🪙FIS & M10 are collaborating for a test CBDC sandbox

While rather swept behind the scenes, theres a lotta connections behind M10 & some SSB's that point towards some HUGE things for $QNT & #TC307

🐇Let's dive down the rabbit hole🧵🔽

ledgerinsights.com/fis-is-latest-…

While rather swept behind the scenes, theres a lotta connections behind M10 & some SSB's that point towards some HUGE things for $QNT & #TC307

🐇Let's dive down the rabbit hole🧵🔽

ledgerinsights.com/fis-is-latest-…

By now we've heard of @FISGlobal, an $HBAR governing member alongside 26 other large corps.

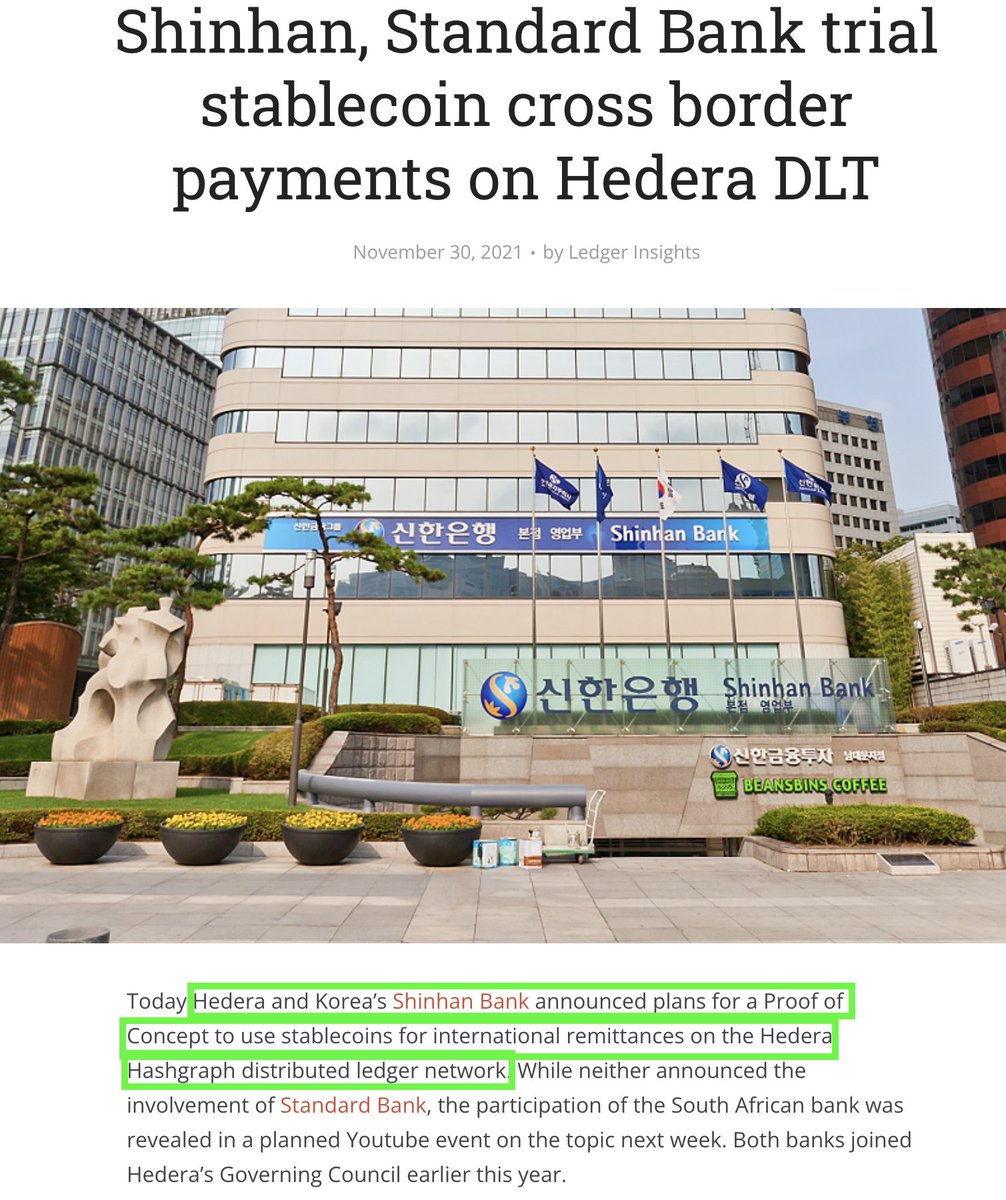

2 of these members Shinhan Bank🇰🇷 & Standard Bank🇿🇦 have tested X-Border stablecoins on $HBAR about a year ago

2 of these members Shinhan Bank🇰🇷 & Standard Bank🇿🇦 have tested X-Border stablecoins on $HBAR about a year ago

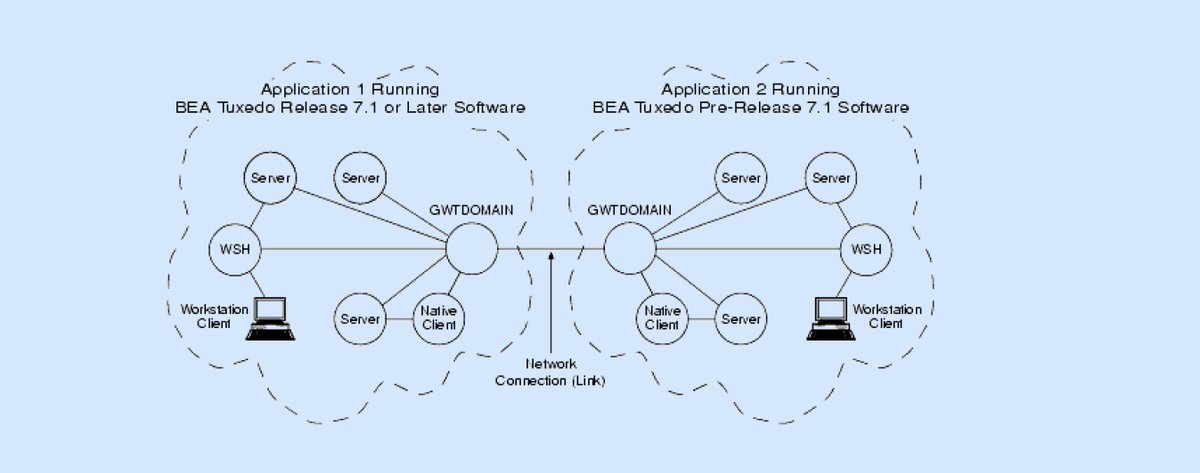

Though this collaboration is not using $HBAR, rather its using @m10io network⭕️

💸M10 is a FinTech focused on digital payments & currencies for efficiency in banking networks

Aside from FIS they've also landed some other key partners such as IBM (Another $HBAR member)

💸M10 is a FinTech focused on digital payments & currencies for efficiency in banking networks

Aside from FIS they've also landed some other key partners such as IBM (Another $HBAR member)

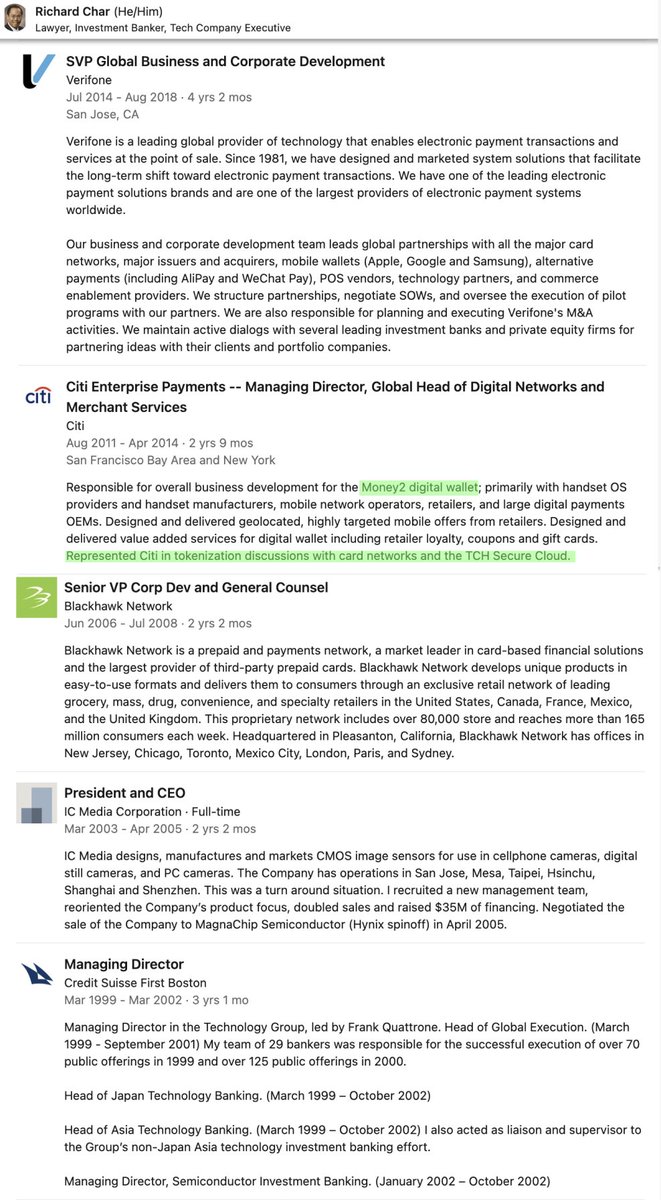

Looking at the technical development side of the team, we see strong experience in FinTec/Financial Services with positions at IBM, Citi, Verifone, etc

As expected out of a FinTech company building for the future of digital payments👍

But of course theres more...👀🔽

As expected out of a FinTech company building for the future of digital payments👍

But of course theres more...👀🔽

This is the M10 CEO, Marten Nelson. Shortly after he cofounded M10 in Dec 2019, just 6 months later he joined the ITU as a Vice Team Lead in a group heavily focused around "interoperability" 🤔

Let's take a look at how the ITU plans to tackle this issue

Let's take a look at how the ITU plans to tackle this issue

ITU is the first specialized @UN agency established back in 1865 for all things communication & information technology.

Its a collaborative from both governments & private sector players with over 193 member countries, 700 sector members & over 150 academias🤯

Its a collaborative from both governments & private sector players with over 193 member countries, 700 sector members & over 150 academias🤯

DCGI stands for Digital Currency Group Initiative. Much like MITs work with CBDCs w other central banks, @Stanford is also working towards the future of digital currencies w @ITU

It'll be interesting to see how they solve these 3 key pillars

🔗AIRU

🔏PG

🧑⚖️SA

It'll be interesting to see how they solve these 3 key pillars

🔗AIRU

🔏PG

🧑⚖️SA

Arguably they're another powerful standard setting body. So when we think of "interoperability requirements" whats need?

✅Governance

✅Standardization

✅Regulation

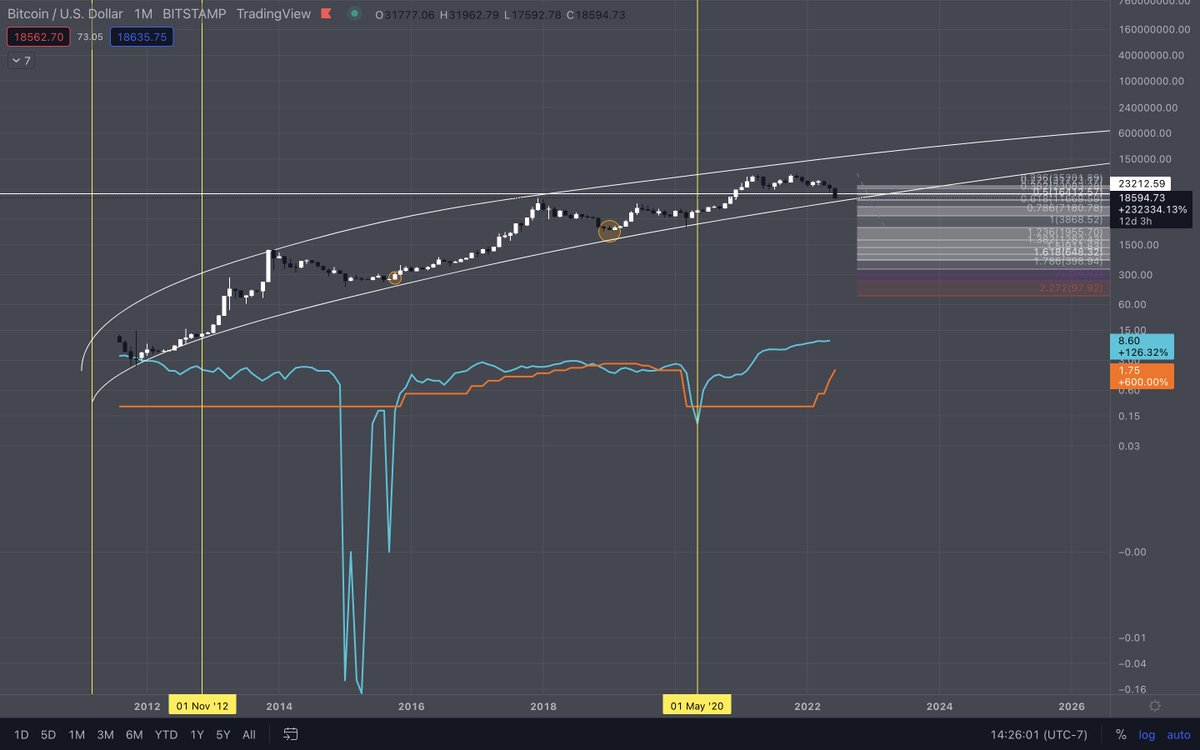

But theres a standard for this already being built out by ISO titled #TC307 $QNT

✅Governance

✅Standardization

✅Regulation

But theres a standard for this already being built out by ISO titled #TC307 $QNT

The whole scope of ISO TC307 is gonna take multiple standard setting bodies. Which is why ITU & ISO are collaborating on the integration of #TC307 together!

So now we have ISO & ITU onboard for #TC307

While the #IETF is building out SAT/ODAP

Things are looking pretty good 👍

So now we have ISO & ITU onboard for #TC307

While the #IETF is building out SAT/ODAP

Things are looking pretty good 👍

In fact, Gilbert Verdian as the founder of TC307 has likely directly had some work with them

While no confirmation, its very likely ITU's DCGI could be using #TC307 for digital currency interoperability, which solves their AIRU pillar🏁

While no confirmation, its very likely ITU's DCGI could be using #TC307 for digital currency interoperability, which solves their AIRU pillar🏁

The Head of AIRU department, Julio Faura also has some connections to the development of digital currencies w connections to Santander, Consensys & Fnality

▷ These volunteering experiences are quite interesting too, especially Alastria w their leads to $QNT

▷ These volunteering experiences are quite interesting too, especially Alastria w their leads to $QNT

You may remember @Danieleidan, hes the senior advisor to @BIS_org & also an AIRU member in the ITU DCGI

Check out his work @StandardsCanada w the focus on #TC307

We've already seen the BIS interoperability solution in their CBDC papers 👀

Check out his work @StandardsCanada w the focus on #TC307

We've already seen the BIS interoperability solution in their CBDC papers 👀

https://twitter.com/Tokenicer/status/1543683074805747713?s=20&t=Z74da95mYKzJsBpJa-dE7w

If that wasn't enough of seeing ISO X ITU working together to solidify ISO TC307. Meet Ismael

He alongside Gilbert Verdian co-chair @INATBA_org one of the largest blockchain consortiums filled with FinTechs, crypto startups such as $XRP $MNW $VET $ALGO, policymakers, etc

He alongside Gilbert Verdian co-chair @INATBA_org one of the largest blockchain consortiums filled with FinTechs, crypto startups such as $XRP $MNW $VET $ALGO, policymakers, etc

Looking at Ismael's background, some serious work w standards & governing

🌐Not only is he referred to as an EXPERT in ITU for DLT, he also serves as Spains expert to delegate TC307 in that region on behalf of ISO

The @LACChain certification makes it even more interesting👀

🌐Not only is he referred to as an EXPERT in ITU for DLT, he also serves as Spains expert to delegate TC307 in that region on behalf of ISO

The @LACChain certification makes it even more interesting👀

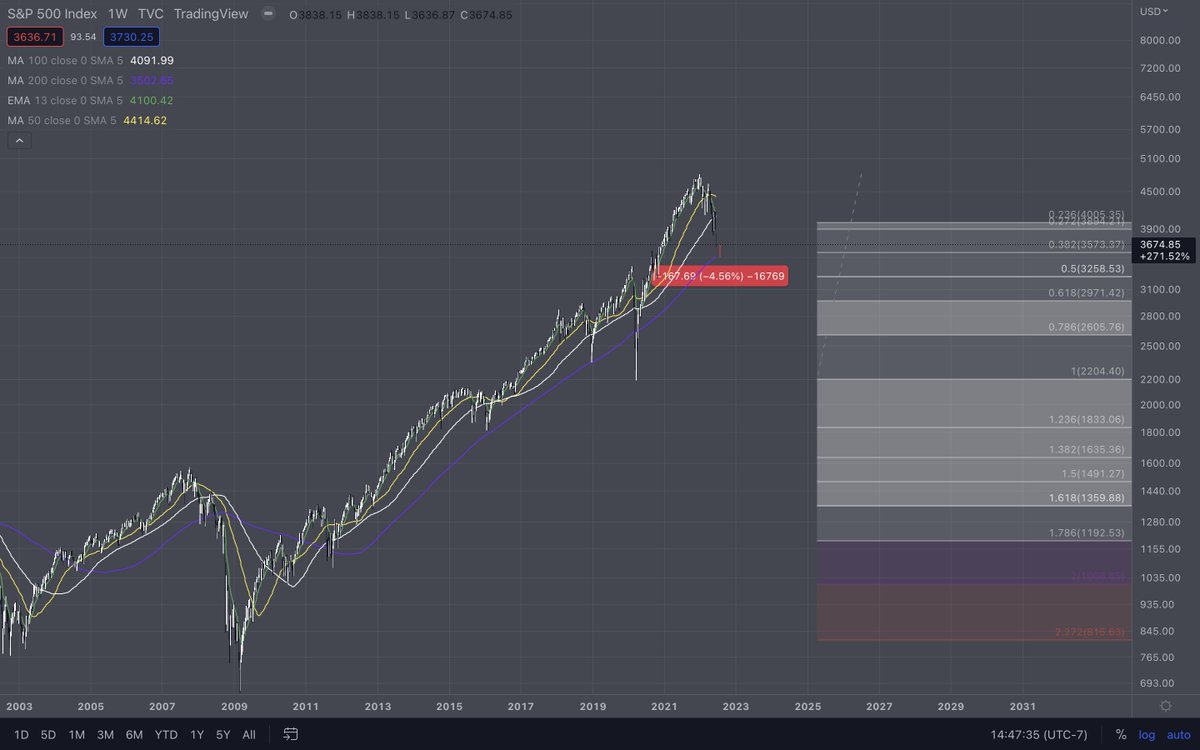

So now in ITU we see ties to Spain, Alastria, ISO TC307, Canada, BIS....

I've previously mentioned the connections of $QNT & $LCX to the BoC & MAS w Jasper/Ubin to potentially TC307

@GregLunt27 also highlights the essentiality of Spain in his Meta 🧵🔽

I've previously mentioned the connections of $QNT & $LCX to the BoC & MAS w Jasper/Ubin to potentially TC307

@GregLunt27 also highlights the essentiality of Spain in his Meta 🧵🔽

https://twitter.com/GregLunt27/status/1527676454237941761?s=20&t=Z74da95mYKzJsBpJa-dE7w

We all knew how big ISO is & the scope of TC307, but who woulda known it was this intertwined with OTHER global standard setting bodies?!

This rabbit holes led me to more connections we'll discuss on these organizations

Feelin #Quamfy w this level of adoption $QNT

This rabbit holes led me to more connections we'll discuss on these organizations

Feelin #Quamfy w this level of adoption $QNT

🦒As usual, this was all broken down & shared first @terramoonvnture and further discussed on yesterdays 🍵⏲️ in our FREE section

If you guys want first hand access to all my research & to how I use it to play the markets, join now!

Code: tokenice

🔽🔽🔽

discord.gg/2Cca7x2x5n

If you guys want first hand access to all my research & to how I use it to play the markets, join now!

Code: tokenice

🔽🔽🔽

discord.gg/2Cca7x2x5n

If you guys enjoyed this rabbit hole, a follow/retweet would be much appreciated to spread the knowledge🤍

I try to consistently bring quality DLT research on regulated players like $QNT $DAG $HBAR, Hyperledger, R3, ISO, etc

I try to consistently bring quality DLT research on regulated players like $QNT $DAG $HBAR, Hyperledger, R3, ISO, etc

https://twitter.com/Tokenicer/status/1564685075123687425?s=20&t=xHpZM_SLoJzyqbQZu4bzbg

• • •

Missing some Tweet in this thread? You can try to

force a refresh