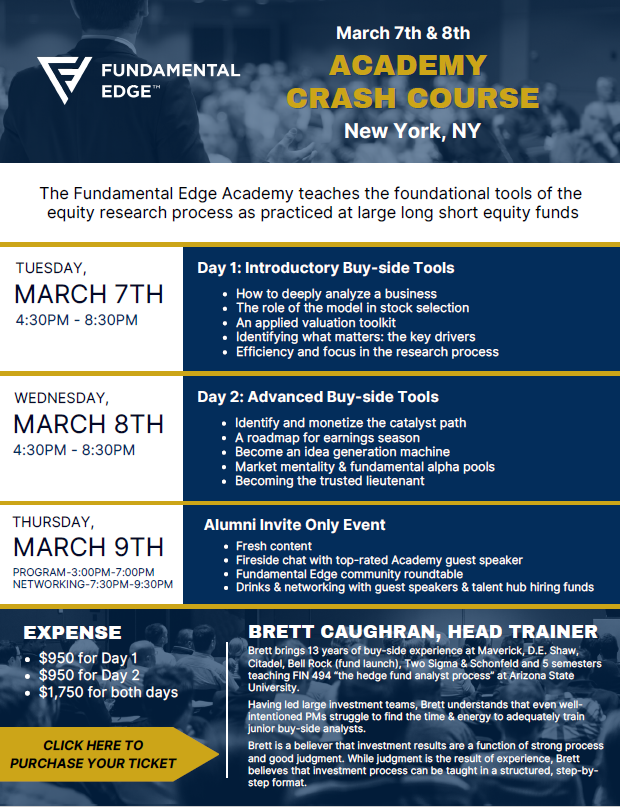

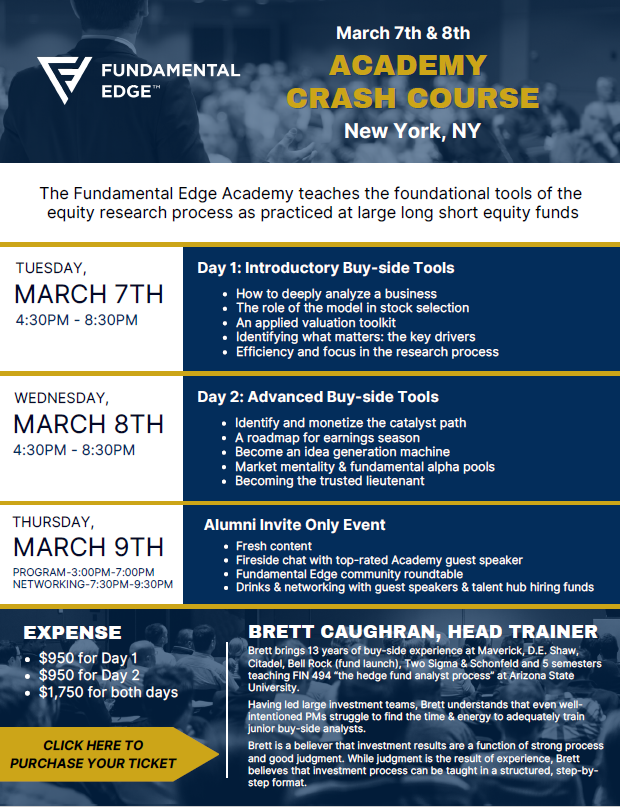

Completed my hedge fund tour of duty (Maverick, D.E. Shaw, Citadel, Schonfeld). Adjunct at ASU.

Now building an exceptional analyst training firm.

DMs open!

90 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/FundamentEdge/status/1631306165853507586

I hosted an information session on Live Academy today - for the replay please e-mail info@fundamentedge.com

I hosted an information session on Live Academy today - for the replay please e-mail info@fundamentedge.com

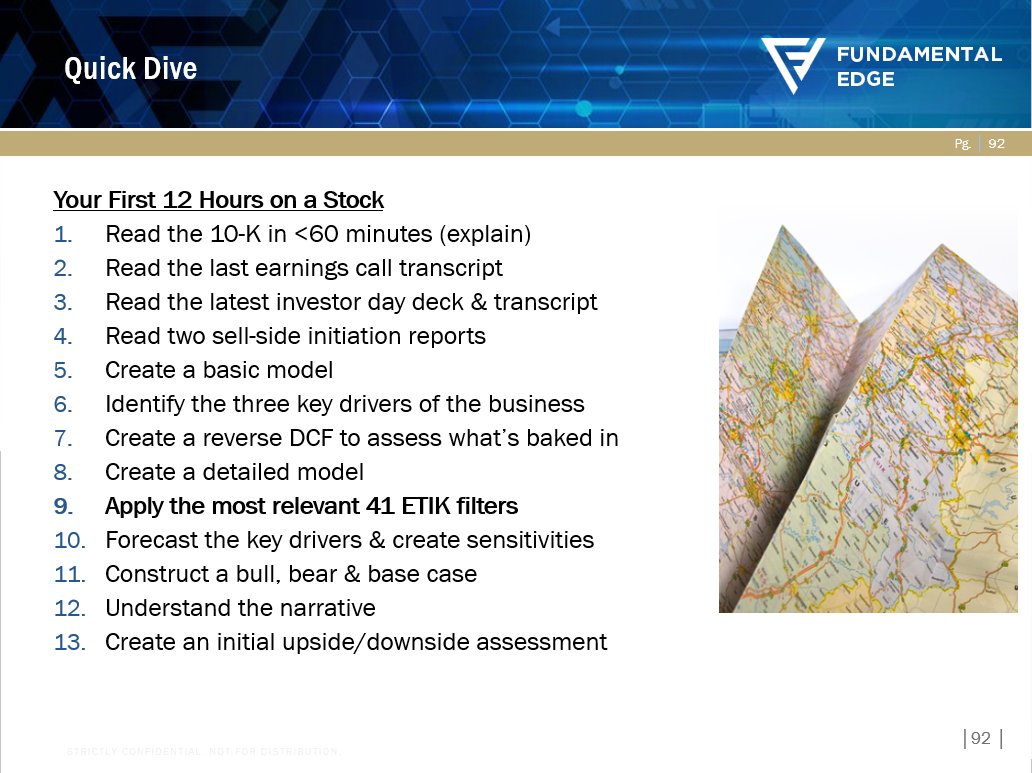

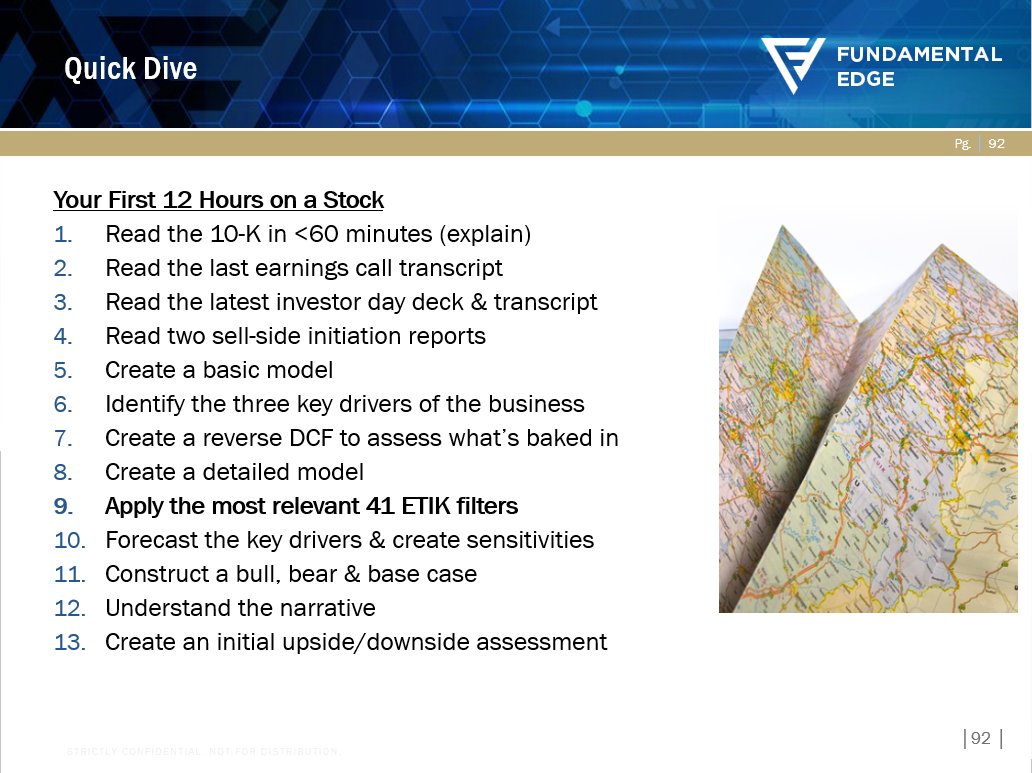

https://twitter.com/FundamentEdge/status/16277898326752747541) ROAD-MAP FOR YOUR FIRST 12 HOURS ON A STOCK

https://twitter.com/FundamentEdge/status/1628383847149867009We will walk through:

Having hired ~15 analysts onto my team over the years, I know first hand of the pain points in the hiring process.

Having hired ~15 analysts onto my team over the years, I know first hand of the pain points in the hiring process.

Our goal at Fundamental Edge is to become the "Training the Street" for the fundamental equity buy-side.

Our goal at Fundamental Edge is to become the "Training the Street" for the fundamental equity buy-side.