1/25. Let's keep going with a comparison of the dot com crash & today, but this time looking through the eyes of Microsoft. At the dot com 1999 zenith, $MSFT was world's largest market cap company, & pre-pandemic it was back in that position again.

visualcapitalist.com/a-visual-histo…

visualcapitalist.com/a-visual-histo…

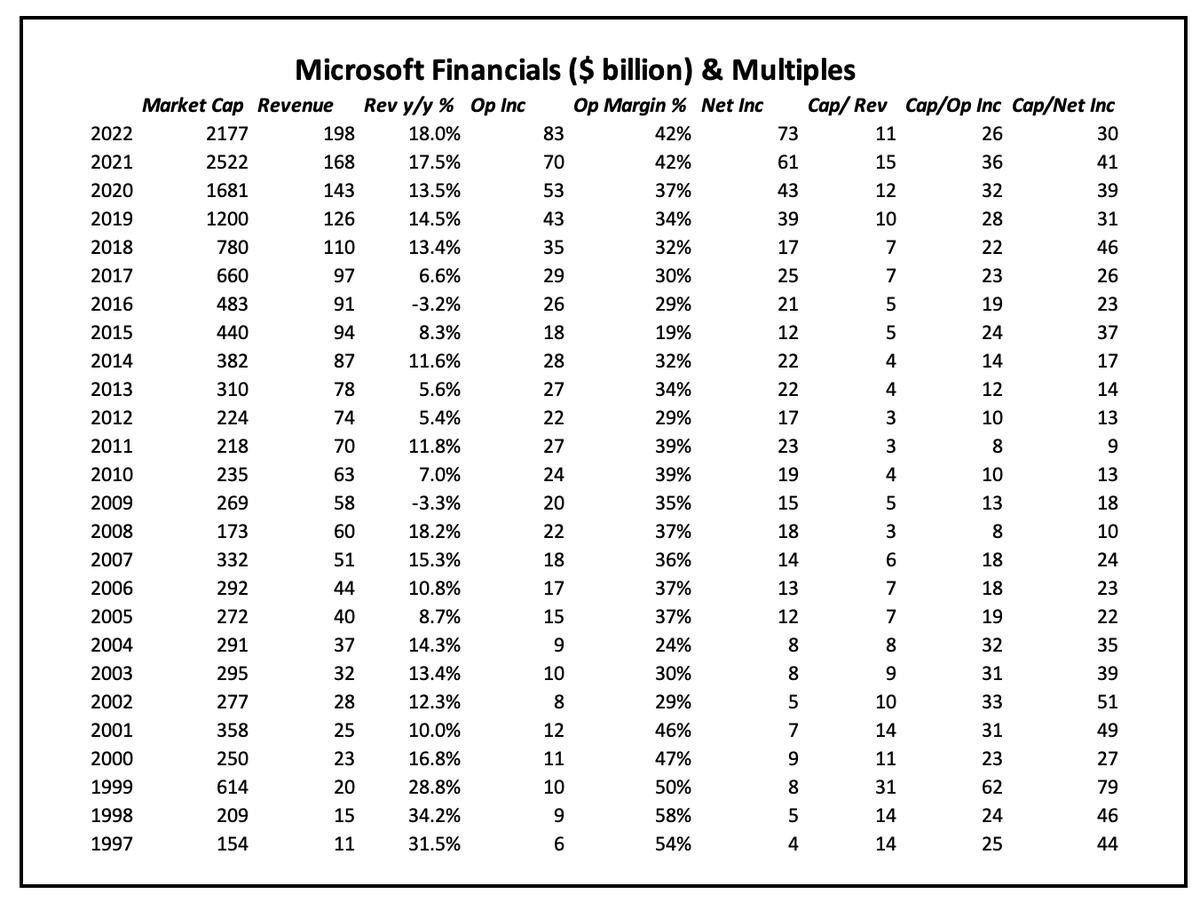

2/25. For a time in early 2000, Cisco took No 1, & obviously Apple has powered past it now. But unlike those 2 companies, Microsoft was a colossus in the tech bubble then, & the tech bubble now. Before we try to get into management's head circa 1999, let's look at some numbers:

3/25. As the dot com bubble progressed, Microsoft's market cap exploded upward to reach a peak of $614 billion on 27th December 1999. Using the Fed's GDP deflator, $614 billion then is equivalent to a little over $1 trillion now.

fred.stlouisfed.org/series/GDPDEF

fred.stlouisfed.org/series/GDPDEF

4/25. We should always be careful comparing a stock (a company's stock market capitalisation) with a flow (like GDP). But they should, theoretically, be linked.

5/25. A stock price ultimately is the value of all the future discounted cash flows of a company. And those cash flows are derived from economic activity, i.e., GDP.

6/25. Back to the Fed's FRED data base again. Today, nominal GDP annualised is $24.8 trillion. In Q4, in nominal terms, it was $9.9 trillion. So today the Microsoft market cap-GDP ratio is 8.8%. In 1999, it was 6.2%.

fred.stlouisfed.org/series/GDP

fred.stlouisfed.org/series/GDP

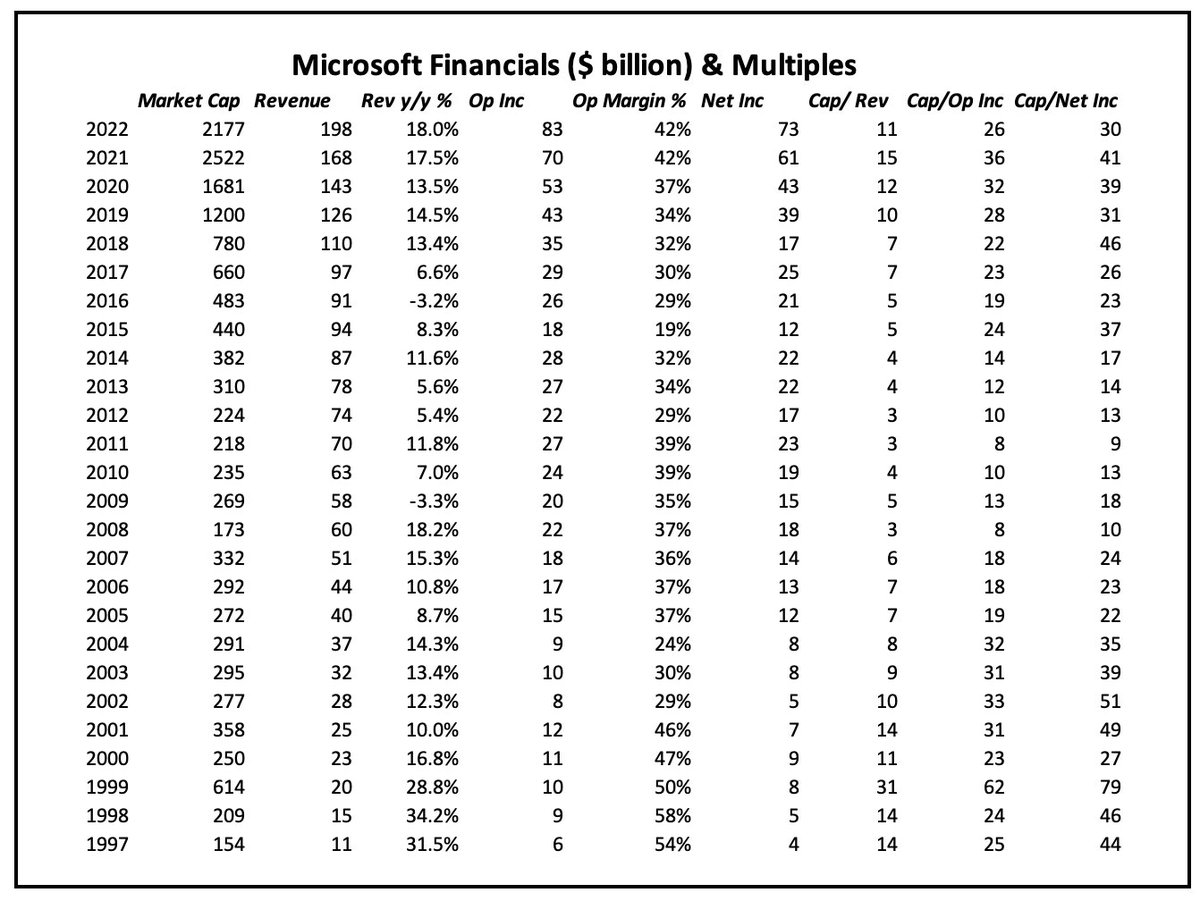

7/25. The 31 times market-cap-to-revenue ratio (which you can also call price-sales ratio) in December 1999 looks utterly absurd. But in many ways, so does our current 11 times ratio.

8/25. Ultimately, Microsoft's growth will be capped by GDP growth. Otherwise, Microsoft will eventually take over the entire economy & become Skynet or Netflix's E Corp in Mr. Robot.

9/25. Back in 1999, one could argue that at least Microsoft at that valuation had one superior thing going for it compared to now: it had plenty of room to gobble up more of the country's economic activity.

10/25. But if you take Microsoft now, and let's add in the rest of #TheMagnificentSeven-- $AAPL, $GOOGL, $AMZN, $META, $TSLA & $NVDA -- unless they start flipping hamburgers, building houses and drilling for oil, their market cap expansion will be limited by nominal GDP growth.

11/25. What about the rest of the world, you will shout. Yes, they all get growth from abroad, but that growth is slowing everywhere too. Deglobalisation & demographics make everything tougher going forward but Microsoft's valuation (& the others) refuses to recognise that fact.

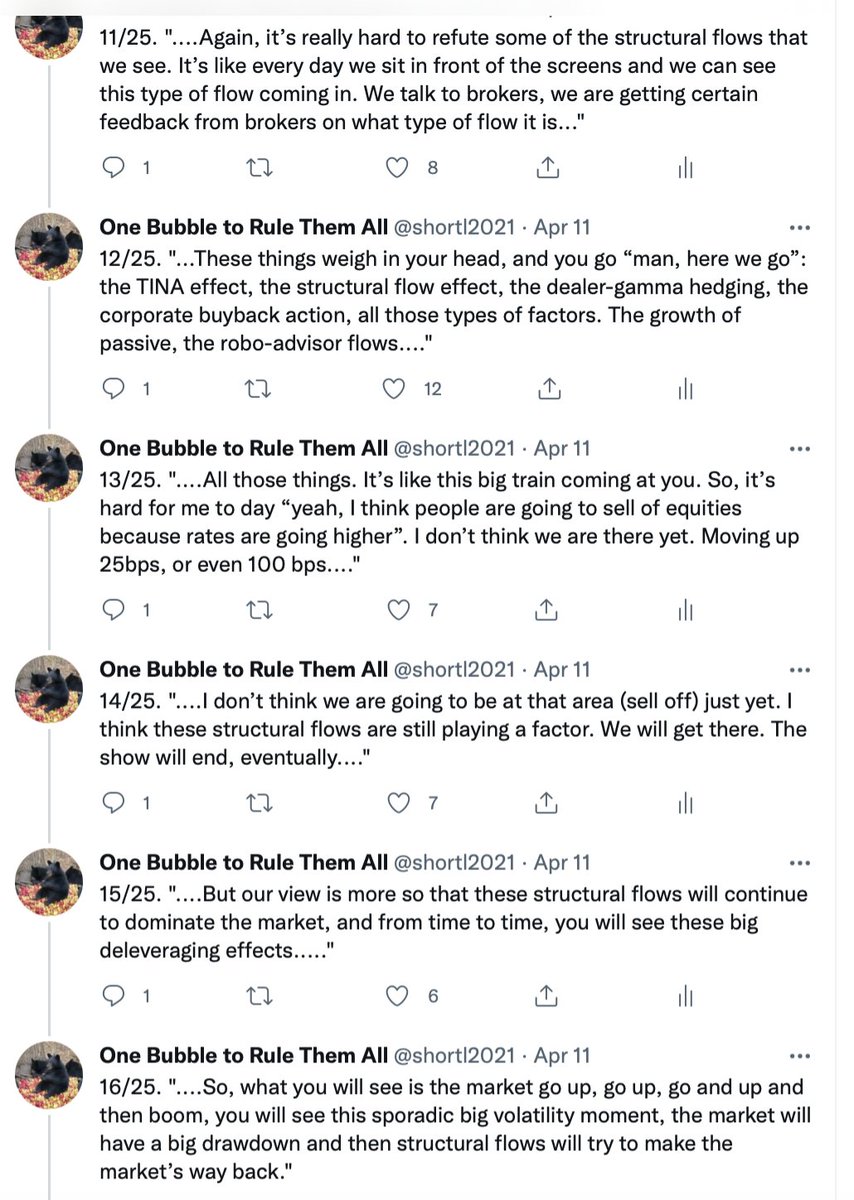

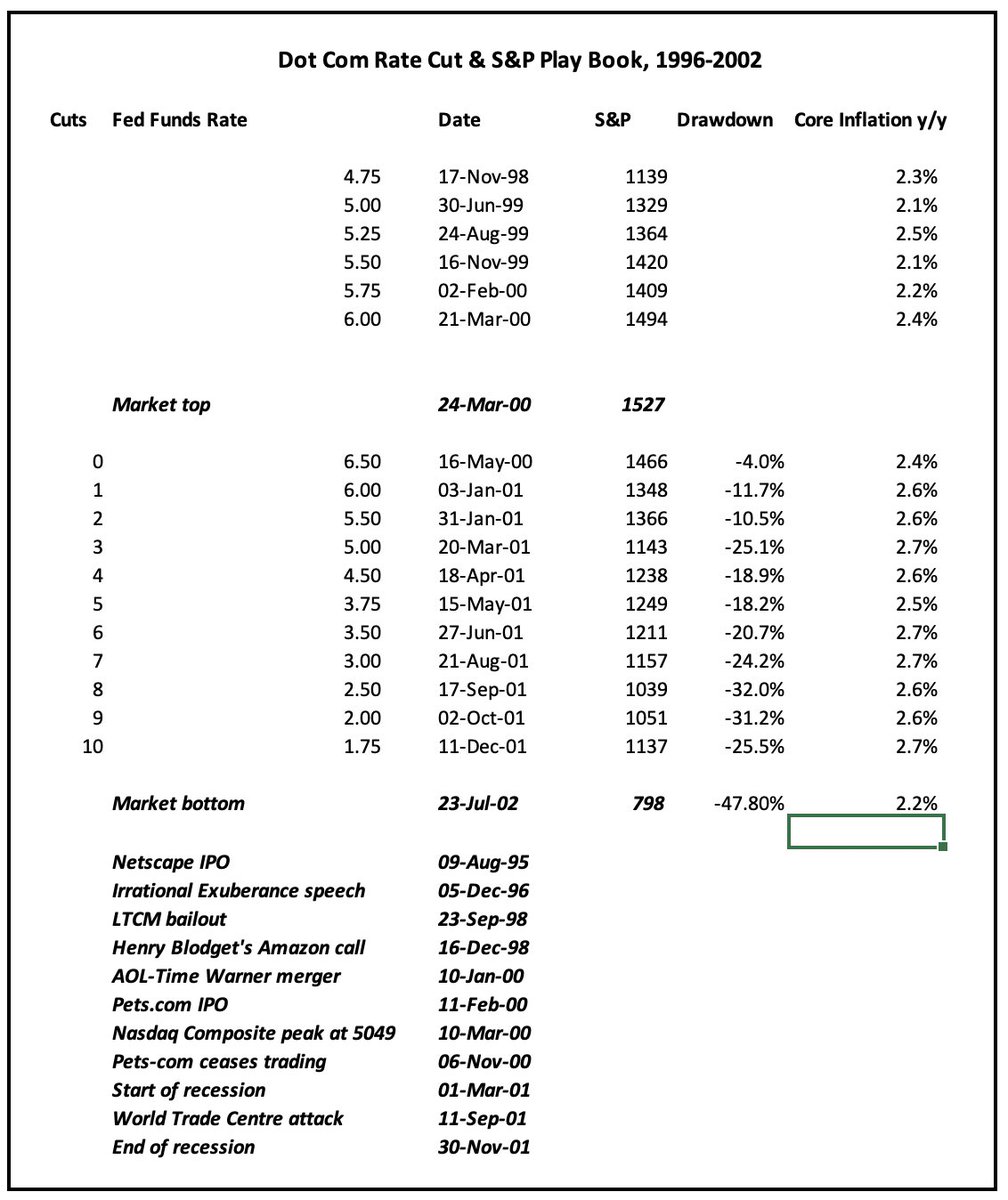

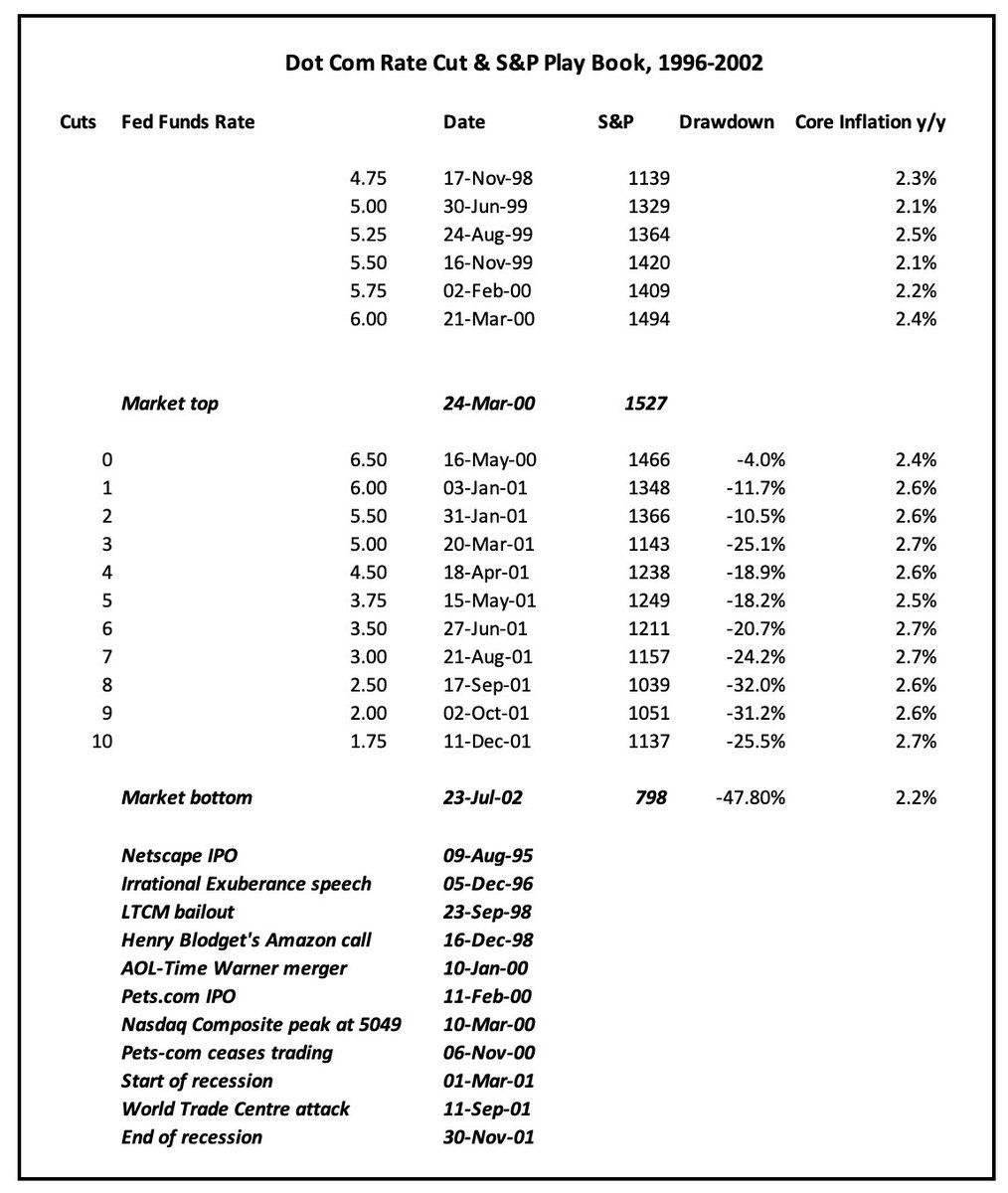

12/25 But back to my Big Thesis: The dot com bubble will built on 2 foundations: 1) an easy Fed policy that refused to recognise asset inflation as a legitimate form of actual inflation & 2) valuations that mistook a transitory tech growth positive shock for a permanent one.

13/25. The long thread I posted at the weekend centred on Alan Greenspan's big idea. This was that the tech revolution was boosting productivity and allowing the economy to run hotter with lower levels of unemployment.

https://twitter.com/shortl2021/status/1558820584481595396?s=20&t=tQYw031m-V5DhBEn76omeQ

14/25. In 1999, just as Microsoft took its last leg upward to become the most valuation company in the world, the Fed decided that perhaps that thesis was overdone since inflation was creeping up again, so it started lifting rates.

15/25. With 'animal spirits' running high, the market initially ignored the Fed and management teams did the same. Microsoft's 2000 results announcement contained no guidance & mostly was a victory lap on their achievements to date.

news.microsoft.com/2000/07/18/mic…

news.microsoft.com/2000/07/18/mic…

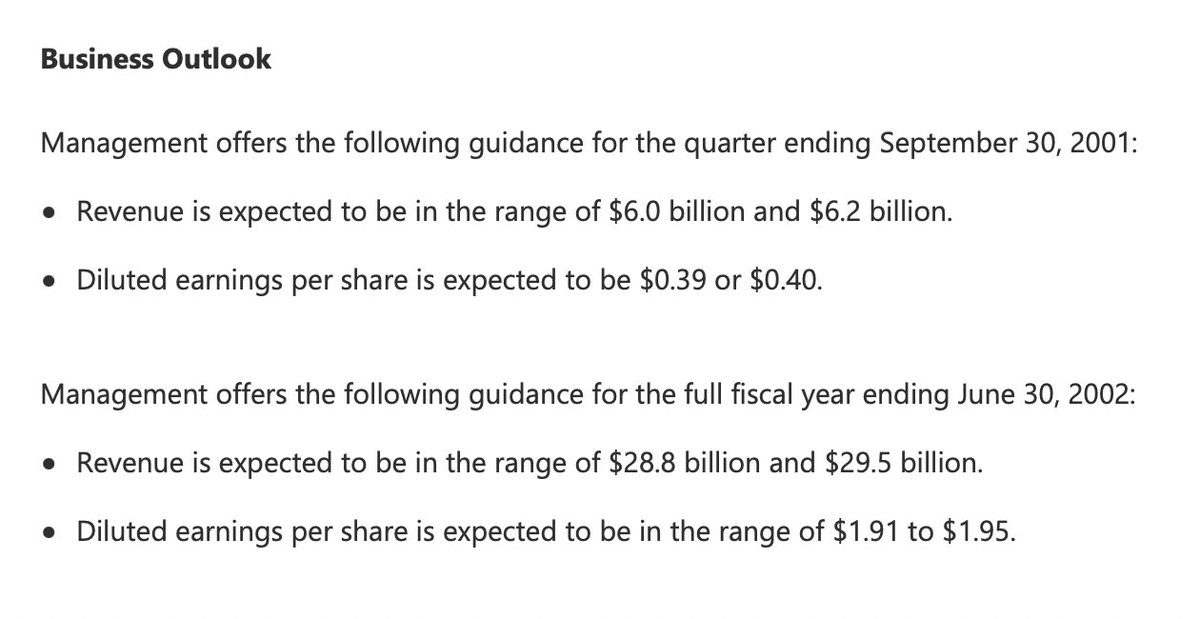

16/25. At the 2001 full-year announcement, the company forecast both steady top- and bottom-line growth. They then went on to hit the top line, but had a huge miss on the bottom line, coming in at around $1.40 for EPS.

news.microsoft.com/2001/07/19/mic…

news.microsoft.com/2001/07/19/mic…

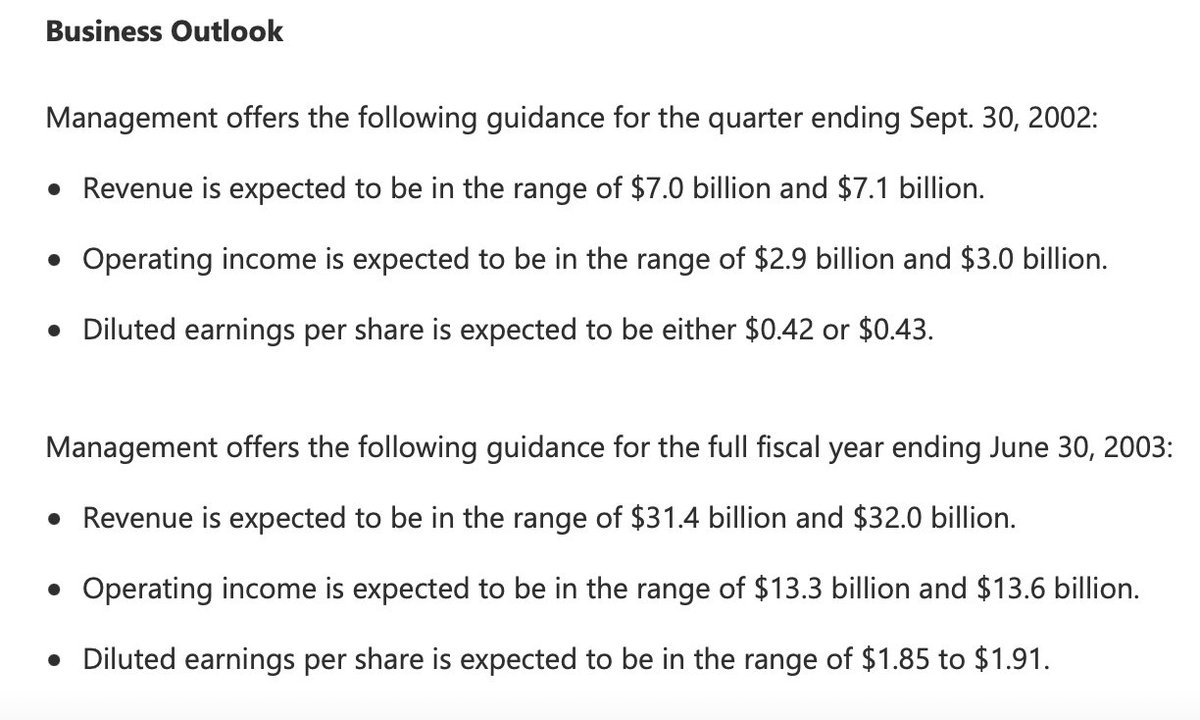

17/25. In the 2002, earnings announcement, management guided to $32 billion in earnings and around $13.5 billion in operating income. They hit their revenue number, but they again missed their OP number by about 30%, coming in at $9.5 billion.

news.microsoft.com/2002/07/18/mic…

news.microsoft.com/2002/07/18/mic…

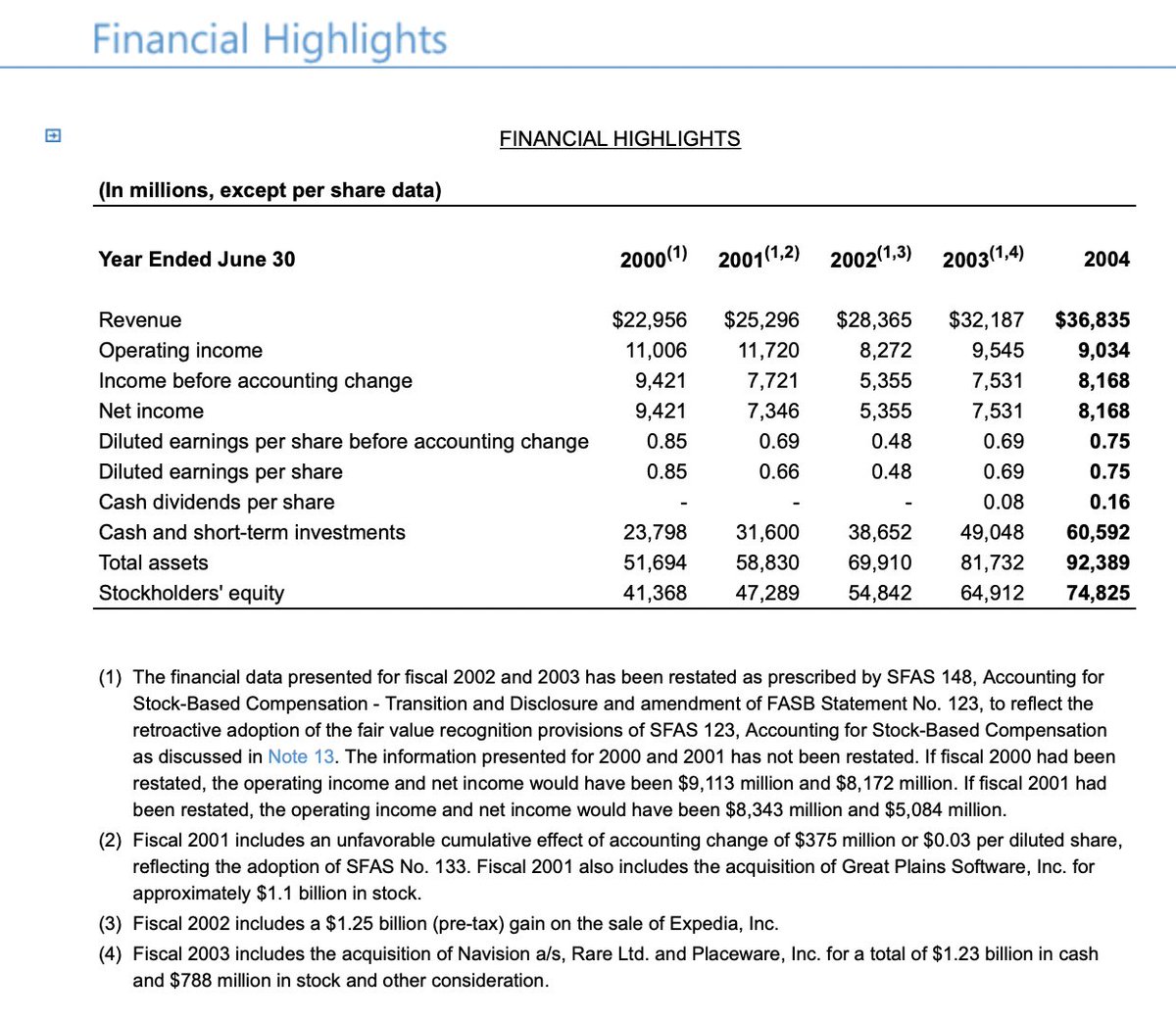

18/25. From the 2004 report, you can see the impact of the dot com crash on Microsoft's results over a multi-year period. Basically, the company managed to maintain top-line growth but at the expense of margins. (Note the 2:1 share split in Feb 2003).

microsoft.com/investor/repor…

microsoft.com/investor/repor…

19/25. An inability to lift operating profit & net income even as revenue rose caused major multiple compression as you can see in the chart below. Indeed, and this is the terrifying part, it's taken another tech bubble to get those valuation multiples shooting back up again.

20/25. Now we have had a little run through Microsoft's history over the dot com boom & bust, I will conclude with this thought. In my humble opinion, Microsoft is in a far worse position valuation wise nowadays for 3 main reasons.

21/25..

1) Greenspan's Fed only hiked by 175 bps to dampen down animal spirits in the dot com boom. We are already at 225 bps and going a lot higher.

1) Greenspan's Fed only hiked by 175 bps to dampen down animal spirits in the dot com boom. We are already at 225 bps and going a lot higher.

22/25.

Moreover, inflation never got to a 3% handle under Greenspan during the mania period, so he could pivot to cuts 7 months after his last hike. With our inflation rate so high, we may be stuck at a high terminal rate for a lot, lot longer.

Moreover, inflation never got to a 3% handle under Greenspan during the mania period, so he could pivot to cuts 7 months after his last hike. With our inflation rate so high, we may be stuck at a high terminal rate for a lot, lot longer.

23/25.

2) Throughout the dot com crash Microsoft still managed to grow. I think it will be much, much tougher to do that this time around. And with ROW economies slumping and USD strong, overseas sales will be a source of weakness not strength.

2) Throughout the dot com crash Microsoft still managed to grow. I think it will be much, much tougher to do that this time around. And with ROW economies slumping and USD strong, overseas sales will be a source of weakness not strength.

24/25.

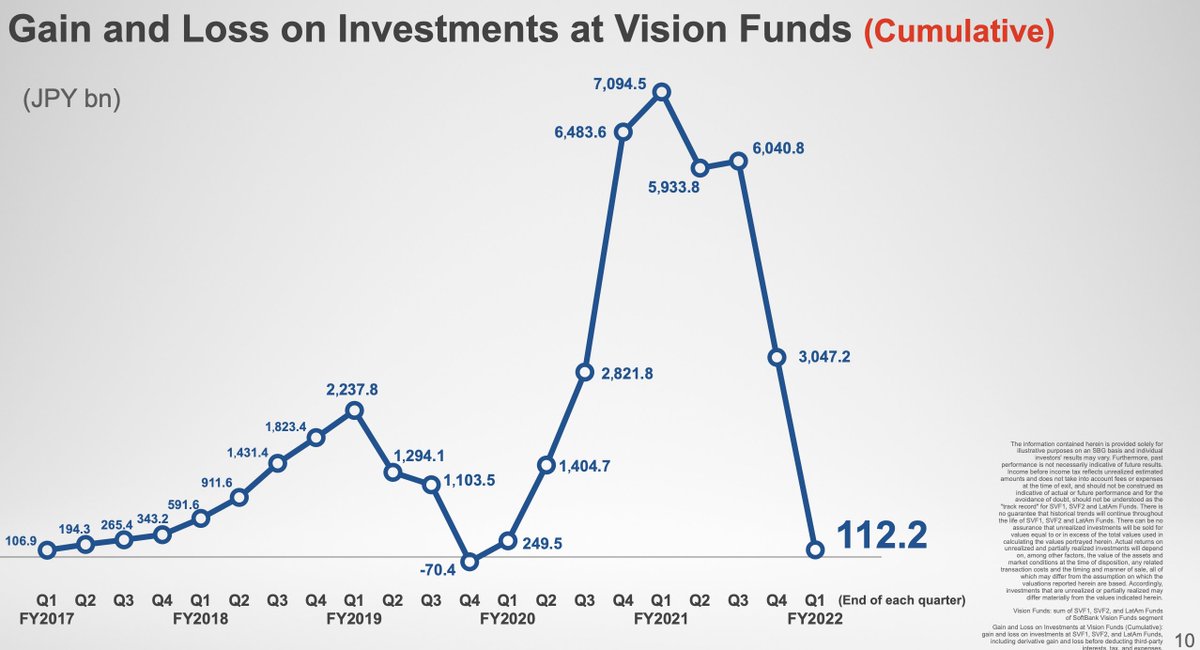

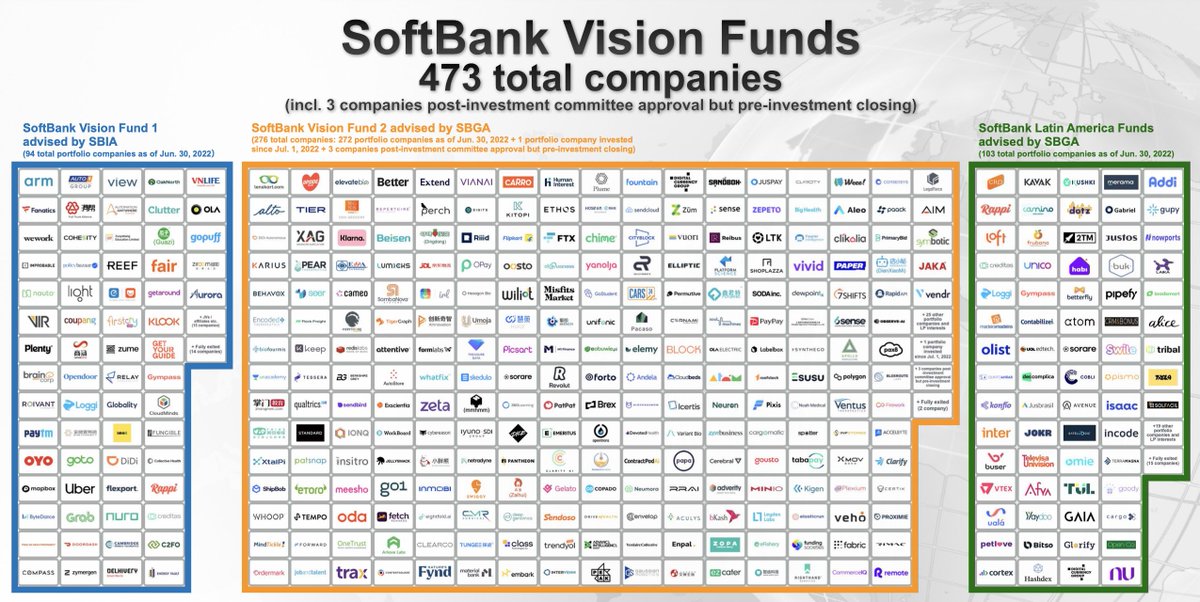

The world is overweight tech on the false belief that its earnings are defensive & that cloud-related super growth is permanent not temporary. Dot com belief vis a vis internet was the same. Except, our bubble is more epic in scale & tech's role in it more pronounced.

The world is overweight tech on the false belief that its earnings are defensive & that cloud-related super growth is permanent not temporary. Dot com belief vis a vis internet was the same. Except, our bubble is more epic in scale & tech's role in it more pronounced.

25/25.

Nasdaq as percent of S&P was a lot lower in the dot com era, hence S&P held up initially even as Nasdaq took its first leg down. But our grotesque tech over-weighting is about to be hit by a perfect storm. I expect carnage in the space, taking everything with it down.

Nasdaq as percent of S&P was a lot lower in the dot com era, hence S&P held up initially even as Nasdaq took its first leg down. But our grotesque tech over-weighting is about to be hit by a perfect storm. I expect carnage in the space, taking everything with it down.

• • •

Missing some Tweet in this thread? You can try to

force a refresh