GMX and dYdX appear to be the dominant destinations for traders seeking leverage in DeFi, but how do they stack up against each other?

@MattFiebach and @swmartin19 break it down for you 🧵👇

@MattFiebach and @swmartin19 break it down for you 🧵👇

1/ The derivatives market for crypto is absolutely huge.

Of the ~$100B of futures volume traded on FTX, Binance, BTCEX, dYdX, and GMX on Aug 31, dYdX and GMX captured less than 2% of the volume.

This makes us optimistic that both dapps have a long runway for growth.

Of the ~$100B of futures volume traded on FTX, Binance, BTCEX, dYdX, and GMX on Aug 31, dYdX and GMX captured less than 2% of the volume.

This makes us optimistic that both dapps have a long runway for growth.

2/ dYdX operates similarly to its CEX counterparts by charging traders a funding rate to keep the perp price in line with the spot price:

Positive funding rate = longs pay shorts

Negative funding rate = shorts pay longs

dYdX has seen nearly $700B of historical trading volume.

Positive funding rate = longs pay shorts

Negative funding rate = shorts pay longs

dYdX has seen nearly $700B of historical trading volume.

3/ GMX, on the other hand, operates more similarly to a decentralized margin trading account.

It does have a funding rate, but does not use it to balance long and short positions like dYdX.

It instead calculates the funding rate based on GLP asset utilization.

It does have a funding rate, but does not use it to balance long and short positions like dYdX.

It instead calculates the funding rate based on GLP asset utilization.

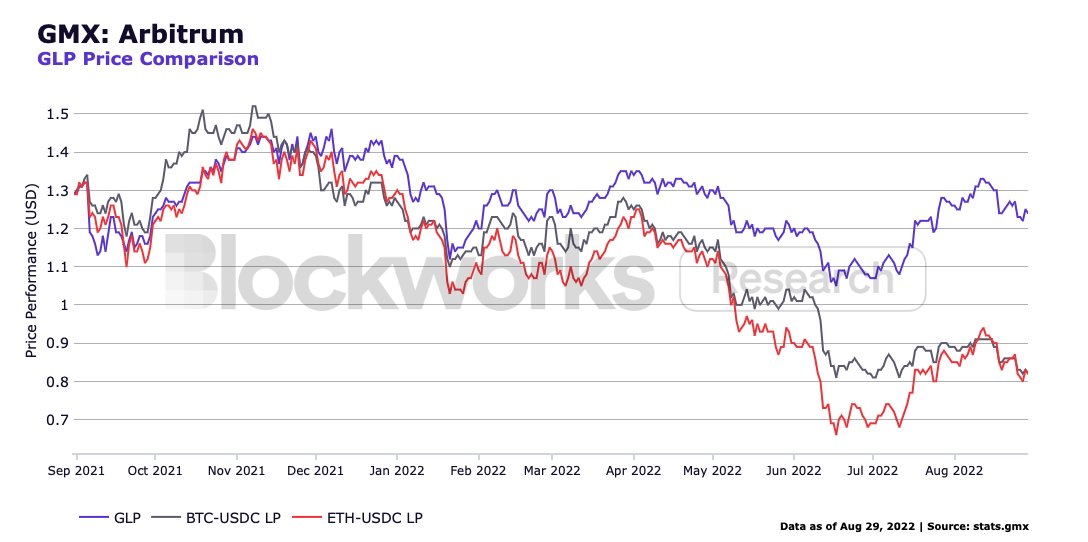

4/ This is where dYdX has an advantage.

If you can get paid to go short on dYdX, what is the point of going short on GMX?

Despite this, GLP has performed extremely well when compared to other popular LP positions after baking in its 70% allocation of trading fee revenue.

If you can get paid to go short on dYdX, what is the point of going short on GMX?

Despite this, GLP has performed extremely well when compared to other popular LP positions after baking in its 70% allocation of trading fee revenue.

5/ GLP acts as the counterparty to traders.

Long positions use the asset being longed as collateral and short positions use stablecoins as collateral.

If traders wins big on GMX going short, GLP LPs take the loss in stables while dollar-denominated AUM gets crushed.

Long positions use the asset being longed as collateral and short positions use stablecoins as collateral.

If traders wins big on GMX going short, GLP LPs take the loss in stables while dollar-denominated AUM gets crushed.

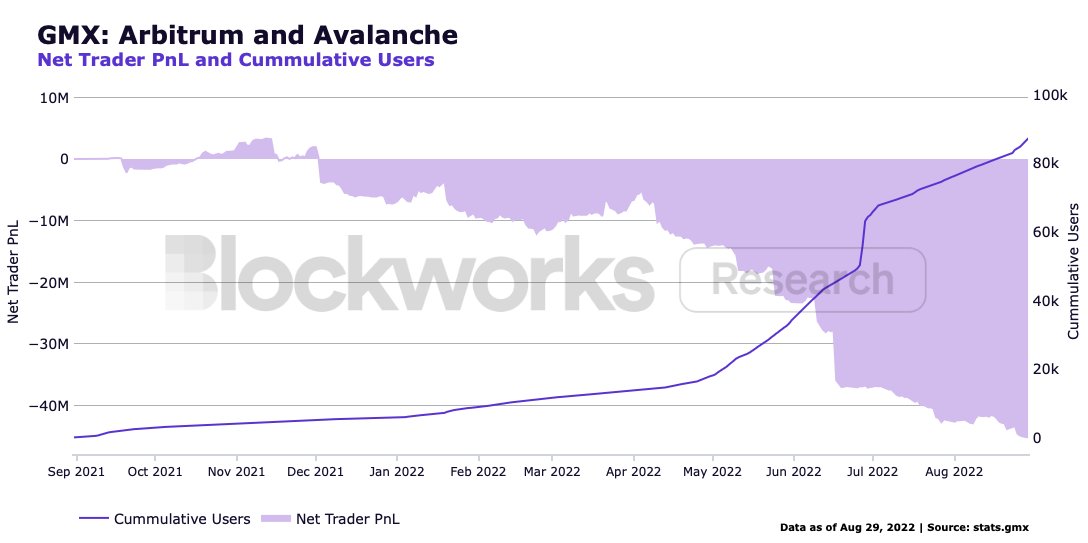

6/ However, despite that being one of the primary risks associated with GMX's design, the house (GLP LPs) normally wins.

There have been over 80k traders attempt to beat GLP LPs, and they are now down over $40M since GMX launched last year.

There have been over 80k traders attempt to beat GLP LPs, and they are now down over $40M since GMX launched last year.

7/ Not only have traders consistently been slaughtered, but they pay fees to do so - 70% to GLP LPs and 30% to GMX single-sided stakers.

This has resulted in ~$77M of revenue paid out to token holders.

GLP AUM continues to grow, which creates more volume and protocol revenue.

This has resulted in ~$77M of revenue paid out to token holders.

GLP AUM continues to grow, which creates more volume and protocol revenue.

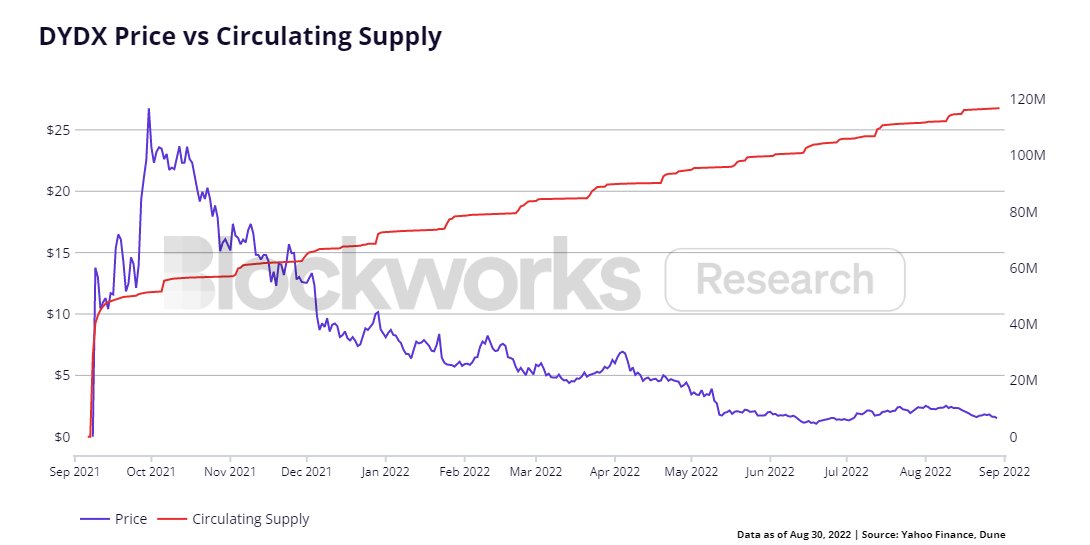

8/ dYdX's $700B of volume dwarfs GMX's $45B, but all of the revenue is flowing back to the company.

Additionally, volume is likely inflated from dYdX token incentives.

While the incentives are tempting, users are essentially trading USDC fees for an inflationary token.

Additionally, volume is likely inflated from dYdX token incentives.

While the incentives are tempting, users are essentially trading USDC fees for an inflationary token.

9/ dYdX v4 will be on its own app-specific Cosmos chain which will provide more opportunities for token value accrual and improve decentralization.

But it doesnt come w/o challenges:

- Increased security cost

- MEV problems

- No gasless trading

- Less optimal for performance

But it doesnt come w/o challenges:

- Increased security cost

- MEV problems

- No gasless trading

- Less optimal for performance

10/ dYdX is the king for now, but GMX is catching up quickly with their zero price impact trades and revenue share model with token holders.

Only time will tell if GMX can oust dYdX as the dominant player, but we have no doubt DEXs will continue to eat CEX marketshare.

Only time will tell if GMX can oust dYdX as the dominant player, but we have no doubt DEXs will continue to eat CEX marketshare.

11/ For a deeper dive into these two protocols, check out our most recent report and stay tuned for part 2 where we dive into the small caps.

Also be sure to follow @blockworksres if you enjoyed this thread.

blockworksresearch.com/research/decen…

Also be sure to follow @blockworksres if you enjoyed this thread.

blockworksresearch.com/research/decen…

• • •

Missing some Tweet in this thread? You can try to

force a refresh