TOUGH TIMES PLAYBOOK

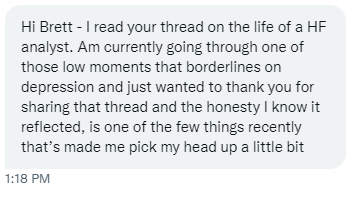

Getting a DM like this is better than my biggest short down 30.

This industry can take you to the highest of highs and the lowest of lows. When you're low, it feels like things will never improve. But they always do.

Getting a DM like this is better than my biggest short down 30.

This industry can take you to the highest of highs and the lowest of lows. When you're low, it feels like things will never improve. But they always do.

For those of you going through a tough time ('22 has been brutal), I wanted to share a framework that I give to my ASU students right before graduation called the Tough Times Playbook. More than fame & fortune on Wall Street, my hope is that my students live meaningful lives

filled with challenge, triumph & growth. Life is tragic by design, and I give this lecture to help equip them in a small way for the inevitable disasters, big and small, that will befall them. If you are struggling, I hope something here can help you.

So here we go.

So here we go.

1) IMPROVE THE BASICS. When going through a tough time, it's easy to spiral. When the stress started to eat me alive around year 5, I self-medicated with pizza and McCallan (the half-gallon bottles). That obviously impacted my sleep, and just put me into a really bad spiral.

My body literally started breaking down on me, and at 28 I had the health of a 60 year old. I received a less than optimal blood panel, and a coach I was working told me that I was going to die young if I didn't change my approach. That scared me shitless, and I made some radical

changes to my diet, started exercising religiously, learned to meditate, picked up yoga, aimed for 8 hours of sleep, and cut my alcohol consumption by 75%. Not only did my health improve dramatically (I lost almost 50 pounds) but my mood and resilience improved dramatically.

So when going through a tough time, exercise, eat right, sleep and find any practice that can quiet your monkey mind (for me meditation & yoga fit the bill perfectly).

2) TIGHTEN THE BELT. This shit isn't life or death. It's just a job. You are just a small, inconsequential cog

2) TIGHTEN THE BELT. This shit isn't life or death. It's just a job. You are just a small, inconsequential cog

in a global system of capital formation. So have some perspective. But if you lose your job and can't pay your rent, that's a problem. In this industry, I encourage you to proactively live below your means and keep a conservative balance sheet, so that if a tough period does come

and, God forbid, you lose your job, you aren't overextended. I'm a fan of personal investments into cash flowing real estate that can provide a steady baseline of financial stability irrespective of the public markets outcomes. For me, a conservative balance sheet

and some consistent cash flow has added a level of equanimity to my investing, which is critical in market dislocations.

3) REMEMBER WHO YOU ARE. It's very easy to get down on yourself, particularly during extended periods of underperformance. You can't be a successful stock

3) REMEMBER WHO YOU ARE. It's very easy to get down on yourself, particularly during extended periods of underperformance. You can't be a successful stock

picker without self-belief, so any loss of confidence can be fatal. When you're down, you have to get your mojo back. One exercise I went through with a coach is called a "greatest hits". Write down the greatest triumphs in your career, read them consistently, and work to feel

the feelings you felt during those successes. For me, I went to see the guru of self-belief, Tony Robbins. I attended the Robin Hood Foundation Investors Conference in Fall of 2016 basically at my lowest (7 of 9 losing months, $100m hole). It was a conversation with

Paul Tudor Jones, and PTJ talked about how Tony helped him get his mojo back. Good enough for PTJ, I thought, good enough for me. After the fireside I went up and introduced myself to Tony, and then went to his Unleash the Power Within event in March of 2017, which helped me get

my mojo back. So whatever you need to do, rebuild your confidence, be a fucking lion, and remember who you are.

4) IMAGINE IT'S A BLESSING. Now I'll get a bit woo-woo on you. But what if the thing you are going through is actually a blessing? For me, it's a powerful re-frame,

4) IMAGINE IT'S A BLESSING. Now I'll get a bit woo-woo on you. But what if the thing you are going through is actually a blessing? For me, it's a powerful re-frame,

and can take me out of victim mode (and short circuit any spirals). I was an epic, semi-public failure at my first PM job, but looking back on my life my failure was actually an incredible blessing in so many ways. Maybe that disaster you are going through right now is actually

a necessary catalyst to move you to another path, a more fulfilling path. Or maybe as a PM, this drawdown motivates you to improve processes & skills that will slingshot you to even greater success in the future.

Imagine it's a blessing.

5) TELL ME WHAT YOU WANT. This was

Imagine it's a blessing.

5) TELL ME WHAT YOU WANT. This was

another helpful exercise I went through with a coach. Take a few hours on a weekend and just write a few pages about lay out EXACTLY what you want in your life. Not what you don't want, i.e. this drawdown sucks and I don't like it. But the specific things you want, the feelings

want to feel, etc. I did this in 2016 at a low point, and it was uncanny how so many of the things came true.

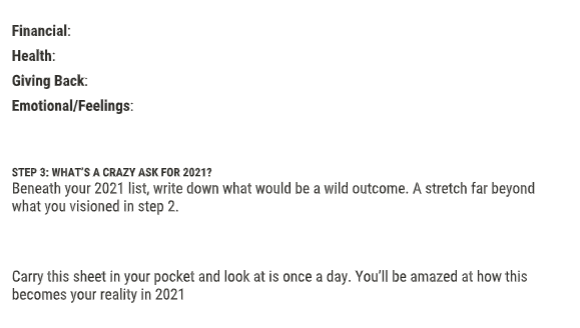

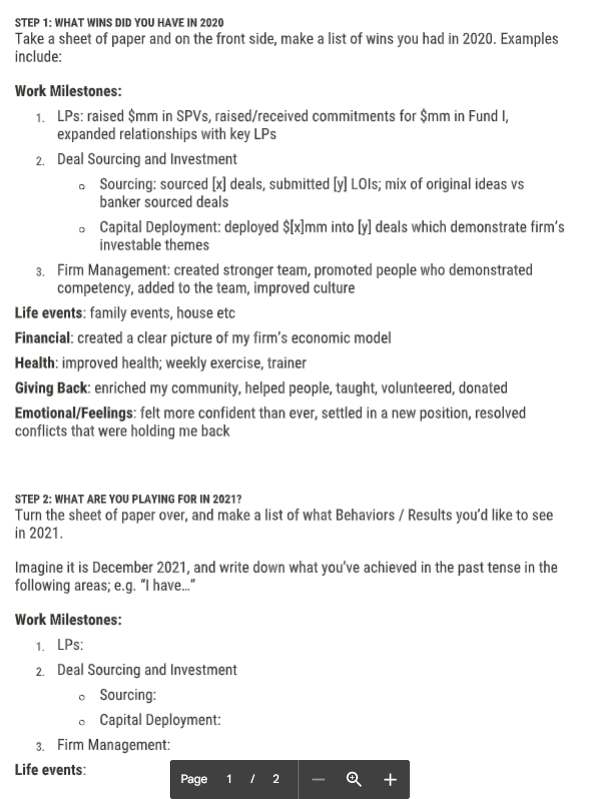

Now, I do an in-depth exercise at the end of the year mapping out SPECIFICALLY what I want for the next year. Fuck it, I'll give you the prompts here. Do it. It works!

Now, I do an in-depth exercise at the end of the year mapping out SPECIFICALLY what I want for the next year. Fuck it, I'll give you the prompts here. Do it. It works!

6) ASK FOR HELP. Seriously, if you are struggling, ask for help. It's 2022. Mental health isn't stigmatized anymore. I've had more therapists, shamans, executive coaches, reiki masters, intuitives & hypnotists work on my shit than I can count. And you know what? It helped.

It's a journey, but I'm happier and more at peace than I've ever been in my life.

Especially during a tough period, don't go it alone. I genuinely mean it - if you are struggling and don't have anyone else you can talk to, DM me. I'm here for you.

Especially during a tough period, don't go it alone. I genuinely mean it - if you are struggling and don't have anyone else you can talk to, DM me. I'm here for you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh