Housing is in trouble.

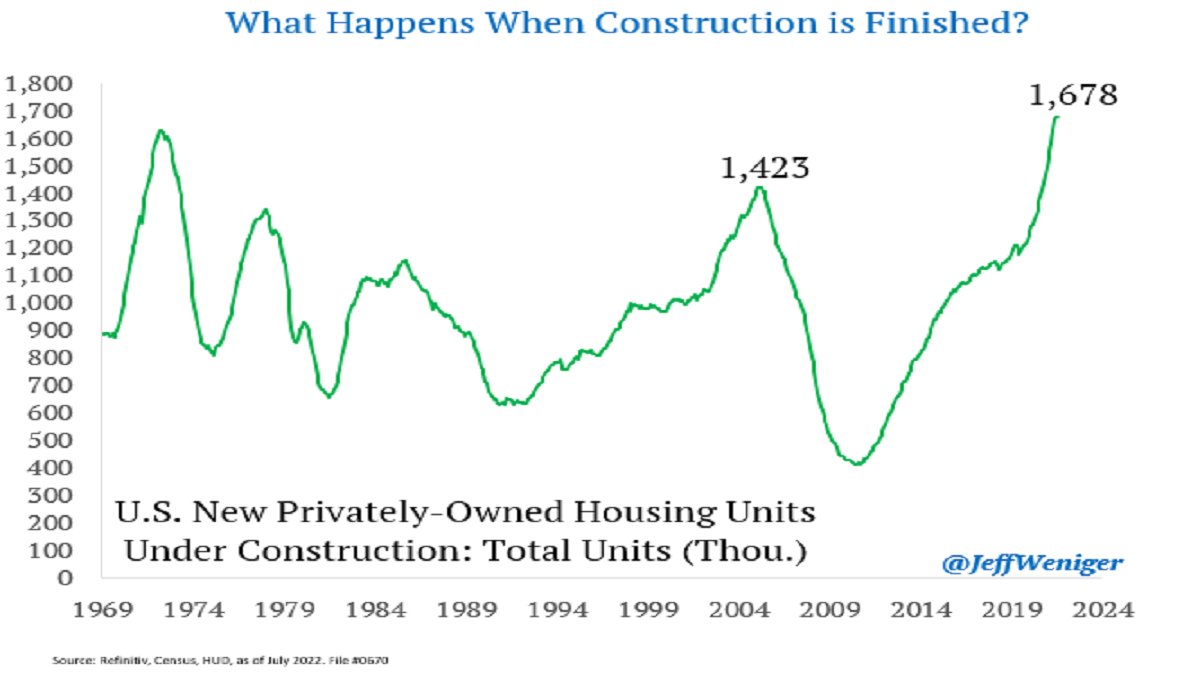

1/10

1/10

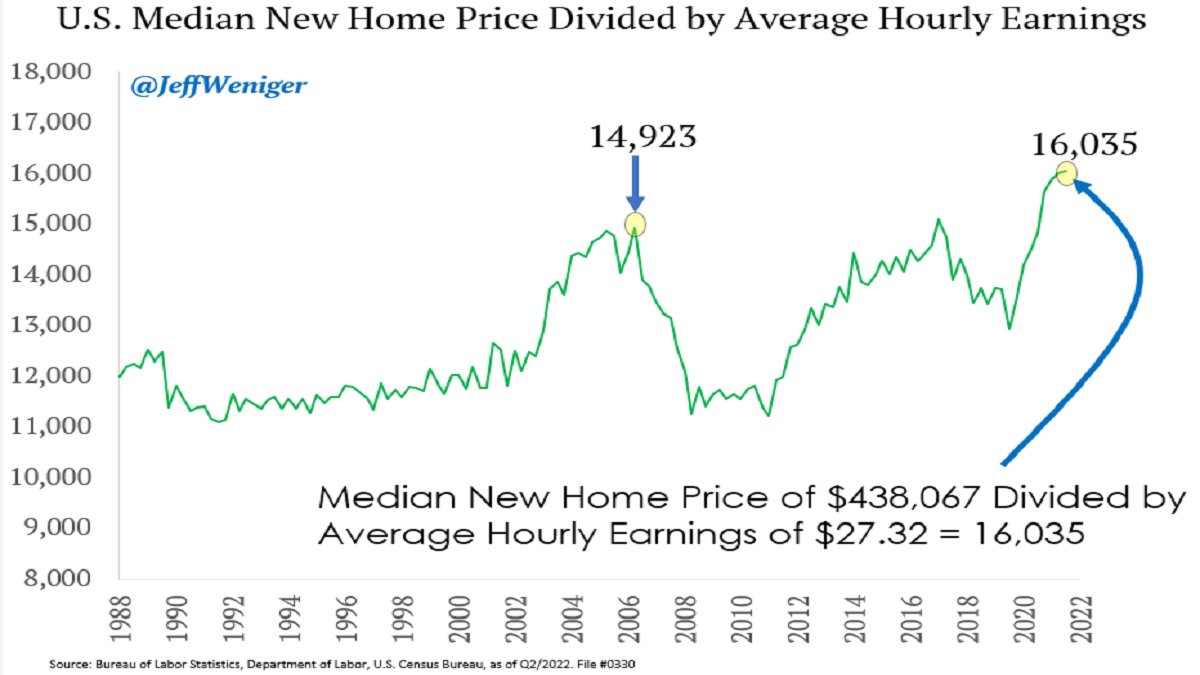

2/10

The combination of principal and interest is backbreaking. And maybe mortgage rates go even higher.

The combination of principal and interest is backbreaking. And maybe mortgage rates go even higher.

3/10

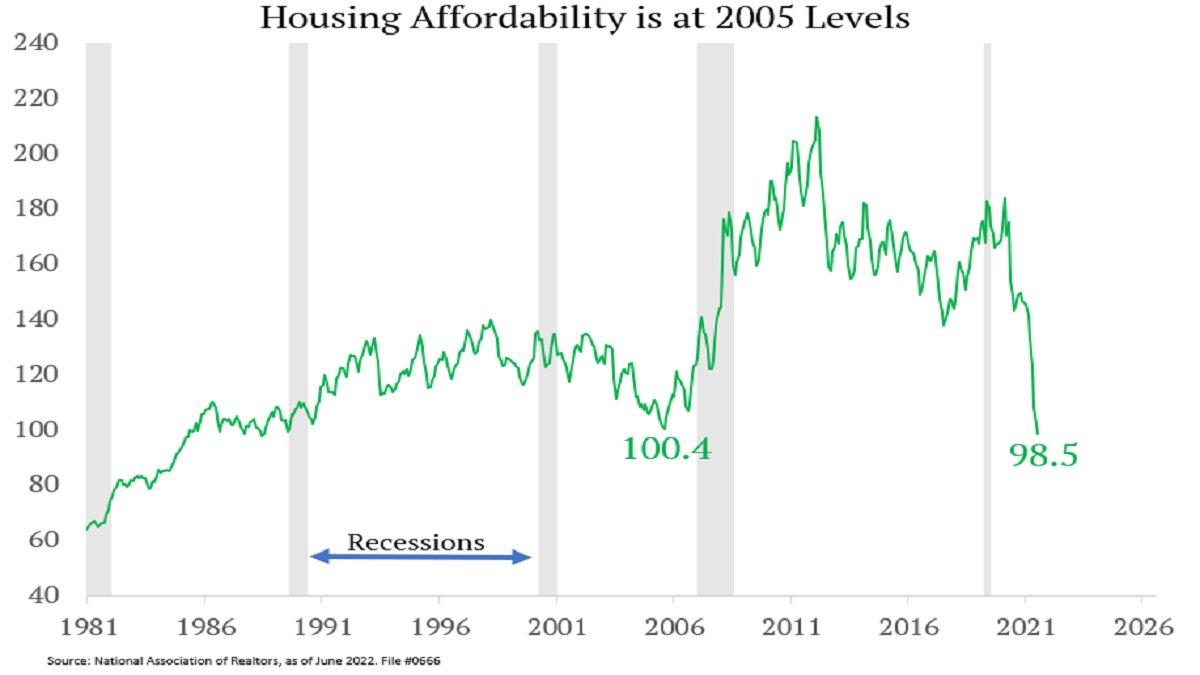

Many people defended home price-to-income ratios when people were locking in 2.75%. I'm not sure what the defense is anymore, now that mortgages rates are 5+%.

Many people defended home price-to-income ratios when people were locking in 2.75%. I'm not sure what the defense is anymore, now that mortgages rates are 5+%.

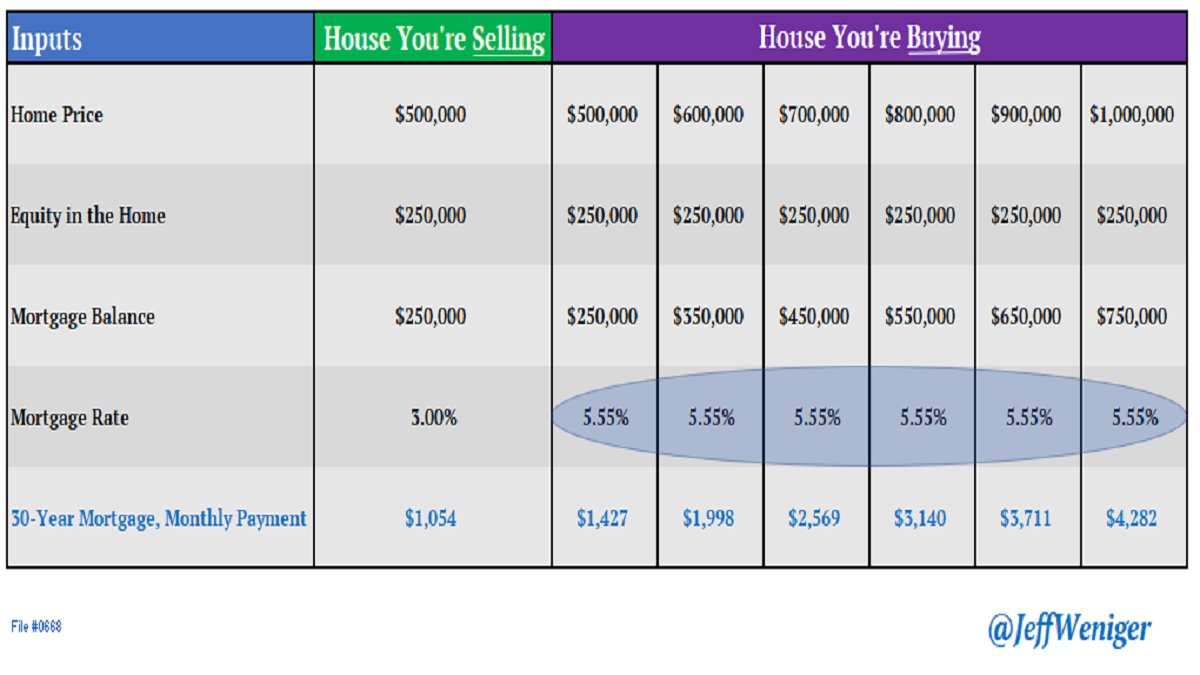

4/10

I'll show this table until I'm blue in the face. A total disappearance of the move-up buyer.

The whole thing was built on 3% mortgages. You get one more bathroom for $1,500 more per month. No thanks.

I'll show this table until I'm blue in the face. A total disappearance of the move-up buyer.

The whole thing was built on 3% mortgages. You get one more bathroom for $1,500 more per month. No thanks.

5/10

"Soft" housing market? Ask the shareholders of Redfin and Zillow if those stock prices are predicting something a bit more dramatic than "soft."

"Soft" housing market? Ask the shareholders of Redfin and Zillow if those stock prices are predicting something a bit more dramatic than "soft."

6/10

July new home supply records JULY data.

But July existing home data captures bids accepted in May/June with the closing documents signed in July.

Wait until the summer numbers come in. Up we go.

July new home supply records JULY data.

But July existing home data captures bids accepted in May/June with the closing documents signed in July.

Wait until the summer numbers come in. Up we go.

7/10

If you're not convinced, look at this.

The right scale is inverted.

The people who build houses for a living are telling us something. Maybe we should listen.

If you're not convinced, look at this.

The right scale is inverted.

The people who build houses for a living are telling us something. Maybe we should listen.

• • •

Missing some Tweet in this thread? You can try to

force a refresh