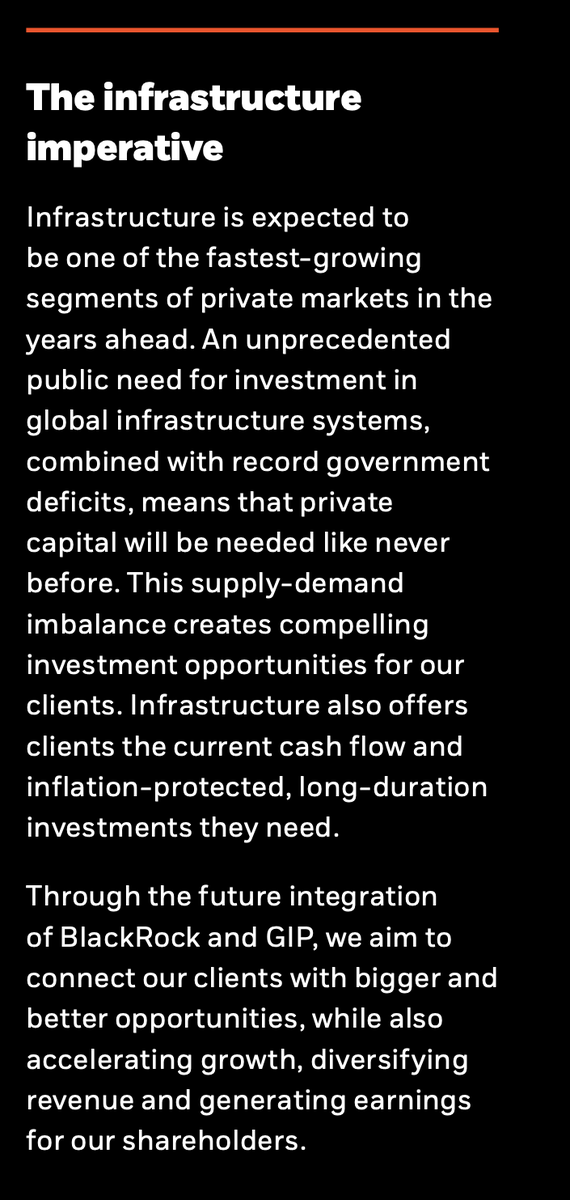

Like Hong Kong, the UK Govt and its so-called opposition parties have reached a verdict, the markets know best, they will be trusted to self-regulate, UK's policymakers are 'free' from Big govt, 12 Freeports and 74 economic zones will install corporate governance post-Brexit.

The UK public are effectively lab rats in a laboratory experiment, this is what happens when Govt is shrunk to its 'proper' function, people know when they fail 'they bear the cost' - Milton Friedman.

The more power the market has the more the state implodes. ECHR, unions, welfare, the rule of law, environmental protections, unemployment, spiking inflation, and public spending are anathema to the Tories and the oligarch leading its cabal. What do you think happens next?

Globalization prioritizes capitalism, off-shoring revenue over core principles of social democracy. The most lucrative line of business is between Governments and the investor classes. Zone fever is the next stage in 'countrypreneurship', public services are 'small potatoes'

The UK is part of the reconfiguration of democracy to a plutocracy, where corporations set up governance in patchworks of sovereignty, in the UK these are represented by 12 Freeports and 74 SEZs, each zone will compete with the other, extract profit then move on leaving ruins.

'Administrative absolutism' will see the end of🇬🇧politics, the obstacle of democracy is being dismantled, and the public are now witnesses to their own fate. All public funding is being extracted to subsidize big corps to set up shop in the 74 zones, these will be charter cities

Freeports, free zones, free schools, free cities. The absence of politics is what our so-called representative parties seek, you do not allow local councils to collapse and then spend billions on setting up SEZs for nothing, these zones are modeled on Hong Kong and Singapore.

1950's, Mont Pelerin Group called its members neoliberals, they each believed that capitalism had to be protected from democracy, they believed that creeping socialism and the welfare state were a threat to their profits and individual freedom. Tories base everything on this.

A Freeport is a tax haven, it's not a regular port for freight, it is a zone designated for maximum capital accumulation beyond the prying eyes of Big Govt, relaxed laws in these ports and their companion SEZS mean relaxed enforcement of laws. Exiting ECHR will seal the fate of🇬🇧

SEZs will have fences and barriers put up around them, this comes from the libertarian maxim of protecting private property, residents in the zones will be issued compulsory purchase orders which are legal in the UK, so anyone objecting can 'opt in or out' of the zone.

Rees Mogg - we are restructuring the role of the state

Leave Campaign - we will write our own laws

Sunak - I will not allow a foreign court, like the ECHR, to block these flights

Singham - we are looking at Laws as services that companies demand

#Brexit

bylines.cymru/politics-and-s…

Leave Campaign - we will write our own laws

Sunak - I will not allow a foreign court, like the ECHR, to block these flights

Singham - we are looking at Laws as services that companies demand

#Brexit

bylines.cymru/politics-and-s…

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh