/ Thread: $FMX Deep Dive

100 pg. slide deck here 👉🏼 patient-capital.de/s/FMX.pdf

In this thread I'll walk you through my assumptions why FEMSA owns one of the best retail assets in LatAm with sizable growth potential.

The deck has eight chapters, starting with "FMX AT A GLANCE".

100 pg. slide deck here 👉🏼 patient-capital.de/s/FMX.pdf

In this thread I'll walk you through my assumptions why FEMSA owns one of the best retail assets in LatAm with sizable growth potential.

The deck has eight chapters, starting with "FMX AT A GLANCE".

2/

$FMX owns c-store chain OXXO: the clear market leader in Mexico with 20k stores and an 85% share of the formal market.

OXXO has a 10x lead vs. #2 $SVNDY (7-Eleven) in Mexico and >13m people shop at its stores every day. It's the #2 domestic retailer by revenue after $WALMEX

$FMX owns c-store chain OXXO: the clear market leader in Mexico with 20k stores and an 85% share of the formal market.

OXXO has a 10x lead vs. #2 $SVNDY (7-Eleven) in Mexico and >13m people shop at its stores every day. It's the #2 domestic retailer by revenue after $WALMEX

3/

Besides its retail arm, FMX owns equity stakes in two mature beverage companies, $KOF & $HEIA, that generate stable amounts of FCF and fund the company’s dividends.

$FMX owns 47.2% of Coca-Cola FEMSA, 14.8% of Heineken plus some emerging distribution and digital businesses.

Besides its retail arm, FMX owns equity stakes in two mature beverage companies, $KOF & $HEIA, that generate stable amounts of FCF and fund the company’s dividends.

$FMX owns 47.2% of Coca-Cola FEMSA, 14.8% of Heineken plus some emerging distribution and digital businesses.

4/

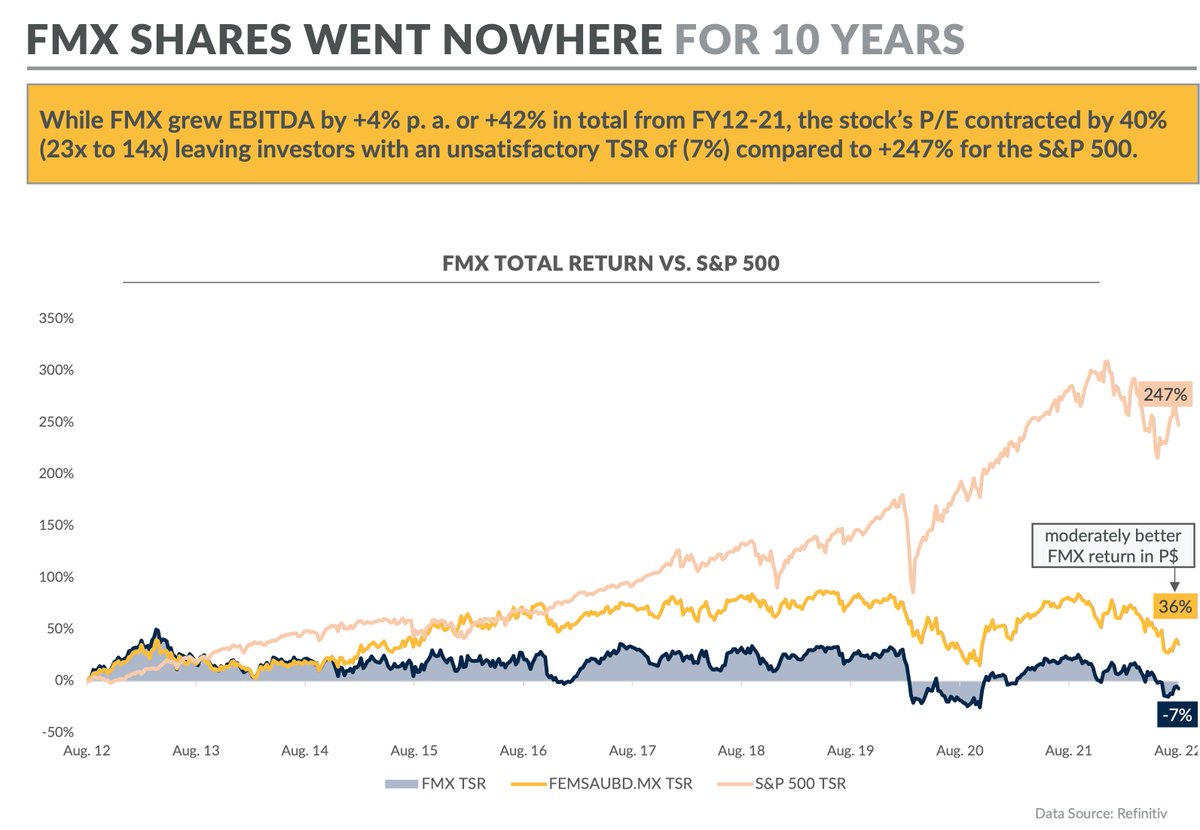

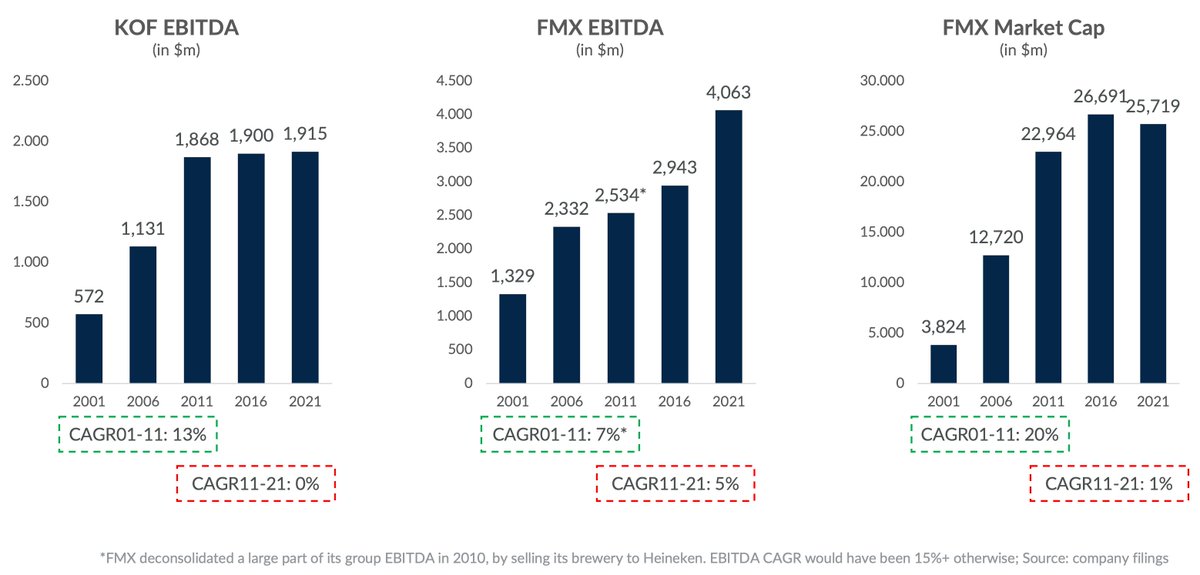

FMX RETAIL is responsible for 38% of net profit vs. KOF 30%/HEIA 29%. RETAIL delivered a 3x gain in EBITDA (in $) from FY12-21, but KOF/HEIA stayed flat, dragging down FMX company-wide EBITDA CAGR to 4%.

Low growth combined w multiple contraction led to a dismal stock return

FMX RETAIL is responsible for 38% of net profit vs. KOF 30%/HEIA 29%. RETAIL delivered a 3x gain in EBITDA (in $) from FY12-21, but KOF/HEIA stayed flat, dragging down FMX company-wide EBITDA CAGR to 4%.

Low growth combined w multiple contraction led to a dismal stock return

5/

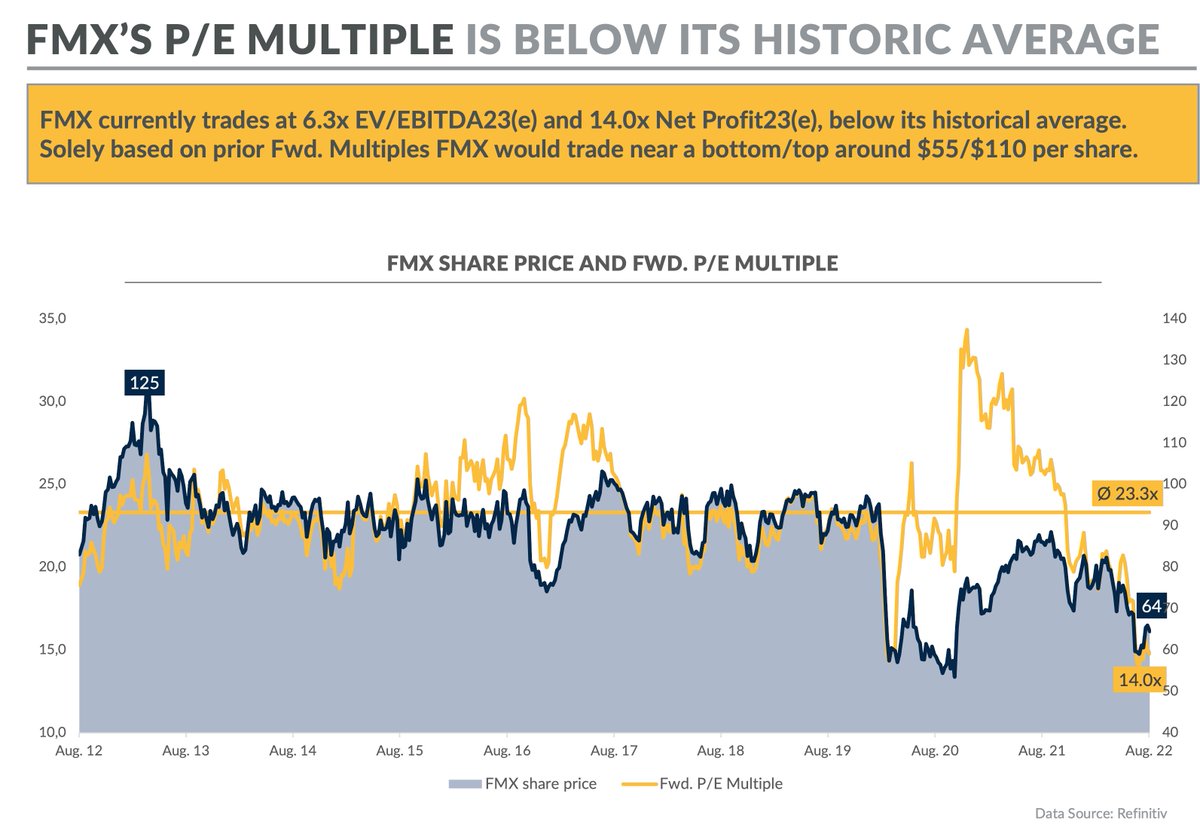

One reason for $FMX lackluster stock performance is market participants overpaid for $KOF big-time. KOF has fallen to more reasonable levels (-65% from peak), increasing odds that future FMX performance may look better than past performance.

FMX stock trades at 6x EBITDA23e.

One reason for $FMX lackluster stock performance is market participants overpaid for $KOF big-time. KOF has fallen to more reasonable levels (-65% from peak), increasing odds that future FMX performance may look better than past performance.

FMX stock trades at 6x EBITDA23e.

6/

“EXECUTIVE SUMMARY”: Prior to the last decade, FEMSA used to be a high-growth stock delivering strong profit increases and 20% market cap CAGR until 2011/12.

In 2010 $FMX sold its legacy beer biz (Cervecería Cuauhtémoc Moctezuma) to Heineken in exchange for a 20% stake.

“EXECUTIVE SUMMARY”: Prior to the last decade, FEMSA used to be a high-growth stock delivering strong profit increases and 20% market cap CAGR until 2011/12.

In 2010 $FMX sold its legacy beer biz (Cervecería Cuauhtémoc Moctezuma) to Heineken in exchange for a 20% stake.

7/

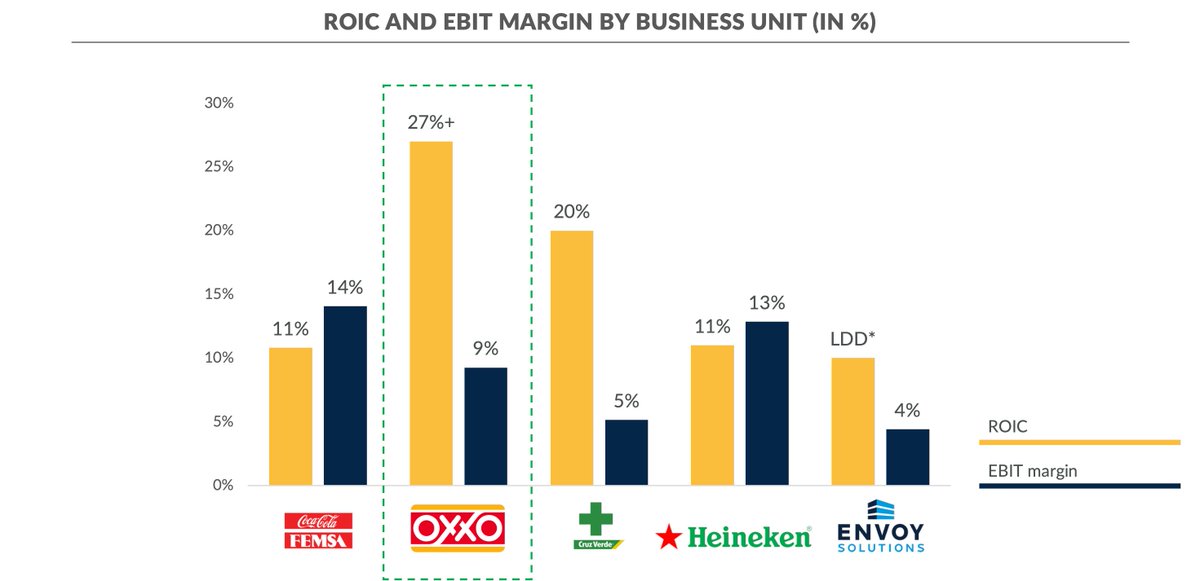

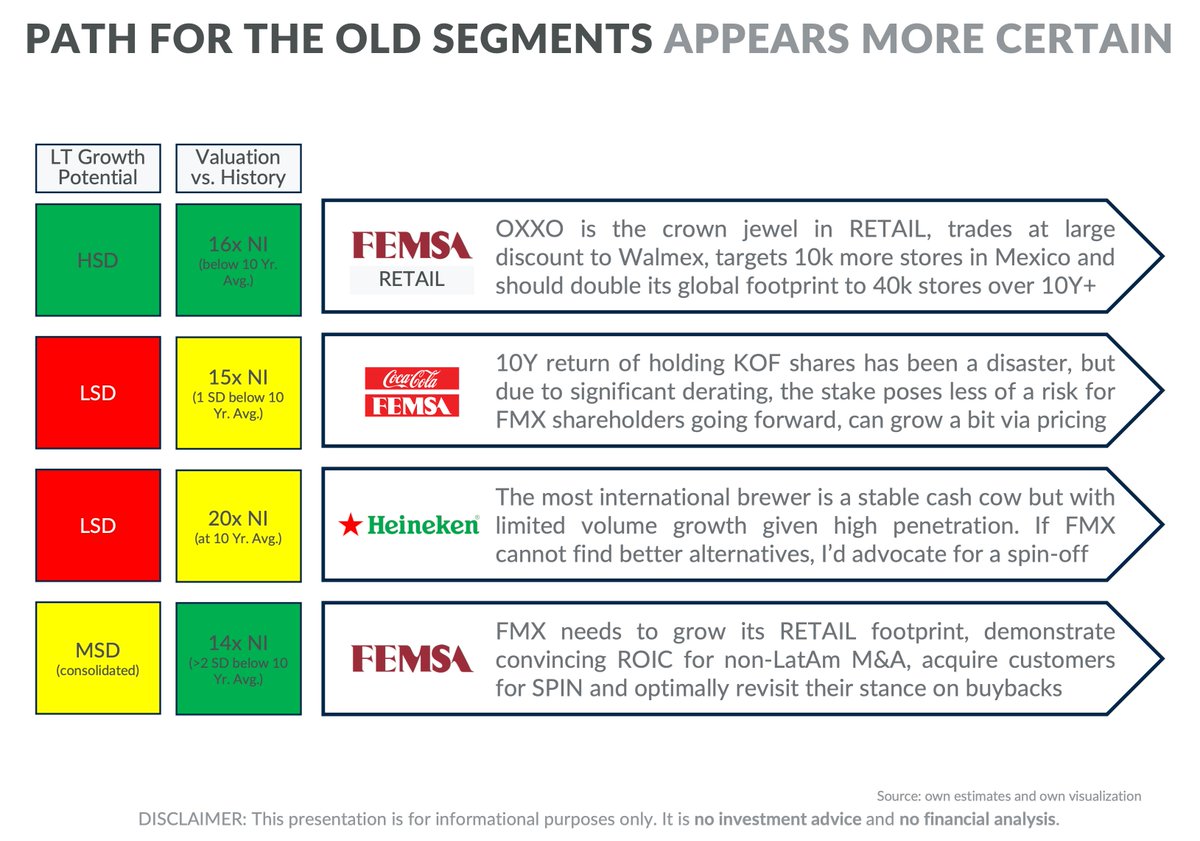

KOF/HEIA margins are > OXXO’s, but OXXO ROIC is far superior. Capital allocation priorities should be:

1. exhaust OXXO unit potential in LatAm over next decade+

2. increase drugstore footprint

3. spin-off HEIA stake if management can’t find bargain redeployment opportunities

KOF/HEIA margins are > OXXO’s, but OXXO ROIC is far superior. Capital allocation priorities should be:

1. exhaust OXXO unit potential in LatAm over next decade+

2. increase drugstore footprint

3. spin-off HEIA stake if management can’t find bargain redeployment opportunities

8/

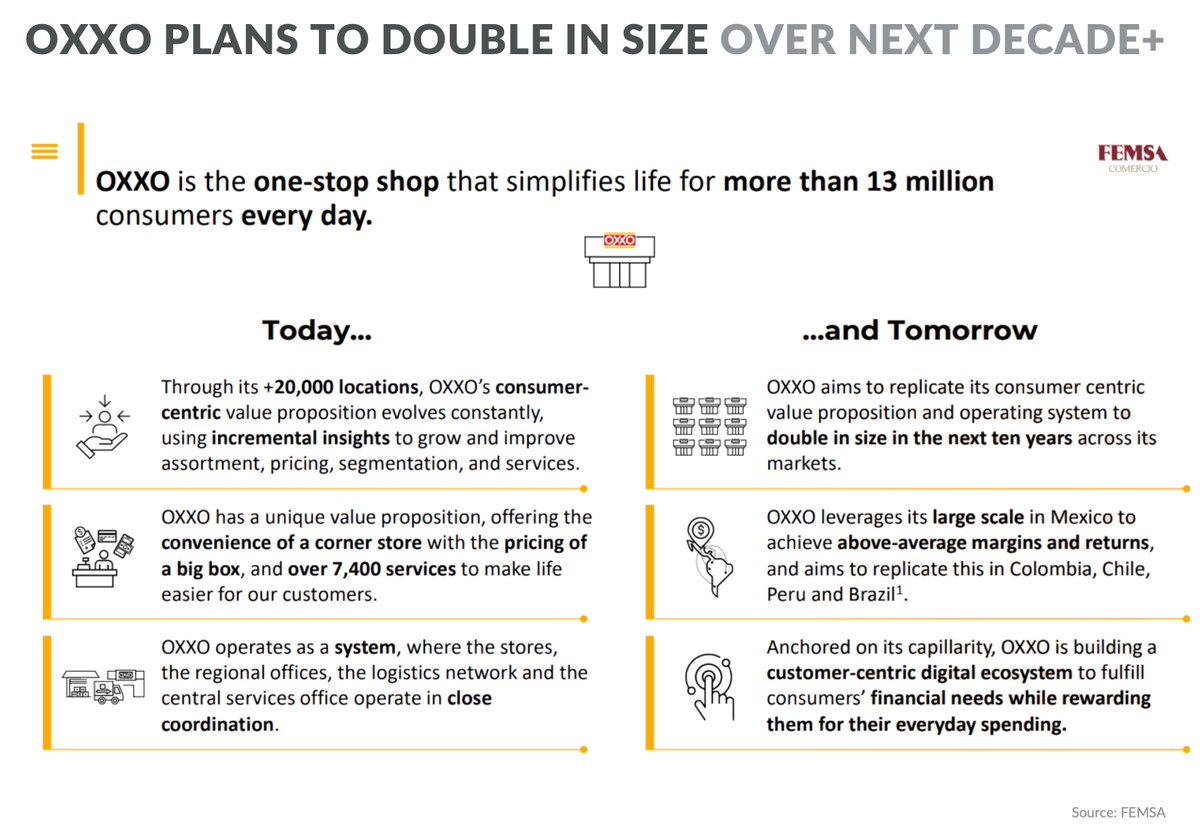

Management plans to increase OXXO's store footprint in Mexico 1.5x from 20k to 30k over next 10Y.

In the economically stronger north there’s an OXXO for every 3,700 ppl vs. 8,300/10,100 in SW/SE. In the south OXXO could reach a penetration of 4,600 ppl/store (+9.7k units).

Management plans to increase OXXO's store footprint in Mexico 1.5x from 20k to 30k over next 10Y.

In the economically stronger north there’s an OXXO for every 3,700 ppl vs. 8,300/10,100 in SW/SE. In the south OXXO could reach a penetration of 4,600 ppl/store (+9.7k units).

9/

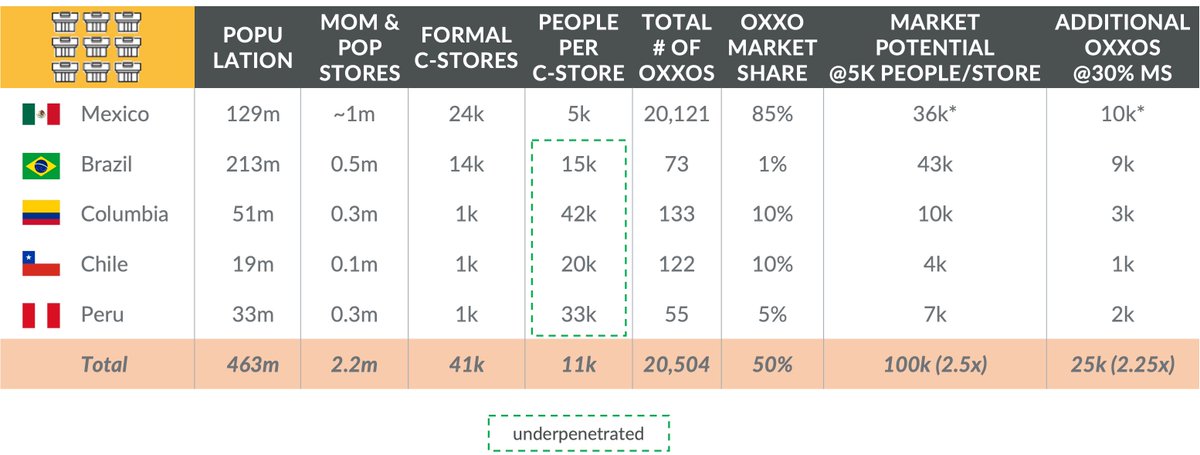

Outside Mexico OXXO operates 133/122/55 stores in Colombia/Chile/Peru. Brazil is currently picking up steam and should contribute significantly to a meaningful store footprint outside Mexico over time

Including these markets $FMX sees potential for +100% more units over 10Y+

Outside Mexico OXXO operates 133/122/55 stores in Colombia/Chile/Peru. Brazil is currently picking up steam and should contribute significantly to a meaningful store footprint outside Mexico over time

Including these markets $FMX sees potential for +100% more units over 10Y+

10/

Lately CFO @egarzaygarza & CEO got more vocal about Brazil's potential

CEO:“If you compare the population of Brazil w Mexico, definitely there's room to grow. I mean long term we should not expect that the number could be very different from what we've seen here in Mexico”

Lately CFO @egarzaygarza & CEO got more vocal about Brazil's potential

CEO:“If you compare the population of Brazil w Mexico, definitely there's room to grow. I mean long term we should not expect that the number could be very different from what we've seen here in Mexico”

11/

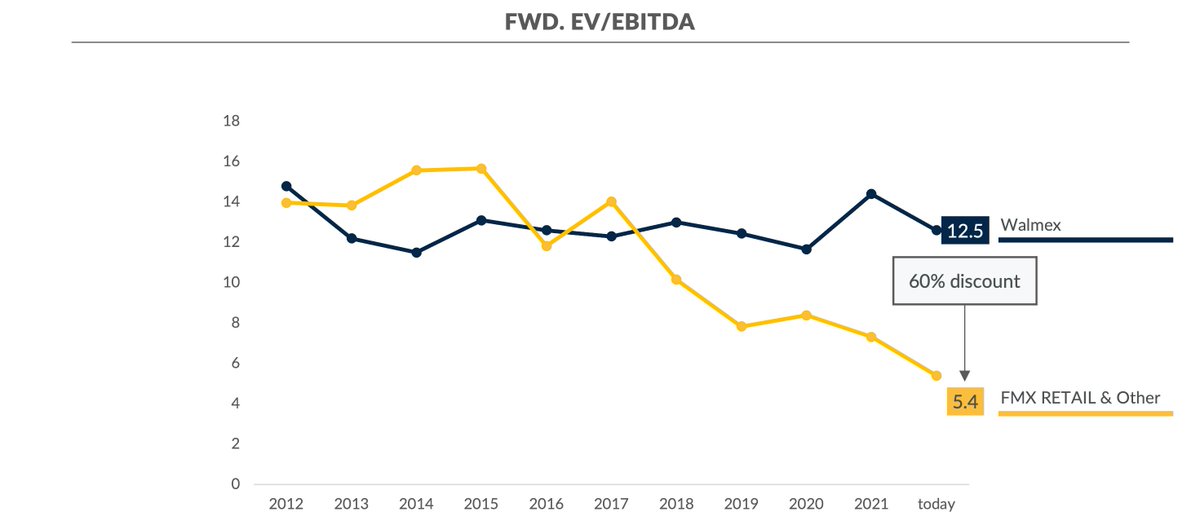

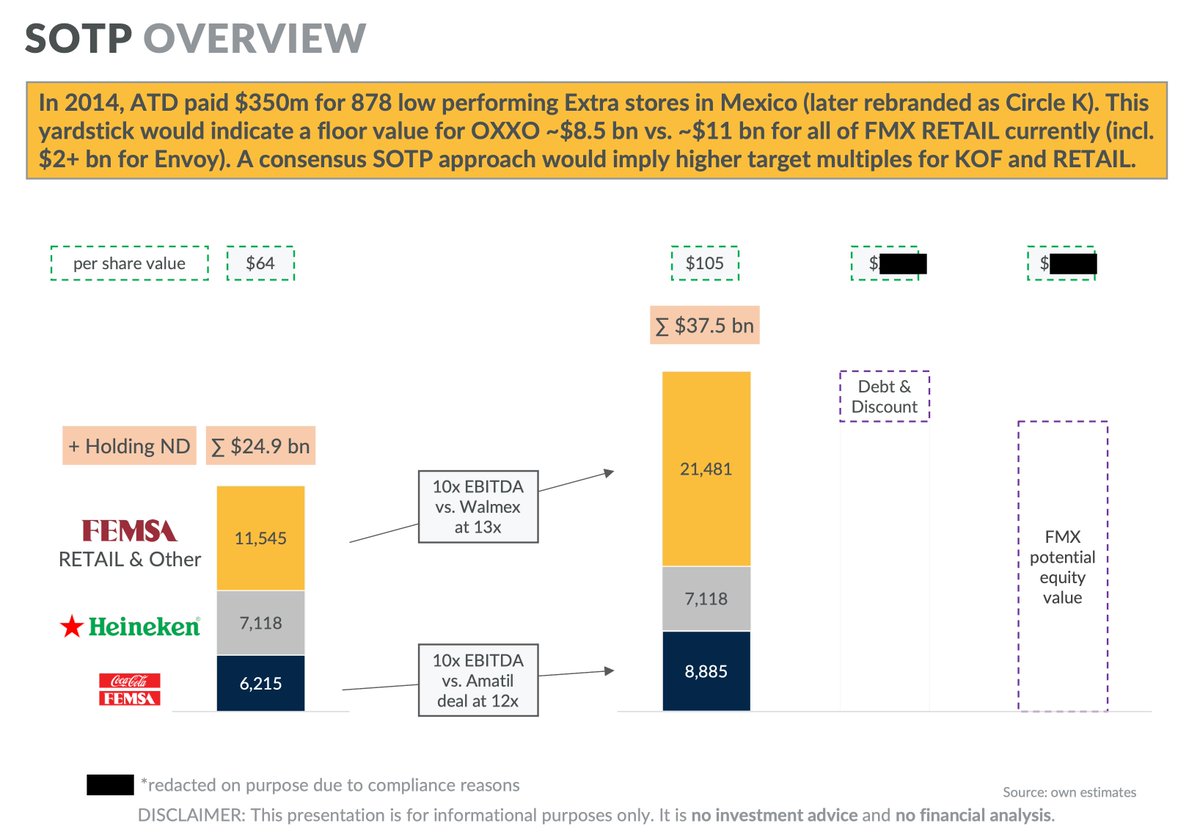

Besides higher margins/growth/unit potential given the underperformance of $FMX total (ytd: -17%) vs. KOF (ytd: 14%) and HEIA (ytd -8%), the RETAIL stub currently trades at an unprecedented discount of 60% vs. $WALMEX

Walmex trades at 13x Fwd EBITDA, FMX RETAIL at 5x EBITDA

Besides higher margins/growth/unit potential given the underperformance of $FMX total (ytd: -17%) vs. KOF (ytd: 14%) and HEIA (ytd -8%), the RETAIL stub currently trades at an unprecedented discount of 60% vs. $WALMEX

Walmex trades at 13x Fwd EBITDA, FMX RETAIL at 5x EBITDA

12/

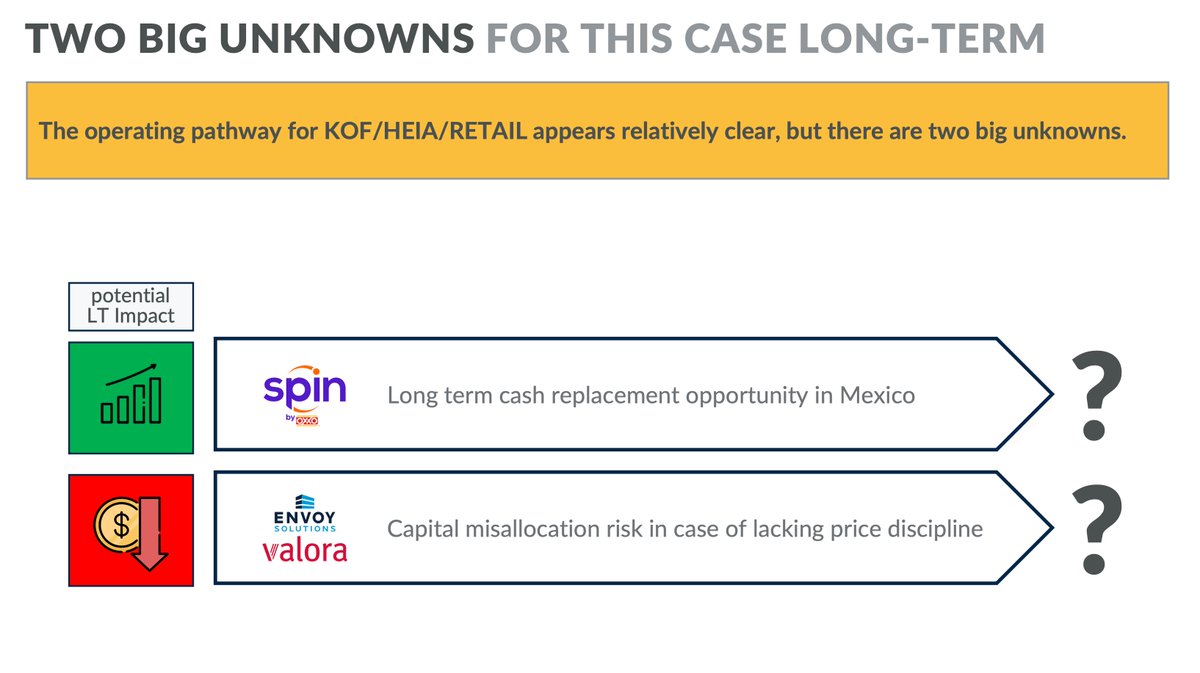

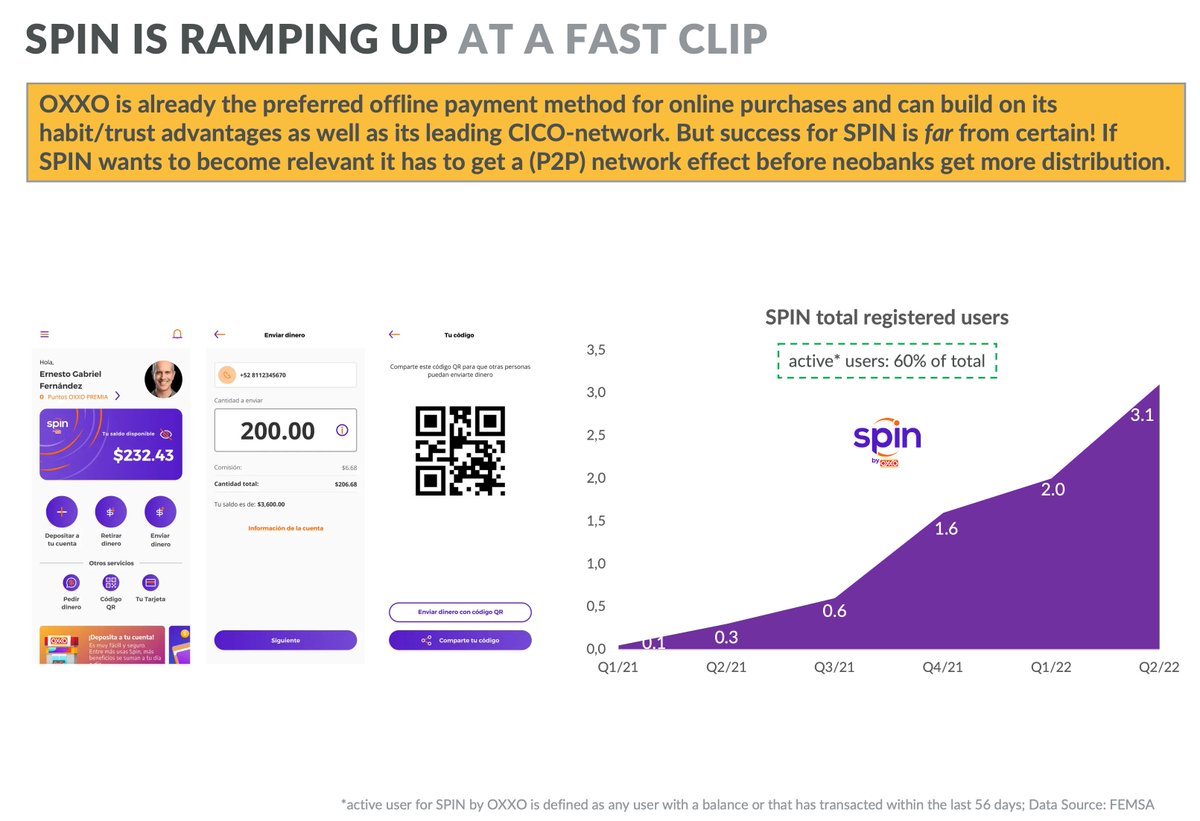

While the operating pathway for KOF/HEIA/RETAIL appears relatively clear, there are two big unknowns for this case LT:

1. Upside Risk "SPIN by OXXO": a mobile wallet launched in 21 with rapid user growth

2. Downside Risk through M&A outside LatAm if price discipline lacks

While the operating pathway for KOF/HEIA/RETAIL appears relatively clear, there are two big unknowns for this case LT:

1. Upside Risk "SPIN by OXXO": a mobile wallet launched in 21 with rapid user growth

2. Downside Risk through M&A outside LatAm if price discipline lacks

13/

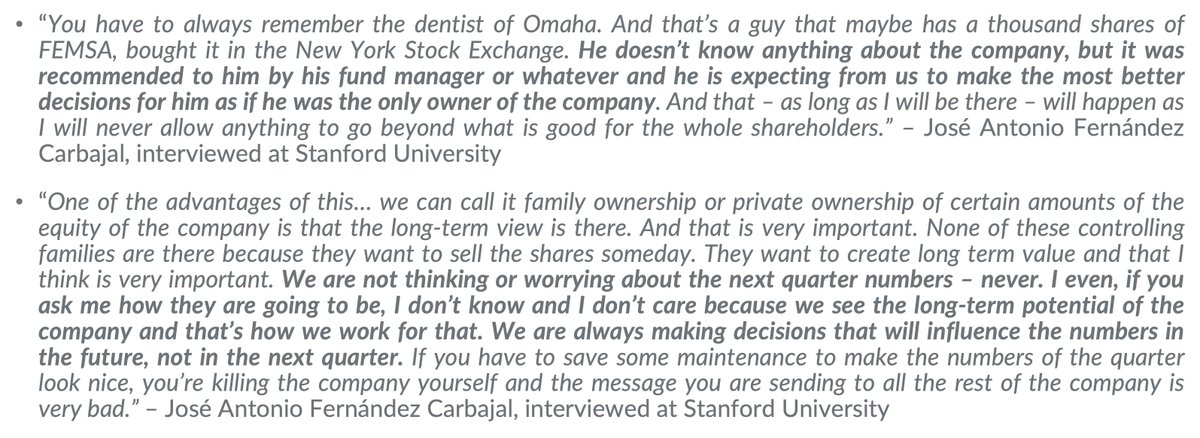

“COMPANY BACKGROUND”: Former CEO/now chairman José Antonio Fernández Carbajal is hugely influential at $FMX

He's the most prominent rep of the controlling families, who own 39% of FEMSA followed by @BillGates /Cascade 8%

M. Larson sits at the board

“COMPANY BACKGROUND”: Former CEO/now chairman José Antonio Fernández Carbajal is hugely influential at $FMX

He's the most prominent rep of the controlling families, who own 39% of FEMSA followed by @BillGates /Cascade 8%

M. Larson sits at the board

14/

In my opinion, mgmt has an adequate understanding of their fiduciary duties and tries to treat shareholders equally.

Additionally, $FMX has often proven to prioritize the LT potential of a business unit vs. a short-term financial gain (e. g. restructuring OXXO in the 1990s)

In my opinion, mgmt has an adequate understanding of their fiduciary duties and tries to treat shareholders equally.

Additionally, $FMX has often proven to prioritize the LT potential of a business unit vs. a short-term financial gain (e. g. restructuring OXXO in the 1990s)

15/

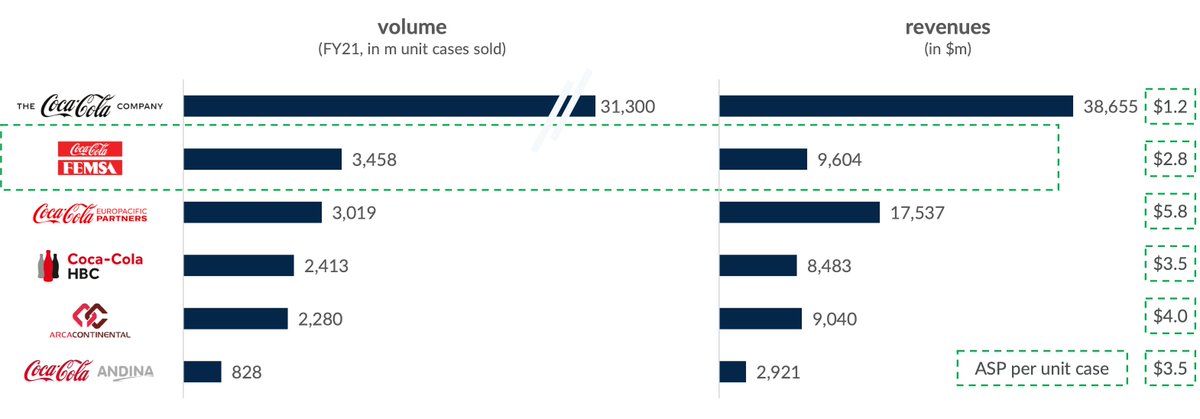

"SEGMENT BREAKDOWNS: KOF": $KOF is the largest franchise bottler of Coca-Cola trademark beverages in the world in terms of volume, selling 11% of global Coca-Cola output

In 2021 the entire Coca-Cola system sold 31.3 bn unit cases and KOF sold 3.5 bn unit cases ($9.6 bn rev)

"SEGMENT BREAKDOWNS: KOF": $KOF is the largest franchise bottler of Coca-Cola trademark beverages in the world in terms of volume, selling 11% of global Coca-Cola output

In 2021 the entire Coca-Cola system sold 31.3 bn unit cases and KOF sold 3.5 bn unit cases ($9.6 bn rev)

16/

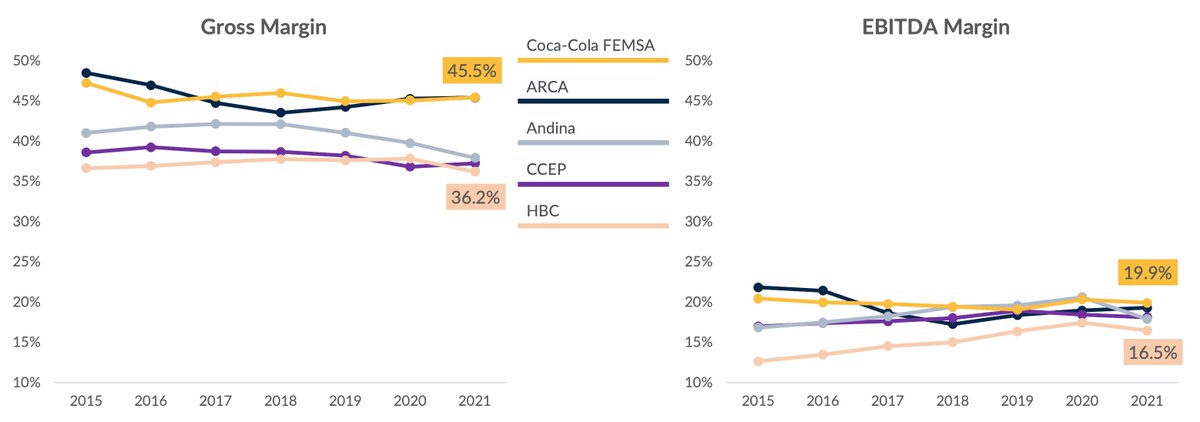

KOF is the most profitable bottler globally with 19.9% FY21 EBITDA margin

The obvious question looking at any bottler is: will TCCC allow it a sustainable, healthy ROIC WACC spread

KOF has an advantage in negotiations: FMX’s ownership of OXXO (largest Coke retailer in MEX)

KOF is the most profitable bottler globally with 19.9% FY21 EBITDA margin

The obvious question looking at any bottler is: will TCCC allow it a sustainable, healthy ROIC WACC spread

KOF has an advantage in negotiations: FMX’s ownership of OXXO (largest Coke retailer in MEX)

17/

"SEGMENT BREAKDOWNS: RETAIL": Despite clear leadership in Mexico with 20k c-stores, $FMX plans to open 10k additional domestic and 10k international stores for a potential 2x in size over the next decade+.

An average OXXO carries 3.3k SKUs, 45% of its sales are beverages.

"SEGMENT BREAKDOWNS: RETAIL": Despite clear leadership in Mexico with 20k c-stores, $FMX plans to open 10k additional domestic and 10k international stores for a potential 2x in size over the next decade+.

An average OXXO carries 3.3k SKUs, 45% of its sales are beverages.

18/

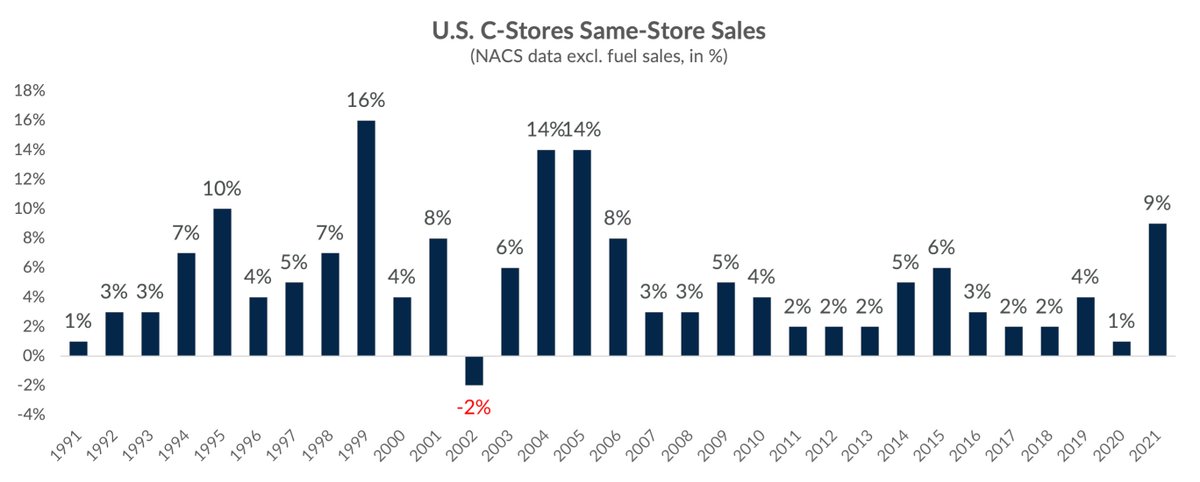

OXXO's moat is its scale driven purchasing power, which led to gross margins of 42.4% in FY21 vs. 20-30% at smaller retailers.

It's also not just OXXO achieving great success running c-stores: peer $ATD is up 10x over 10Y. The entire industry shows resiliency in SSS trends.

OXXO's moat is its scale driven purchasing power, which led to gross margins of 42.4% in FY21 vs. 20-30% at smaller retailers.

It's also not just OXXO achieving great success running c-stores: peer $ATD is up 10x over 10Y. The entire industry shows resiliency in SSS trends.

19/

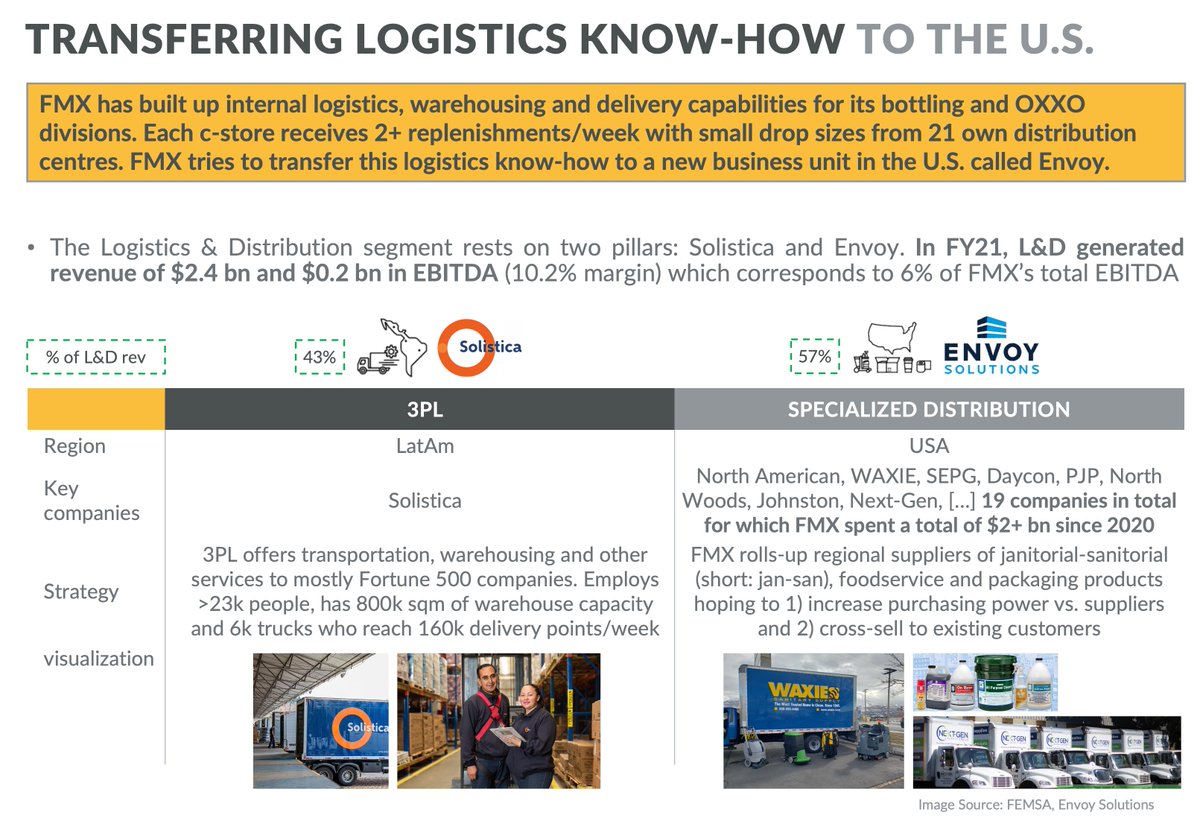

"SEGMENT BREAKDOWNS: LOGISTICS": FMX built up internal logistics capabilities for its bottling and OXXO division and now tries to transfer this know-how to a new business unit in the U.S. called Envoy

It rolls-up U.S. suppliers of jan-san, foodservice and packaging products

"SEGMENT BREAKDOWNS: LOGISTICS": FMX built up internal logistics capabilities for its bottling and OXXO division and now tries to transfer this know-how to a new business unit in the U.S. called Envoy

It rolls-up U.S. suppliers of jan-san, foodservice and packaging products

20/

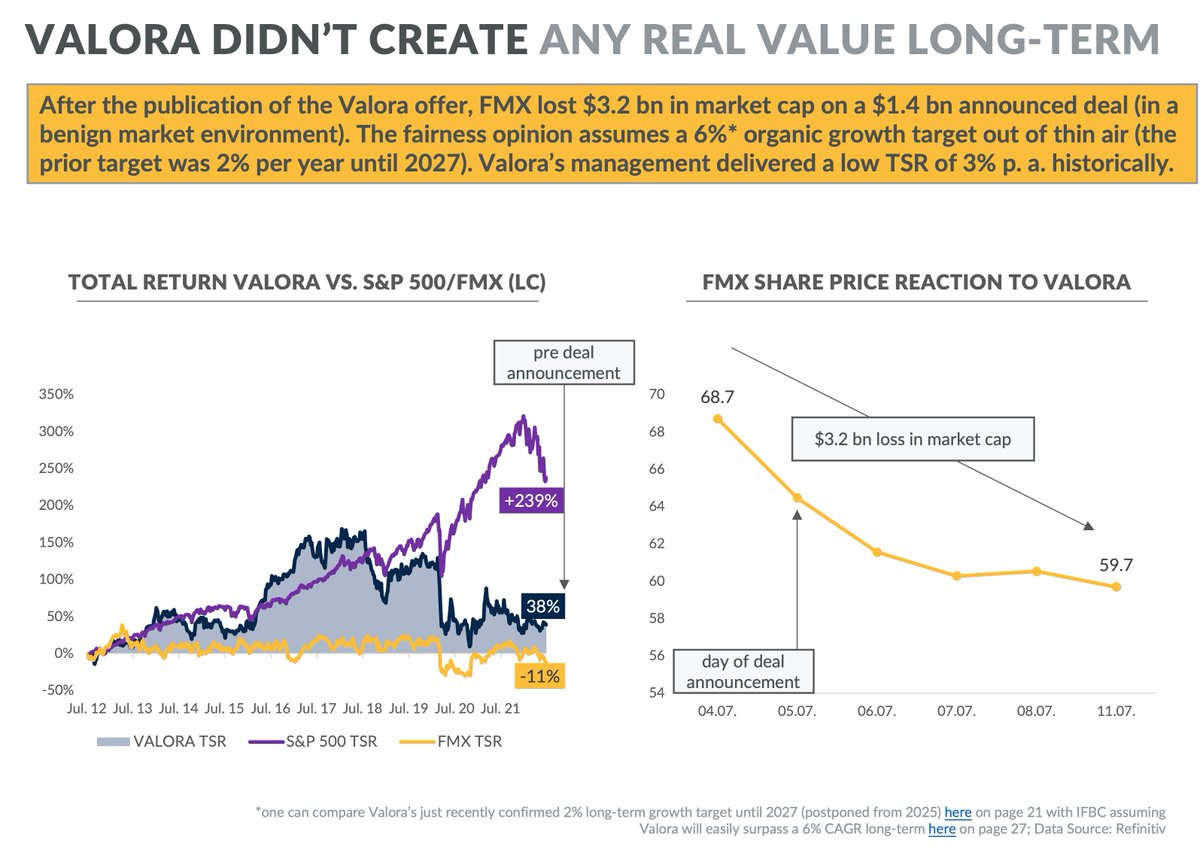

M&A for Envoy is conducted by a local team which has yet to prove itself. It didn’t help the big picture that on 5th of July 2022 $FMX announced another controversial deal: takeover of Swiss listed group Valora, which runs c-stores in Switzerland/Germany for an EV of $1.4 bn

M&A for Envoy is conducted by a local team which has yet to prove itself. It didn’t help the big picture that on 5th of July 2022 $FMX announced another controversial deal: takeover of Swiss listed group Valora, which runs c-stores in Switzerland/Germany for an EV of $1.4 bn

21/

So there it is: the obvious downside risk for this case is capital misallocation risk in case of lacking price discipline.

Worst outcome imo would be a redeployment of the $HEIA stake into a low IRR alternative.

In stark contrast lies a fintech upside risk in SPIN by OXXO.

So there it is: the obvious downside risk for this case is capital misallocation risk in case of lacking price discipline.

Worst outcome imo would be a redeployment of the $HEIA stake into a low IRR alternative.

In stark contrast lies a fintech upside risk in SPIN by OXXO.

22/

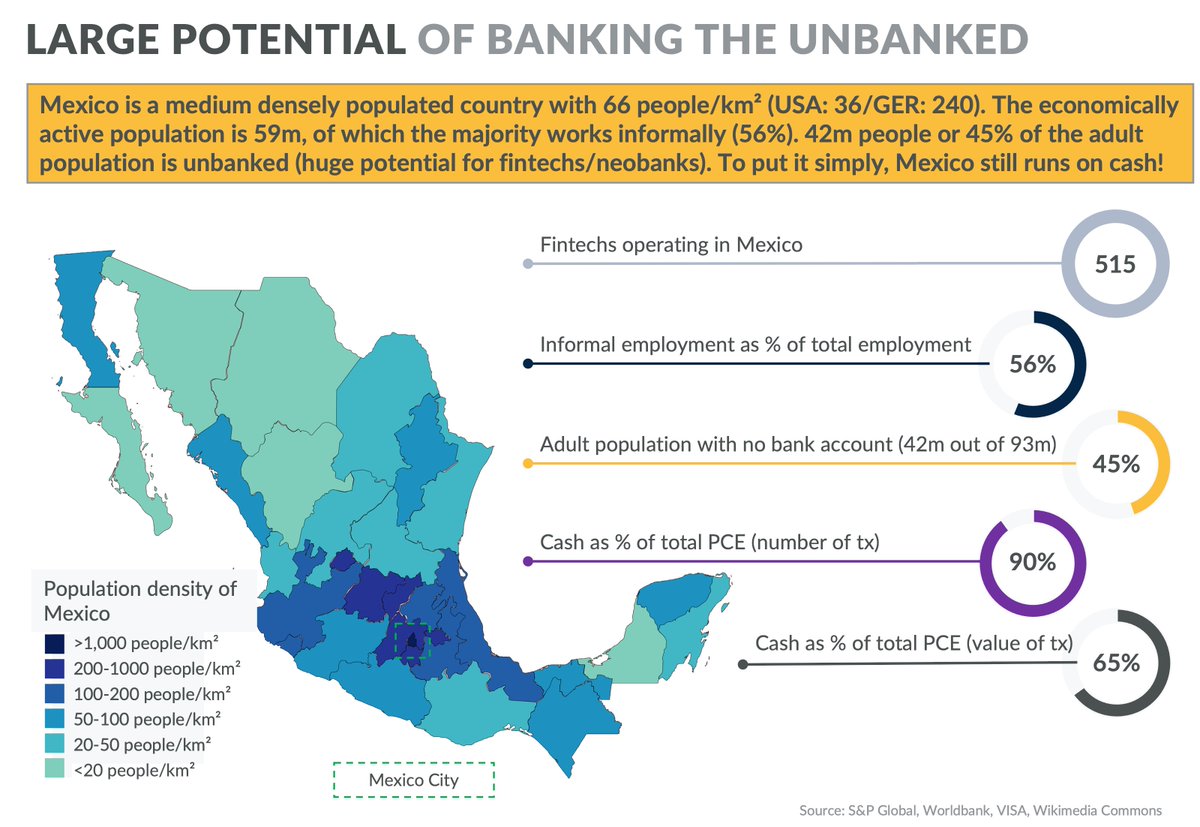

Mobile wallets in emerging markets must solve for the fundamental question of how to inject money into a new digital platform.

Offline cash-in/cash-out (CICO) agent networks are crucial (see e. g. M-Pesa). OXXO represents 46% of Mexican banking access points, boosting SPIN.

Mobile wallets in emerging markets must solve for the fundamental question of how to inject money into a new digital platform.

Offline cash-in/cash-out (CICO) agent networks are crucial (see e. g. M-Pesa). OXXO represents 46% of Mexican banking access points, boosting SPIN.

23/

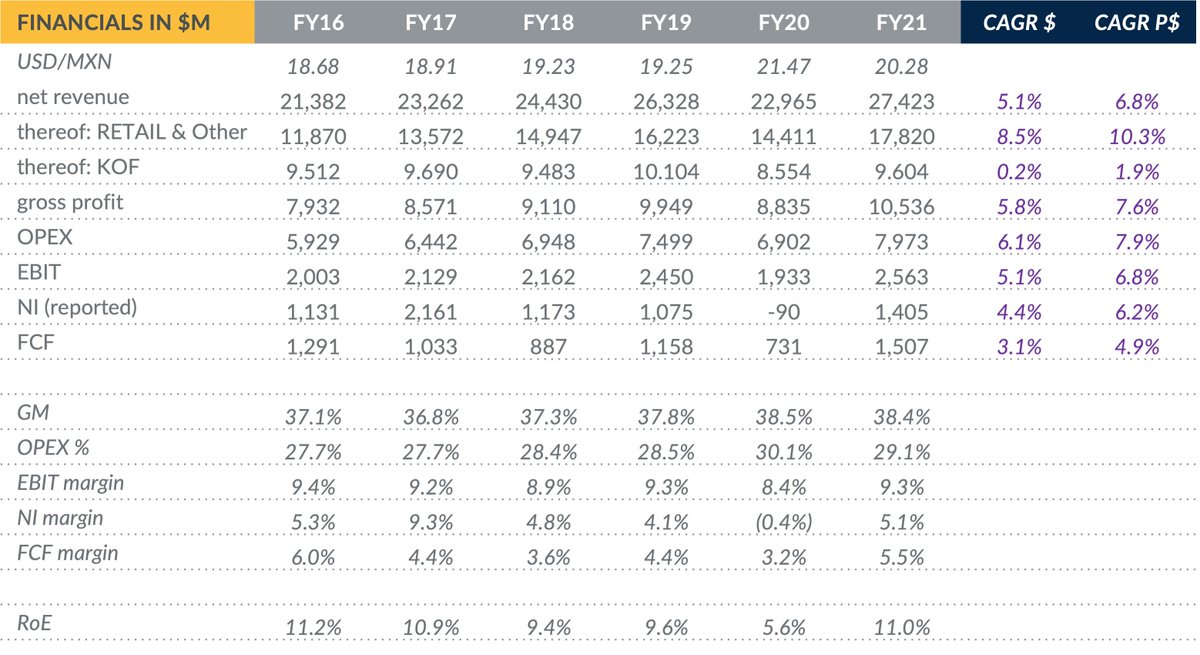

"FINANCIALS AND THOUGHTS ON VALUATION": With $KOF and $HEIA achieving almost no growth, FMX RETAIL with HSD growth drove a consolidated revenue CAGR of 5.1% from FY2016-21.

Going forward, I’d expect a similar trajectory for $FMX consolidated (MSD revenue and HSD NI growth).

"FINANCIALS AND THOUGHTS ON VALUATION": With $KOF and $HEIA achieving almost no growth, FMX RETAIL with HSD growth drove a consolidated revenue CAGR of 5.1% from FY2016-21.

Going forward, I’d expect a similar trajectory for $FMX consolidated (MSD revenue and HSD NI growth).

24/

"CONCLUSION": With $FMX trading at historic low multiples ~6x EBITDA, KOF down -65% from peak, it's not hard to see why some brokers see upside in a SOTP valuation.

In my opinion the biggest risk for the case is a redeployment of the Heineken stake into low IRR alternative.

"CONCLUSION": With $FMX trading at historic low multiples ~6x EBITDA, KOF down -65% from peak, it's not hard to see why some brokers see upside in a SOTP valuation.

In my opinion the biggest risk for the case is a redeployment of the Heineken stake into low IRR alternative.

25/

Is there something else I can recommend from #FinTwit on $FMX?

- Investor Letter @ChrisPavese: broyhillasset.com/wp-content/upl…

- Blog Post @memyselfandi006: valueandopportunity.com/2020/12/17/fem…

- Substack @packyM, @Post_Market: notboring.co/p/femsa

- Tweets: @ohcapideas, @LatamData, @irbezek

Is there something else I can recommend from #FinTwit on $FMX?

- Investor Letter @ChrisPavese: broyhillasset.com/wp-content/upl…

- Blog Post @memyselfandi006: valueandopportunity.com/2020/12/17/fem…

- Substack @packyM, @Post_Market: notboring.co/p/femsa

- Tweets: @ohcapideas, @LatamData, @irbezek

26/End

Full patient-capital.de/s/FMX.pdf

My last deck (SPOT) reached interesting ppl based on likes/RT of some of my fav accs here (all worth a follow): @TSOH_Investing @borrowed_ideas @YHamiltonBlog @SleepwellCap @goodinvestingc

If anyone finds this valuable plz like/share 🧡 thx!

Full patient-capital.de/s/FMX.pdf

My last deck (SPOT) reached interesting ppl based on likes/RT of some of my fav accs here (all worth a follow): @TSOH_Investing @borrowed_ideas @YHamiltonBlog @SleepwellCap @goodinvestingc

If anyone finds this valuable plz like/share 🧡 thx!

• • •

Missing some Tweet in this thread? You can try to

force a refresh