Telling my 8 years of experience in 5 min. A very simple and effective trading strategy.

🧵

🧵

Gann grid trading strategy

Gann Grid act as support/resistance levels and help in spotting potential breakouts.

Gann Grid act as support/resistance levels and help in spotting potential breakouts.

How to draw gann grid?

Take 2 point swing high (100) and swing low (60) and draw 2 vertical lines. Now subtract the swing high from swing low and divide it by 8. (Ex- 100-60 =40/8 =5 )Now draw a horizontal line at swing low point.

Take 2 point swing high (100) and swing low (60) and draw 2 vertical lines. Now subtract the swing high from swing low and divide it by 8. (Ex- 100-60 =40/8 =5 )Now draw a horizontal line at swing low point.

Now add our previous value 5 to the swing low and draw a new horizontal line at that point (ie 60+5 =65). Now in the same way the next horizontal lines will be formed at 70,75,80....

Now you have to draw a cross line from the swing high vertical line to the intersection of the horizontal and swing low line points as shown in the chart below. 👇

Gann Grid Trade Entry:-

There are two options to open a trade with Gann Grid. The first is to look for breakouts through the grid levels, and the second is to spot bounces from the grid levels.

There are two options to open a trade with Gann Grid. The first is to look for breakouts through the grid levels, and the second is to spot bounces from the grid levels.

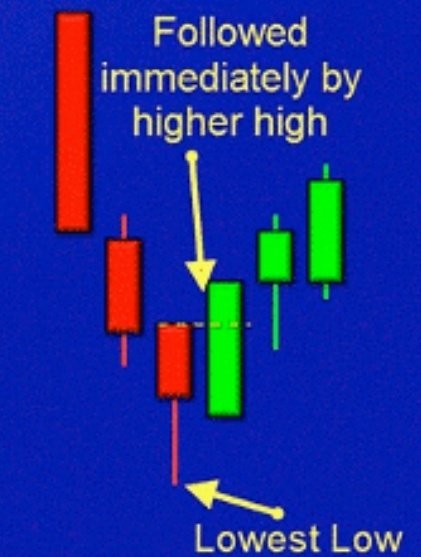

Gann Grid Breakouts :- The breakouts in the Gann Grid are traded the same way as with the Gann Fans. If a breakout appears in the Grid, then you should open a trade in the direction of the breakout.

Again, do not enter trades right after the first candle, which creates the breakout. Make sure you wait for the second confirmation candle, which extends beyond the breakout candle.

Gain Grid Bounces :- When a bounce appears from the Gann grid level on the chart, you can trade in the direction of the bounce. But as we just mentioned, make sure you confirm the bounce with an additional candle.

Gain Grid Stop Loss:-

The Gain Grid indicator should also be traded with a stop loss order. This way you will be safe from any surprises against your trade. Let us now see how we should place stop losses in two different Gann Grid trading scenarios:

The Gain Grid indicator should also be traded with a stop loss order. This way you will be safe from any surprises against your trade. Let us now see how we should place stop losses in two different Gann Grid trading scenarios:

S/L on Gann Grid Breakouts :- When the price breaks through a grid level and you open a trade, you should place a stop loss below/above a previous bottom/top on the chart.

S/L on Gann Grid Bounces :- When the price bounces from a Gann Grid level and you open a trade, you should place a stop loss below/above the bottom/top which is created at the time of the bounce.

Gann Grid Take Profit :-

But how long you should hold your Gann Grid trades?

T/P on Gann Grid Breakouts – When the price breaks from the Gann grid level and you open a trade, you must stay in the trade at least until the price reaches the next level on the grid.

But how long you should hold your Gann Grid trades?

T/P on Gann Grid Breakouts – When the price breaks from the Gann grid level and you open a trade, you must stay in the trade at least until the price reaches the next level on the grid.

T/P on Gann Grid Bounces :– When the price bounces from a grid level and you open a trade, you should stay in the trade at least until the price reaches the previous level on the grid.

Today we understood how to trade with gann grid strategy. I post such threads every day.

Follow me for regular stock market learning for free.

I am on the mission to make 1 lakh independent trader for free. Follow me to be part of this.

#Gann #StockMarket #trading

Follow me for regular stock market learning for free.

I am on the mission to make 1 lakh independent trader for free. Follow me to be part of this.

#Gann #StockMarket #trading

• • •

Missing some Tweet in this thread? You can try to

force a refresh