The real change occurs when we aren’t looking. The slow, boring, long-term trends are often missed.

#DSPNetra presents a few which are visible, important, and well, actionable.

Download #DSPNetra: dspim.co/NetSep22

Follow the thread below 👇

#DSPNetra presents a few which are visible, important, and well, actionable.

Download #DSPNetra: dspim.co/NetSep22

Follow the thread below 👇

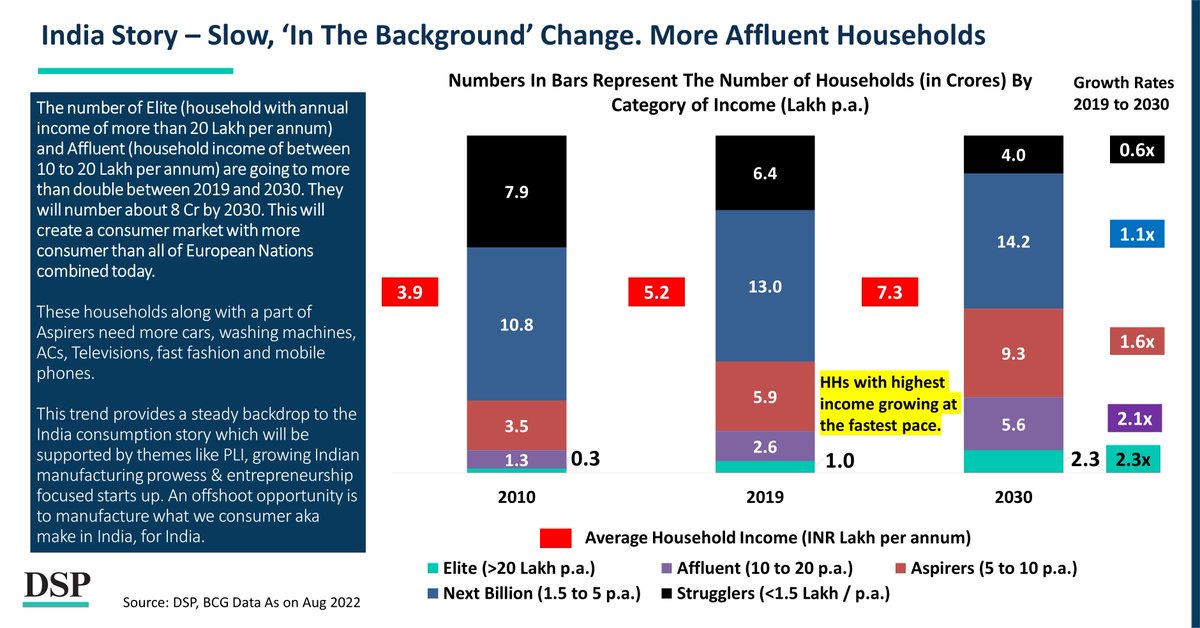

Consumption: The India story is alive and kicking. The changes which happen slowly and aren’t visible on a daily basis are powerful. Indian households are becoming more affluent.

Download #DSPNetra: dspim.co/NetSep22

Download #DSPNetra: dspim.co/NetSep22

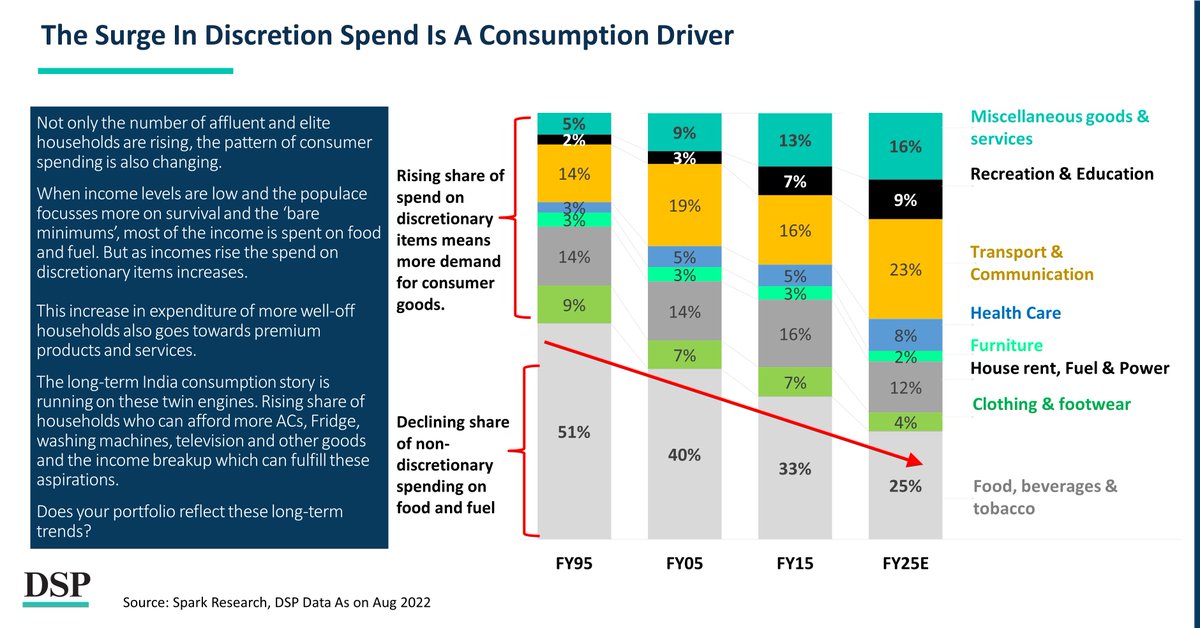

As incomes rise, discretionary spending rises too. This accelerates adoption of more goods & services as the expenditure of food & fuel stagnates. This means more demand for white goods, brown goods, electricity & contact services.

Download #DSPNetra: dspim.co/NetSep22

Download #DSPNetra: dspim.co/NetSep22

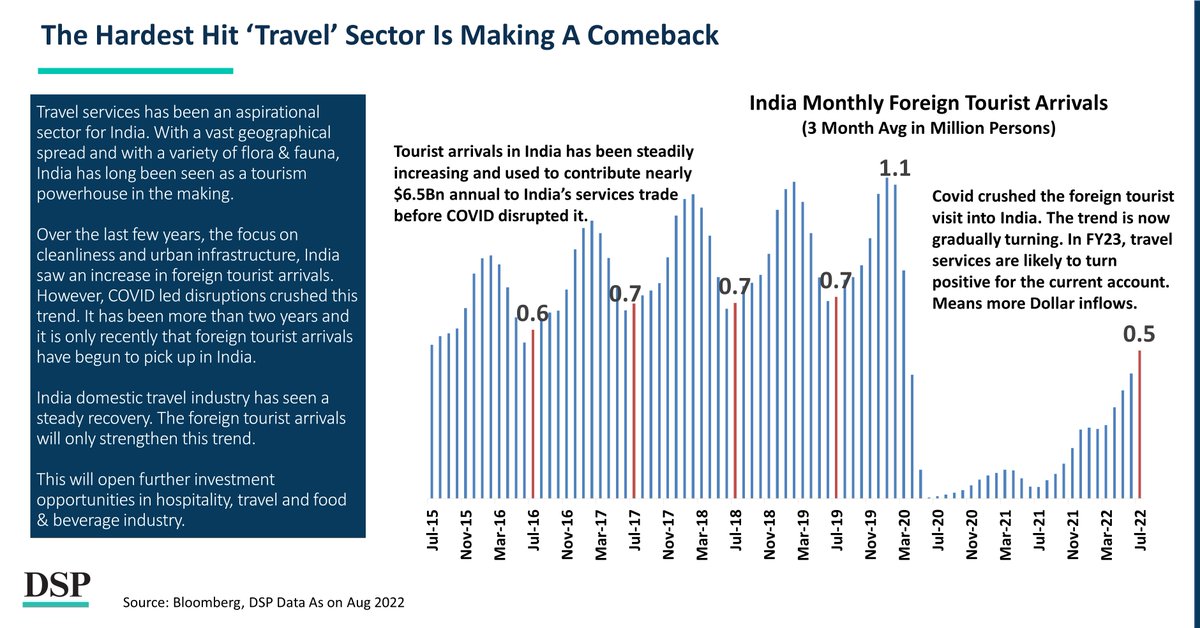

Hospitality: Foreign tourists are coming back with the Dollars.

Download #DSPNetra: dspim.co/NetSep22

Download #DSPNetra: dspim.co/NetSep22

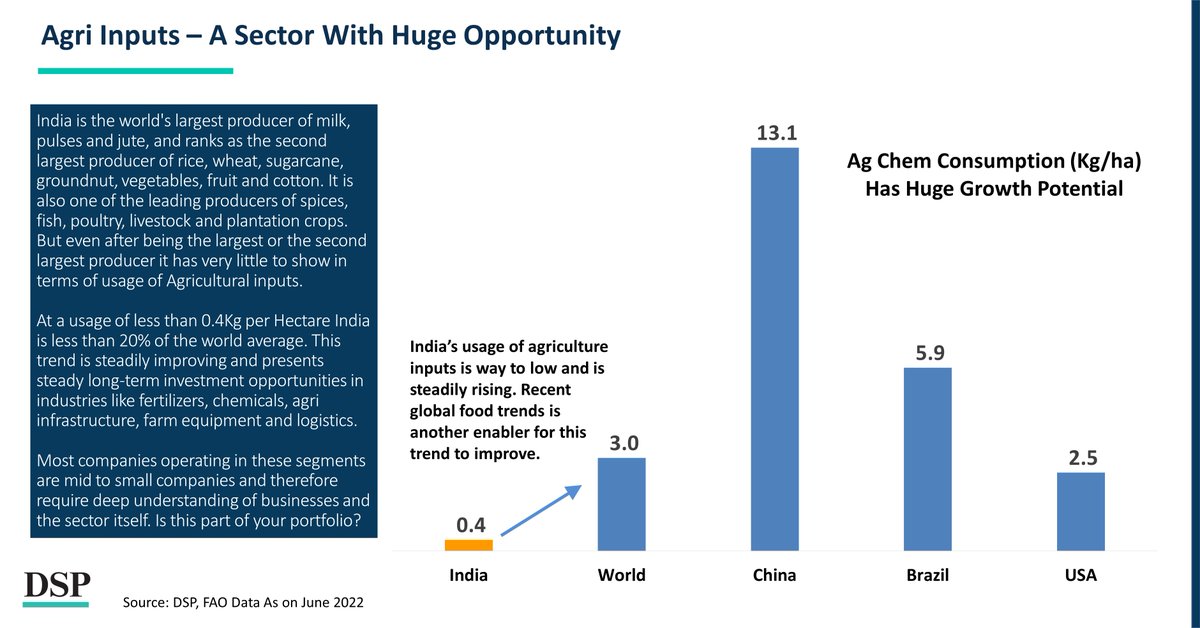

Agri inputs: India’s usage of Agri inputs is such a steady long-term trend that it pays to stay with it. We have. Have you?

Download #DSPNetra: dspim.co/NetSep22

Download #DSPNetra: dspim.co/NetSep22

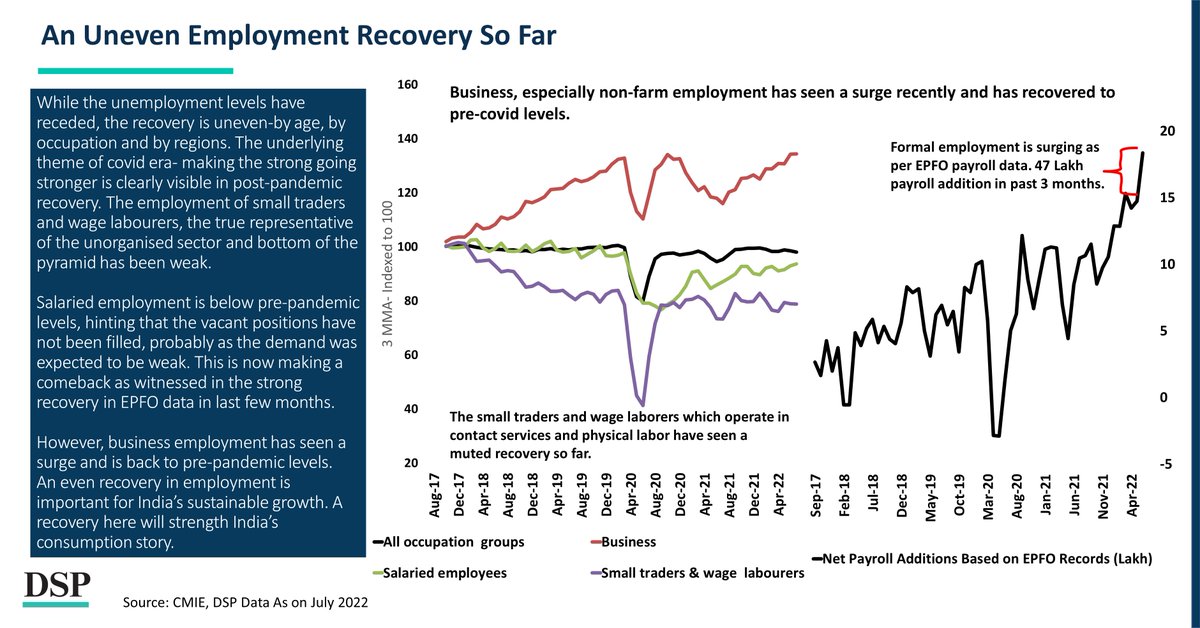

Employment hasn’t recovered as smoothly, but formal employment is supportive. For a resilient economic recovery, we need a strong employment situation.

Download #DSPNetra: dspim.co/NetSep22

Download #DSPNetra: dspim.co/NetSep22

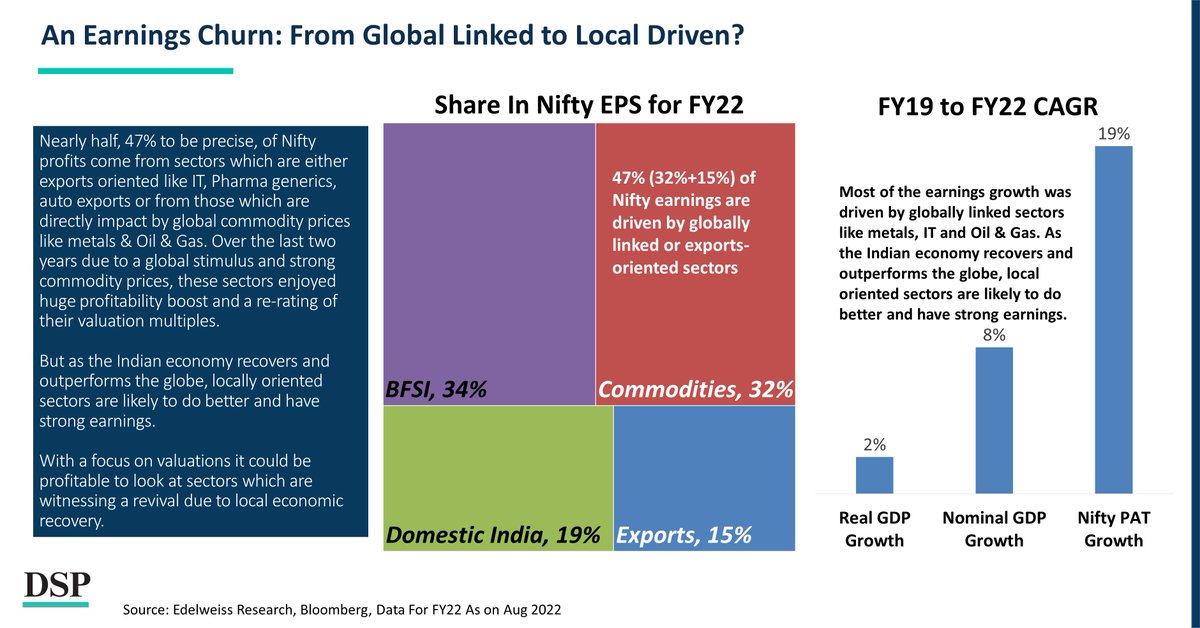

Nifty earnings are not only a function of how India’s economy is doing but also what the world is doing. And there-in lies the opportunity. A sectoral earnings churn is underway.

Download #DSPNetra: dspim.co/NetSep22

Download #DSPNetra: dspim.co/NetSep22

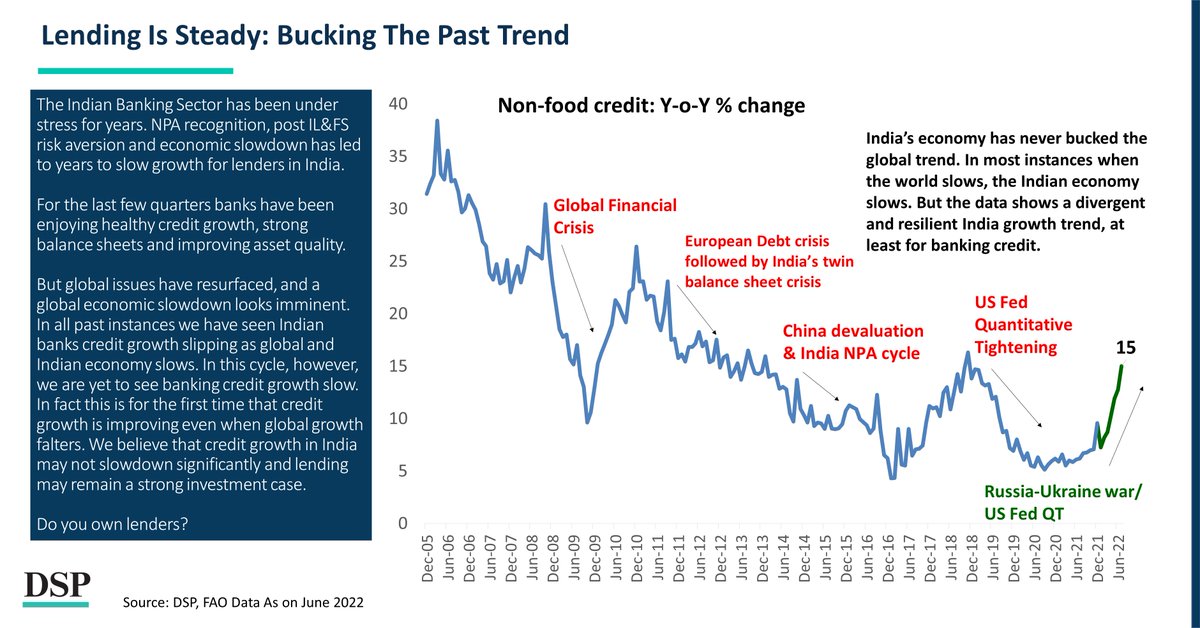

Decoupling has never played out. We haven’t seen it in data, ever. But for now, India’s bank credit growth is bucking the trend & flying strong into the headwinds.

Download #DSPNetra: dspim.co/NetSep22

Download #DSPNetra: dspim.co/NetSep22

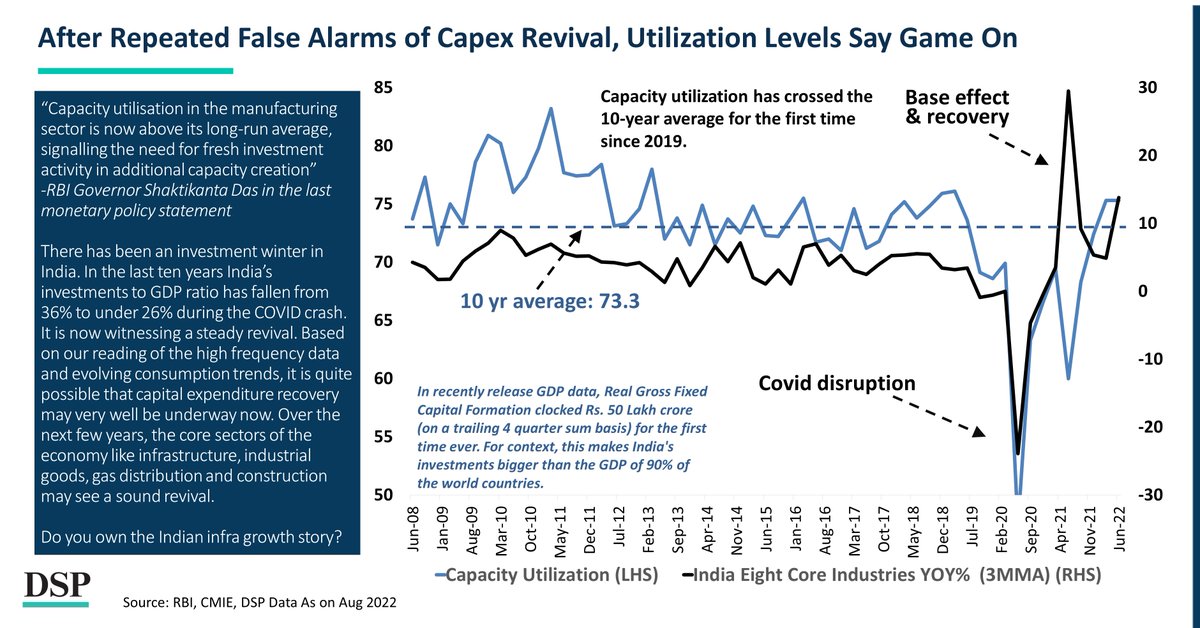

The nascent signs of a CAPEX revival are here. Another false alarm or a change of trend? We will stay with the data and play along.

Download #DSPNetra: dspim.co/NetSep22

Download #DSPNetra: dspim.co/NetSep22

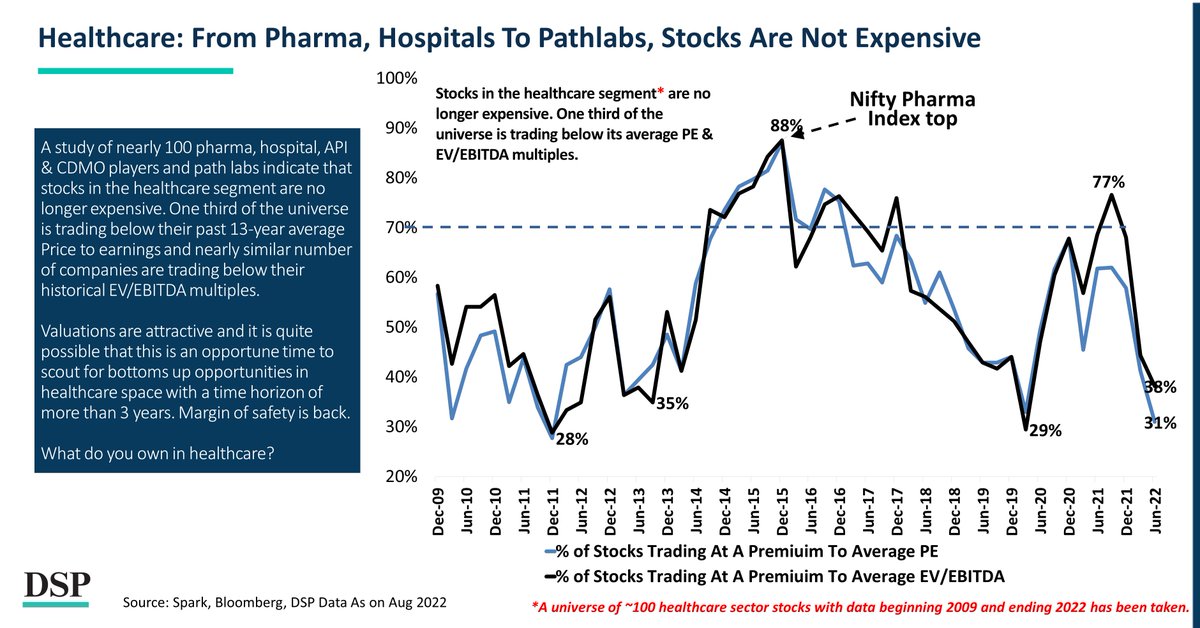

Healthcare sector is NOT expensive. It has

i) Margin of Safety

ii) No euphoria

iii) Good quality stocks

What else do we want?

Download #DSPNetra: dspim.co/NetSep22

i) Margin of Safety

ii) No euphoria

iii) Good quality stocks

What else do we want?

Download #DSPNetra: dspim.co/NetSep22

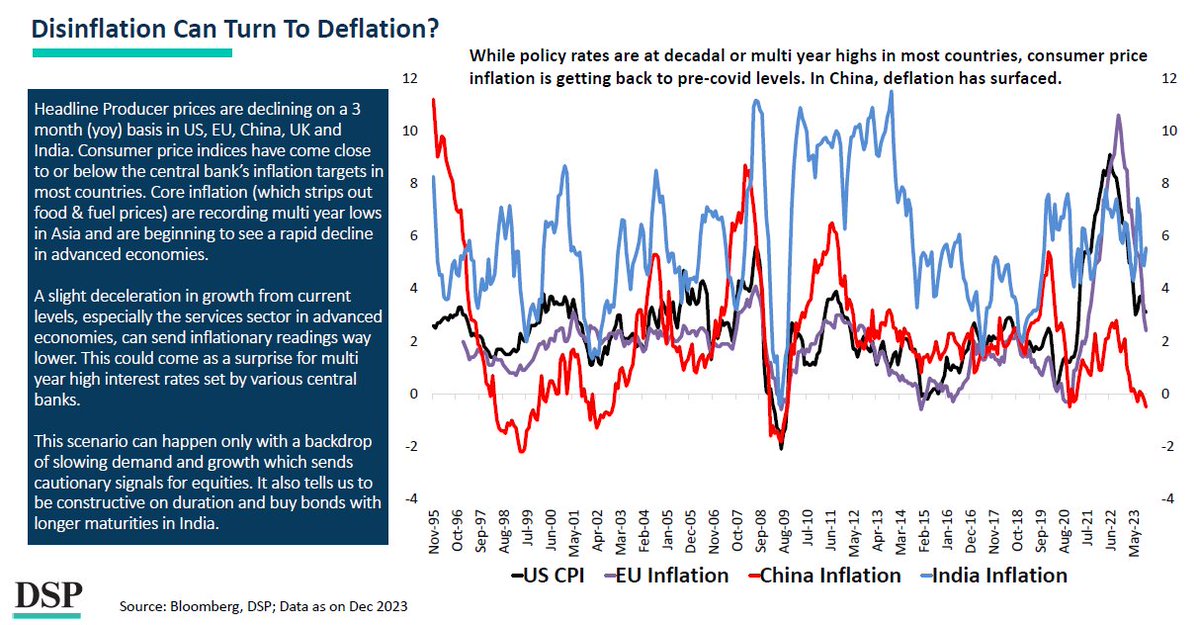

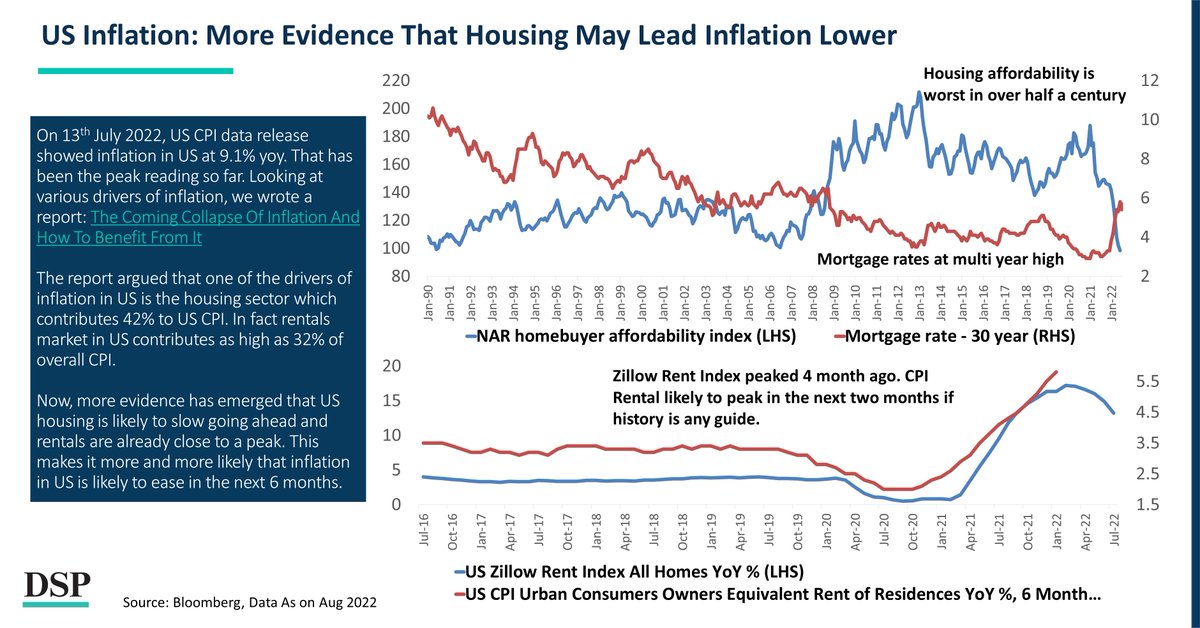

More evidence that US Inflation is likely to cool. Rentals and housing, both are cooling.

Download #DSPNetra: dspim.co/NetSep22

Download #DSPNetra: dspim.co/NetSep22

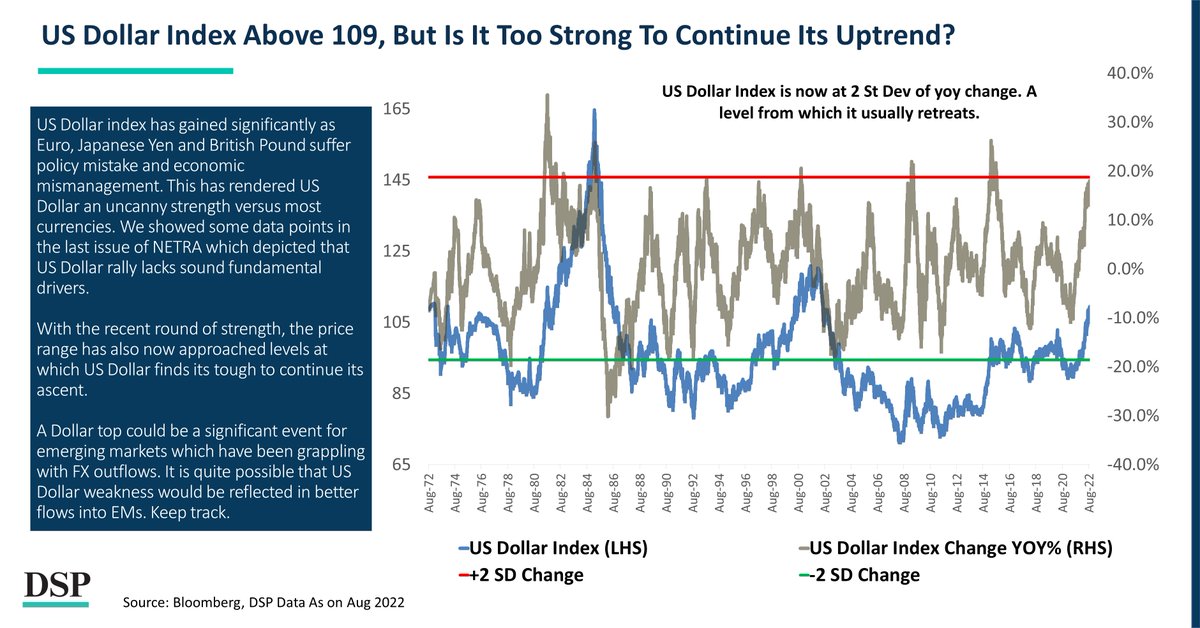

Market’s favourite trade: Long US Dollar isn’t the data favourite. Beware of the US Dollar long sentiment!

Download #DSPNetra: dspim.co/NetSep22

Download #DSPNetra: dspim.co/NetSep22

धीरे धीरे रे मना, धीरे सब कुछ होय

माली सींचे सौ घड़ा, ऋतू आए फल होय

- Kabir Das

Download #DSPNetra: dspim.co/NetSep22

माली सींचे सौ घड़ा, ऋतू आए फल होय

- Kabir Das

Download #DSPNetra: dspim.co/NetSep22

• • •

Missing some Tweet in this thread? You can try to

force a refresh