#NIFTY

Our markets are opening with a gap down due to imported weakness, however it recovers strongly during the session.

Lets see what's in store for the upcoming week.

Outlook for the week Sep 5 - Sep 9, 2022.

THREAD: Deconstructing NIFTY on 5 different TF's.

Our markets are opening with a gap down due to imported weakness, however it recovers strongly during the session.

Lets see what's in store for the upcoming week.

Outlook for the week Sep 5 - Sep 9, 2022.

THREAD: Deconstructing NIFTY on 5 different TF's.

#NIFTY

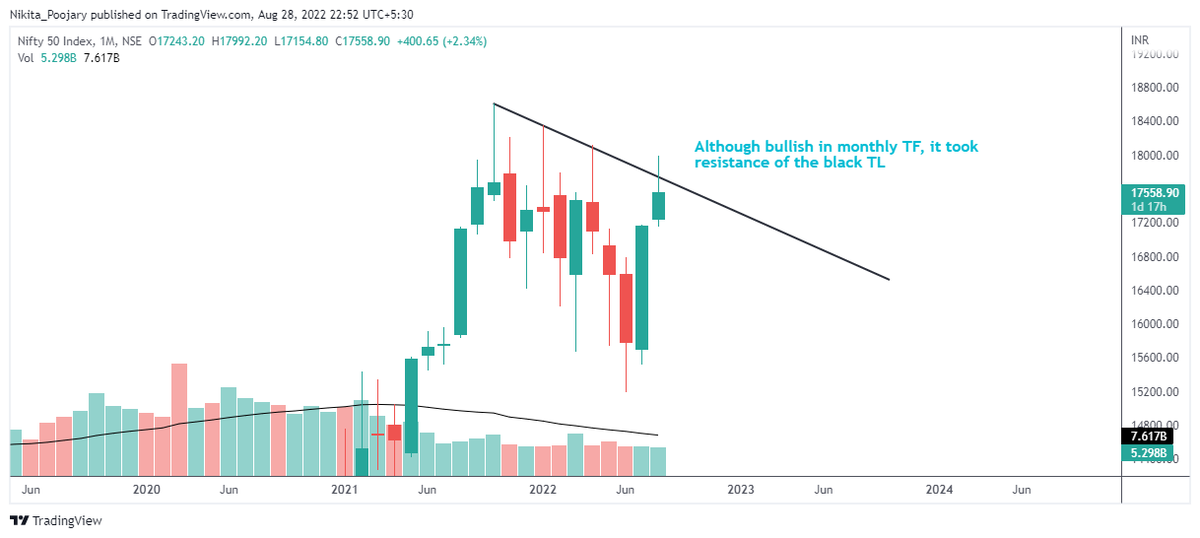

1. Monthly TF:

• NF rallied by 15% in the month of July & Aug

• Bullish on higher TF.

• However NF is facing a resistance (black TL).

1. Monthly TF:

• NF rallied by 15% in the month of July & Aug

• Bullish on higher TF.

• However NF is facing a resistance (black TL).

#NIFTY

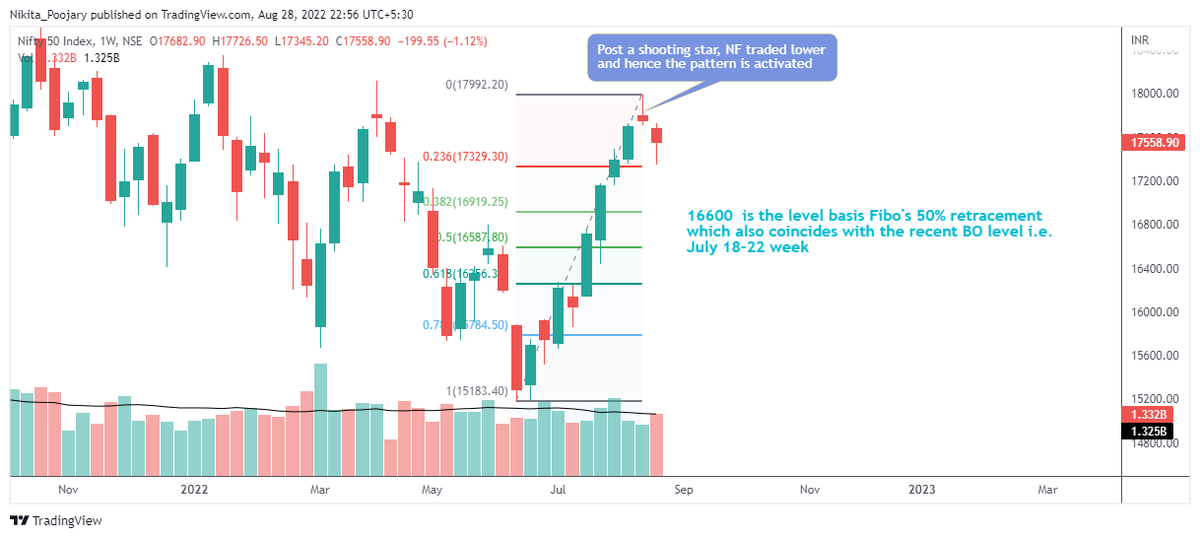

2. Weekly TF:

• Post the formation of shooting star the high of the same is not taken out yet (in fact lower high formation)

• On a higher TF, expecting NF to make a fresh ATH.

• However, NF is still consolidating within 17150-18000 range.

2. Weekly TF:

• Post the formation of shooting star the high of the same is not taken out yet (in fact lower high formation)

• On a higher TF, expecting NF to make a fresh ATH.

• However, NF is still consolidating within 17150-18000 range.

#NIFTY

3. Daily TF:

• In the past 3 trading sessions, inside bar is under formation, better to wait for a break of the high or low of the child bar.

•Closing below 17150 on daily might open the levels for 16800-17150.

3. Daily TF:

• In the past 3 trading sessions, inside bar is under formation, better to wait for a break of the high or low of the child bar.

•Closing below 17150 on daily might open the levels for 16800-17150.

#NIFTY

5. 15min TF:

• Keep an eye on the downward sloping trendline (yellow) & upward sloping trendline (purple) and break of either with a solid confirmation will help us to go towards that direction.

5. 15min TF:

• Keep an eye on the downward sloping trendline (yellow) & upward sloping trendline (purple) and break of either with a solid confirmation will help us to go towards that direction.

Conclusion:

•BNF is more stronger than NF

•17150 has acted as a supported twice in the recent past.

• Closing above 18000 on daily might open the levels for 18300.

•BNF is more stronger than NF

•17150 has acted as a supported twice in the recent past.

• Closing above 18000 on daily might open the levels for 18300.

I regularly share weekly outlook on indices (NIFTY & BANKNIFTY) and many more threads on trading & finance

If you enjoyed this, then do check out the outlook for #BANKNIFTY by clicking here

If you enjoyed this, then do check out the outlook for #BANKNIFTY by clicking here

https://twitter.com/niki_poojary/status/1566360334708850688?s=20&t=4hgbiqwSxdNK790-wWhiWA

• • •

Missing some Tweet in this thread? You can try to

force a refresh