CFA, veteran former hedge fund manager, analyst, economist. Back to trade the "Skynet" bubble.

15 subscribers

How to get URL link on X (Twitter) App

https://x.com/Econimica/status/19070974943053045982/8. CH is also connecting the dots between deteriorating demographics, rising debt and declining interest rates (until now?).

https://x.com/Econimica/status/1907095996871659680

https://twitter.com/thinkercar/status/18987162855437888882/8. And such commercial capacity has the ability to be turned into military capacity. This is basically what the US did in WW2 with Japan. It flicked a switch: then auto makers produced tanks and commercial ship yards produced aircraft carriers.

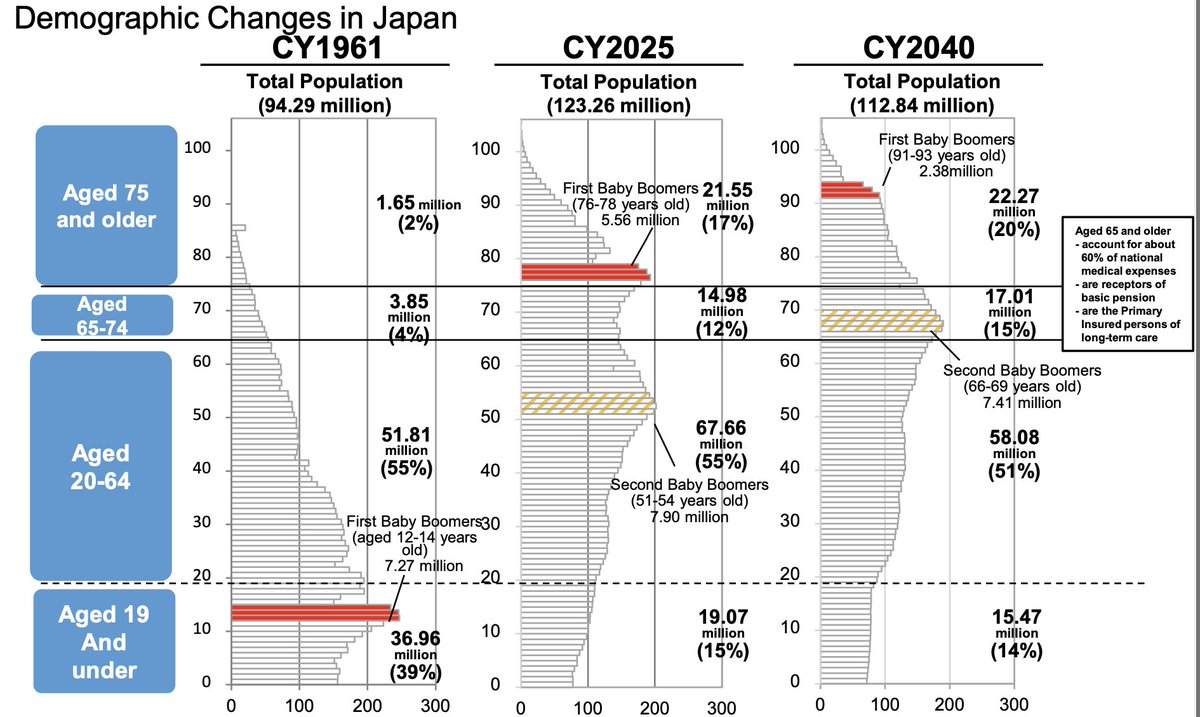

https://twitter.com/kobeissiletter/status/18911314922076285332/5. Ballooning structural deficits are due to a multitude of factors, most important of which are negative demographic (principally an ageing population & falling trend in workforce participation, plus an LT decline in the corporate tax take.

2/24. Looking at Twitter feed, I don't think any one of its rabid supporters has looked at 10Q.

2/24. Looking at Twitter feed, I don't think any one of its rabid supporters has looked at 10Q.

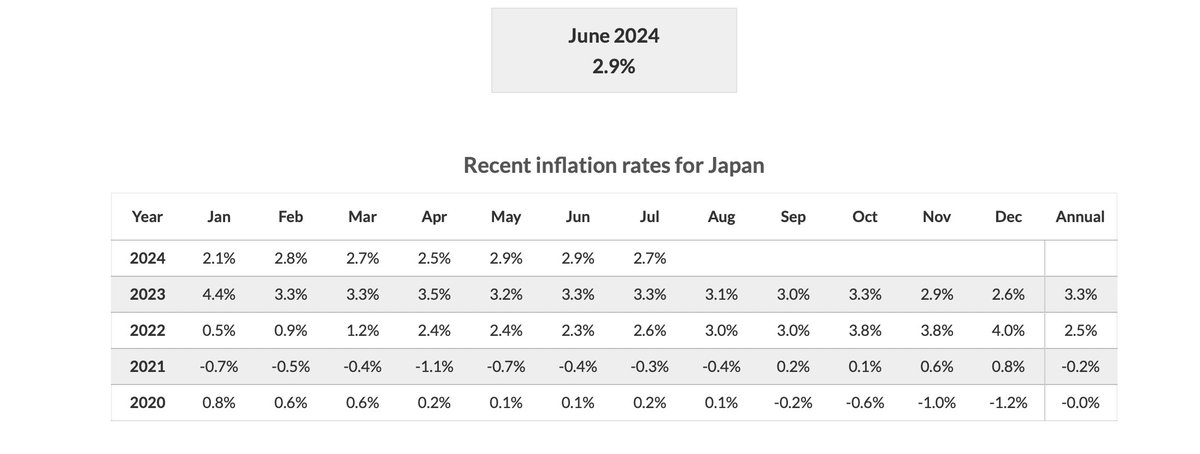

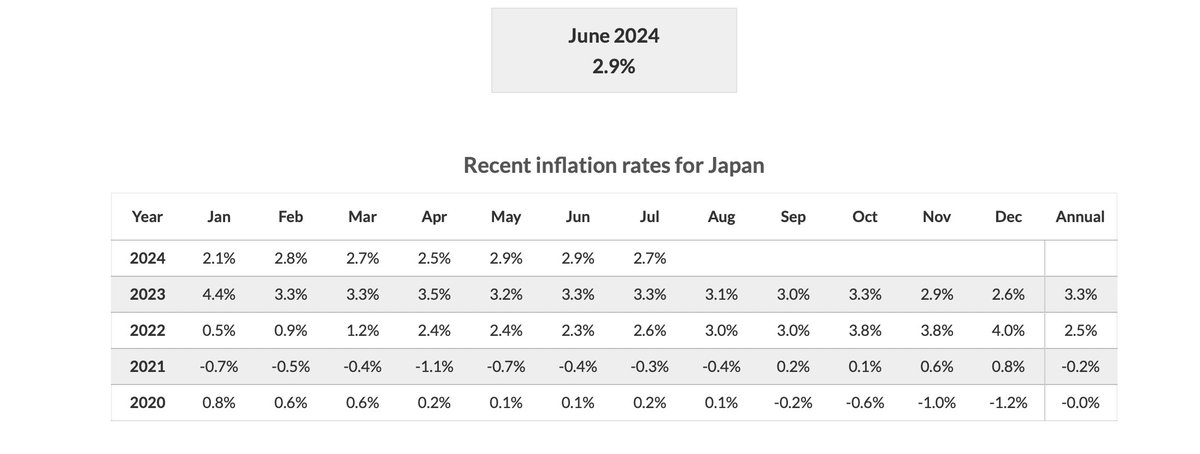

2/13. I go through the dynamics here. In short, government spending > taxation, so government borrows to fill the gap. The BoJ monetises the debt.

2/13. I go through the dynamics here. In short, government spending > taxation, so government borrows to fill the gap. The BoJ monetises the debt. https://x.com/shortl2021/status/1586366953882808321

https://x.com/LoganMohtashami/status/18184064059233321282/16. Like stocks, houses are currently wrongly priced. The discount rate has gone up (oh my f*cking God, it is actually a non-negative discount rate in real terms) and the implicit rent generated from the value of the house is low.

2/10. This period of financial history in France and England is so rich that I find it difficult to do justice in tweet threads. But the 2 authors give us the chart below to contrast & compare.

2/10. This period of financial history in France and England is so rich that I find it difficult to do justice in tweet threads. But the 2 authors give us the chart below to contrast & compare.

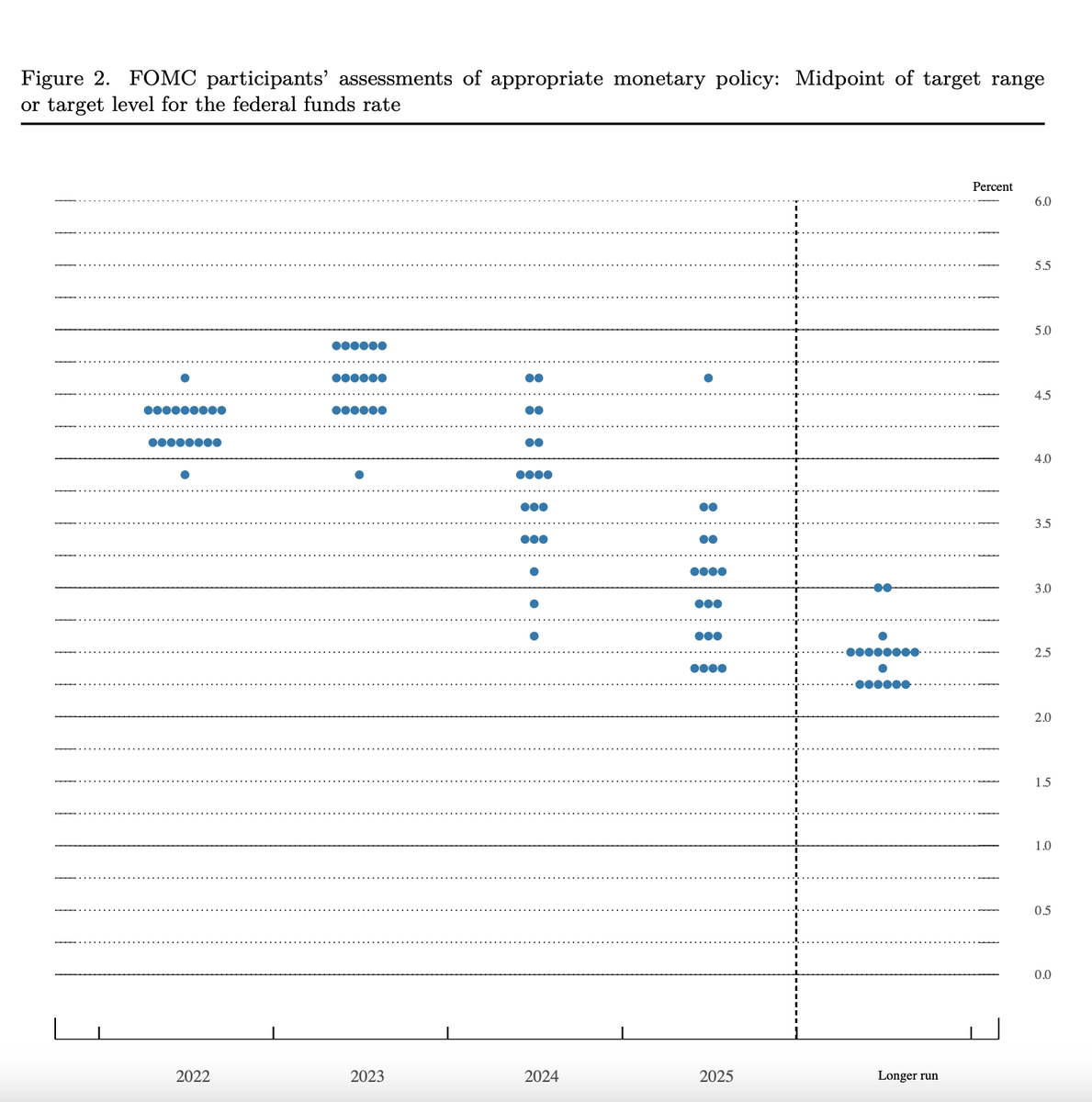

2/4. Three months ago, not one hawk was above the 5% target line for 2023! Note that the most dovish 2023 projection in Sep (Brainhard?) has moved up by 100 bps between the 2 meeting from 3.75 to 4.75!

2/4. Three months ago, not one hawk was above the 5% target line for 2023! Note that the most dovish 2023 projection in Sep (Brainhard?) has moved up by 100 bps between the 2 meeting from 3.75 to 4.75!

2/7. For 2023, IEA see baseline demand of 395 bcm, and a shortfall of supply of 57 bcm. 30 bcm should be covered by existing initiatives, while the IEA suggests a further set of initiatives to close the final 27 bcm gap.

2/7. For 2023, IEA see baseline demand of 395 bcm, and a shortfall of supply of 57 bcm. 30 bcm should be covered by existing initiatives, while the IEA suggests a further set of initiatives to close the final 27 bcm gap.

https://twitter.com/shortl2021/status/1599790138866880512?s=20&t=W7BOuqSLhkeDHoDd-5uzgg2/19. Now, @macroalf has done a nice little dive into the composition of these trades. First 9 minutes tackles how these trades arise, & from then onward he looks at the risk these trades pose.

2/9. Michael Howell @crossbordercap, who I have huge respect for, suggests that the liquidity spigot is now being turned back on,....

2/9. Michael Howell @crossbordercap, who I have huge respect for, suggests that the liquidity spigot is now being turned back on,....

2/4. "For 2024 and 2025 there is almost as little consensus as there could possibly be. With the economic scene complicating further (energy prices are coming under control in a way that seemed unlikely three months ago;..."

2/4. "For 2024 and 2025 there is almost as little consensus as there could possibly be. With the economic scene complicating further (energy prices are coming under control in a way that seemed unlikely three months ago;..."