EU Commission organized SSB, @ETSI_STANDARDS had recently published a group report on interoperability between permissioned DLTs

This organization has over 900 members from 65+ countries. Let's see what they had to say

🔽🧵🔬

This organization has over 900 members from 65+ countries. Let's see what they had to say

🔽🧵🔬

🌐While not as big as ISO or ITU, the ETSI has previously collaborated w these other SSB's on multiple occasions

With an agreement signed between them & ITU in 2000

Along with collaborating in multiple ISO working groups for IoT semantic interoperability🤔

With an agreement signed between them & ITU in 2000

Along with collaborating in multiple ISO working groups for IoT semantic interoperability🤔

1⃣Right away we already see an ISO Standard reference in their references.

TS 23635, this standard is on "guidelines for governance for blockchain & DLT". But who do we see as the technical committee for this standard?

Thats right, the standard founded by $QNT CEO #TC307

TS 23635, this standard is on "guidelines for governance for blockchain & DLT". But who do we see as the technical committee for this standard?

Thats right, the standard founded by $QNT CEO #TC307

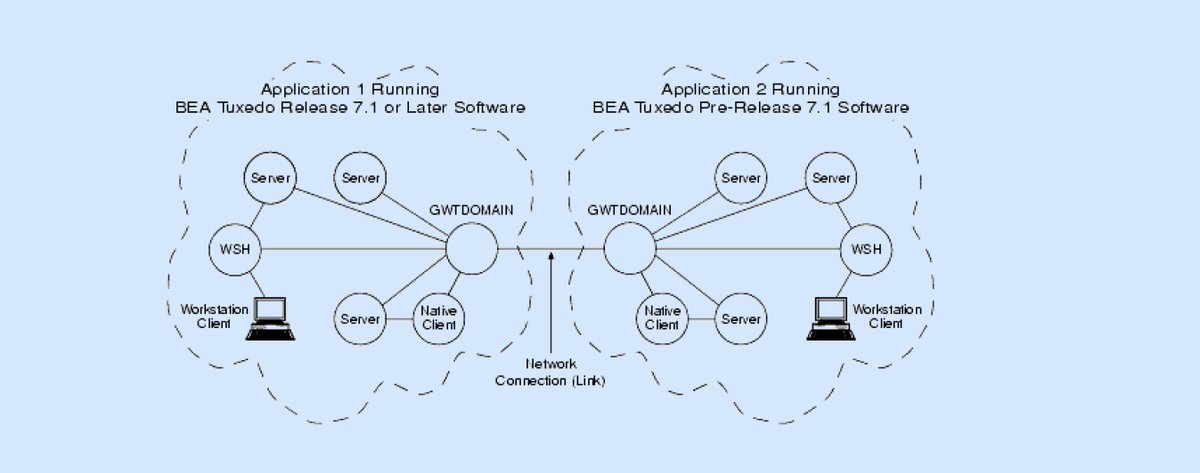

Looking a lil further, we see multiple mentions towards API Gateways sitting between layers. A DLT interoperability solution that $QNT is specifically using

There are also some talks of security risks in the event a Gateway fails & ways around solving the issue

There are also some talks of security risks in the event a Gateway fails & ways around solving the issue

Interoperability governance is also mentioned. A section of interoperability thats almost never mentioned in the crypto side of development

MIT CTO & SAT Co-Author Thomas Hardjono had previously said

"You need to figure out your layered architecture... before moving assets"🎙️

MIT CTO & SAT Co-Author Thomas Hardjono had previously said

"You need to figure out your layered architecture... before moving assets"🎙️

They also mention apps for interoperability. This would a HUGE advancement for DLT as a whole & very few projects have such a solution.

mDapps on Overledger is one of these solutions $QNT

🔌A multipurpose application accessible from multiple networks

mDapps on Overledger is one of these solutions $QNT

🔌A multipurpose application accessible from multiple networks

Then towards the end, we see a direct mention of ISO/TC307 with a table showing the context of each part of the interoperability procedure

@ETSI_STANDARDS likely knows what $QNT has been building

@ETSI_STANDARDS likely knows what $QNT has been building

For anyone whose forgotten or maybe has doubts on the connections of $QNT w the European Council

Keep in mind Gilbert was at one point a EU Commission member on blockchain/DLT Framework & likely having some work w drafting #MiCA given the connections

Keep in mind Gilbert was at one point a EU Commission member on blockchain/DLT Framework & likely having some work w drafting #MiCA given the connections

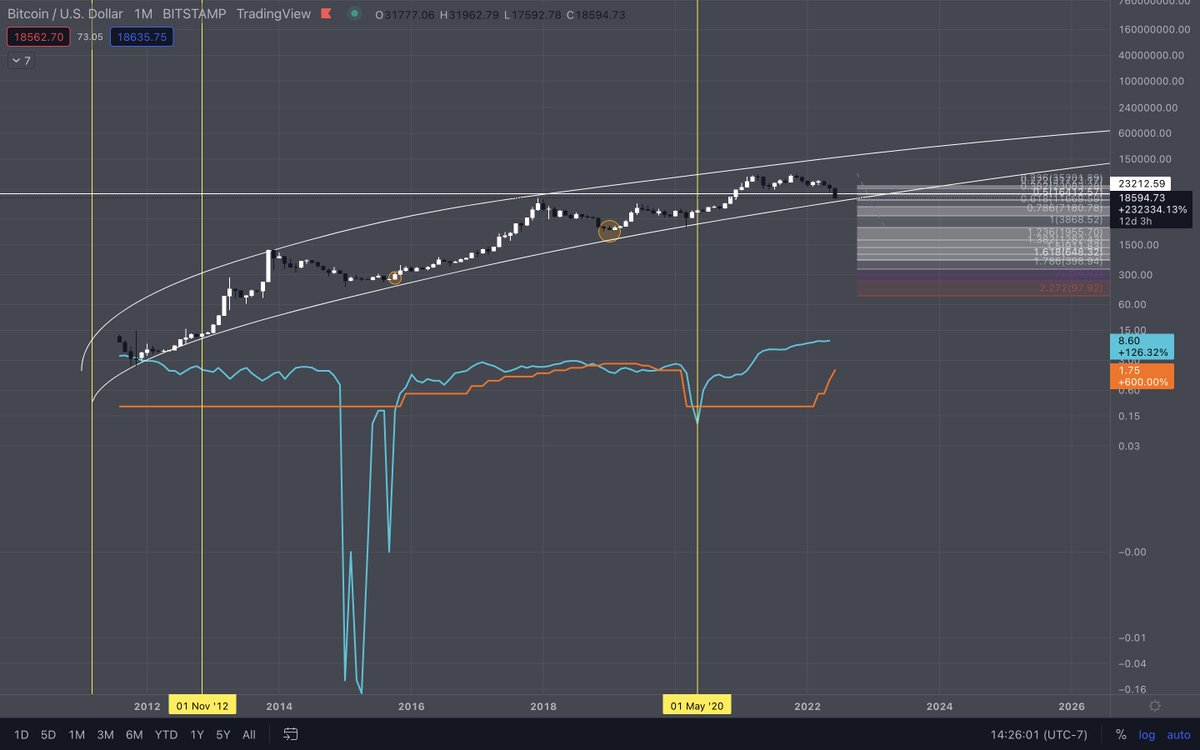

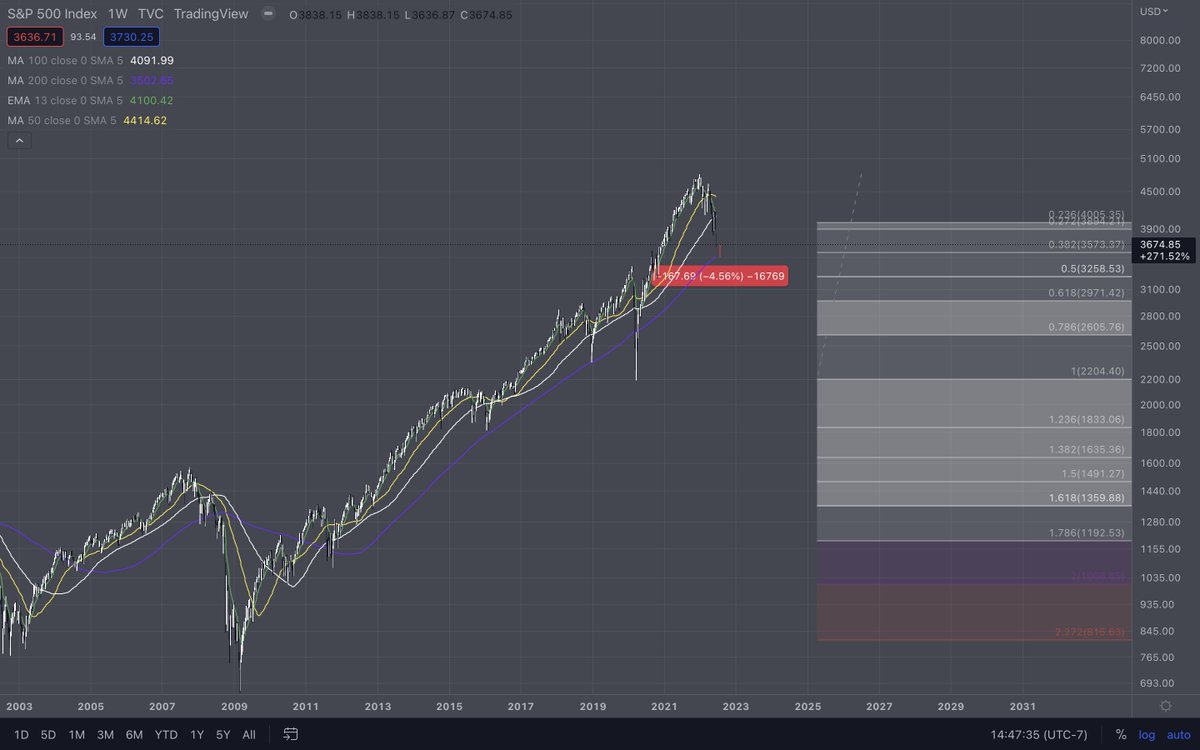

🌎TC307s already seen adoption around the world with countries in ISO

But now we're witnessing the growth of this standard in other Standard Setting Bodies such as the ITU, UN/CEFACT & now ETSI

🪐I believe we're reaching the turning point for TRUE industry application for DLT

But now we're witnessing the growth of this standard in other Standard Setting Bodies such as the ITU, UN/CEFACT & now ETSI

🪐I believe we're reaching the turning point for TRUE industry application for DLT

• • •

Missing some Tweet in this thread? You can try to

force a refresh