Treasury Wine Estates $TWE $TWE.AX FY22 results came out, and they're good considering the China wine-ban is still being flushed out. Total revenues down, but margins and NPAT are both up 🍷😋

Let's take a quick look 👇

Let's take a quick look 👇

You can find my original thread here where I outlined TWE as an asset play, with the hope that profits may return in due course.

https://twitter.com/DownunderValue/status/1359704968551231488

To put in perspective the FY22 results, you can see here the 1H22 results were less negative than the market expected. But 2H22 has been pretty strong, which is why NPAT is up *only* 4% but almost 10% if you annualise 2H22.

https://twitter.com/DownunderValue/status/1493774986716147717

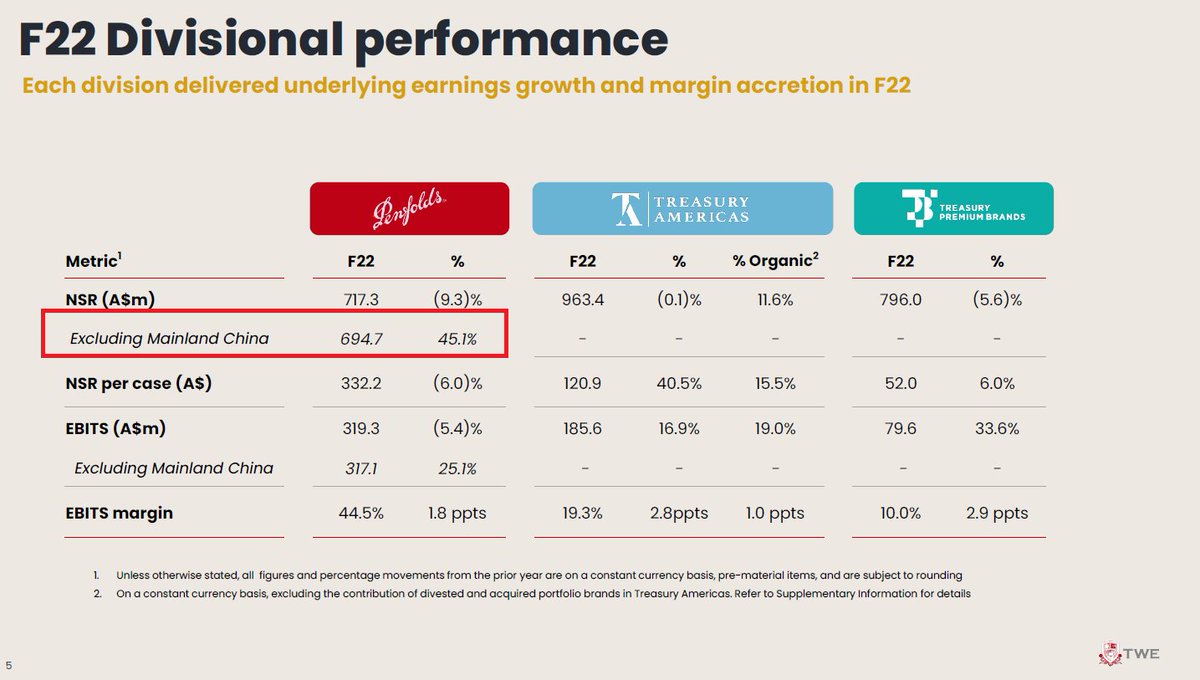

You can see here how China made a huge difference to Penfolds. This will be washed out by FY23 though.

Meanwhile, Snoop Doggs best performance may not be Half Baked or Portrait of a Pimp, but rather +19% at Treasury Americas. 🚬

Meanwhile, Snoop Doggs best performance may not be Half Baked or Portrait of a Pimp, but rather +19% at Treasury Americas. 🚬

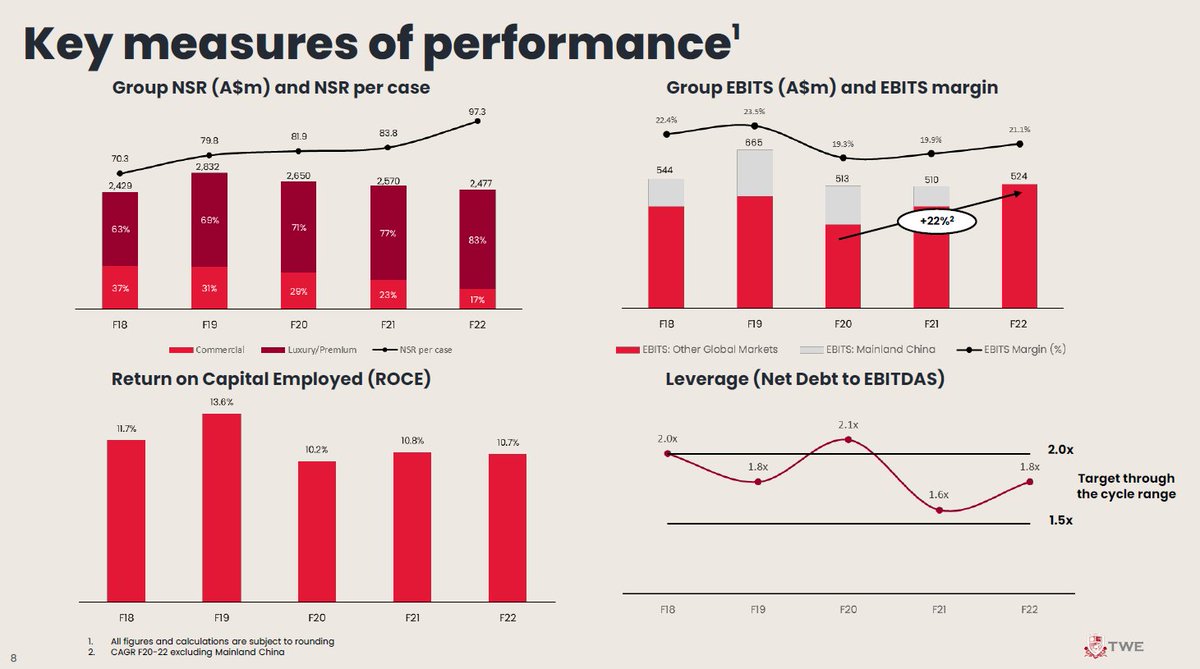

A knock on their results may be lower revenues.

However NSR and margins are up as they execute on their 'premiumisation' strategy. EBITS margin is up to 21.1%, targeting 25%.

However NSR and margins are up as they execute on their 'premiumisation' strategy. EBITS margin is up to 21.1%, targeting 25%.

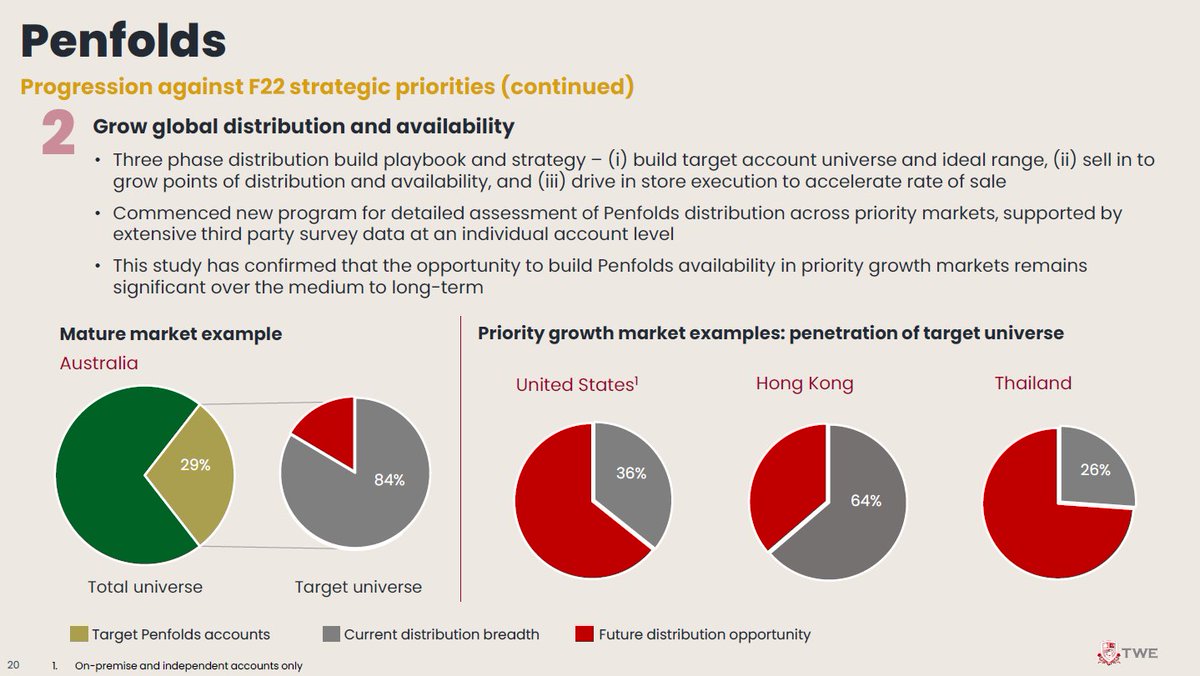

The runway for growth and premiumisation looks pretty good. A long way to go with the US and some Asian countries.

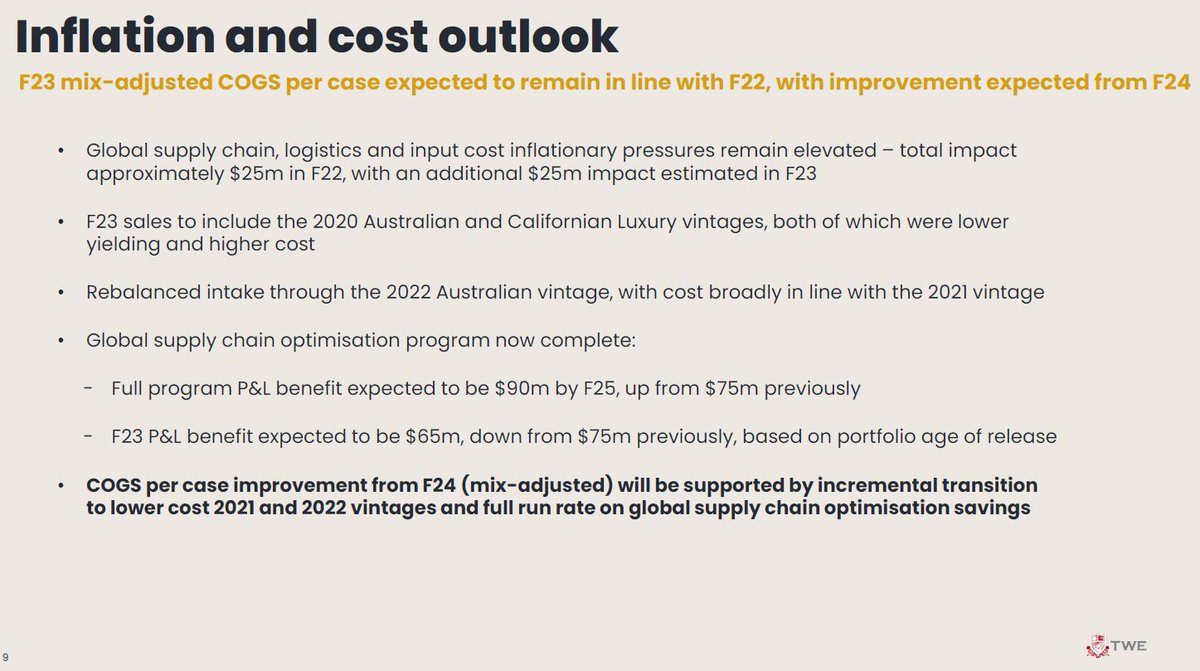

There may be a bit of headwind in FY23 due to higher cost of goods sold (more expensive wine), but FY24 we will see that reverse because 2021 was a bumper year with high yields / low costs.

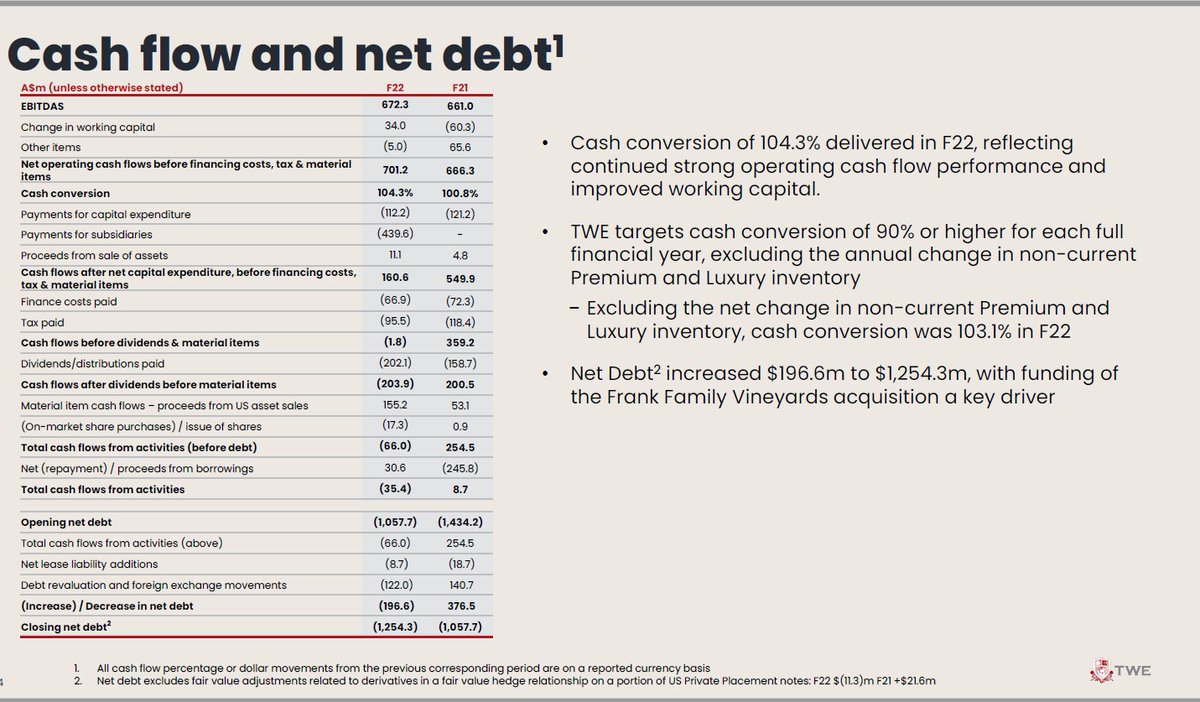

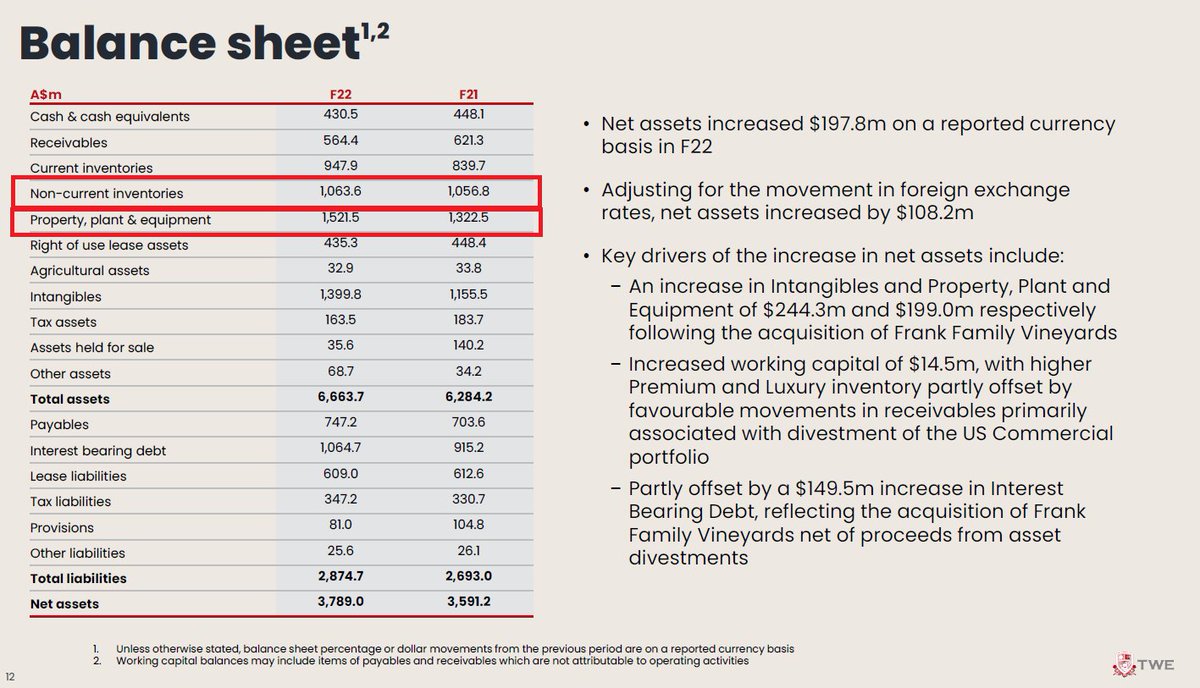

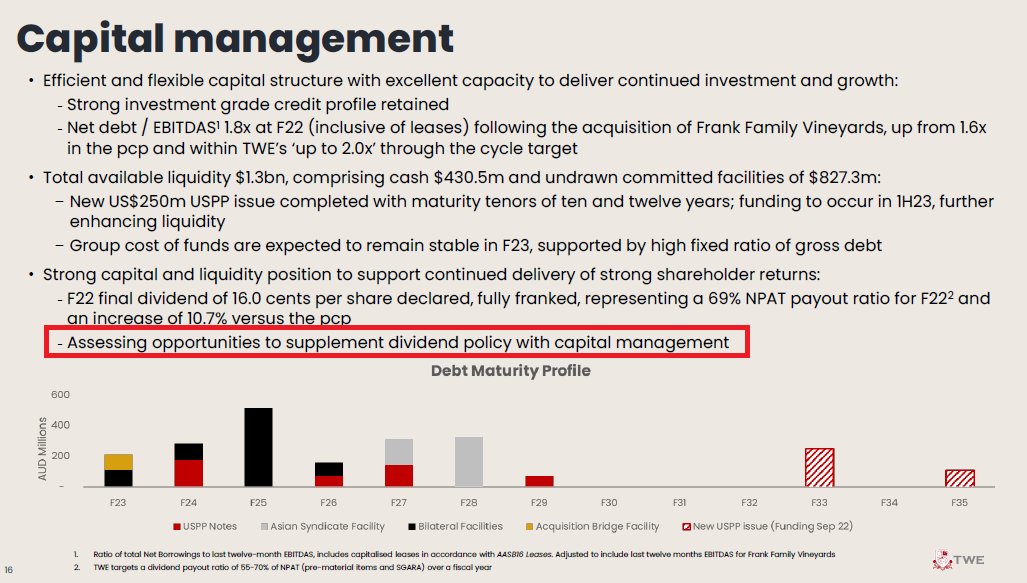

Balance sheet looks really good. They were able to buy Franks without disturbing things, so that's quite impressive.

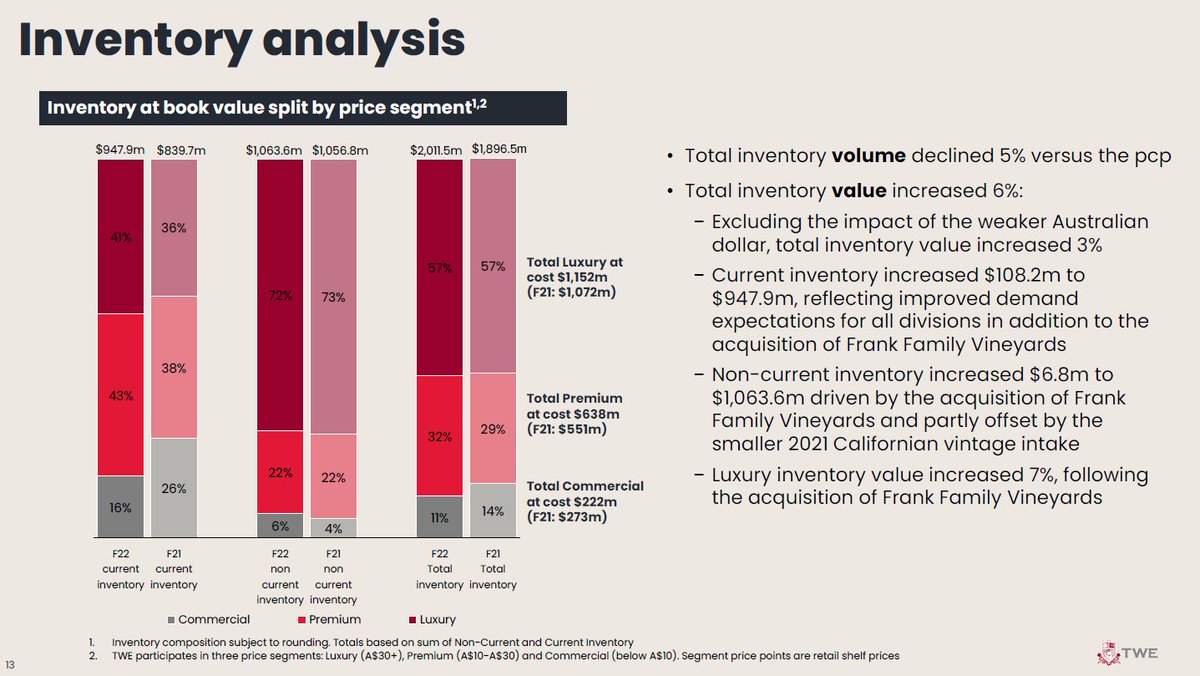

But the thing I love their most is their PPE and inventory🤩

But the thing I love their most is their PPE and inventory🤩

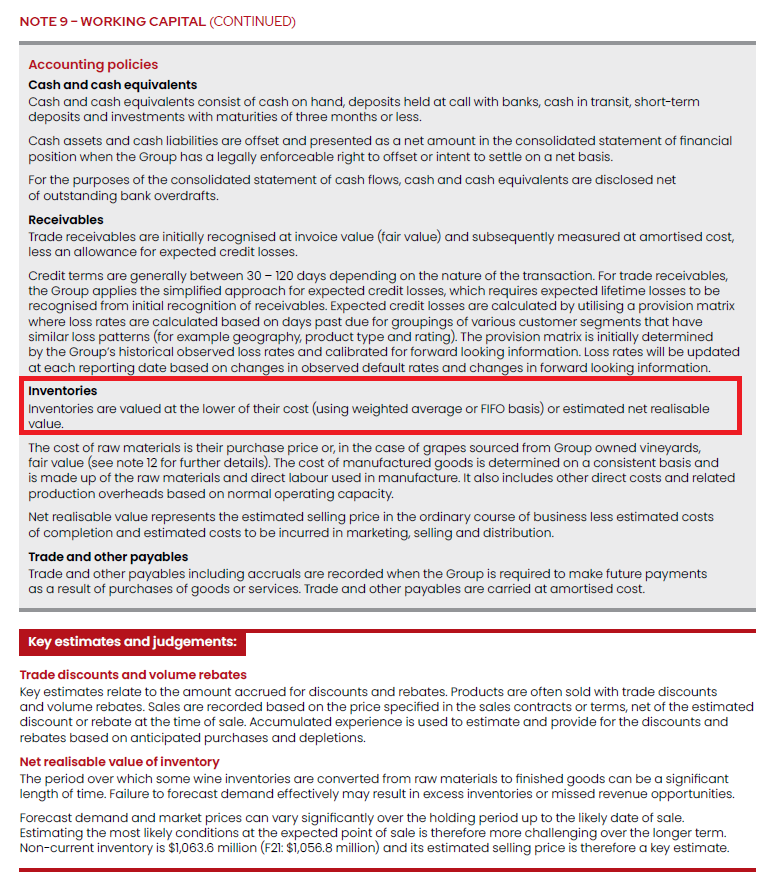

Because of archaic accounting rules, these are recorded at the cost of production. Now we all know that the ~$40/bottle for labour and grapes to make a Penfolds is not a fair representation of the true value.

However, the $700m of Penfolds (non-current luxury inventory) is valued on a very low cost of production. Some reckon it could be 5x that. I just add conservatively $1-2bn, and another $1bn for PPE (vineyards at cost price).

NTA is +$9-10 per share imho.

NTA is +$9-10 per share imho.

Shout out to @lachlanbjensen who brought this one to my attention - TWE also looking to update their capital management, perhaps share buy backs?

We still have this lovely arc forming as @ElephantCapita2 shared a little while ago.

https://twitter.com/ElephantCapita2/status/1515310874772180993

Valuations are OK:

✅EV/EBITS=19.1x (below takeover price)

✅EV/NTA=1.2x (below takeover price)

❓PE=32x

Overall, I still like the value in TWE and happy to see the investment thesis play out. 🍷

✅EV/EBITS=19.1x (below takeover price)

✅EV/NTA=1.2x (below takeover price)

❓PE=32x

Overall, I still like the value in TWE and happy to see the investment thesis play out. 🍷

• • •

Missing some Tweet in this thread? You can try to

force a refresh