#education

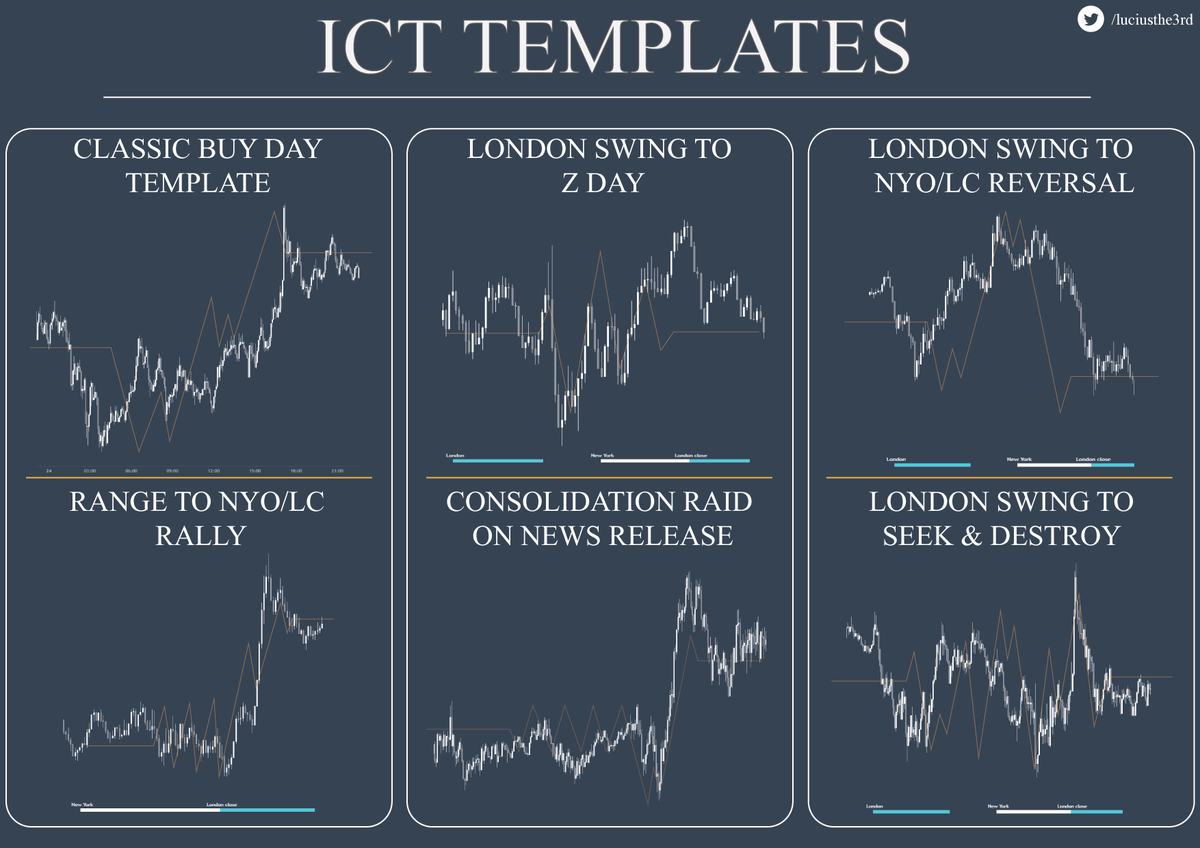

ICT TEMPLATES

Training your eye to recognise patterns which occur frequently (London>NYO reversal) or establishing your daily bias (buy/sell day) may turn a losing day into a winning day.

It's not guaranteed these templates will play out, it depends on the context.

ICT TEMPLATES

Training your eye to recognise patterns which occur frequently (London>NYO reversal) or establishing your daily bias (buy/sell day) may turn a losing day into a winning day.

It's not guaranteed these templates will play out, it depends on the context.

• Buy day/sell day

There are things you can do to get a better 𝘰𝘱𝘪𝘯𝘪𝘰𝘯 on daily bias for today or the next day but be aware it's never guaranteed. In a bullish market the PDH should be the target and PDL should be supported, (vice versa for sell days).

There are things you can do to get a better 𝘰𝘱𝘪𝘯𝘪𝘰𝘯 on daily bias for today or the next day but be aware it's never guaranteed. In a bullish market the PDH should be the target and PDL should be supported, (vice versa for sell days).

Daily bias isn't essential to some traders as everyone has their own style but if you're struggling with trades (selling on green days/buying on red days), unless you're very skilled you should work on identifying key levels and establishing daily bias.

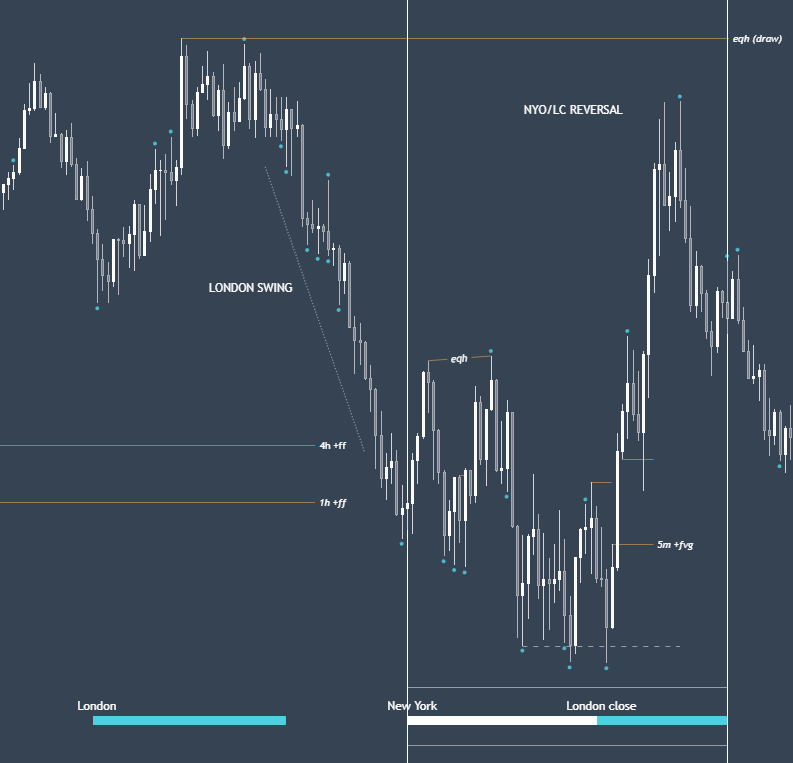

• London swing NYO/LC reversal

Pattern recognition is very important for spotting moves like this, although it occurs frequently you should not abandon your system & rules just because you see a pattern.

Pattern recognition is very important for spotting moves like this, although it occurs frequently you should not abandon your system & rules just because you see a pattern.

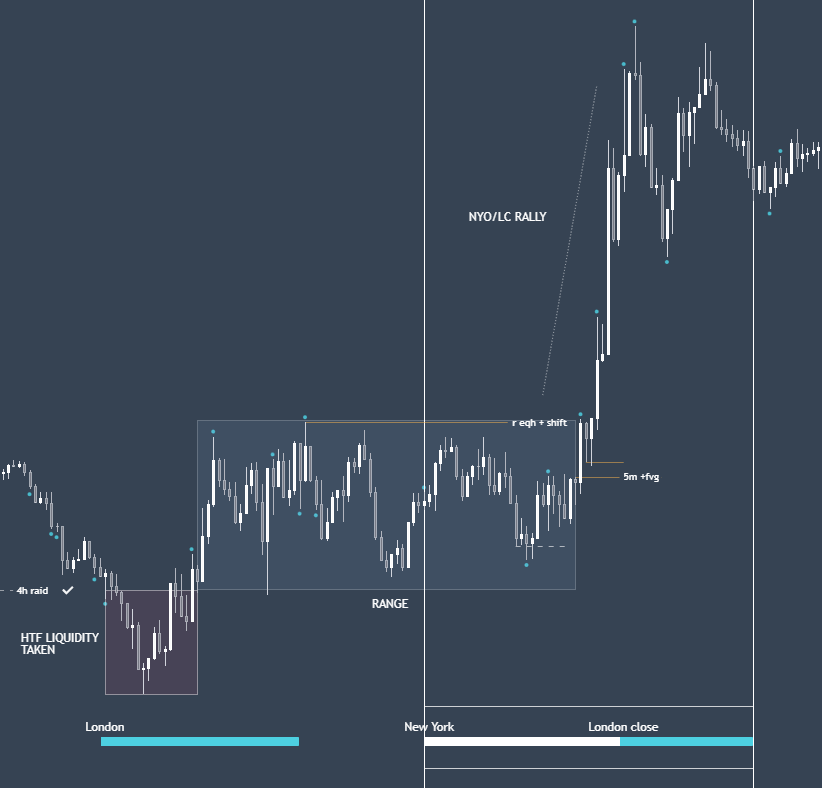

• Range to NYO/LC rally

As mentioned these patterns are most effective when they align with your system - not on their own.

Like any other trade there should be:

☐ Clear draw on liquidity (target)

☐ Liquidity taken (BSL/SSL and/or HTF raid of old high/low)

☐ Valid LTF entry

As mentioned these patterns are most effective when they align with your system - not on their own.

Like any other trade there should be:

☐ Clear draw on liquidity (target)

☐ Liquidity taken (BSL/SSL and/or HTF raid of old high/low)

☐ Valid LTF entry

The other patterns look different but they follow the same idea in that they're effective when used with a system (London S&D, Swing to Z, News release)

Personally I don't attempt trades on high impact news days, some traders enjoy the volatility but often it doesn't go to plan.

Personally I don't attempt trades on high impact news days, some traders enjoy the volatility but often it doesn't go to plan.

• • •

Missing some Tweet in this thread? You can try to

force a refresh