A lot of people have shown their support for the family of deceased and we all want @theicai to help their family.

ICAI is always ready to help their genuine members, ICAI representatives have reached out to their family for offering help. But..

Check whole thread below 👇

ICAI is always ready to help their genuine members, ICAI representatives have reached out to their family for offering help. But..

Check whole thread below 👇

ICAI has searched their Membership database and asked the family to provide with Membership Number, But they are able to trace the Membership Number of Late Mr. Rakshit Khandelwal

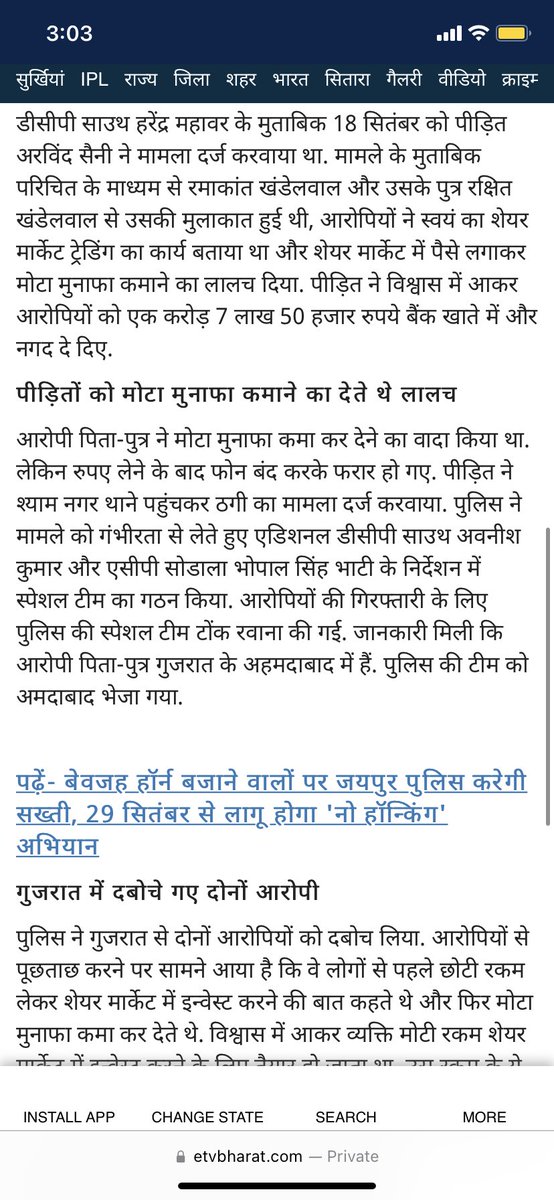

Also, just for the knowledge of everyone, a few other news reports of fraud is there (Link below👇)

Also, just for the knowledge of everyone, a few other news reports of fraud is there (Link below👇)

If anyone has his Membership Number or Student Reg No, that would help

Matter is being investigated by Police.

Let’s all wait for a few days for whole picture to be clear

Matter is being investigated by Police.

Let’s all wait for a few days for whole picture to be clear

• • •

Missing some Tweet in this thread? You can try to

force a refresh