IBD News Editor by day, I write about the #stockmarket at night. I'm on #IBDLive in the morning. Gen X pop culture enthusiast. Sleep optional. @IBDInvestors

How to get URL link on X (Twitter) App

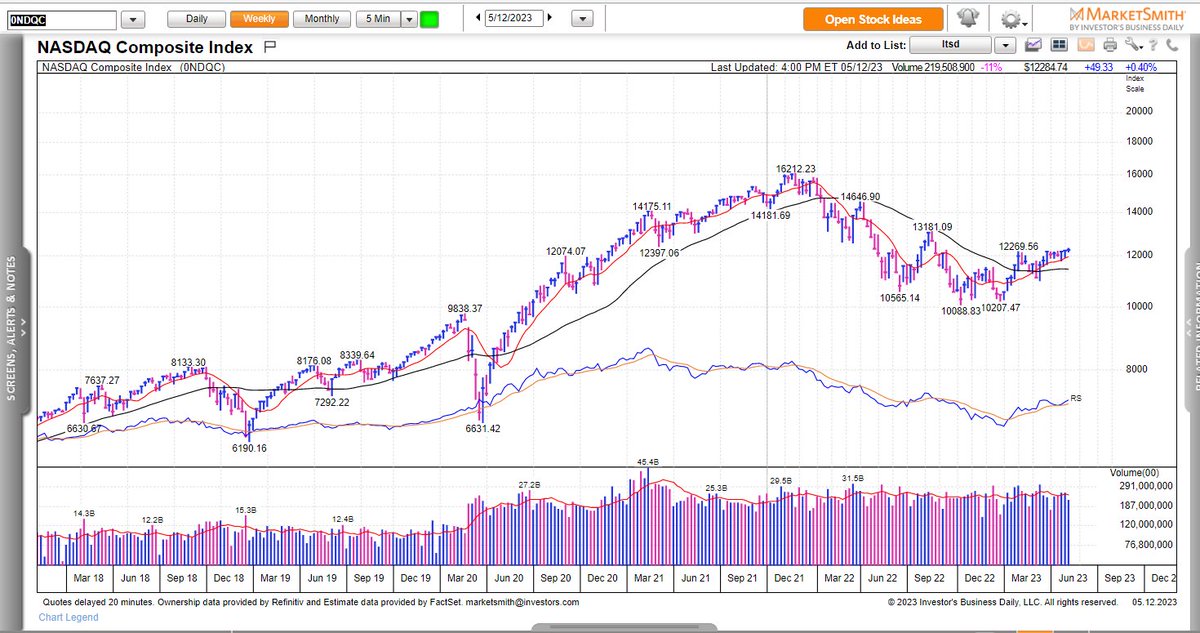

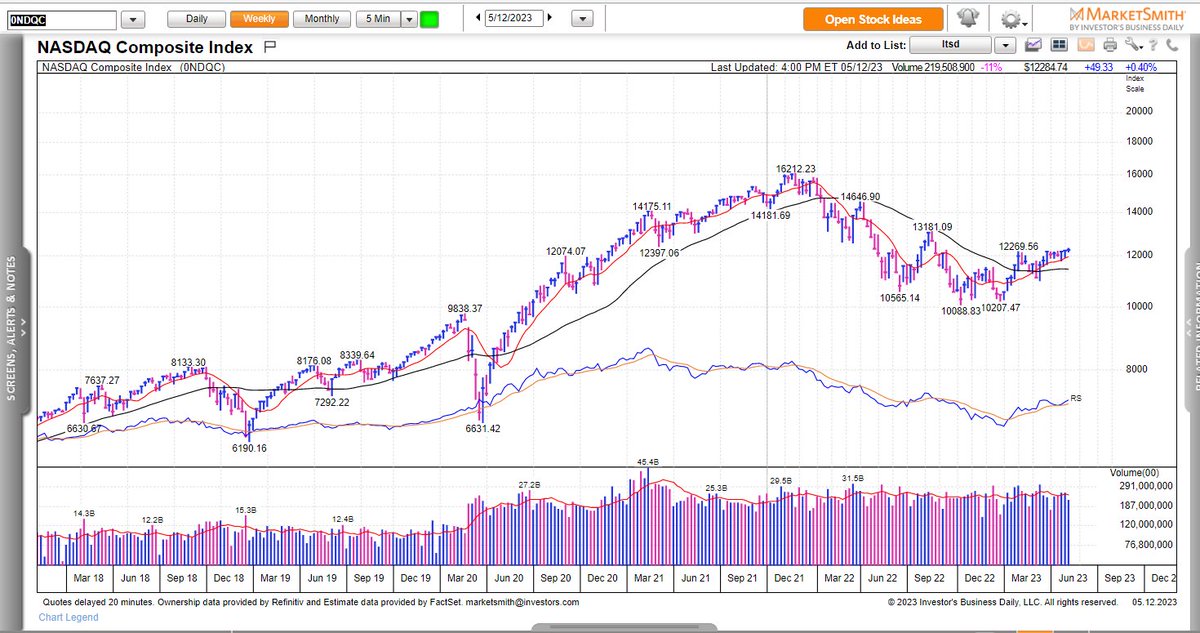

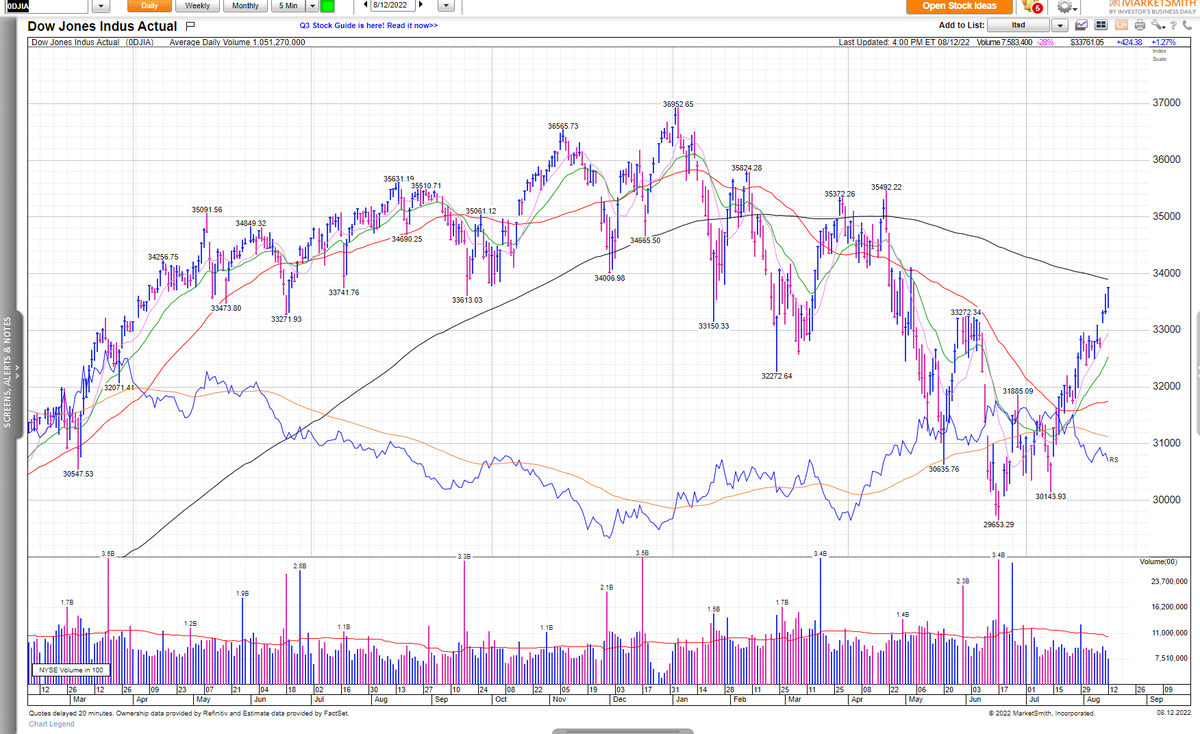

Let's not go crazy with the divergence. Yes, the Nasdaq rose slightly for the week while the S&P 500 and Dow fell. But all extended their streak of tight weekly closes. Even the Dow held support at the 50-day/10-week lines. 2/

Let's not go crazy with the divergence. Yes, the Nasdaq rose slightly for the week while the S&P 500 and Dow fell. But all extended their streak of tight weekly closes. Even the Dow held support at the 50-day/10-week lines. 2/

Treasury yields and the dollar plunged. For the next few weeks, there won't be big inflation/labor data, so that could give the market rally room/time to run. But that doesn't mean investors should quickly ramp up exposure. (2/6)

Treasury yields and the dollar plunged. For the next few weeks, there won't be big inflation/labor data, so that could give the market rally room/time to run. But that doesn't mean investors should quickly ramp up exposure. (2/6)

But in some ways the market is a lot better than the big-cap indexes suggest. $RSP, the equal-weight S&P 500 ETF, retook its 50-day line on Wed. and kept rising. Megacaps, though they did fine Fri., have masked broader market strength. (2/5)

But in some ways the market is a lot better than the big-cap indexes suggest. $RSP, the equal-weight S&P 500 ETF, retook its 50-day line on Wed. and kept rising. Megacaps, though they did fine Fri., have masked broader market strength. (2/5)

While the major indexes resisted a pullback - the Dow and S&P 500 were positive for the week until Friday - highly valued growth starting selling off earlier. $ARKK plunged to below its 50-day line, down 14.1% for the week. (2/9)

While the major indexes resisted a pullback - the Dow and S&P 500 were positive for the week until Friday - highly valued growth starting selling off earlier. $ARKK plunged to below its 50-day line, down 14.1% for the week. (2/9)

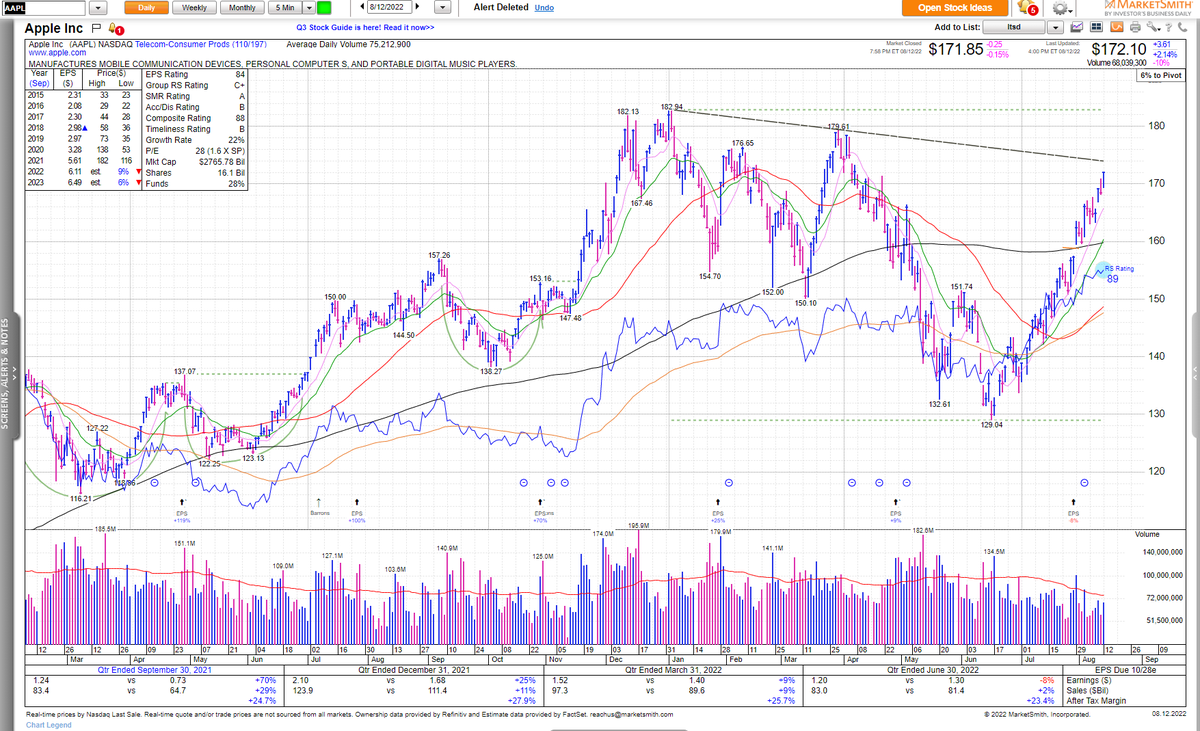

Apple is near a double-bottom buy point, and just below a trendline entry, but could really use a handle first. Exxon Mobil, UnitedHealth, Microsoft and Costco also stocks setting up. (2/6) $AAPL $MSFT $UNH $COST $XOM

Apple is near a double-bottom buy point, and just below a trendline entry, but could really use a handle first. Exxon Mobil, UnitedHealth, Microsoft and Costco also stocks setting up. (2/6) $AAPL $MSFT $UNH $COST $XOM