Today, remember this 2021 @usedgov legal memo on why the president does not have the authority to execute broad based student loan forgiveness. I have yet to see the Biden admin explain why this @usedgov Office of the General Council memo was wrong. static.politico.com/d6/ce/3edf6a39…

"Title IV’s plain text and statutory scheme, and controlling interpretative canons, compel us to conclude Congress appropriated funds for student loans with the expectation that such loans would be repaid except in very specific circumstances."

"...we believe 20 U.S.C. § 1082(a)(6) is best construed as a limited authorization for the Secretary to provide cancellation, compromise, discharge, or forgiveness only on a case-by-case basis and then only under those circumstances specified by Congress."

"Given HEA’s many specific provisions for cancellation, compromise, discharge, or forgiveness... we believe any Executive Branch action on a blanket or mass basis...wrongfully transforms carefully cabined HEA settlement authority into a general administrative dispensing power."

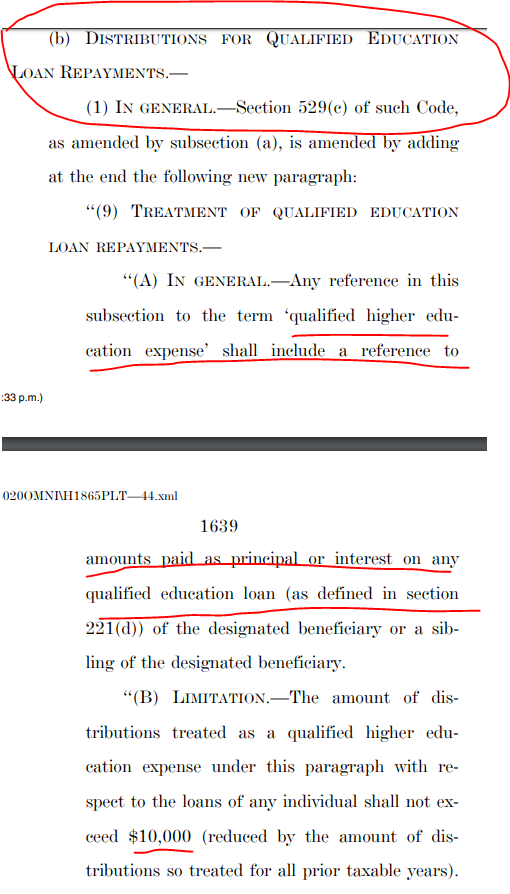

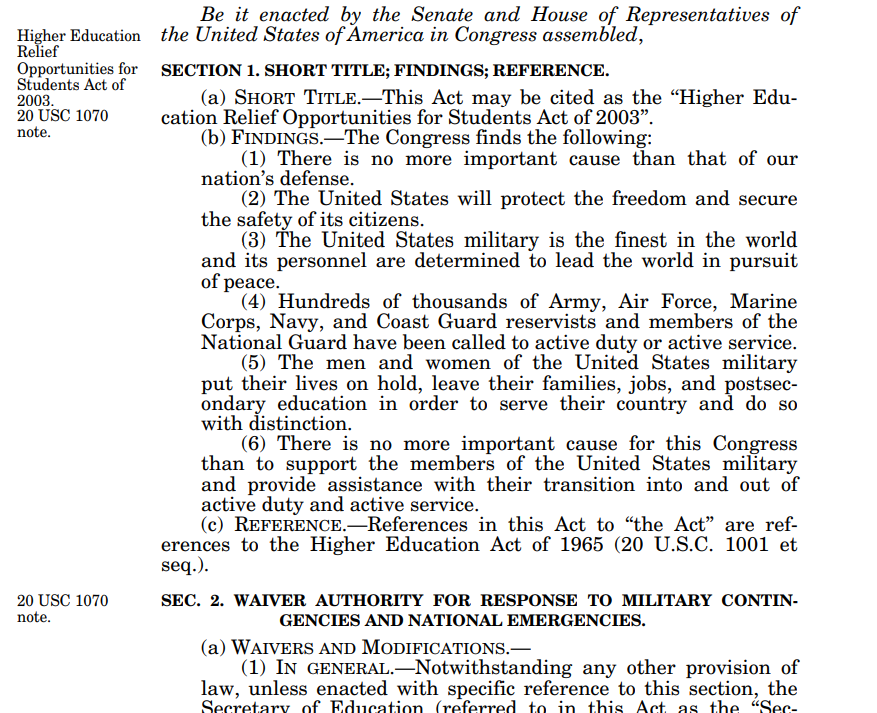

The Biden admin has just released their own memo on this. References the HEROES Act, which Congress passed in response to 9-11 mainly to allow active duty military to have their loan payments waived.

https://twitter.com/mstratford/status/1562477193061892098

• • •

Missing some Tweet in this thread? You can try to

force a refresh