Supreme Court Asked to Consider if FBAR Penalty Is Excessive Fine taxnotes.com/research/feder…

Separately on Nov. 2/22, in Bittner, the US Supreme Court will hear the case on the issue of whether the non-willful civil #FBAR penalty (found in 5321) - can be applied (based on a reading of 5314) on a "per account" or on a per "form" basis. It's the season of @InFBARWeTrust!

So, Bitter is about the interpretation of penalty application under 31 USC 5314 and 5321. Toth (if the Supreme Court hears the case) is about whether there are constitutional limitations to any penalties imposed under 31 USC 5321.

Bittner appeal assumes the civil @InFBARWeTrust penalty can be imposed. Is this true? 5314 imposes an obligation on ONLY Treasury (obligation to create FBAR). 5314 imposes NO obligation on ANY individual. Link to 5314 and text ... law.cornell.edu/uscode/text/31…

Notice also that under 5314 Treasury has the right (no Congressional approval required) to exempt any person from the FBAR rules INCLUDING #Americansabroad but has refused to do so. Shouldn't @DemsAbroad and @DemsAbroadTax help? isaacbrocksociety.ca/2016/03/07/the…

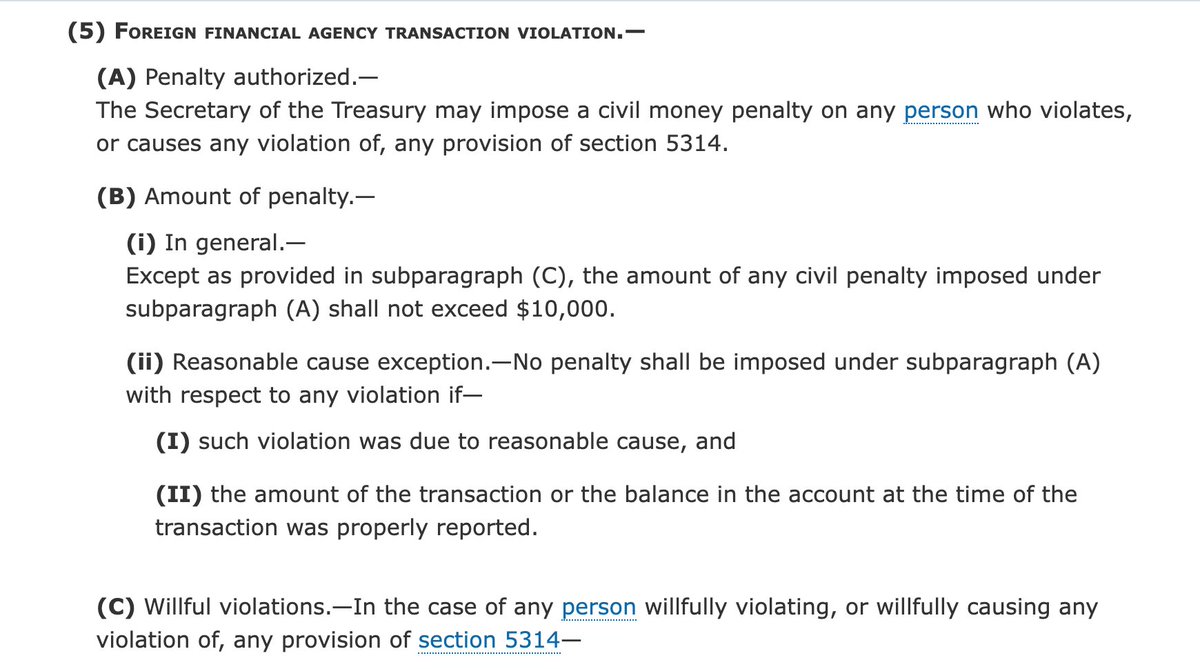

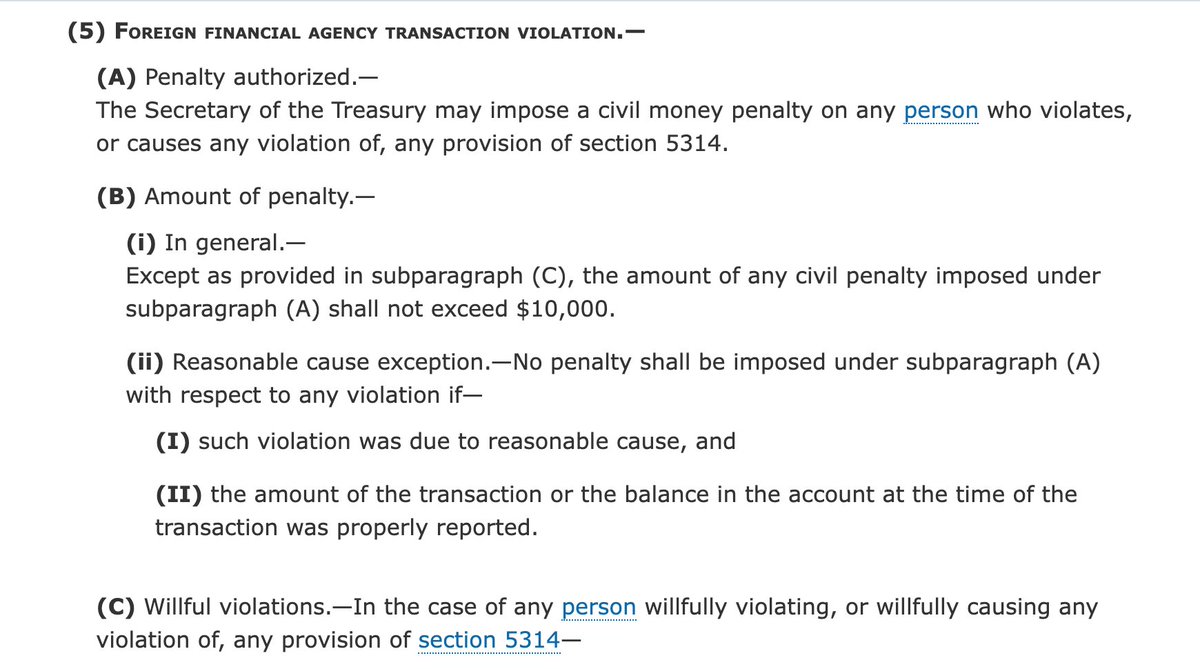

Let's now consider civil @InFBARWeTrust penalty in context of 31 USC 5321(a)(5) which creates a penalty for violating or causing a violation of 5314. Question: if 5314 imposes no obligation on individual, how can 5321 authorize a penalty on individual for violating 5314?

Again: An individual can ONLY violate the Treasury reg which creates the FBAR rules. The individual CANNOT violate 5314 because 5314 creates NO obligation on individual but ONLY on Treasury. The 5321 penalty applies to a violation of 5314 which means ONLY Treas can be penalized.

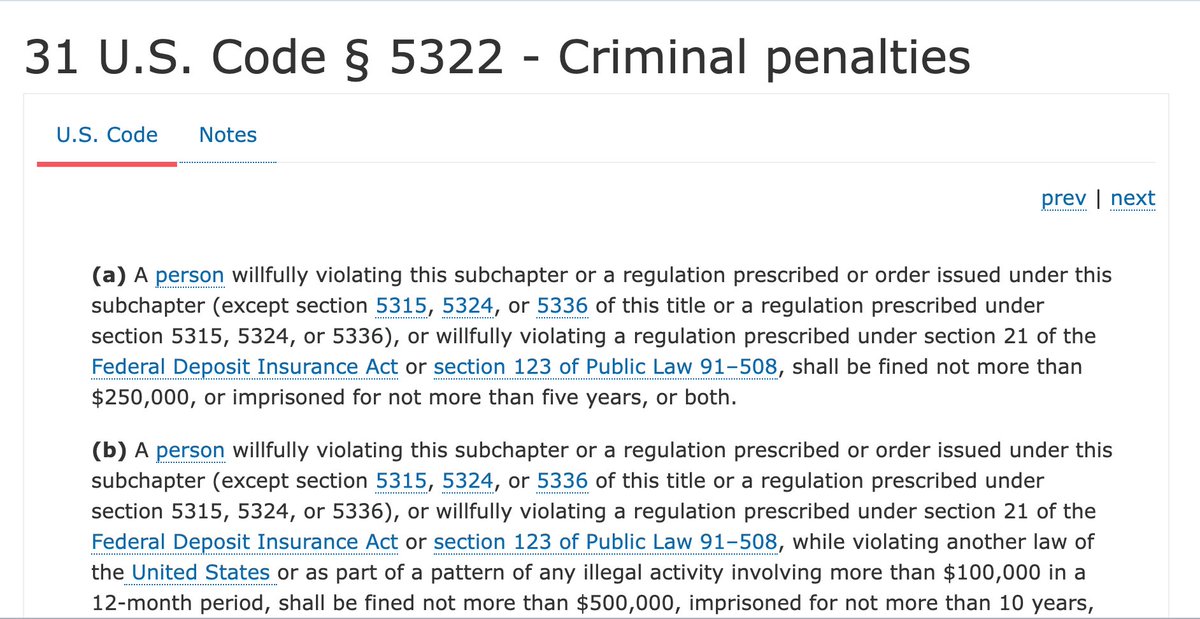

Note also that if we look at Criminal penalties under 5322 it creates a penalty for the violation of the regulation created by Treasury under 5314. 5321 does NOT impose a penalty for violation of regulation. Here are 5321 and 5322 side by side. Thoughts? law.cornell.edu/uscode/text/31…

@threadreaderapp unroll

#FBAR rules created by Treasury pursuant to 31 USC 5314 directive. Congress is irrelevant. Biden admin can exempt #Americansabroad from @InFBARWeTrust. If @DemsAbroad want @USVotersAbroad to #VoteFromAbroad, then @TheDemocrats must arrange for FBAR exemption for @USCitizenAbroad.

• • •

Missing some Tweet in this thread? You can try to

force a refresh