Contextualizing the @arbitrum Ecosystem's Opportunity.

Putting some data behind what early Arbitrum users are playing for.

Putting some data behind what early Arbitrum users are playing for.

With Arbitrum Nitro coming August 31st (mark your calendars) and the likely return of Arbitrum Odyssey shortly thereafter, I'm sharing some relevant data to help contextualize where Arbitrum is in its growth trajectory and what its ecosystem could become.

Before we get to the data, here are a few relevant resources for those less familiar with Ethereum's top Layer 2 (L2).

Firstly, here's an overview of the Arbitrum thesis.

Firstly, here's an overview of the Arbitrum thesis.

https://twitter.com/DeFiSurfer808/status/1557096471958360064?s=20&t=xzbRku0yVrl4olLnZa4YMg

Secondly, here's a great thread on how to Arbitrum from @ethersole.

https://twitter.com/ethersole/status/1559584539642458112?s=20&t=xzbRku0yVrl4olLnZa4YMg

Finally, it's important to note Arbitrum has been on a hot streak and could be due for some consolidation or even a big pullback due to the macro backdrop.

This should only be considered ***the starting point*** in your research journey.

This should only be considered ***the starting point*** in your research journey.

https://twitter.com/dLuxGMI/status/1558188471143079936?s=20&t=xzbRku0yVrl4olLnZa4YMg

To kick us off, it's important to note Arbitrum is still very smol compared to @ethereum.

Ethereum vs. Arbitrum:

* Unique Addresses: 200M vs. 1M (0.5%).

* Daily Transactions: 1.2M vs. 0.1M (<10%).

Ethereum vs. Arbitrum:

* Unique Addresses: 200M vs. 1M (0.5%).

* Daily Transactions: 1.2M vs. 0.1M (<10%).

https://twitter.com/DeFiSurfer808/status/1549909374277193728?s=20&t=BhohU2NlQSo7jHjAwWPYaA

Similarly, the TVL of the chain is a fraction of the L1 and its main Alt-L1 competitors.

This gap likely closes over time as liquidity migrates from mainnet and incremental users are attracted to the cheaper and faster L2.

Key takeaway is there's a lot of room for growth.

This gap likely closes over time as liquidity migrates from mainnet and incremental users are attracted to the cheaper and faster L2.

Key takeaway is there's a lot of room for growth.

What could @arbitrum be worth?

Impossible to know but here are the valuations of comparable smart contract platforms:

@solana / $SOL

@avalancheavax / $AVAX

@0xPolygon / $MATIC

@optimismFND / $OP

You don't want to miss Odyssey...

Impossible to know but here are the valuations of comparable smart contract platforms:

@solana / $SOL

@avalancheavax / $AVAX

@0xPolygon / $MATIC

@optimismFND / $OP

You don't want to miss Odyssey...

Let's get into the protocols.

PERPS

@arbitrum is heavy on derivatives applications.

As I've discussed this is the biggest fee opportunity in crypto.

Arbitrum protocol valuations compare favorably to their Ethereum and centralized counterparts.

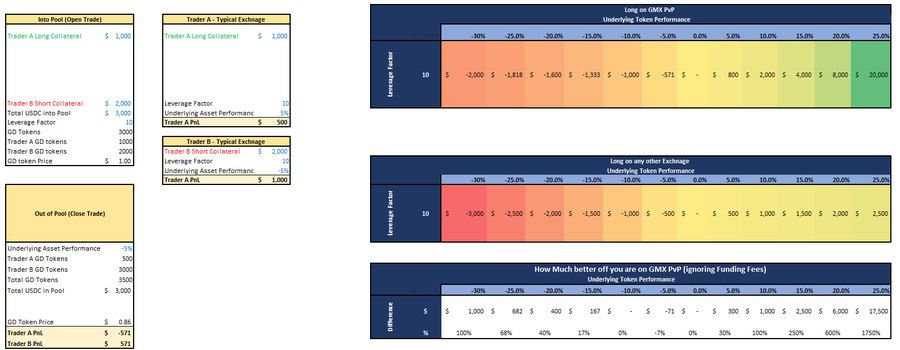

@GMX_IO / $GMX

@mycelium_xyz / $TCR

@CapDotFinance / $CAP

@arbitrum is heavy on derivatives applications.

As I've discussed this is the biggest fee opportunity in crypto.

Arbitrum protocol valuations compare favorably to their Ethereum and centralized counterparts.

@GMX_IO / $GMX

@mycelium_xyz / $TCR

@CapDotFinance / $CAP

OPTIONS

Here the only @arbitrum-native project is the legendary @dopex_io ($DPX).

Options are biggest derivatives opportunity, but also the most nascent.

The most mature crypto options player - @DeribitExchange - is worth a modest $3B according to 3AC BK rumors.

Here the only @arbitrum-native project is the legendary @dopex_io ($DPX).

Options are biggest derivatives opportunity, but also the most nascent.

The most mature crypto options player - @DeribitExchange - is worth a modest $3B according to 3AC BK rumors.

STABLECOINS / MONEY MKT

@arbitrum has a number of novel protocols attacking the vast stablecoin market.

* $RDPX base token for @dopex_io stables (#wen).

* @vestafinance ($VST) looking to be @arbitrum's @MIM_Spell ($SPELL).

* @SperaxUSD ($SPA) a @BillyBobBaghold fave.

@arbitrum has a number of novel protocols attacking the vast stablecoin market.

* $RDPX base token for @dopex_io stables (#wen).

* @vestafinance ($VST) looking to be @arbitrum's @MIM_Spell ($SPELL).

* @SperaxUSD ($SPA) a @BillyBobBaghold fave.

META GOVERNANCE

Here @PlutusDAO_io ($PLS) has free rein over the @arbitrum eco, being the yield-aggregator of choice for @dopex_io, @DAOJonesOptions and @SperaxUSD and working on partnerships w/ @GMX_IO.

Convex of Arbitrum hmmk?

@ConvexFinance / $CVX

@redactedcartel / $BTRFLY

Here @PlutusDAO_io ($PLS) has free rein over the @arbitrum eco, being the yield-aggregator of choice for @dopex_io, @DAOJonesOptions and @SperaxUSD and working on partnerships w/ @GMX_IO.

Convex of Arbitrum hmmk?

@ConvexFinance / $CVX

@redactedcartel / $BTRFLY

ASSET MANAGEMENT

Finally, @UmamiFinance ($UMAMI) and @DAOJonesOptions ($JONES) are working on solutions to give users #realyield through various derivatives strategies.

Obvious next iteration of @iearnfinance 's ($YFI) yield-farming automation if you ask me.

Finally, @UmamiFinance ($UMAMI) and @DAOJonesOptions ($JONES) are working on solutions to give users #realyield through various derivatives strategies.

Obvious next iteration of @iearnfinance 's ($YFI) yield-farming automation if you ask me.

In conclusion, Arbitrum is likely to attract a lot of attention and flows over the coming months / years.

Its ecosystem is full of exciting and novel projects that have favorable starting valuations compared to their Ethereum and centralized peers.

Its ecosystem is full of exciting and novel projects that have favorable starting valuations compared to their Ethereum and centralized peers.

Best to do the work on understanding the ecosystem sooner rather than later, anon.

• • •

Missing some Tweet in this thread? You can try to

force a refresh