Aug 31, #ArbitrumNitro will be released, 1 year after the #ArbitrumOne mainnet

So have you ever wondered abt Arbi Nova, Odyssey,.?

In this 🧵, I'll give you the most basic information about @arbitrum that you must know & what we need to prepare for the upcoming $ARBI airdrop🧑🚀

So have you ever wondered abt Arbi Nova, Odyssey,.?

In this 🧵, I'll give you the most basic information about @arbitrum that you must know & what we need to prepare for the upcoming $ARBI airdrop🧑🚀

1/In this thread I will cover you guys:

>What is @arbitrum and their scaling solutions?

>What are the differences between Arbitrum One, Nitro and Nova?

>What is #ArbitrumOdyssey & how to prepare?

>Future forecast for $ARBI token value?

>Gud reads for @arbitrum

Let's go, frens

>What is @arbitrum and their scaling solutions?

>What are the differences between Arbitrum One, Nitro and Nova?

>What is #ArbitrumOdyssey & how to prepare?

>Future forecast for $ARBI token value?

>Gud reads for @arbitrum

Let's go, frens

2/>What is @arbitrum and their scaling solutions?

@arbitrum is a product under @OffchainLabs

It is a @ethereum L2 scaling solutions to reduce the costs and latency of decentralized applications

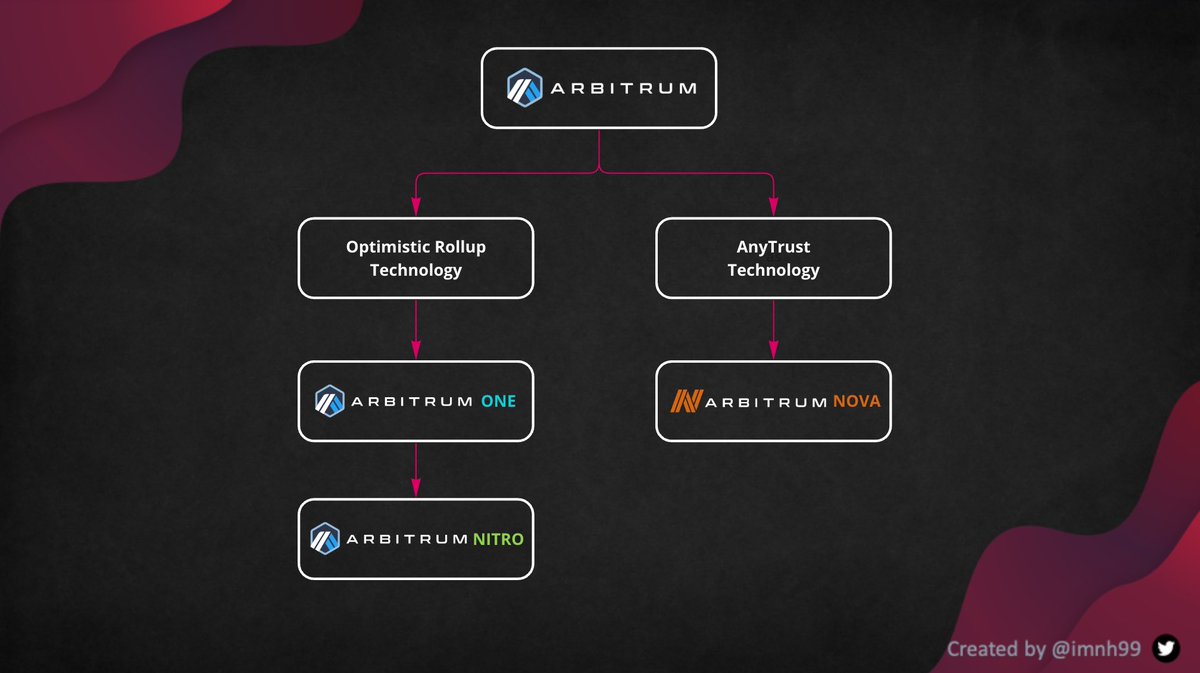

Currently, @arbitrum has 2 main technologies: Arbitrum Rollup and AnyTrust chains

@arbitrum is a product under @OffchainLabs

It is a @ethereum L2 scaling solutions to reduce the costs and latency of decentralized applications

Currently, @arbitrum has 2 main technologies: Arbitrum Rollup and AnyTrust chains

3/

Arbitrum Rollup uses #OptimisticRollup technology. Currently, the products of this branch include #ArbitrumOne & the upcoming #ArbitrumNitro upgrade

AnyTrust technology is distinct from Rollup solutions. The first AnyTrust chain-#ArbitrumNova, is currently live on mainnet

Arbitrum Rollup uses #OptimisticRollup technology. Currently, the products of this branch include #ArbitrumOne & the upcoming #ArbitrumNitro upgrade

AnyTrust technology is distinct from Rollup solutions. The first AnyTrust chain-#ArbitrumNova, is currently live on mainnet

4/

Ok, now we have a look at some of @arbitrum's products

Let's dig a little deeper into how each solution works. I will write as briefly and simply as possible for the technical understanding differences between Rollups (One/Nitro) vs AnyTrust (Nova)! (Odyssey's coming later)

Ok, now we have a look at some of @arbitrum's products

Let's dig a little deeper into how each solution works. I will write as briefly and simply as possible for the technical understanding differences between Rollups (One/Nitro) vs AnyTrust (Nova)! (Odyssey's coming later)

5/>Differences of ArbiOne, Nitro & Nova?

Arbi One

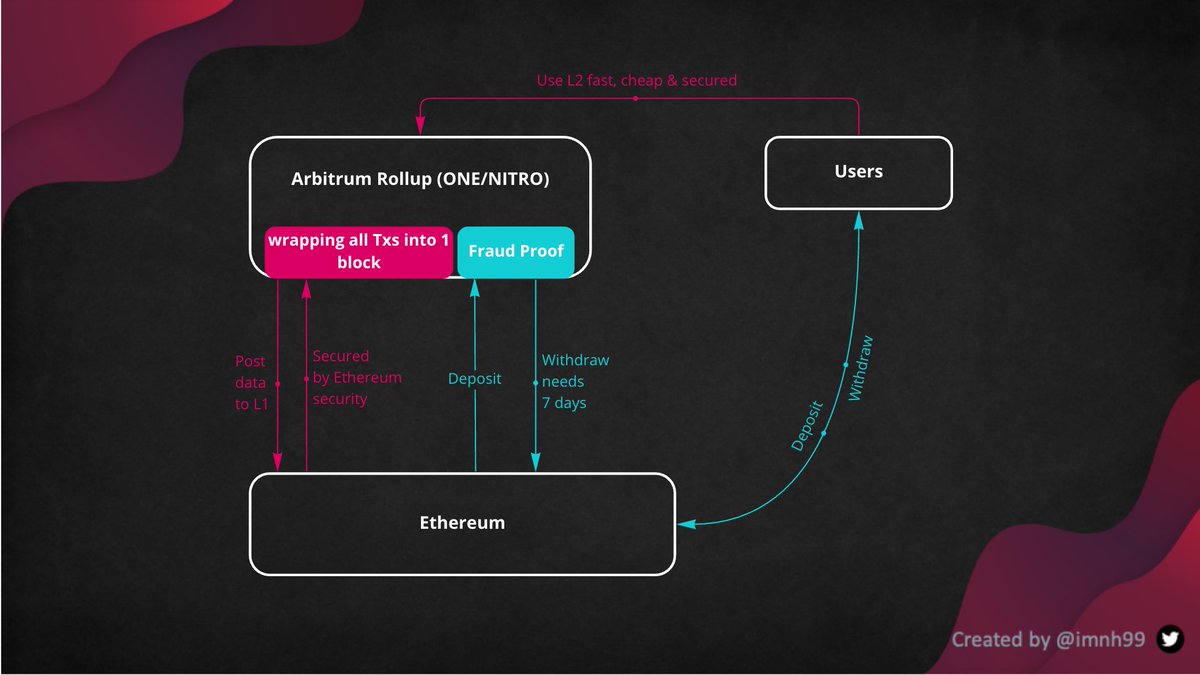

Rollup techs are basically wrapping all Txns into 1 block & sending them back to L1 as calldata

This allows Arbi One to be fast, cheap & secured by native L1 due to the chain's data is available to any party to correct execution

Arbi One

Rollup techs are basically wrapping all Txns into 1 block & sending them back to L1 as calldata

This allows Arbi One to be fast, cheap & secured by native L1 due to the chain's data is available to any party to correct execution

6/

Arbi Nitro

This is an upgraded version of ArbiOne with the following strengths

>Advanced Calldata Compression: reduce amount of data to L1➡️reduce tx costs

>Additional L1 Interoperability: using new standard languages & tools (Geth), replacing the old AVM design➡️ faster TPS

Arbi Nitro

This is an upgraded version of ArbiOne with the following strengths

>Advanced Calldata Compression: reduce amount of data to L1➡️reduce tx costs

>Additional L1 Interoperability: using new standard languages & tools (Geth), replacing the old AVM design➡️ faster TPS

7/ In short, #ArbitrumNitro is faster and incredibly flexible, estimating a 20–50x increase in L2 speed

Yet, the Rollup factor of One & Nitro: all data will be stored at L1 & takes 7 days to withdraw assets from L2 to L1 in exchange for being secured by native Ethereum security

Yet, the Rollup factor of One & Nitro: all data will be stored at L1 & takes 7 days to withdraw assets from L2 to L1 in exchange for being secured by native Ethereum security

8/AnyTrust

Rollup's approach➡️post data to L1 for security➡️slow withdraw

AnyTrust's approach➡️has a group to validate transactions, whereas AnyTrust chains introduce their own security assumption➡️No post data to L1➡️able to withdraw immediately & charge users much lower fees

Rollup's approach➡️post data to L1 for security➡️slow withdraw

AnyTrust's approach➡️has a group to validate transactions, whereas AnyTrust chains introduce their own security assumption➡️No post data to L1➡️able to withdraw immediately & charge users much lower fees

9/ AnyTrust chain usually has 20 committee members active and storing data. It sounds like a sidechain (@0xPolygon,@xdaichain) But it's not, it's much better!

Other sidechains require more than ⅔ honest members to work which are 14/20

But for AnyTrust only 2/20 are needed~

Other sidechains require more than ⅔ honest members to work which are 14/20

But for AnyTrust only 2/20 are needed~

10/

Why only 2, then won't it be a security problem if it conts to work, ser?

Not really, thus they already have a "Fallback to Rollup" mechanism

if most committee members crash, then the chain can still operate by at least 2 members & falling back to a standard Rollup tech

Why only 2, then won't it be a security problem if it conts to work, ser?

Not really, thus they already have a "Fallback to Rollup" mechanism

if most committee members crash, then the chain can still operate by at least 2 members & falling back to a standard Rollup tech

11/

In a simple way, AnyTrust chain will behave differently depending on whether members are honest &participate

>Turbo Mode: 19/20 Honest➡️data stays off-chain➡️fast & low cost

>Rollup Mode: 2/20 Honest➡️the chain works with Rollup characteristic

>Failure Mode: 19/20 Evil➡️RIP

In a simple way, AnyTrust chain will behave differently depending on whether members are honest &participate

>Turbo Mode: 19/20 Honest➡️data stays off-chain➡️fast & low cost

>Rollup Mode: 2/20 Honest➡️the chain works with Rollup characteristic

>Failure Mode: 19/20 Evil➡️RIP

12/ Arbi Nova

Arbitrum Nova is the first chain built using the AnyTrust technology

Nova was created to be a solution of choice for gaming and social applications (@Reddit points) with cost-sensitive, high Txn volume that frequently mint new items

Arbitrum Nova is the first chain built using the AnyTrust technology

Nova was created to be a solution of choice for gaming and social applications (@Reddit points) with cost-sensitive, high Txn volume that frequently mint new items

https://twitter.com/arbitrum/status/1557025237769805825?s=20&t=vd95U59qE5H_xb6x8iYzlA

13/

Nova is said to reduce gas fees significantly when posting data to L1: 144K gas spent compared to 1.2M gas spent with One

In addition, it already had famous committees including @ConsenSys @FTX_Official @googlecloud @OffchainLabs @QuickNode @Reddit

Nova is said to reduce gas fees significantly when posting data to L1: 144K gas spent compared to 1.2M gas spent with One

In addition, it already had famous committees including @ConsenSys @FTX_Official @googlecloud @OffchainLabs @QuickNode @Reddit

https://twitter.com/bkiepuszewski/status/1555180056498114561?s=20&t=N1EBgTuJX6k6c3Nd1c5fVg

14/In summary, the fundamental tradeoff between Rollup & AnyTrust is decentralization vs Tx costs

Depending on the purpose,𝘈𝘙𝘉𝘐𝘕𝘈𝘜𝘛𝘚 are free to choose

@arbitrum is accelerating this August, perhaps they're preparing for the big bang, perhaps it is the Odyssey event

Depending on the purpose,𝘈𝘙𝘉𝘐𝘕𝘈𝘜𝘛𝘚 are free to choose

@arbitrum is accelerating this August, perhaps they're preparing for the big bang, perhaps it is the Odyssey event

15/>What is #ArbitrumOdyssey?

It is a multi-week initiative for exploring the Arbitrum ecosystem with exclusive NFTs as rewards

NO $ARBI airdrop confirmed

But all participants would be using @arbitrum & could later be easily identified through holding NFTs, make sense right?

It is a multi-week initiative for exploring the Arbitrum ecosystem with exclusive NFTs as rewards

NO $ARBI airdrop confirmed

But all participants would be using @arbitrum & could later be easily identified through holding NFTs, make sense right?

16/

This event runs for 8 weeks & started in June

14 projects were selected for participants to do the interactive tasks they set out

But Odyssey had to stop & wait until the Nitro version came out because the gas fee had reached the threshold of Ether

This event runs for 8 weeks & started in June

14 projects were selected for participants to do the interactive tasks they set out

But Odyssey had to stop & wait until the Nitro version came out because the gas fee had reached the threshold of Ether

https://twitter.com/arbitrum/status/1542159105946787840?s=20&t=r-_1t0ozyCFeh_MLcH9Weg

17/

Some exploration of 14 Odyssey projects:

W1 Bridge Week

W2 @yield & @GMX_IO

W3 @AboardExchange & @tofuNFT

W4 @Uniswap & @OfficialApeXdex

W5 @1inch & @izumi_Finance/@YINFinance

W6 @BreederDodo & @SwaprEth

W7 @Treasure_DAO & @BattleFlyGame

W8 @ideamarket_io & @SushiSwap

Some exploration of 14 Odyssey projects:

W1 Bridge Week

W2 @yield & @GMX_IO

W3 @AboardExchange & @tofuNFT

W4 @Uniswap & @OfficialApeXdex

W5 @1inch & @izumi_Finance/@YINFinance

W6 @BreederDodo & @SwaprEth

W7 @Treasure_DAO & @BattleFlyGame

W8 @ideamarket_io & @SushiSwap

18/Some insights that I have collected:

>Collect at least 12/15 NFTs when doing tasks to receive exclusive final arbi-verse NFT

>Odyssey has been confirmed to reopen after Nitro LIVE

>As soon as $OP was launched, @sgoldfed (@OffchainLabs CEO) hinted about the token release

>Collect at least 12/15 NFTs when doing tasks to receive exclusive final arbi-verse NFT

>Odyssey has been confirmed to reopen after Nitro LIVE

>As soon as $OP was launched, @sgoldfed (@OffchainLabs CEO) hinted about the token release

19/

>Projects like @yield & @AboardExchange & @tofuNFT, have not issued tokens yet. It would be wise if you skin in the game carefully

>You can pre-purchase @battlefly NFTs now at @Treasure_DAO,the current floor price is 36 $MAGIC~$21 before it is overpriced during the campaign

>Projects like @yield & @AboardExchange & @tofuNFT, have not issued tokens yet. It would be wise if you skin in the game carefully

>You can pre-purchase @battlefly NFTs now at @Treasure_DAO,the current floor price is 36 $MAGIC~$21 before it is overpriced during the campaign

20/

>Do the quest to get roles on @arbitrum Discord, although "NOT REQUIRED" but still potentially become eligible for the $ARBI airdrop

The tasks are very simple like holding at least 0.0001 $MAGIC; $RDPX; $LINK; $GMX. You can join here: guild.xyz/arbitrum

>Do the quest to get roles on @arbitrum Discord, although "NOT REQUIRED" but still potentially become eligible for the $ARBI airdrop

The tasks are very simple like holding at least 0.0001 $MAGIC; $RDPX; $LINK; $GMX. You can join here: guild.xyz/arbitrum

21/

>Opportunities (NFA):@GMX_IO (perpetual) @dopex_io (options) @vestafinance (lend & borrow) @SperaxUSD ($USDs) @Treasure_DAO (gaming) are all highly rated products. What if Arbitrum Autumn appears?

GMX alone recently created a big buzz when the Txn fee surpassed #Bitcoin

>Opportunities (NFA):@GMX_IO (perpetual) @dopex_io (options) @vestafinance (lend & borrow) @SperaxUSD ($USDs) @Treasure_DAO (gaming) are all highly rated products. What if Arbitrum Autumn appears?

GMX alone recently created a big buzz when the Txn fee surpassed #Bitcoin

22/>Future forecast for $ARBI?

Compare with $OP, we can predict that $ARBI will have some similarities to her sister:

>Vote for protocol updates

>Vote for the distribution of incentives

>Project funding

>Participate in project management

The vote is boring, what abt revenue?

Compare with $OP, we can predict that $ARBI will have some similarities to her sister:

>Vote for protocol updates

>Vote for the distribution of incentives

>Project funding

>Participate in project management

The vote is boring, what abt revenue?

23/

The economic value of Rollups mainly comes from users' txn fees:

>From their docs: for every $1, $0.13 belongs to the protocol ➡️ @arbitrum revenue accounts for 25% - 35% of the total txn fees paid by users on Arbitrum ➡️ That could be an incentive case for $ARBI holder

The economic value of Rollups mainly comes from users' txn fees:

>From their docs: for every $1, $0.13 belongs to the protocol ➡️ @arbitrum revenue accounts for 25% - 35% of the total txn fees paid by users on Arbitrum ➡️ That could be an incentive case for $ARBI holder

24/

Finally, is becoming a supreme "Sequencer" - a superpower position

"Sequencer" is an important role

They're the entity that has the authority to order Txns and execute them in the network

Finally, is becoming a supreme "Sequencer" - a superpower position

"Sequencer" is an important role

They're the entity that has the authority to order Txns and execute them in the network

25/

@OffchainLabs is currently the only sequencer operator on Arbitrum, but we can guess some potential designs for $ARBI:

>Auction (use $ARBI to identify someone as a Sequencer)

>Required bonding $ARBI to be a Sequencer

>Holder can delegate $ARBI to a Sequencer they trust

@OffchainLabs is currently the only sequencer operator on Arbitrum, but we can guess some potential designs for $ARBI:

>Auction (use $ARBI to identify someone as a Sequencer)

>Required bonding $ARBI to be a Sequencer

>Holder can delegate $ARBI to a Sequencer they trust

26/ That's what I know and can share with you about @arbitrum, here are some gud reads I think you should read to better understand Arbitrum

Nitro Preview: medium.com/offchainlabs/a…

Nitro Advanced:

medium.com/offchainlabs/p…

AnyTrust Tech:

developer.offchainlabs.com/docs/AnyTrust

Nitro Preview: medium.com/offchainlabs/a…

Nitro Advanced:

medium.com/offchainlabs/p…

AnyTrust Tech:

developer.offchainlabs.com/docs/AnyTrust

Nova Preview:

medium.com/offchainlabs/i…

Arbitrum Ecosystem - by @blocmatesdotcom

The merge + Arbitrum summary - by @DeFiSurfer808

How to prepare $ARBI airdrop - by @OlimpioCrypto

medium.com/offchainlabs/i…

Arbitrum Ecosystem - by @blocmatesdotcom

https://twitter.com/blocmatesdotcom/status/1562340498744160258?s=20&t=q_peaLHjoXqspGJZConOnw

The merge + Arbitrum summary - by @DeFiSurfer808

https://twitter.com/DeFiSurfer808/status/1562786925295304707?s=20&t=UAa2DaHQypyMqIs6SXWQUQ

How to prepare $ARBI airdrop - by @OlimpioCrypto

https://twitter.com/OlimpioCrypto/status/1533472054367903745?s=20&t=UAa2DaHQypyMqIs6SXWQUQ

Thanks for spending your time reading this thread. If you like this kind of content, please take a moment to RT this. I'll write down more abt @arbitrum in the upcoming days

https://twitter.com/imnh99/status/1562962549943185412?s=20&t=RExnoqoWeV4LdK7B3yP_1g

• • •

Missing some Tweet in this thread? You can try to

force a refresh