Struggling intraday traders will spend TIME to save MONEY.

Successful intraday traders will spend MONEY to save TIME.

But this world has many beautiful souls, and they offer their products for free users.

Top-8 FREE TOOLS for Intraday Trading:

Thread 🧵

Successful intraday traders will spend MONEY to save TIME.

But this world has many beautiful souls, and they offer their products for free users.

Top-8 FREE TOOLS for Intraday Trading:

Thread 🧵

1 - Tradingview

It is the #1 charting platform in the world.

You can view all charts for free. Besides, you can also use this tool for

- Backtest

- Set alert

- Screening

- Paper Trading

Check this for more details:

profiletraders.in/post/tradingvi…

@tradingview

It is the #1 charting platform in the world.

You can view all charts for free. Besides, you can also use this tool for

- Backtest

- Set alert

- Screening

- Paper Trading

Check this for more details:

profiletraders.in/post/tradingvi…

@tradingview

2 - Chartink

Scanning good stocks for next-day trading is an essential process for day traders.

It contains 1000s of screeners on various criteria.

@ChartinkConnect

chartink.com/screeners

Scanning good stocks for next-day trading is an essential process for day traders.

It contains 1000s of screeners on various criteria.

@ChartinkConnect

chartink.com/screeners

3 - Gocharting

It is the first Indian web-based market profile & order flow charting platform.

Along with charts, one can also see free EOD market profile charts, multiple-charts-in-one window, and options chain details for free

@gocharting

gocharting.com/terminal?ticke…

It is the first Indian web-based market profile & order flow charting platform.

Along with charts, one can also see free EOD market profile charts, multiple-charts-in-one window, and options chain details for free

@gocharting

gocharting.com/terminal?ticke…

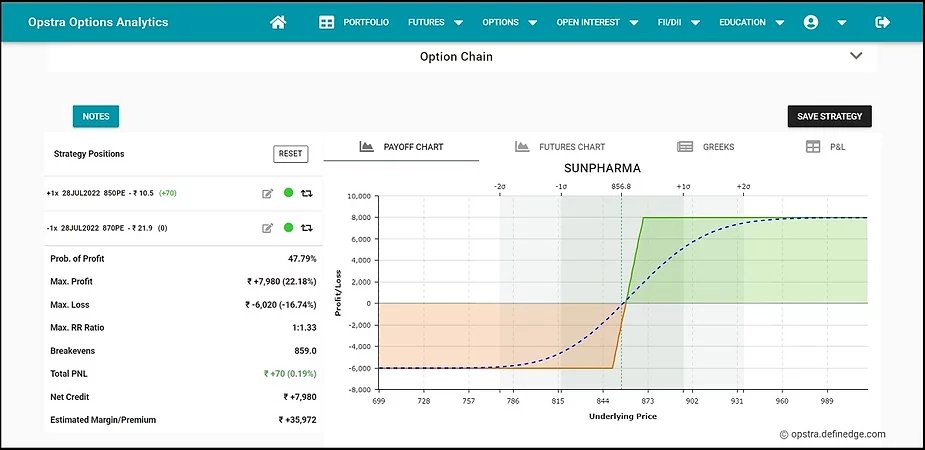

4 - Opstra Define Edge

Some options strategies are difficult to visualize the P&L.

But Opstra provides a simple interface to know the outcome of your strategy (P&L, probability of success, max loss, max profit, etc.).

Know more

profiletraders.in/post/how-to-te…

Some options strategies are difficult to visualize the P&L.

But Opstra provides a simple interface to know the outcome of your strategy (P&L, probability of success, max loss, max profit, etc.).

Know more

profiletraders.in/post/how-to-te…

5 - Ninja Trader

It is a powerful trading platform for day traders.

It has many charting, analysis, and backtesting tools, which immensely help day traders.

Software is free, but one must buy the data to use it.

It is a powerful trading platform for day traders.

It has many charting, analysis, and backtesting tools, which immensely help day traders.

Software is free, but one must buy the data to use it.

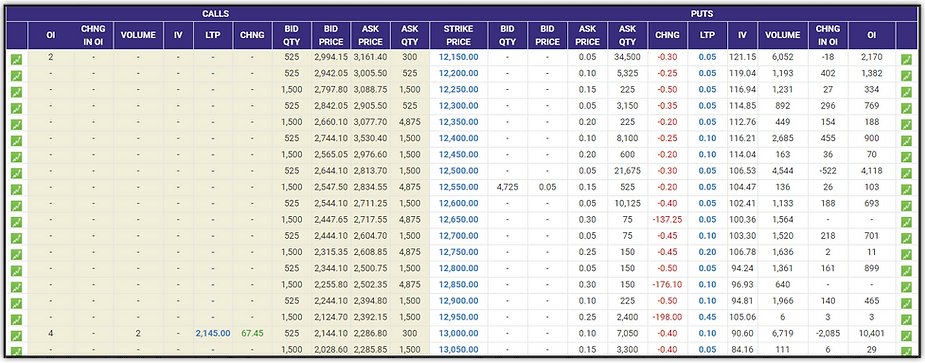

6 - NSE Options Chain

For day traders & options traders, option chain data is crucial.

It helps traders check the liquidity, price, Implied Volatility (IV), and Open Interest (OI) details of each specific strike price option.

NSE Options chain - nseindia.com/option-chain

For day traders & options traders, option chain data is crucial.

It helps traders check the liquidity, price, Implied Volatility (IV), and Open Interest (OI) details of each specific strike price option.

NSE Options chain - nseindia.com/option-chain

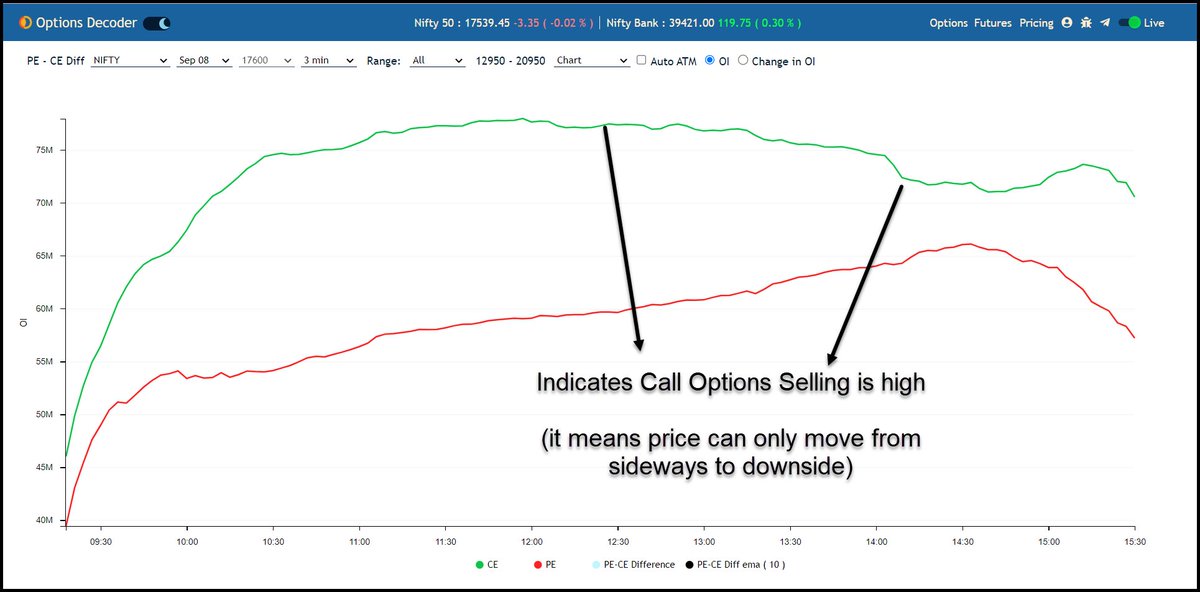

7 - Options Decoder

Options OI details are important to understanding big players' games.

Anyone can see options OI details for free after market hours.

options-decoder.truedata.in/ce-pe-differen…

@truedata1 @TrueData2

Options OI details are important to understanding big players' games.

Anyone can see options OI details for free after market hours.

options-decoder.truedata.in/ce-pe-differen…

@truedata1 @TrueData2

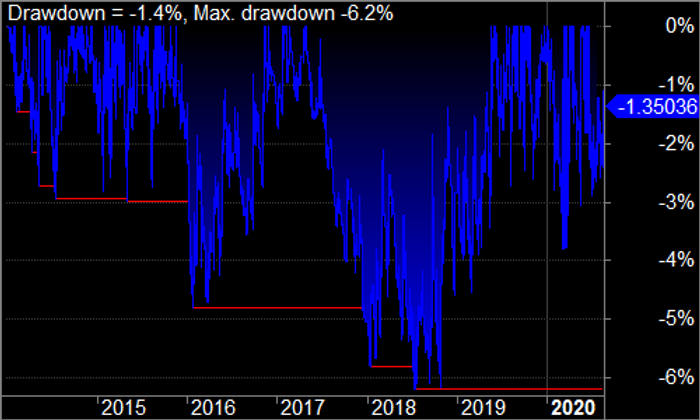

8 - Amibroker

Anyone can use amibroker for free for backtesting, historical analysis, optimization, etc.

But one has to buy the license only if they aim to deploy algo trading.

Anyone can use amibroker for free for backtesting, historical analysis, optimization, etc.

But one has to buy the license only if they aim to deploy algo trading.

That's a wrap!

If you enjoyed this thread:

1. Follow me

@indraziths

for more threads on the stock market trading

2. RT the tweet below to share this thread with your audience

One can also check this free online course

stockmarketcourses.in/s/store/course…

If you enjoyed this thread:

1. Follow me

@indraziths

for more threads on the stock market trading

2. RT the tweet below to share this thread with your audience

One can also check this free online course

stockmarketcourses.in/s/store/course…

• • •

Missing some Tweet in this thread? You can try to

force a refresh