Thank god we're finally addressing the plight of America's most disadvantaged community, Harvard Law graduates

https://twitter.com/tribelaw/status/1562465791014215681

Lawrence Tribe is University Professor Emeritus and former Carl M. Loeb University Professor at Harvard Fucking Law School. He's the one saying "thousands of my former students" are making less than $100k, not me

https://twitter.com/Excellentspeelr/status/1562572676065296384

I mean, it's kind of surprising to learn there's that many Harvard Law alumni living paycheck to paycheck in a doublewide, working double shifts at Waffle House to pay their crushing student loan payments, but I guess Professor Tribe is the expert here

Fact of the matter is, grads of elite colleges like Harvard aren't the beneficiaries of loan forgiveness. Harvard has a negligible (1.1%) fed student loan default rate. And I do have sympathy for people who took out a loan, at 18-22, for the magic beans of a college diploma.

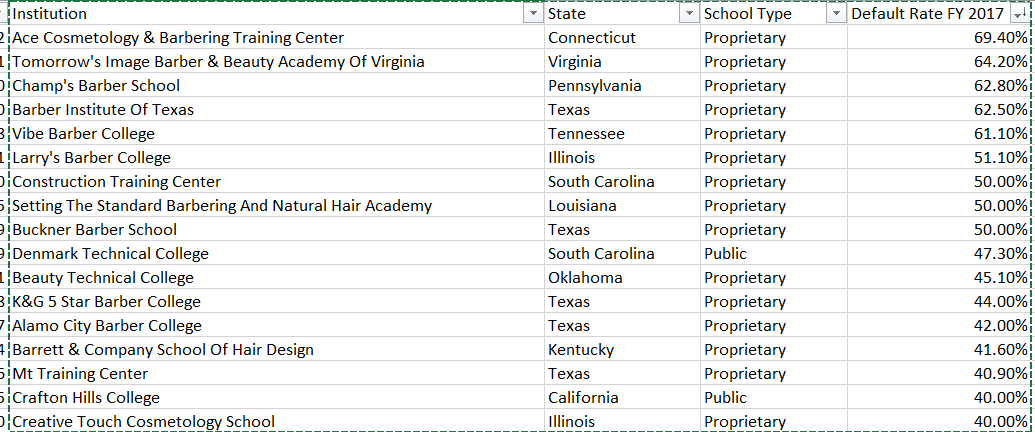

Like I said yesterday, the rogue's gallery of "colleges" with insane fed loan default rates are proprietary for-profit places, particularly barber & cosmetology schools, some approaching 70%. They prey on naive young people and should be blackballed from more fed student loans.

Here's bottom of the barrel, a list of "colleges" with fed student loan default rates of 40% and higher. They are less colleges than they are long cons to use naive 18 year olds to scam federal money.

The next group of colleges that have high loan default rates tend to be public community and vo-tech schools, many in economically depressed areas. Again, I have sympathy for those saddle with student loans for these schools.

IMO such places should have free tuition, but as a practical matter they *are* very inexpensive. Their high default rates stem from a number of underlying issues. First, many of their students need remediation and aren't well prepared for college, and end up dropping out.

A second issue is that while the school may have low cost, the fed student loan program doesn't quite track with student expenses. Possible to get a $10k student loan to attend a $5k/year community college.

It's not atypical for 18-year old community college students to rack up five figure debt, drop out in the first year, and have that debt hanging over their head without the benefit of even an AA diploma. A reasonable solution is to provide free tuition for CCs w/ oversight.

When we get to 4-year institutions the picture is sort of a two-by-two matrix. Ivys (which everybody on pundit Twitter seems to think are the only colleges in existence) have minimal default rates, as do highly selective public universities.

The default rates tend to climb as you get into 2nd and 3rd tier colleges. For instance UCLA, UC Berkeley, Stanford all have default rates <2%; Fresno State 4.7%; CSU-Bakersfield 5.3%.

The other dimension to the student loan default rate matrix is the *field of study*. I can't find default rates by specific majors within specific colleges, but it's reasonable to assume arts & humanities majors account for a disproportionate % regardless of the college.

As much as I'm for people following their artistic bliss, it's not unreasonable to question why we should extend student loans on a no-questions-about-major basis.

*Not to say there aren't art schools that do pretty well, student loan default-wise; Art Center College Of Design

in Pasadena for example has only a 1.1% default rate, which is as low as Harvard.

in Pasadena for example has only a 1.1% default rate, which is as low as Harvard.

Anyway I'm late for dinner, I have a few other thoughts on this I will get to tomorrow

To continue: yes, student loan relief helps out poor people who were lured at young age into taking student loan debt to attend a shitty for-profit college, on the premise it was a ticket to a lucrative career in makeup and hair styling. In a way, that's good.

But it's not really good unless the fed loan program also produces a shit list of colleges like this with unacceptable loan default rates that are blackballed from further program participation. I'm sorry if this mean financial problems for venerable Larry's Barber College.

As I said the other day, the entire raison d'etre for these places is insane state occupational licensing requirements, like Texas's 1500 minimum hours to be a barber. And... surprise! The biggest lobbyists for these requirements are the barber colleges themselves.

Student debt relief also helps those who drop out of college due to lack of preparation, leaving them with no degree, a lost year of wages, and plenty of debt. Again good. But the follow up should be the college refunding the student's subsidized tuition to the loan program.

The lender (our) attitude should be: we subsidized this student's education at your school, on the premise they were prepared and the experience would benefit them enough that they would be able to pay it back. Clearly that didn't happen, so fork over the refund.

But the relief also benefits recent graduates of selective colleges of dubious need -- 2018 theater graduates of NYU for instance. Many selective colleges, like Harvard, have negligible default rates and experience suggests their grads would've paid loans without relief.

Even at expensive, highly selective colleges, there are study programs within it with unacceptable default rates. If there is an obvious glut of artists and actors unable to repay student loans, it's fair to ask why we should be further subsidizing more of them.

The student loan relief makes no such distinctions. Do you make less than $125k? Here's $10k off your principle. Did you have Pell Grants? Double it.

Worse, it doesn't make even the slightest nod toward reforms that would address the root of the repayment problem.

Worse, it doesn't make even the slightest nod toward reforms that would address the root of the repayment problem.

Worse yet, it pretty much incentivizes current and future student debt holder to default at even hire rates. Why pay back your loan, when eventually there'll be another relief package coming in a couple years?

Above all, while we're all arguing on who should pay for student debt, we need to address the real root of the problem: why does a college education cost so fucking much? Nothing - and I mean nothing - has inflated like the cost of college. Not heath care, not gasoline, nothing.

The answer, in large part, is the student loan program itself. Offering $10k in tuition assistance at a $20k college just encourages the college to hike tuition to $25k. And use the proceeds to add layer upon layer of administrative bloat and overhead.

At many (if not most) top universities in the US, administrative staff outnumbers teaching staff, with vast fiefdoms of admin departments with no apparent function other than useless busywork.

After the dust clears on all this, in my mind the simplest and most effective way to reform the student loan system is to require colleges to co-sign the loan contract. The students have skin in the game, taxpayers have skin in the game, now it's time for colleges to ante.

just my 2c. End of rant.

well I guess *not* the end of my rant. Don't cite me as supporting a "fuck the poors, I paid back my loans they can too" position. I am a middle class farm kid from rural Iowa, first 4-year college grad in my family who greatly benefitted from my time at Ottumwa Body & Fender.

I have genuine sympathy for low income kids with unpayable student debt, and want them to experience the boost I did. I have far far more in common with them than I do Harvardians. And I know the cheap tuition I paid is dwarfed by what it would cost today.

You can gripe that states aren't picking up enough of the tab, but that's an expensive band aid when university spending budgets are growing at unsustainable rates.

Case in point, U of Iowa. FY2000 expenditures ~$1 billion, FY2022 $2.7 billion.

Case in point, U of Iowa. FY2000 expenditures ~$1 billion, FY2022 $2.7 billion.

That's a 170% spending increase over 22 years with cumulative inflation of 72%, and when student enrollment only increased from 28,500 to 31,500.

It's not anti-poor kids to ask exactly why university spending, in real per student terms, has nearly doubled in 22 years.

It's not anti-poor kids to ask exactly why university spending, in real per student terms, has nearly doubled in 22 years.

Exerting some cost containment at universities - eliminating useless admin departments and poor performing degree programs - would in fact BENEFIT disadvantaged students through lower tuition. And that kind of fiscal discipline should be rewarded in state appropriations.

Instead, universities are treated as the Great and Beneficent God Mammon, from whom all favor comes, and to whom all tribute must be paid without question. And we sit around and bitch about who's gonna pay for Mammon's tribute without examining the invoice.

The issue here is not so much predatory lending as it is predatory educating.

*quick correction: I stated earlier in this thread that inflation adjusted per student spending at U of Iowa had "nearly doubled" 2000-2022, which is incorrect. Actual number is a 42% increase. Still a major increase but not 100%.

Apologies for that math error, I'm just a drunk who IDs cars and makes fart jokes on Twitter. In my own defense I at least have an interest in the underlying nature of the problem, unlike political pundits who'd rather regurgitate simplistic class resentment hysterics.

• • •

Missing some Tweet in this thread? You can try to

force a refresh