An option buyer made Rs. 58 lacs from Rs. 2 lac capital in a span of just one month (March 2020 COVID crash).

He is none other than Mr. Subasish Pani.

THREAD: 11 things you must know to become an option buyer.

Collaborated with @AdityaTodmal

He is none other than Mr. Subasish Pani.

THREAD: 11 things you must know to become an option buyer.

Collaborated with @AdityaTodmal

•Don't get carried away with the kind of return that Mr. Pani made in such a short period of time.

•This requires a high level of skill, and discipline in terms of which strike to choose, which time to trade, and which days to trade.

•It also comes with higher drawdown.

•This requires a high level of skill, and discipline in terms of which strike to choose, which time to trade, and which days to trade.

•It also comes with higher drawdown.

1/ Screen Time:

• Indian markets function from 9:15-15:30.

• Dividing this time zone into 3 sub parts:

- 9:15 to 10:30: trending market

- 10:30 to 13:30: for retracement

- 13:30 to 3:30: trending market

• Indian markets function from 9:15-15:30.

• Dividing this time zone into 3 sub parts:

- 9:15 to 10:30: trending market

- 10:30 to 13:30: for retracement

- 13:30 to 3:30: trending market

2/ Focus on momentum:

• Option buyers make money when the momentum is quick.

• However if the market remain sideways for few days then the option starts to lose its value.

• This is because theta decay works against option buyers.

• Option buyers make money when the momentum is quick.

• However if the market remain sideways for few days then the option starts to lose its value.

• This is because theta decay works against option buyers.

3/ Option buyers need momentum to make money:

• Hence focus on the 1st & 2nd time zone where the markets are trending.

• Avoid taking trades between 10:30am till 13:30.

• Special focus on Wednesday & Thursday as premiums are low and if you can catch momentum then good R/R.

• Hence focus on the 1st & 2nd time zone where the markets are trending.

• Avoid taking trades between 10:30am till 13:30.

• Special focus on Wednesday & Thursday as premiums are low and if you can catch momentum then good R/R.

4/ Theta decay is a friend of option seller:

• Let's say the market view is -ve and market stays sideways or goes down, option sellers will still make money due to theta decay.

• Hence, the probability of winning for option sellers is 66.6% whereas for buyers its 33.3%.

• Let's say the market view is -ve and market stays sideways or goes down, option sellers will still make money due to theta decay.

• Hence, the probability of winning for option sellers is 66.6% whereas for buyers its 33.3%.

5/What's the favorable risk to reward (R/R):

• Since the winning probability of an option buyer is 33.3%, the edge is maintained by keeping losses at a fraction of gains.

Hence, R/R has to be 1:4.

• Since the winning probability of an option buyer is 33.3%, the edge is maintained by keeping losses at a fraction of gains.

Hence, R/R has to be 1:4.

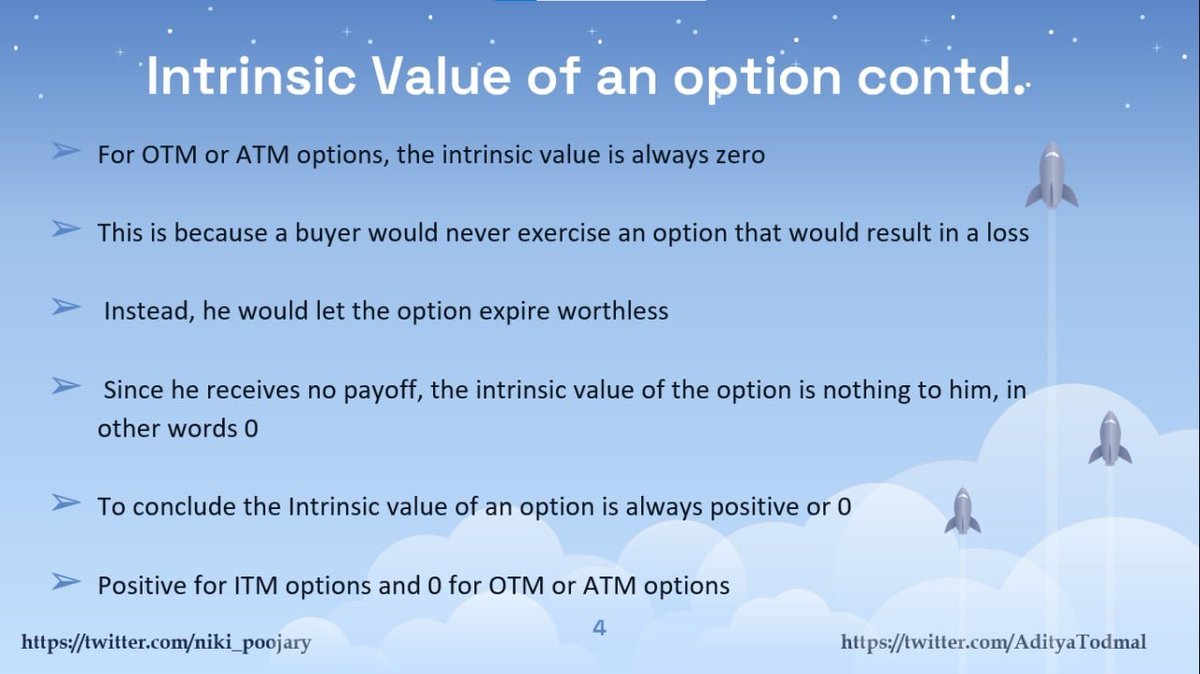

6/ Why deep OTMs doesn't work?

• Most of the option buyers select deep OTMs , but they have a higher probability of losing value as time passes away.

• Hence, deep OTMs are usually favorite of option sellers.

•Option buyers should select strikes near to Rs. 100.

• Most of the option buyers select deep OTMs , but they have a higher probability of losing value as time passes away.

• Hence, deep OTMs are usually favorite of option sellers.

•Option buyers should select strikes near to Rs. 100.

7/ Should option buyers focus on ATM?

• ATM strikes, having prems near to 200-300 is highly volatile. Hence the SL for ATM would be minimum Rs. 40-50.

• R/R is 1:4, then the reward should be atleast Rs. 160-200 which looks slightly challenging.

• So stay away from ATMs.

• ATM strikes, having prems near to 200-300 is highly volatile. Hence the SL for ATM would be minimum Rs. 40-50.

• R/R is 1:4, then the reward should be atleast Rs. 160-200 which looks slightly challenging.

• So stay away from ATMs.

8/ Find the sweet spot!

• ATMs are too volatile and far OTMs lose value quickly, therefore the golden mean is to select option in the range of Rs. 100

• Rs. 100 option doesn't have that kind of volatility that ATM has and Rs. 20-25 SL works, without getting stopped out.

• ATMs are too volatile and far OTMs lose value quickly, therefore the golden mean is to select option in the range of Rs. 100

• Rs. 100 option doesn't have that kind of volatility that ATM has and Rs. 20-25 SL works, without getting stopped out.

9/ On expiry days which premium to focus?

• During expiry's one can work with Rs. 40 - 50 especially post 12:30 noon.

• At times the 2pm moves are ferocious and one can even work with Rs. 20-25 premium.

• During expiry's one can work with Rs. 40 - 50 especially post 12:30 noon.

• At times the 2pm moves are ferocious and one can even work with Rs. 20-25 premium.

10/ Have no regrets:

• We don't know the target, we can only book as per our R/R.

• One can never capture the entire move in option buying.

• Be satisfied with what you book rather than having regrets of exiting the trade early.

• We don't know the target, we can only book as per our R/R.

• One can never capture the entire move in option buying.

• Be satisfied with what you book rather than having regrets of exiting the trade early.

11/ Scaling up:

• Choose option buying because it interests you rather than opting for it due to lack of capital.

•Psychological issues would be higher while scaling up due to the MTM swings in option buying.

• Choose option buying because it interests you rather than opting for it due to lack of capital.

•Psychological issues would be higher while scaling up due to the MTM swings in option buying.

If you enjoyed this thread, here's another one which might be helpful to get a set up in option buying.

https://twitter.com/niki_poojary/status/1543482051256799233?s=20&t=HT1RNHAFRMFPDnAUV1UuZg

Hope you discovered something new (because that's the point!)

If you did, share it with a friend

Hop back up to retweet the first tweet

See past threads here:

@AdityaTodmal

&

@niki_poojary

If you did, share it with a friend

Hop back up to retweet the first tweet

See past threads here:

@AdityaTodmal

&

@niki_poojary

• • •

Missing some Tweet in this thread? You can try to

force a refresh