British, lives/works in NL. UCL. Artist. Researcher. 🏳️⚧️🌈Green Party member. Support me via Ko-Fi. Free zones are Ponzi schemes for the asset classes.

38 subscribers

How to get URL link on X (Twitter) App

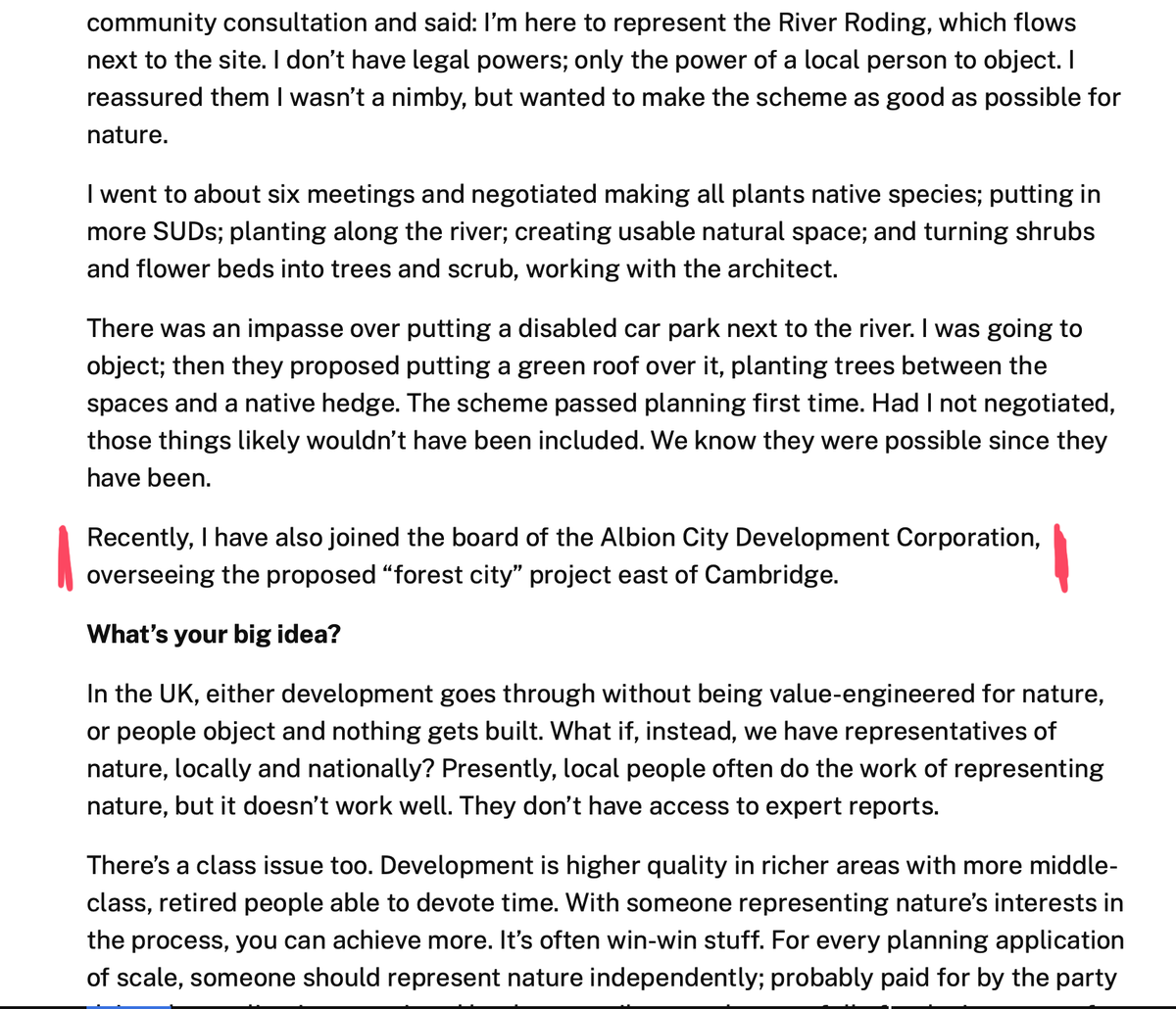

If Forest City proceeds, here’s what you’re accepting:

If Forest City proceeds, here’s what you’re accepting:

These corporations have now been given access to the UK's critical infrastructure, which they describe as new, additional assets to their financial portfolios.

These corporations have now been given access to the UK's critical infrastructure, which they describe as new, additional assets to their financial portfolios.

What’s happening is a repeat of the first rollout of free zones under Thatcher, which were a disaster, the excuse was the EU prevented 'real growth' due to restrictions on State aid, but given the scandalous results at Teesside, exposed by @PrivateEyeNews , £560 million in taxpayers money was splurged on Teesside Freeport, (22.4 times the original amount of £25 million).

What’s happening is a repeat of the first rollout of free zones under Thatcher, which were a disaster, the excuse was the EU prevented 'real growth' due to restrictions on State aid, but given the scandalous results at Teesside, exposed by @PrivateEyeNews , £560 million in taxpayers money was splurged on Teesside Freeport, (22.4 times the original amount of £25 million).

The Age of Surveillance Capitalism by Shoshana Zuboff (2019)

The Age of Surveillance Capitalism by Shoshana Zuboff (2019)

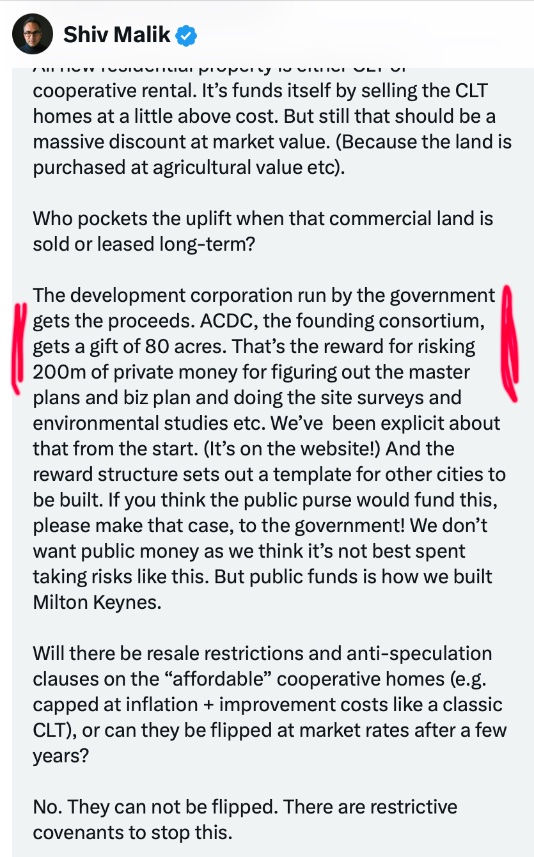

THE PLAN IN PLAIN TERMS

THE PLAN IN PLAIN TERMS

https://x.com/EuropeanPowell/status/1987428910519222470?s=20

https://x.com/EuropeanPowell/status/1983857036140908788

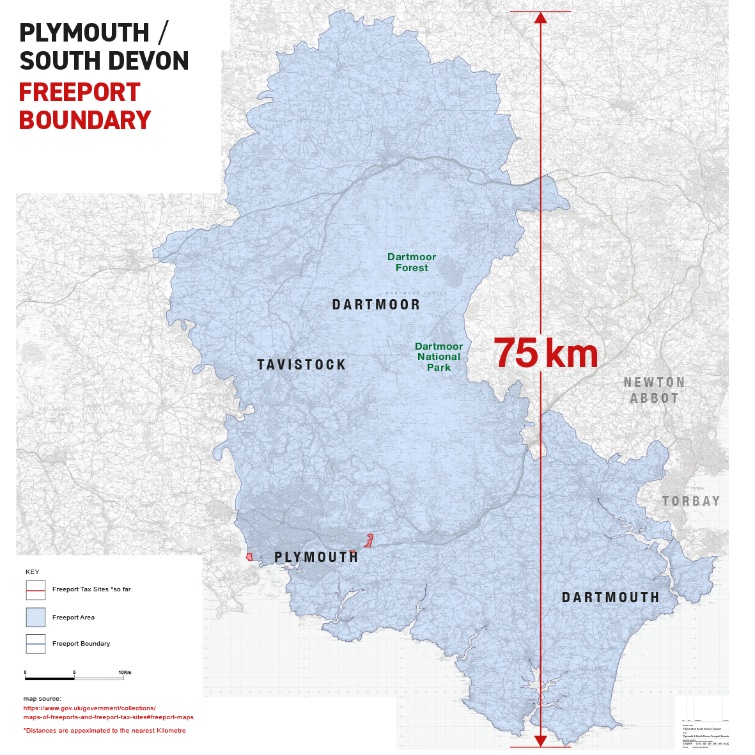

I think what’s happening in the UK with free zones represents one of the most significant, and underreported transformations of democratic governance in modern British history.

I think what’s happening in the UK with free zones represents one of the most significant, and underreported transformations of democratic governance in modern British history.

https://x.com/EuropeanPowell/status/1974732012532510909

Starmer's enthusiastic partnership announcement suggests policy capture at the highest levels. This isn't ordinary foreign investment; it's a systematic acquisition of control over the infrastructure backbone of the UK's economy by one the most criminally corrupt shadow banks in the world.

Starmer's enthusiastic partnership announcement suggests policy capture at the highest levels. This isn't ordinary foreign investment; it's a systematic acquisition of control over the infrastructure backbone of the UK's economy by one the most criminally corrupt shadow banks in the world.

https://x.com/EuropeanPowell/status/1948773137878822977