The Chinese economy is experiencing a near-complete collapse.

Nearly half a million customers have lost their deposits as the banks lent indiscriminately to housing developers who are now facing cascading defaults.

Here’s the story the Chinese Govt. doesn't want you to know 👇

Nearly half a million customers have lost their deposits as the banks lent indiscriminately to housing developers who are now facing cascading defaults.

Here’s the story the Chinese Govt. doesn't want you to know 👇

All of this begins with one thing - Real Estate. Chinese are obsessed with Real Estate and 70% of China’s wealth is tied to real estate (twice as high as the US).

Reports are now emerging about real estate Ponzi schemes, Mortgage boycotts, and an unfolding banking crisis

Reports are now emerging about real estate Ponzi schemes, Mortgage boycotts, and an unfolding banking crisis

Chinese citizens prefer to invest in Real Estate as the Chinese Stock Market is notoriously opaque and unreliable.

The Shanghai Composite (similar to our S&P 500) has not yet recovered from its 2008 peak, despite China's GDP growing by nearly 3 times since then!

The Shanghai Composite (similar to our S&P 500) has not yet recovered from its 2008 peak, despite China's GDP growing by nearly 3 times since then!

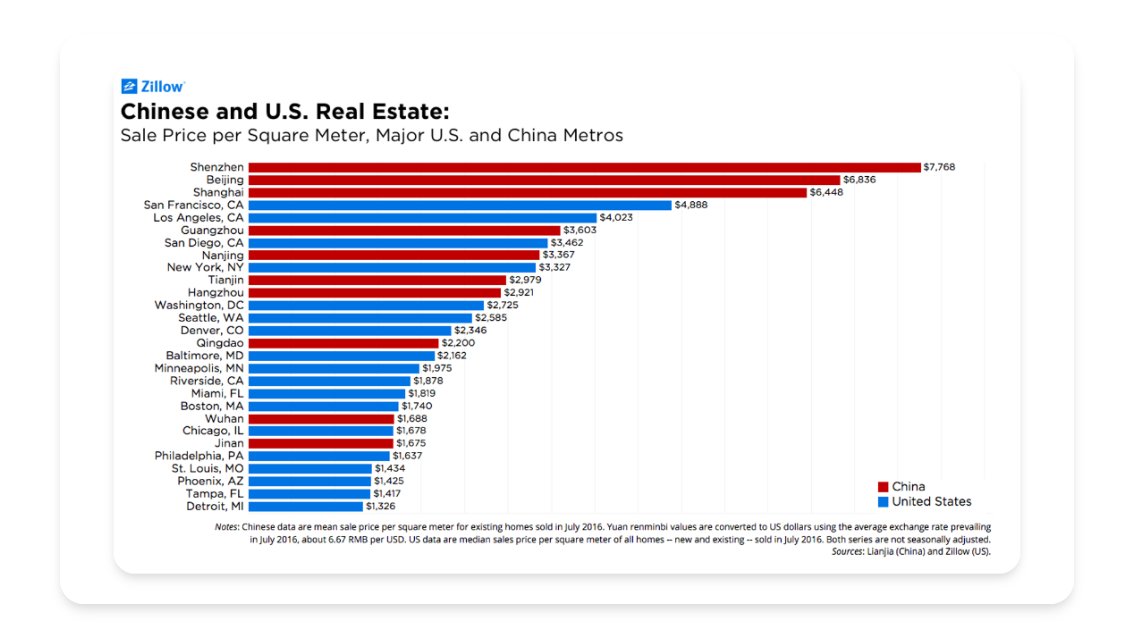

For some context on how crazy the real estate market in China is, the median home price in New York is around 10 times the median annual income, but in Beijing, this can be as high as 25 times the median annual income!

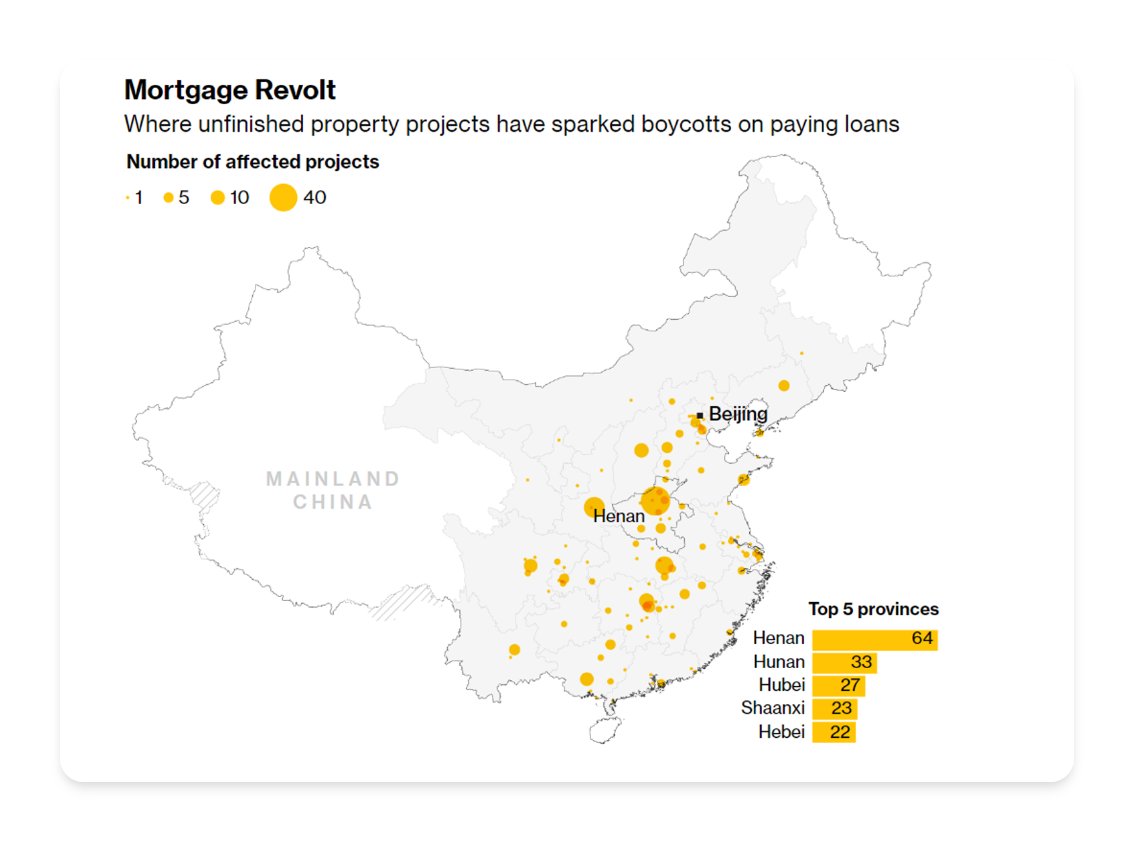

The insatiable demand lead to Ponzi schemes where developers pre-sell homes (which are not even built), use the pre-sale money to start more projects, and then collect more pre-sales from new projects. Buyers started a mortgage boycott as the properties have not been completed.

The crisis spread to banks, as they had loaned out depositors’ money to developers who were now defaulting on payments.

As frozen deposits mounted and protests erupted all over China, investigations revealed critical systemic issues

As frozen deposits mounted and protests erupted all over China, investigations revealed critical systemic issues

For starters, during the covid crisis, the government had lowered the 10% limit on assets that banks had to keep in cash and investigations revealed corrupt practices in the banks, some of which were taken over by criminal gangs who transferred the deposits outside the country

With reports suggesting that over 400,000 customers have fallen victim to such activities, public trust in the banking system plummeted and the government stepped in to avoid bank runs and liquidity crunches. But their strategies seem, at best, questionable.

The government has agreed to pay up to $15,000 dollars for lost deposits, but only if the banks weren't involved in “non-compliant” transactions.

The government’s strategy for overleveraged properties is to lend more money to finish them and pretend that everything is fine.

The government’s strategy for overleveraged properties is to lend more money to finish them and pretend that everything is fine.

Whether these strategies can revive investor confidence or is simply delaying the inevitable remains to be seen, but China is unlikely to meet its targeted 5.5% GDP growth rate, and right now, youth unemployment is at nearly 20%!

As the semiconductor shortages showed us, events across the world can have serious consequences back home. Chinese companies have substantial investments in US equities and might sell them during a crisis. This can tilt the investor sentiment to fear and trigger selloff

Short-term investors should keep an eye out for news from China. The events and its impacts are covered in more detail in my newsletter, so don’t forget to subscribe there!

grahamstephan.substack.com/p/storm-china

grahamstephan.substack.com/p/storm-china

A lot of research went into this as I usually don't cover events outside the U.S. If you found it insightful, please share it by retweeting the first tweet!

https://twitter.com/GrahamStephan/status/1559878464114724865

Follow me @GrahamStephan for more interesting insights into the world of personal finance, investing and stock market.

Well, this blew up! You can find all my deep dives like this👇

https://twitter.com/GrahamStephan/status/1543240917364412416

• • •

Missing some Tweet in this thread? You can try to

force a refresh