Much awaited session at Kolkata by Utpal Seth, Rare Enterprises, on "Dimensions of Mistakes in Investing", to be moderated by Varun Goenka.

#MAW

#MAW

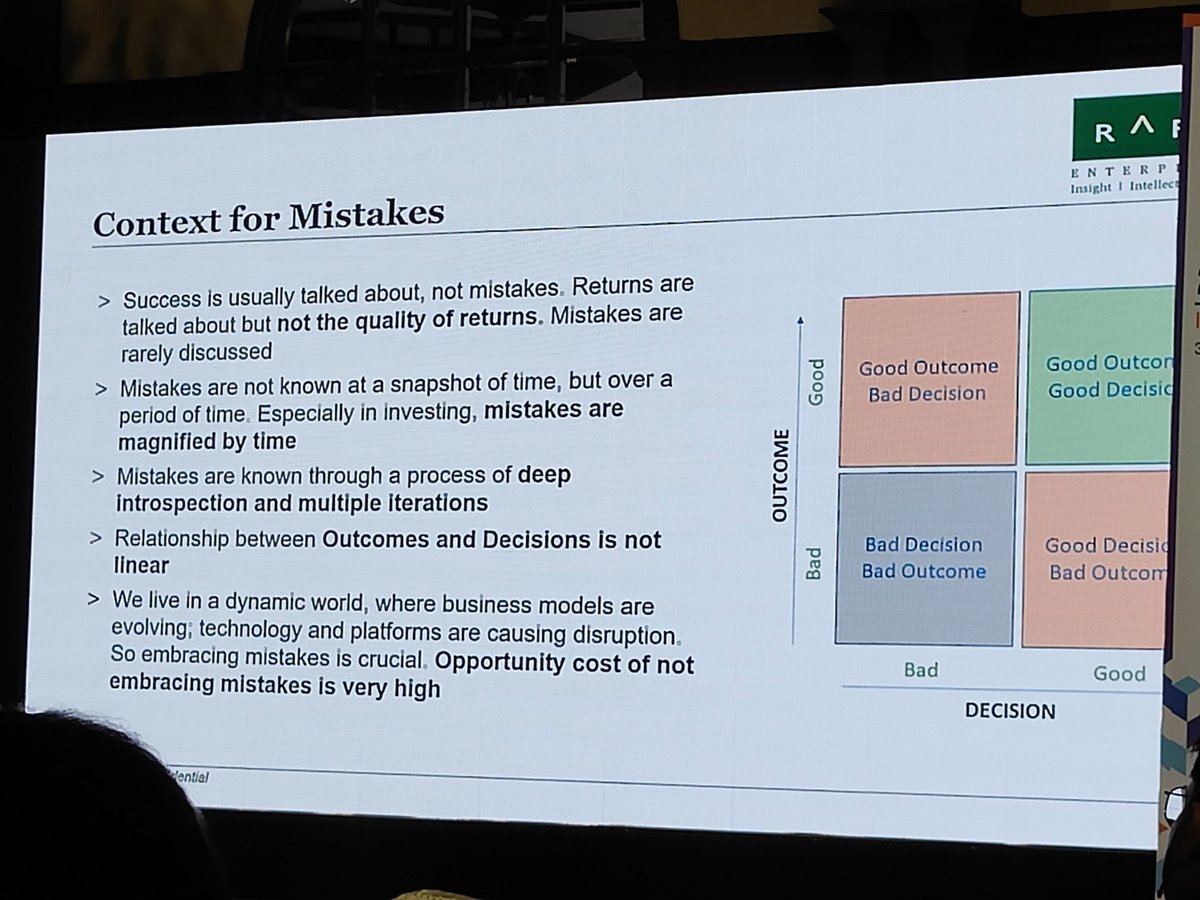

Utpal Sheth lays out the context for today's session - Mistakes are rarely discussed!

Outcomes don't define mistakes. They are known through a process of deep introspection & multiple iterations. The opportunity cost of not embracing mistakes is very high.

Outcomes don't define mistakes. They are known through a process of deep introspection & multiple iterations. The opportunity cost of not embracing mistakes is very high.

When speaking of mistakes in investing, we often speak of 'Type 2 errors', and at times of type 1 errors. Utpal speaks of Type 1.5 error - not buying / selling with conviction!

Utpal discusses their process with mistakes - and quotes Rakesh Jhunjhunwala - making mistakes isn't a crime, repeating them is. Discusses mistakes at RARE Enterprises with the audience with ease.

One needs to think of portfolio balance very deeply. Sizing the bet depends on the degree of conviction and degree of evidence. Recommended book: "Thinking in Bets"

On thinking about investment mistakes - 3 key steps - identification, attribution and rectification. Attribution of mistakes needs time and thought - one need not wait to attribute mistakes for rectification!

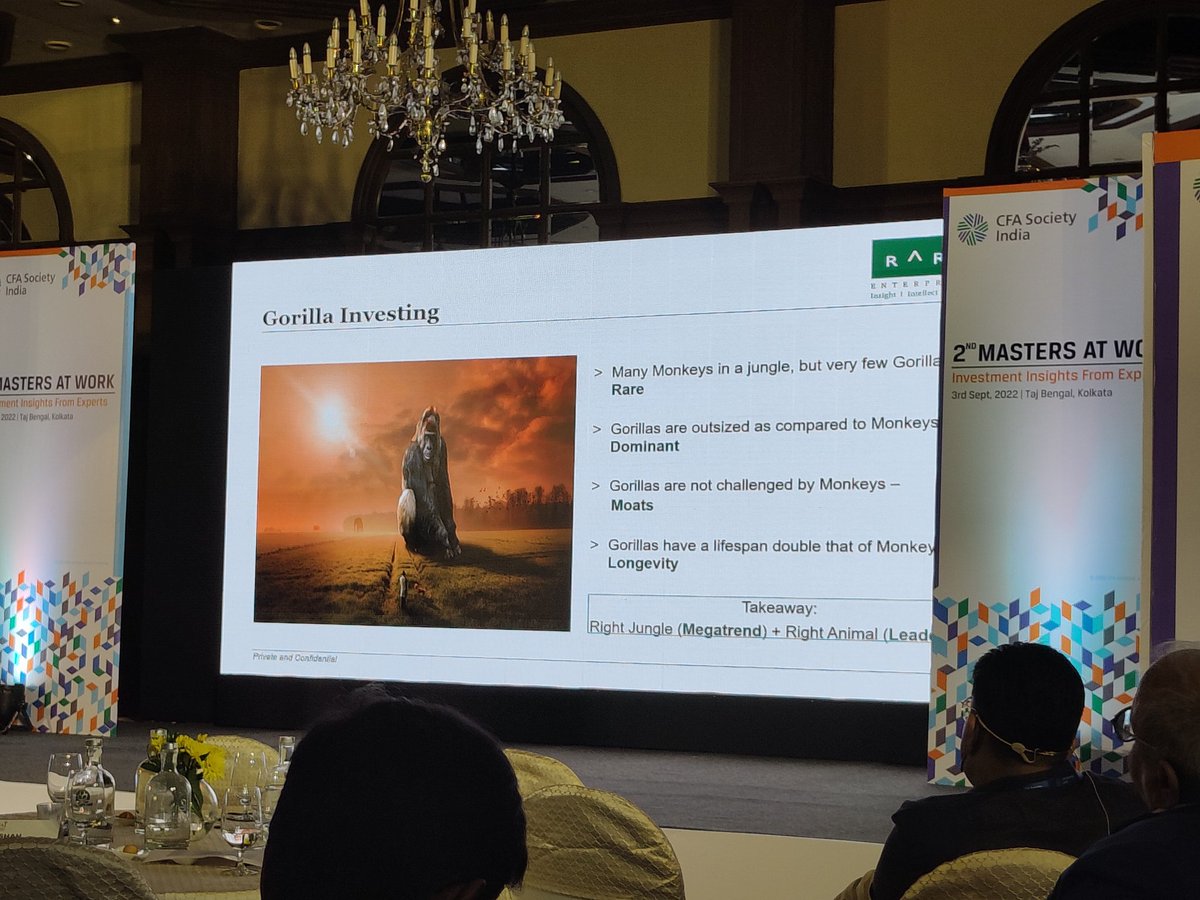

Buying right is tough. The probability of making a good investment is low - due to the chance of making a mistake in any of the 5-8 parameters we use for evaluation. The key is to identify the right jungle (Megatrend) and the right company within that (Gorilla).

Discusses in detail examples of mistakes in buying

Type 1 (didn't buy): Bajaj Finance

Type 1.5 (didn't buy enough/sold partly): CRISIL

Type 2 (bought incorrectly): A2Z Infra Engineering

Type 1 (didn't buy): Bajaj Finance

Type 1.5 (didn't buy enough/sold partly): CRISIL

Type 2 (bought incorrectly): A2Z Infra Engineering

Important: Parameters in discussion were on their framework - Identifying the Megatrend (see next tweet) they were part of, and whether they were Clear leader, Near leader, and Emerging leader

Important: Megatrend buckets used by Rare Enterprises: Consumption, Globalisation, Financial deepening, Digitalisation, Outsourcing and Formalisation, and Renewable Energy.

Now discusses Mistakes in selling:

Type 1 (Didn't sell right): Bilcare Limited

Type 1.5 (didn't sell enough): Praj Industries

Type 2 (Sold too early): Relaxo Footwear

These hurt much more, and they have had much to learn from these.

Type 1 (Didn't sell right): Bilcare Limited

Type 1.5 (didn't sell enough): Praj Industries

Type 2 (Sold too early): Relaxo Footwear

These hurt much more, and they have had much to learn from these.

Utpal concludes his presentation with quotes from Rakesh Jhunjhunwala and Jeff Bezos, and adds: Embrace your mistake, let mistakes not affect the balance of your mind, and have a risk Management framework to enable peace of mind.

We now head to the Q&A session, moderated by @VGoenka82

Q: Attitude that helped him achieve heights

A: Learning attitude and adaptability. Hopes to have a learning attitude to the last day, and ensure that it's not an 'ivory tower learning' - it's important to implement and execute (hence adaptability and resilience).

A: Learning attitude and adaptability. Hopes to have a learning attitude to the last day, and ensure that it's not an 'ivory tower learning' - it's important to implement and execute (hence adaptability and resilience).

Q: How to think about portfolio sizing, given the low joint probability of being right?

A: Buy decisions need not be at one point in time. Gradually build conviction - and continue buying - even if at higher levels. Refers to @mjmauboussin 's Probability adjusted Investing.

A: Buy decisions need not be at one point in time. Gradually build conviction - and continue buying - even if at higher levels. Refers to @mjmauboussin 's Probability adjusted Investing.

Speaks on the importance of the right culture in identifying companies that could create terminal value. You can replace the machinery, the product and all else. You can't buy culture!

Q: How to build the right investment team.

A: one needs to have the right enviornment, empowerment,and right leadership. Complementing skills and behaviours should be present - balance between accelerator and brakes.

A: one needs to have the right enviornment, empowerment,and right leadership. Complementing skills and behaviours should be present - balance between accelerator and brakes.

.@VGoenka82 refers to Utpal's session on Megatrends and Leadership at the #VIP conference

Watch here:

Watch here:

Closing remarks from Utpal: Keep learning, keep adapting and keep investing. Don't be afraid of mistakes, protect your state of mind, it's a fulfilling journey. Has had a good time interacting with youngsters here and looks forward to more such at the #MAW conference.

• • •

Missing some Tweet in this thread? You can try to

force a refresh