If you pick stocks, you MUST learn how to read a balance sheet.

Here’s everything you need to know:

Here’s everything you need to know:

The balance sheet is one of the 3 major financial statements.

It shows:

▪️Assets: What a company owns

▪️Liabilities: What a company owes

▪️Shareholders Equity: The net worth attributable to its owners (shareholders)

At a fixed point in time

It shows:

▪️Assets: What a company owns

▪️Liabilities: What a company owes

▪️Shareholders Equity: The net worth attributable to its owners (shareholders)

At a fixed point in time

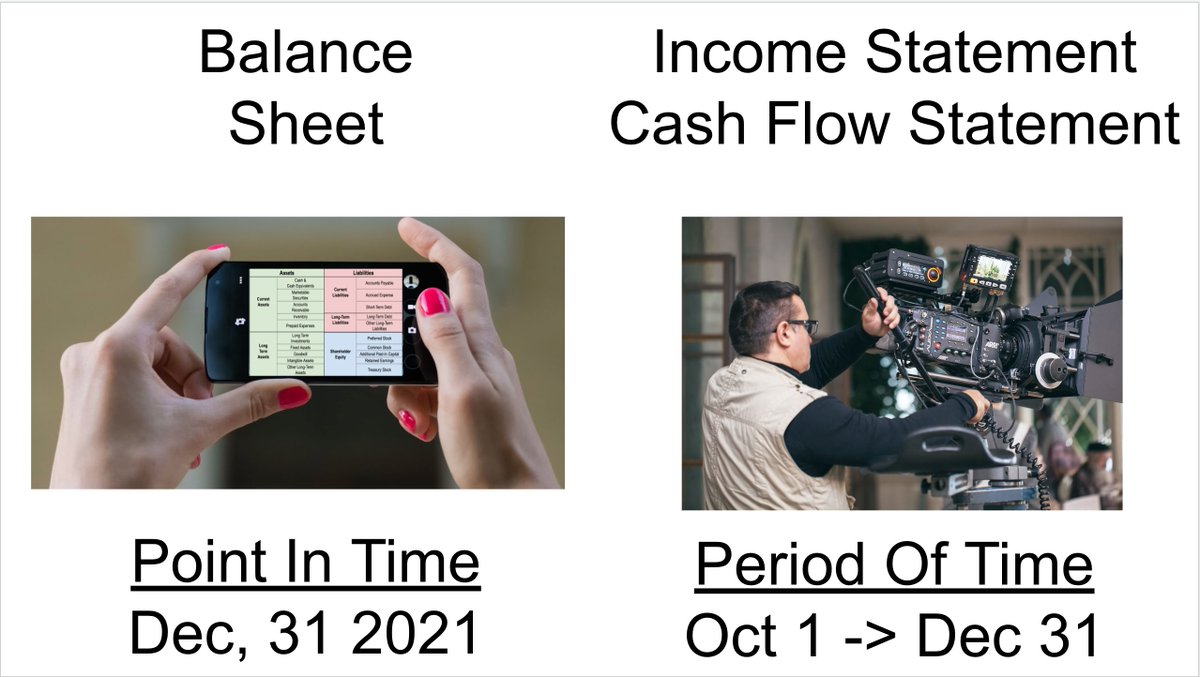

That “at a fixed point in time” part is key!

A balance sheet is a SNAPSHOT of a company’s net worth at a POINT in time, usually measured at the end of a quarter/year.

That differs from an income statement or cash flow statement, both of which are measured over a PERIOD of time

A balance sheet is a SNAPSHOT of a company’s net worth at a POINT in time, usually measured at the end of a quarter/year.

That differs from an income statement or cash flow statement, both of which are measured over a PERIOD of time

Most public companies show their balance sheet in their quarterly earnings press release, but not always

Find them by looking at:

▪️10-Q (quarterly report)

▪️10-K (annual report)

▪️Aggregator websites like @theTIKR

Find them by looking at:

▪️10-Q (quarterly report)

▪️10-K (annual report)

▪️Aggregator websites like @theTIKR

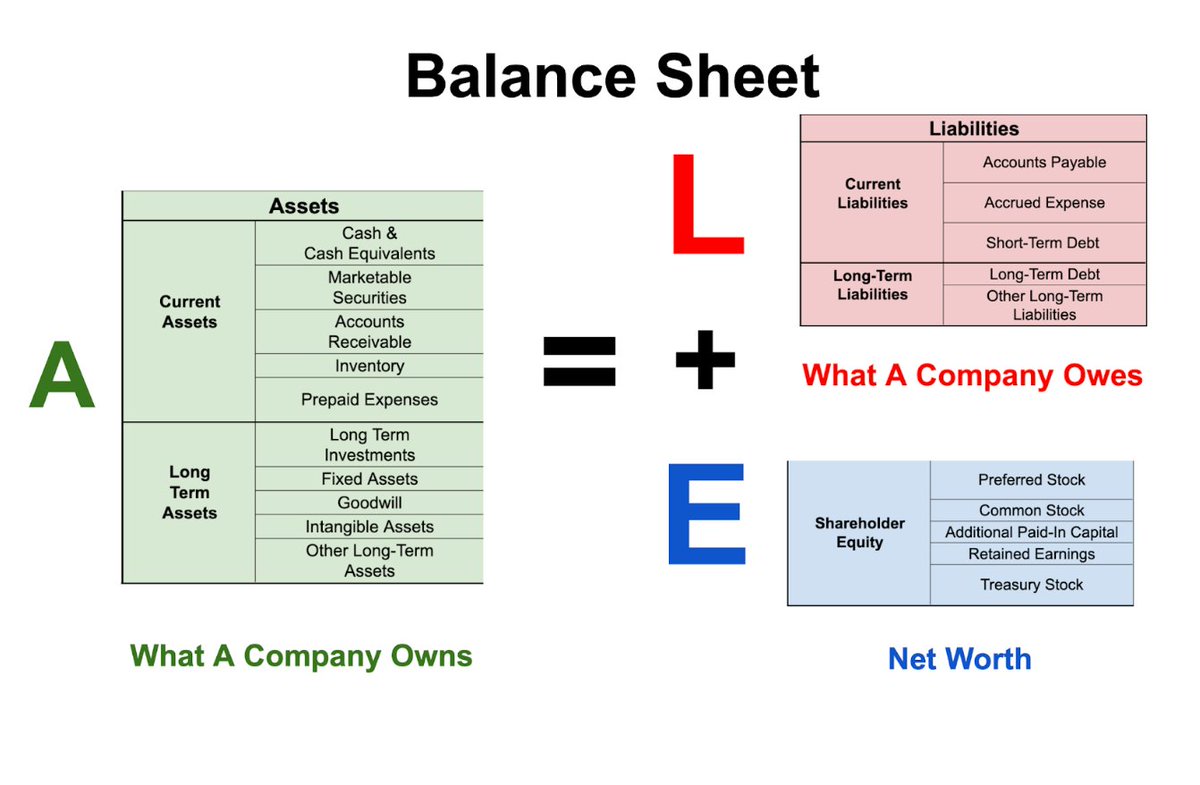

All balance sheets follow the same formula:

Assets = Liabilities + Shareholders Equity

This formula must be in balance at all times

(Hence the term “balance sheet”)

Assets = Liabilities + Shareholders Equity

This formula must be in balance at all times

(Hence the term “balance sheet”)

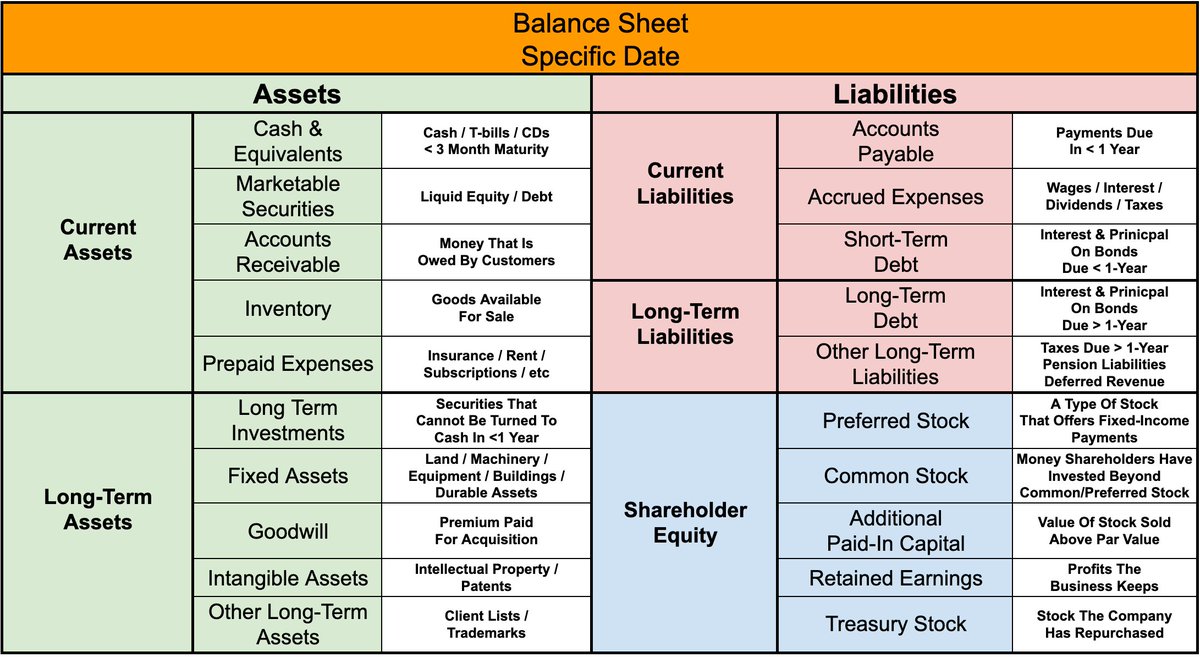

Companies get leeway in how they categorize each item on their balance sheet

This graphic shows some of the most commonly used categories & terms

This graphic shows some of the most commonly used categories & terms

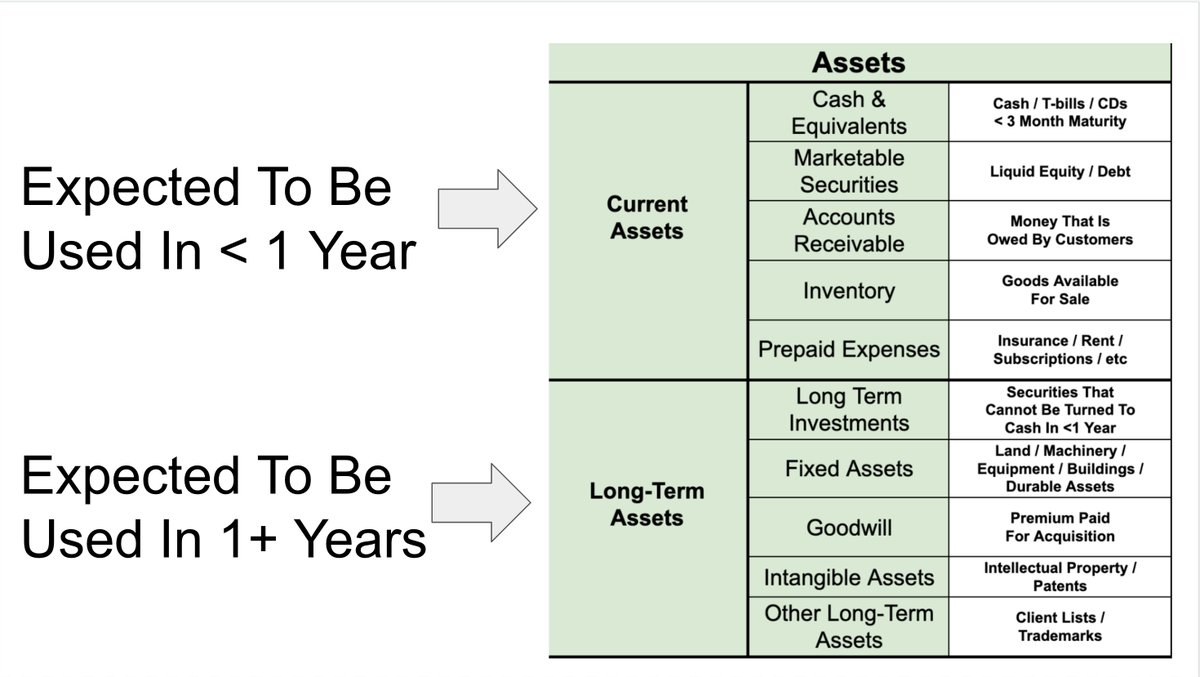

Let’s start with assets, which is what a company OWNS

Assets are listed in order of LIQUIDITY, which means how quickly a security can be turned into cash

The most liquid assets are at the top, the least liquid on the bottom

Assets are listed in order of LIQUIDITY, which means how quickly a security can be turned into cash

The most liquid assets are at the top, the least liquid on the bottom

There are two categories of assets:

Current assets:

▪️Assets that are expected to be used in <1 year

Long-term assets:

▪️Assets that a company will benefit from for >1 year

Current assets:

▪️Assets that are expected to be used in <1 year

Long-term assets:

▪️Assets that a company will benefit from for >1 year

Common current assets:

▪️Cash: Checking account, t-bills, CDs w/ <3 maturity

▪️Marketable Securities: Stocks, bonds...etc that can easily become cash

▪️Accounts Receivable: Money it is owed by its customers

▪️Inventory: Unsold goods

▪️Prepaid expenses: Insurance, rent, etc…

▪️Cash: Checking account, t-bills, CDs w/ <3 maturity

▪️Marketable Securities: Stocks, bonds...etc that can easily become cash

▪️Accounts Receivable: Money it is owed by its customers

▪️Inventory: Unsold goods

▪️Prepaid expenses: Insurance, rent, etc…

Long-term assets come in 2 forms:

1: Tangible Assets (You can touch them)

▪️Buildings

▪️Equipment

▪️Property

▪️Stores

2: Intangible Assets (You can't touch them)

▪️Trademarks

▪️Goodwill (premiums paid to make an acquisition)

▪️Patents

▪️Stocks/Bonds held >1 Year

1: Tangible Assets (You can touch them)

▪️Buildings

▪️Equipment

▪️Property

▪️Stores

2: Intangible Assets (You can't touch them)

▪️Trademarks

▪️Goodwill (premiums paid to make an acquisition)

▪️Patents

▪️Stocks/Bonds held >1 Year

Now for Liabilities, which are what a company OWES

There are 2 categories of liabilities:

1: Current liabilities:

▪️Bills that will be paid in <1 year

2: Long-term liabilities:

▪️Bills that are due in 1+ years

There are 2 categories of liabilities:

1: Current liabilities:

▪️Bills that will be paid in <1 year

2: Long-term liabilities:

▪️Bills that are due in 1+ years

Common current liabilities (due <1 year):

▪️Short-term debt

▪️Accounts payable (money owed to suppliers)

▪️Interest

▪️Unpaid Wages

▪️Dividends

▪️Taxes

Common long-term liabilities (due 1+ years):

▪️Long-term debt (also called "Notes")

▪️Customer pre-payment

▪️Taxes

▪️Pension

▪️Short-term debt

▪️Accounts payable (money owed to suppliers)

▪️Interest

▪️Unpaid Wages

▪️Dividends

▪️Taxes

Common long-term liabilities (due 1+ years):

▪️Long-term debt (also called "Notes")

▪️Customer pre-payment

▪️Taxes

▪️Pension

Finally, there is "Shareholders Equity

This is money attributable to the business owners (shareholders)

It's kind of like a company's "net worth"

This is money attributable to the business owners (shareholders)

It's kind of like a company's "net worth"

Common categories:

▪️Common Stock: Money invested in the company

▪️Additional Paid-In Capital: Amount shareholders have invested beyond common/preferred stock

▪️Retained Earnings: Net profits a company reinvests in the business

▪️Treasury Stock: Money used to buy back stock

▪️Common Stock: Money invested in the company

▪️Additional Paid-In Capital: Amount shareholders have invested beyond common/preferred stock

▪️Retained Earnings: Net profits a company reinvests in the business

▪️Treasury Stock: Money used to buy back stock

Here's an example of a real balance sheet

This is taken from $HD's balance sheet as of July 31st, 2022

This is taken from $HD's balance sheet as of July 31st, 2022

Notice that $HD's Shareholder Equity is really low?

Don't worry -- that's just because of the company's massive stock buyback program ($84.5 billion spent so far)

Treasure stock is listed as a negative number in shareholder's equity

Don't worry -- that's just because of the company's massive stock buyback program ($84.5 billion spent so far)

Treasure stock is listed as a negative number in shareholder's equity

If you pick stocks, it's CRITICAL to learn accounting

Want help? @Brian_Stoffel_ and I created a course that teaches accounting in plain English

Registration is currently open

Interested? DM me for a special coupon code

maven.com/brian-feroldi/…

Want help? @Brian_Stoffel_ and I created a course that teaches accounting in plain English

Registration is currently open

Interested? DM me for a special coupon code

maven.com/brian-feroldi/…

Want to learn more about the nuances of accounting?

This thread I wrote on the income statement can help:

This thread I wrote on the income statement can help:

https://twitter.com/BrianFeroldi/status/1563863961283477506?s=20&t=EFGuRgqQaBjjeQlhmPCmpw

• • •

Missing some Tweet in this thread? You can try to

force a refresh