If you pick stocks, you MUST learn how to read an income statement.

Here’s everything you need to know:

Here’s everything you need to know:

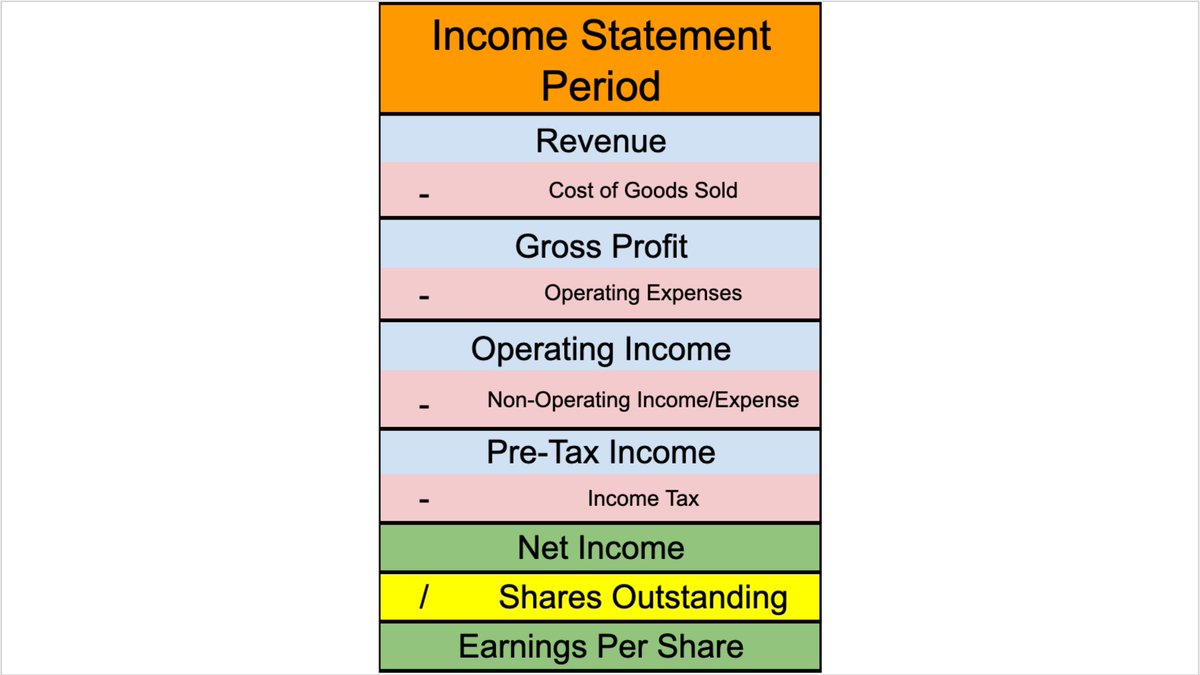

The income statement shows a company’s revenue and expenses over a period of time, usually a quarter or year.

It’s also called:

▪️Profit and Loss statement, or “P & L”

▪️Statement of earnings

It follows this basic format:

It’s also called:

▪️Profit and Loss statement, or “P & L”

▪️Statement of earnings

It follows this basic format:

Most public companies show their income statement in their quarterly earnings press release, but not always

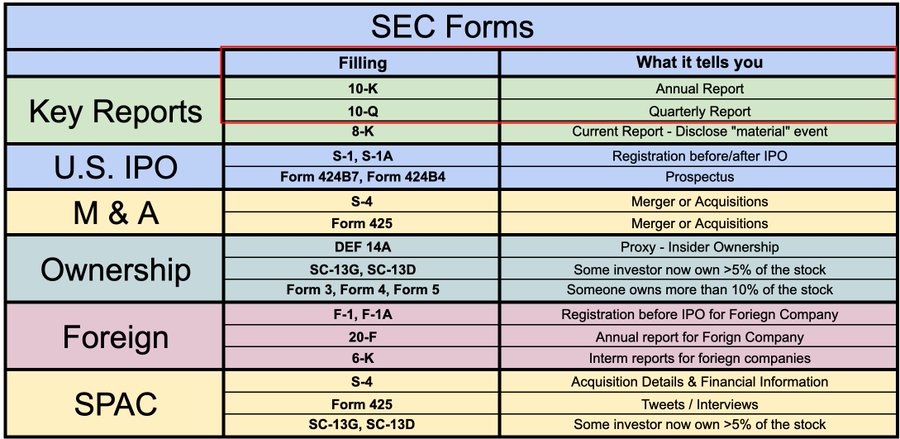

Find them by looking at:

▪️10-Q (quarterly report)

▪️10-K (annual report)

▪️Aggregator websites like @theTIKR

Find them by looking at:

▪️10-Q (quarterly report)

▪️10-K (annual report)

▪️Aggregator websites like @theTIKR

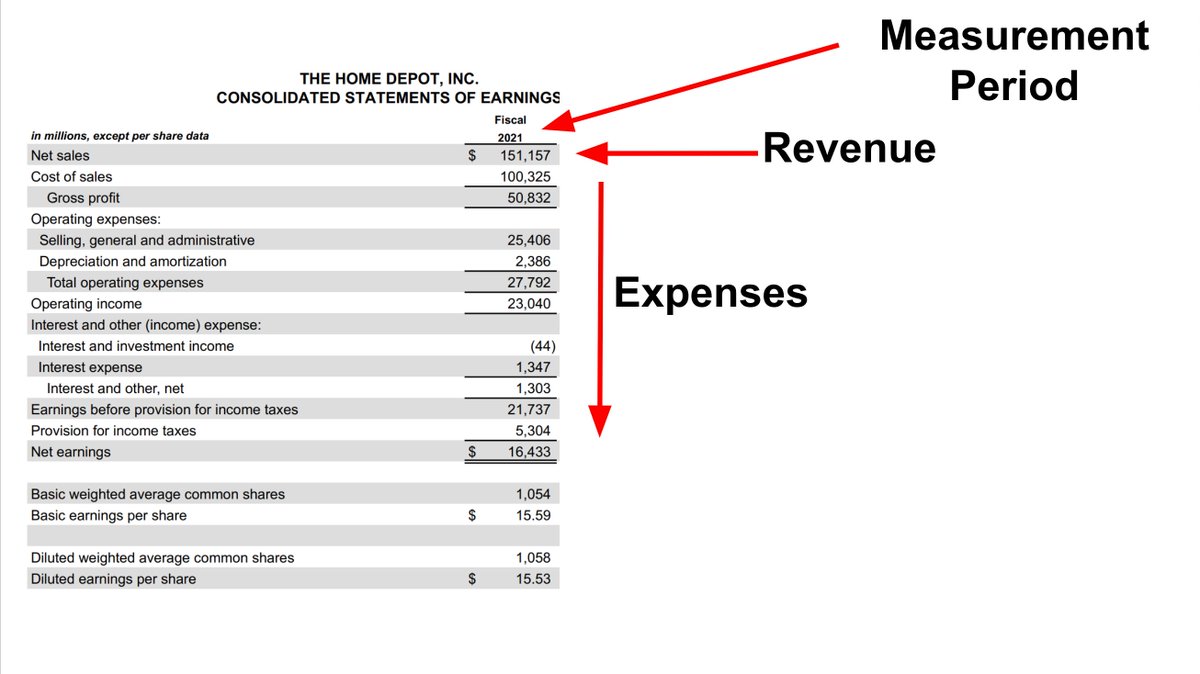

Let's use Home Depot fiscal 2021 as an example

Step 1: Get the data

▪️ Go to sec.gov

▪️ Search "HD"

▪️ Click the "10-K" from March 23rd

▪️ Scroll to "Statement of earnings"

Step 1: Get the data

▪️ Go to sec.gov

▪️ Search "HD"

▪️ Click the "10-K" from March 23rd

▪️ Scroll to "Statement of earnings"

The income statement flows in a step-down manner.

The top number is revenue (sales), and costs + expenses are subtracted as you go down

The top number is revenue (sales), and costs + expenses are subtracted as you go down

Let's take them one at a time

1: Revenue

This is the net amount received from the sales of products/services to customers

Sales are NET, meaning it includes discounts, returns, and any other deductions.

1: Revenue

This is the net amount received from the sales of products/services to customers

Sales are NET, meaning it includes discounts, returns, and any other deductions.

2: Cost of Goods Sold (COGS)

This figure shows all of the costs related to producing the product and/or service

It's also called "cost of sales"

This figure shows all of the costs related to producing the product and/or service

It's also called "cost of sales"

3: Gross profit

Also called “gross income”

This assesses a company's efficiency at using its labor and supplies in producing goods or services

This is a VERY important number

Also called “gross income”

This assesses a company's efficiency at using its labor and supplies in producing goods or services

This is a VERY important number

4: Operating Expenses (OPEX)

A catchall category that includes all expenses to run a company’s day-to-day operations

Some companies break them out by category. Others lump them all together.

A catchall category that includes all expenses to run a company’s day-to-day operations

Some companies break them out by category. Others lump them all together.

5: Operating Income

Gross Profit - OPEX

This shows how much profit a company earned from its ongoing operations

It can also be called “EBIT”

Gross Profit - OPEX

This shows how much profit a company earned from its ongoing operations

It can also be called “EBIT”

6: Non-Operating Income/Expense

Revenue or expenses incurred unrelated to running the business

The biggest number is usually interest on debt or gain/loss on the sale of an asset

Revenue or expenses incurred unrelated to running the business

The biggest number is usually interest on debt or gain/loss on the sale of an asset

7: Pre-tax income

Operating Income

+/-

Non-Operating Income/Expenses

Also called “EBT” or “Earnings Before Tax”

Operating Income

+/-

Non-Operating Income/Expenses

Also called “EBT” or “Earnings Before Tax”

9: Net income

We made it to “the bottom line”, aka “earnings” or “profits”

If this number is positive, the business is "profitable"

If it's negative, the business is "unprofitable"

We made it to “the bottom line”, aka “earnings” or “profits”

If this number is positive, the business is "profitable"

If it's negative, the business is "unprofitable"

10a: Time to divide the profits!

There are 2 ways to report "earnings per share"

1) Divide by "basic shares," which is the total number of shares of common stock currently outstanding

There are 2 ways to report "earnings per share"

1) Divide by "basic shares," which is the total number of shares of common stock currently outstanding

10a:

2) Divide by "diluted" shares, which is the total number of shares that could be outstanding including stock-based compensation + convertible debt

2) Divide by "diluted" shares, which is the total number of shares that could be outstanding including stock-based compensation + convertible debt

A helpful exercise is to divide each figure by sales, giving us "margins"

Doing so allows you to compare companies of different sizes to each other and track profit direction

My favorites:

▪️Gross Margin

▪️Operating Margin

▪️Net Margin

Doing so allows you to compare companies of different sizes to each other and track profit direction

My favorites:

▪️Gross Margin

▪️Operating Margin

▪️Net Margin

If you invest, it's CRITICAL to learn accounting

Want help? @Brian_Stoffel_ and I created a course that teaches accounting in plain English

Registration is currently open

Interested? DM me for a special coupon code

maven.com/brian-feroldi/…

Want help? @Brian_Stoffel_ and I created a course that teaches accounting in plain English

Registration is currently open

Interested? DM me for a special coupon code

maven.com/brian-feroldi/…

Want to learn more about the nuances of accounting?

This other thread I wrote can help:

This other thread I wrote can help:

https://twitter.com/BrianFeroldi/status/1534892551383261184?s=20&t=wS5Xr7M3E-J_3TtfXntakg

• • •

Missing some Tweet in this thread? You can try to

force a refresh