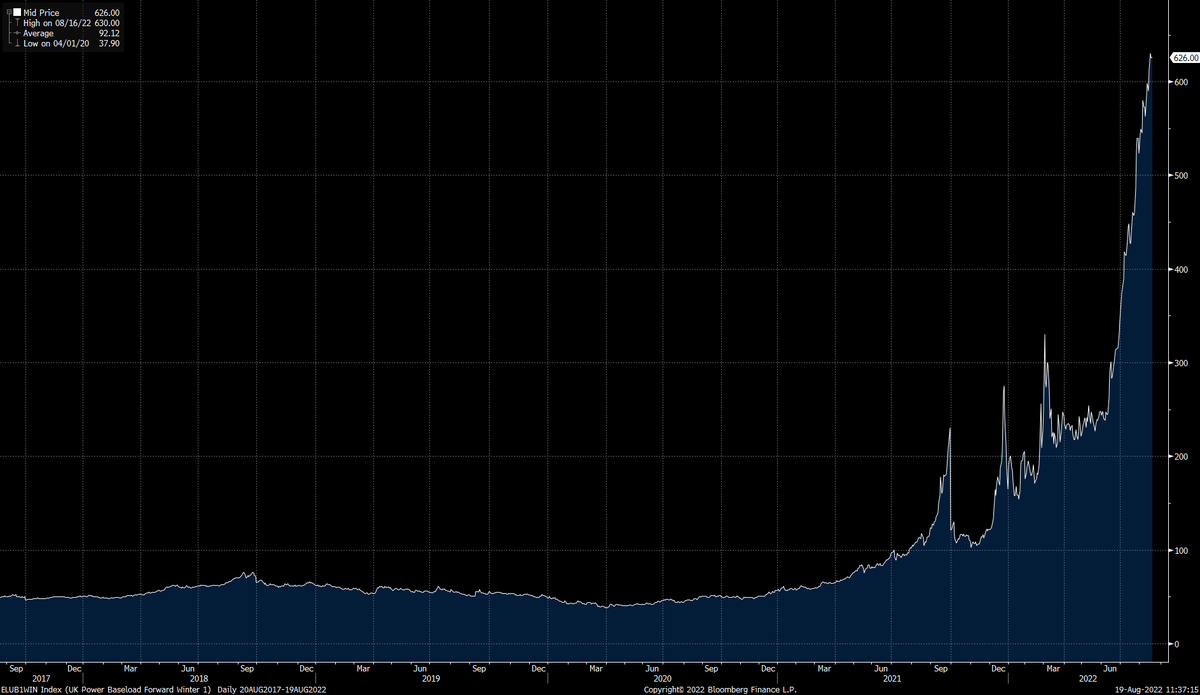

UK and European gas & power prices continue rising to truly scary levels.

The Government will have to act on a very large scale to support households, especially those on lower incomes - and also probably small businesses.

The scale of this shock is hard to overstate.

The Government will have to act on a very large scale to support households, especially those on lower incomes - and also probably small businesses.

The scale of this shock is hard to overstate.

For example - this is the forward price for UK baseload electricity this winter. Shown over the last 5 years to illustrate the scale of what's happening:

This not just another energy shock / cost of living squeeze. It's a once in a generation threat to the solvency of many households and businesses that could scar the economy for years to come

• • •

Missing some Tweet in this thread? You can try to

force a refresh