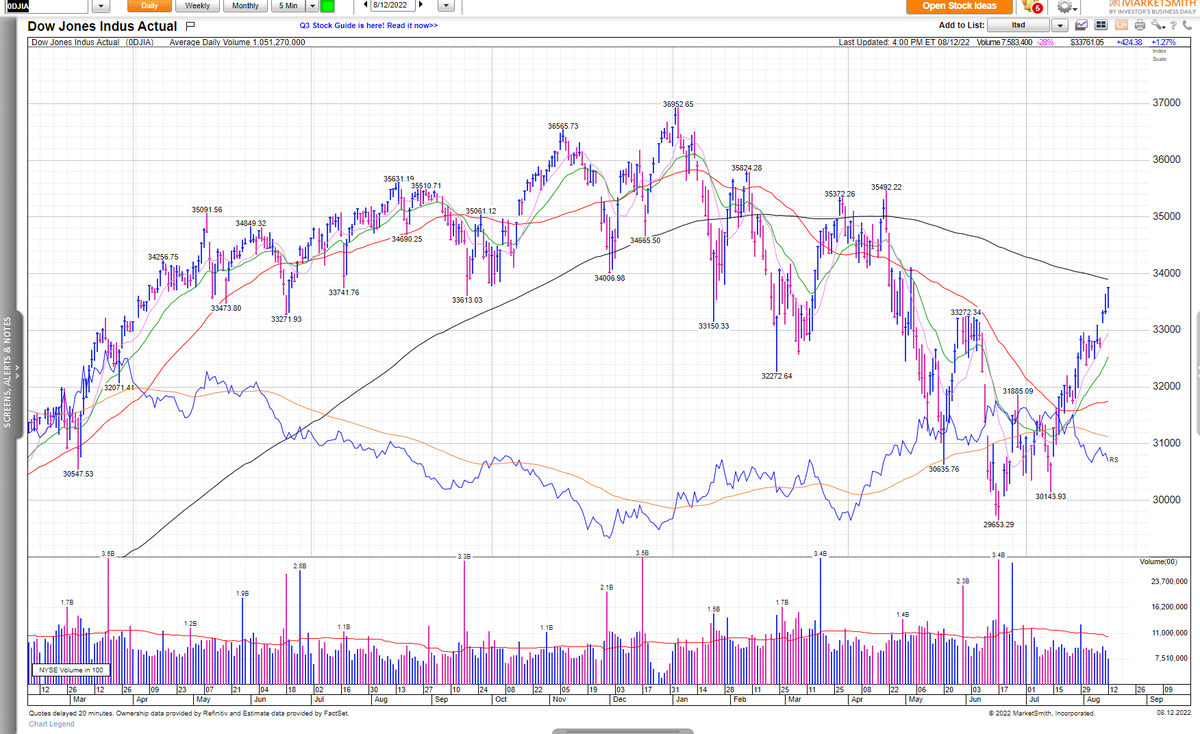

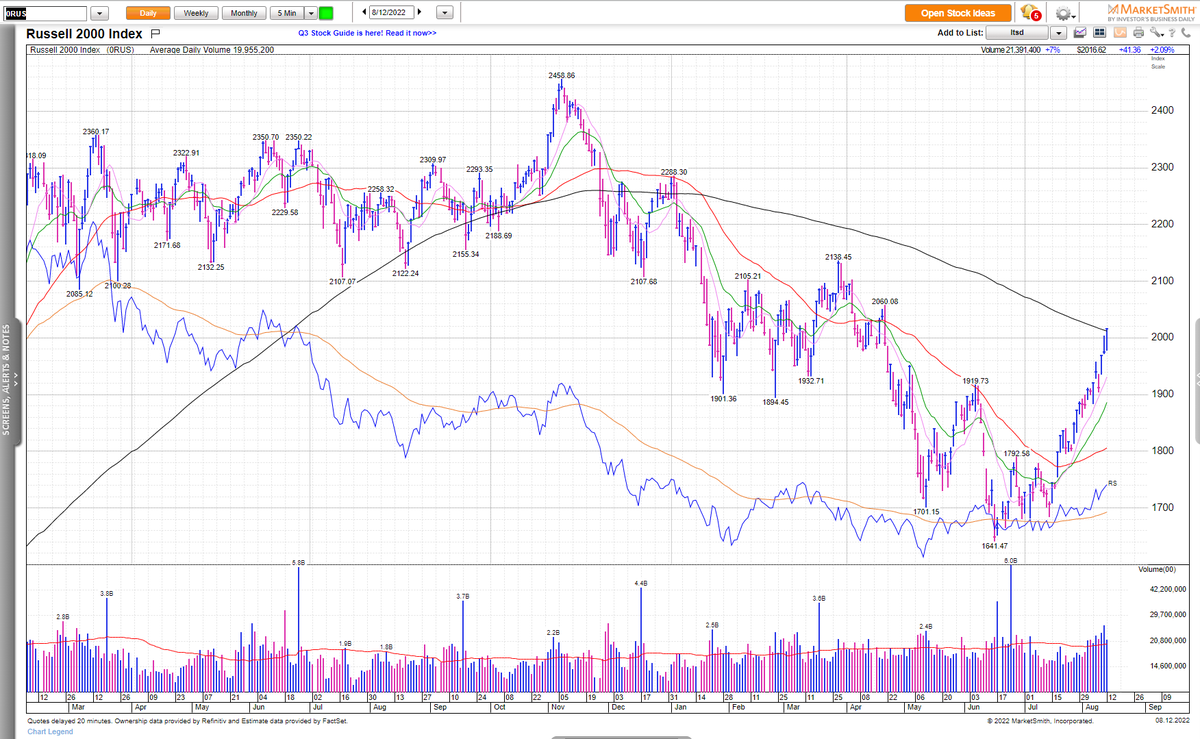

Stocks shrugged off reversals on Monday & Thursday, ending the week with strong gains. The market rally now faces the 200-day line, which the Russell 2000 just crossed. Here's what investors should do now. (1/6)

investors.com/market-trend/s… $AAPL $MSFT $COST $UNH $XOM $LI $TSLA #BYD

investors.com/market-trend/s… $AAPL $MSFT $COST $UNH $XOM $LI $TSLA #BYD

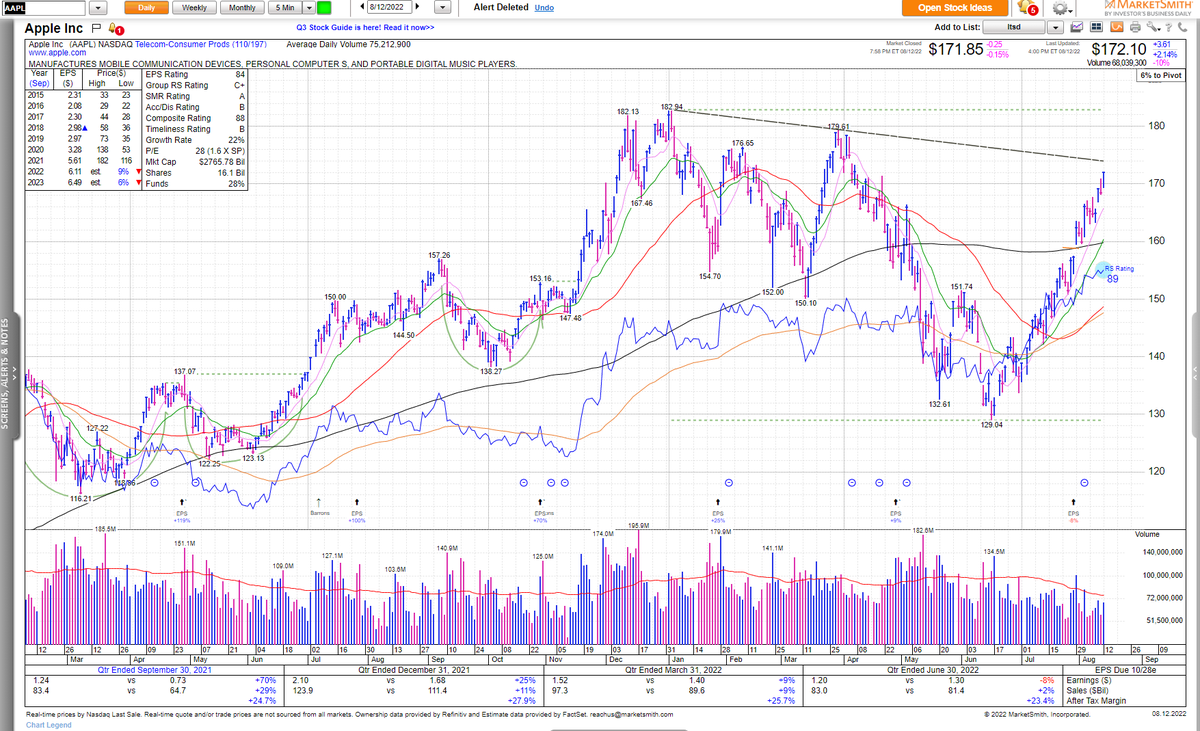

Apple is near a double-bottom buy point, and just below a trendline entry, but could really use a handle first. Exxon Mobil, UnitedHealth, Microsoft and Costco also stocks setting up. (2/6) $AAPL $MSFT $UNH $COST $XOM

China EV maker Li Auto reports earnings early Monday, though the big news may be L9 deliveries later this month. $LI has pulled back, but needs to start building the right side of a base. A strong move above the 50-day line could offer an early entry. (3/6)

$TSLA has shaken off Elon Musk's latest Tesla share sales. It could have an aggressive entry if it retakes its 200-day and tops its Aug. 4 high, but this "handle" is not proper. (4/6)

$BYDDF now has a consolidation. A move above the 50-day would offer an early entry. BYD reportedly is now supplying Blade batteries to Tesla. That comes days before the start of #BYD Seal deliveries. The Seal is a Model 3 rival but for $10K less. (5/6)

Finally, pls watch the video embedded in the article. @AlissaCoram and I reviewed last week's market and sector action in depth, and discussed what investors should be doing now. We also analyzed Exxon Mobil, UnitedHealth and Apple. $XOM $UNH $AAPL (6/6)

• • •

Missing some Tweet in this thread? You can try to

force a refresh