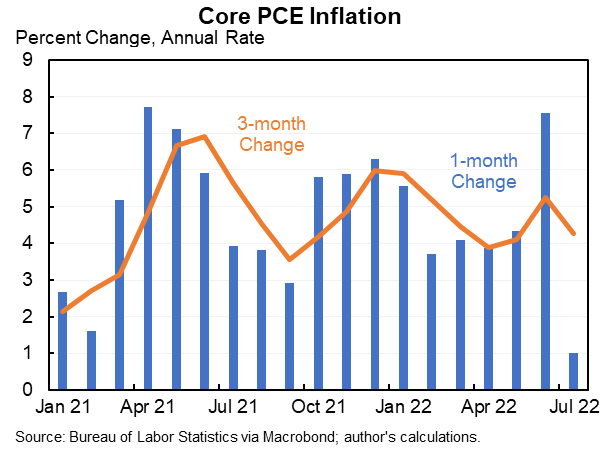

Pouring roughly half trillion dollars of gasoline on the inflationary fire that is already burning is reckless. Doing it while going well beyond one campaign promise ($10K of student loan relief) and breaking another (all proposals paid for) is even worse.

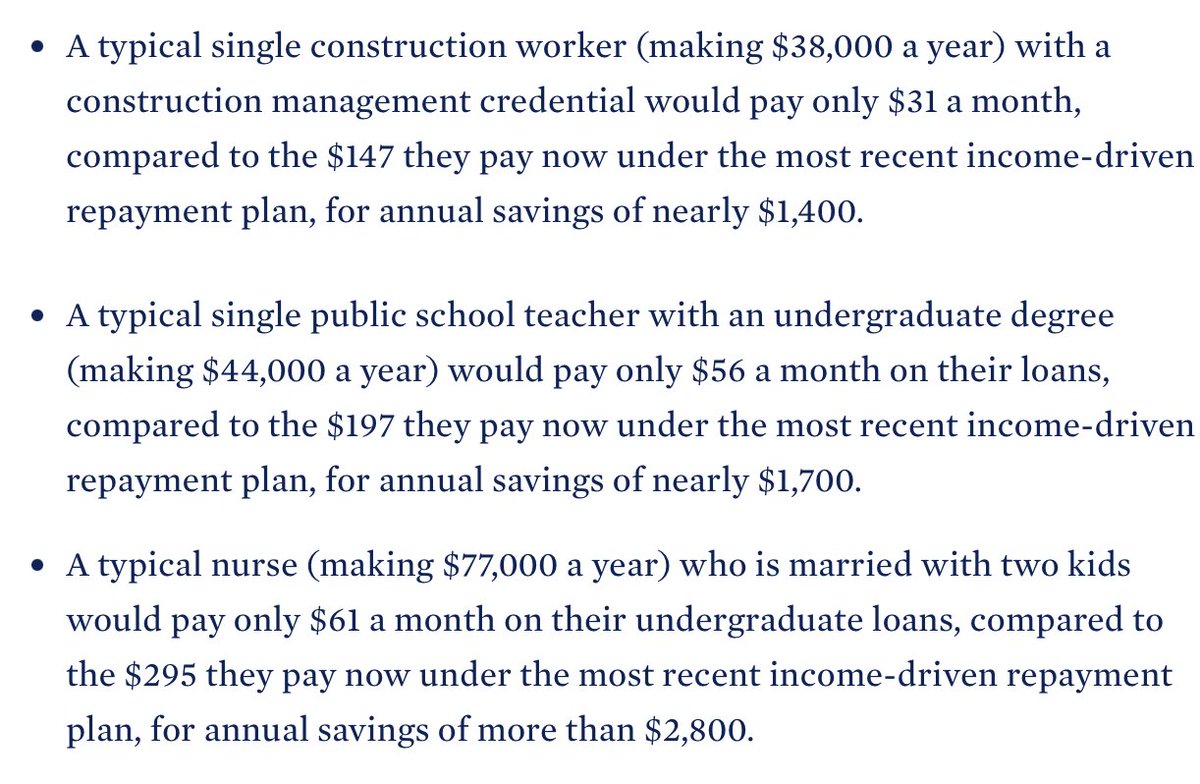

The White House fact sheet has sympathetic examples about a construction worker making $38K and a married nurse making $77,000 a year.

But then why design a policy that would provide up to $40,000 to a married couple making $249,000? Why include law and business school students?

But then why design a policy that would provide up to $40,000 to a married couple making $249,000? Why include law and business school students?

BTW, those examples also contradict the baseline some have concocted to claim that this won't raise inflation. The claim it won't raise inflation is based on the construction worker going from permanently paying $0 interest to paying $31 a month at an annual cost of $372.

You can't use one baseline (interest payments suspended) to argue this will constrain demand & then a different baseline (interest payments restored) to describe the benefits. That is incoherent, inconsistent & indefensible cherry picking--I hope the White House doesn't do it.

Also need to be careful with all of the distributional numbers because the beneficiaries will tend to have higher lifetime incomes than current incomes. A 24 year-old making $75,000 is likely to be at a relatively high percentile on a lifetime basis.

There are a number of other highly problematic impacts including encouraging higher tuition in the future, encouraging more borrowing, creating expectations of future debt forgiveness, and more.

Most importantly, everyone else will pay for this either in the form of higher inflation or in higher taxes or lower benefits in the future. I did a thread on this last night but given the new announcement you need to double everything in it.

https://twitter.com/jasonfurman/status/1562270944412016640?s=20&t=ZwhUp73b82umHa8B7lpqDQ

The stimulus is relatively small (a multiplier of ~0.1). So the inflation impact is likely to be about 0.2-0.3pp. That is $150-200 in higher costs for a typical household.

If the stimulus matched what advocates used to argue the inflation would be higher.

If the stimulus matched what advocates used to argue the inflation would be higher.

https://twitter.com/SenWarren/status/1326903357135605762?s=20&t=ZwhUp73b82umHa8B7lpqDQ

That is a relatively small inflation number. But would take about 50-75bp on the fed funds rate to extinguish that much inflation. Is the Fed going to try to offset this? Or will it do what it did with the American Rescue Plan and ignore that rapidly changing fiscal landscape?

Finally, it's not obvious to me that this is reasonable for a President to do unilaterally. A number of lawyers (and political leaders) have argued inconsistent with the law. Even if technically legal I don't like this amount of unilateral Presidential power.

P.S. I like the reforms to income-driven repayment. But I would much rather have seen them passed by Congress as part of a law that fully paid for them rather than done unilaterally and unpaid for in the context of an already extremely expensive package.

P.P.S. I hope that these tweets are my last word on this topic.

• • •

Missing some Tweet in this thread? You can try to

force a refresh